No doubt, one of my favorite times of the year that tight span between Christmas Day and New Year’s Day.

A time of reflection and renewal.

As I write this the windows are open airing the house out, a record high 70+ degrees today. Short lived for sure but welcome nonetheless.

Always a planner at heart, I used to love sitting down during this week and adding key dates to my new Moleskine weekly for next year, while always making time for a journal entry to reflect on time passed.

I’m not a fan of resolutions, I wrote about that last year around this time, I prefer a more laid back approach of just leaning toward my Best Self.

We can either make deposits toward it or withdrawals from it based on choices and decisions made throughout the year. It’s really as simple as that. They compound and build on one another, both good and bad.

It’s important we take time to mark the wins, reflect on those more than the shortcomings.

As for 2026, I have decided to zoom out, lumping this upcoming year as part of the last four or 40% of the 2020’s. The first 60% is in the books. Adios ’20-’25.

Thinking back on those last six years, extremely transitional for me. Said goodbye to Dad (early), said goodbye to career (early), said goodbye to a growing portfolio (early – now firmly in drawdown mode), said goodbye to freedom.

Enough for goodbyes, I said hello to consistent workouts, said hello to the lowest weight since college, said hello to 9+ hours sleep every single night, said hello to Oura Ring (who lets me know every day how I am doing, including the fact my heart is 6 years older than it should be).

I think she is being more than generous.

So as I embark on the “Final Four” of my 2020’s, I am reminded they will require more grit, more patience, more preparation, more perspiration than the prior six combined.

I am reminded that during the next four, I will turn 55 and will cross the halfway point… of the first decade following my own halfway point… and will be charging toward 60.

That magic retirement account age of 59 1/2 will soon follow, a point in time that once felt a lifetime away will have entered the “within 5”. That is nuts!

The decisions I make in 2026, the path I choose to take, will determine how well equipped I am to endure and successfully exit these next four.

That is the sole, solitary thought dominating the limited space between my ears as I say goodbye to the last 60% and say hello to the remaining 40%.

Some other items on my radar, from a Finance Stance, for 2026:

The Circus in DC will remain

My television and media feed has been muted for over a year and will remain so indefinitely.

I have absolutely zero interest in anything anyone in Washington D.C. has to say, about anything, period. Either side of the aisle. End of story.

It’s a clown convention. It’s a shit show.

We will likely have another shutdown in Q1, and if you think it’s been confusing, chaotic and inconsistent thus far just wait until the midterms approach.

May God have mercy on us all.

Markets are vulnerable

A flat to down year is overdue.

We are coming off 20%+, 20%+, 15%+? years as this year grinds to a halt. It helps to zoom out to a monthly view to appreciate the recent trajectory:

Could we have another 10-20%+ in 2026? Of course. I have no idea whether that will happen anymore than the next talking head on Bloomberg or CNBC.

Earnings are good, margins are good, backdrop is good (entering an easing cycle) and that trifecta is all that is really needed to drive future returns.

Flip side? Inflation could reignite. Job market could crater. Geopolitics could fester. Easing cycle could pause or reverse. Government could ____________ (fill in the blank).

Key word above is could. Not the time to be a fortune teller I just know from experience and our current status that we are vulnerable.

Vulnerable to a reset that manifests itself in one of two ways:

- By pricing in potential trouble way before it is apparent to mere mortals like you and I. A few bad inflation prints, a few questionable earnings reports that reflect compression instead of expansion, reduced guidance, take your pick. What happens here is we lose the bid and start testing (and failing) moving averages slowly over time until the technical picture is broken. Once broken it will take months if not quarters to resolve. Think breach of the 200D.

- By dropping like a stone and erasing 10-20% in a matter of weeks. What I like to refer to as the “crowded 2nd level dance floor” theory. The music stops and someone smells smoke and there is only one exit door. You know the rest. Similar to what happened this April only worse.

Nothing we can do about either scenario other than just be prepared for it. Mentally and Physically in terms of positioning and exposure.

Know your timeframe, know your solvency status and if you can’t stomach a 20-40% haircut it’s time to create some dry powder and reduce what is exposed to said haircut.

Time to sit closer to the exit door perhaps.

FORECASTS ARE ROSY

Enough about what is possible, what do the “Experts” say? No surprise they are saying we continue up and to the right:

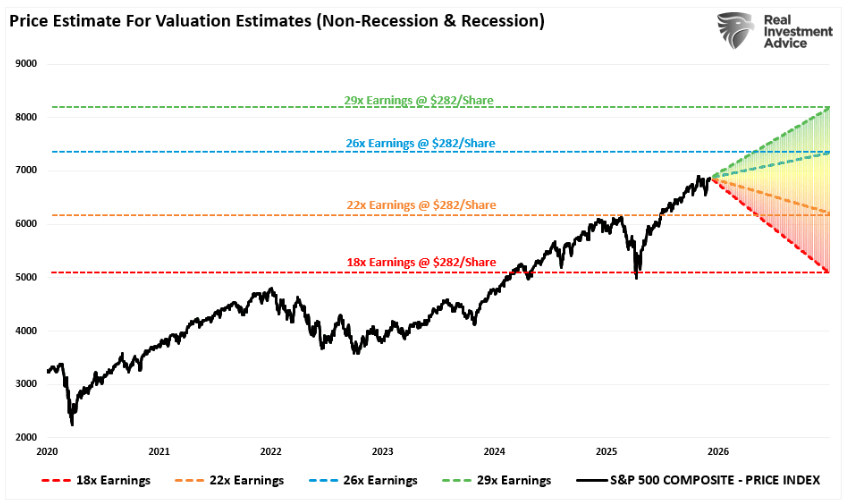

I really like this chart by RIA which adds in layers of projected multiples, whether we maintain the 26x or price in higher/lower expectations:

Again, take all this with a grain of salt, outlier events could drive us to the extremities but I like to start with the base case of “maintaining” current valuation multiples and going from there.

ON BALANCE

I like the set up heading into 2026 but I am lowering my overall expectations from a stretched, fully baked in tape.

Earnings drive markets, they always have, and up to this point the earnings reports have been resilient.

Markets are also forward looking, so they have already priced in most of this optimism one could argue up to at least the halfway point of 2026.

I would expect markets to largely shake off any BS from DC, they are used to it, have built up immunity to it, at least for the first half.

I would expect some midterm expectations to start being priced in exiting Q1 or during Q2. It won’t take long for the street to get a feel for where we are likely headed in the fall.

In the meantime I plan to simply watch the technicals. As long as the 5D EMA is trending above the 20D EMA I will remain constructive. If that fails, I will be watching the longer dated SMA’s (50/200) for support.

If those fail, I will be grabbing a book and heading for the leather chair or outside seating weather permitting. At that point, it’s going to be a while until sanity/clarity and fresher air returns.

Happy New Year.