As I walked back up the driveway tonight, the breeze which was cold enough by itself was also tinged with a fine mist. Christmas lights in all directions as far as the eye could see.

The lawn to my left looks like it was cut yesterday, when in fact it has seen two measurable snowfalls already. Number three is days away.

I stopped at the front door and turned around to take in the lights again, looked skyward and took in a deep cool breath before ducking back into the foyer.

Time to put a big red bow on 2025 and bid farewell.

If you find yourself getting older and think it will slow down, life that is, think again. It will find a way to continue its trajectory, perhaps even speed up in the process.

The change of seasons was always something I used to dread, especially this time of year, not anymore. I welcome it.

Holidays are a different story, they were a constant source of stress in a former life, so these days I just make every attempt to slow things to a crawl. If the forecast calls for snow and ice, hazardous travel, subzero temps, so be it.

I’ll just put on more coffee…

My desire to write, to create has left me for now. It will return in due time, until then I have a stack of books to keep me occupied and I enjoy the research and learning, the quiet reflection just as much, if not more.

I like to go back and review my posts this time of year, see what was occupying my mind as the year progressed and the market ebbed and flowed.

Really just two themes this year, “Liberation/Obliteration Day” and “The Great Reset” that followed. If you stayed invested and bought the dip you did just fine.

If you bailed in the midst of the confusion and chaos and were reluctant to put money back to work, you were left scratching your head most of the year and you were also certainly not alone.

Helps to remind myself the forward looking nature of the market, it is a discounting mechanism, it is pricing in future expectations right in front of your eyes everyday. Normally six months out I might add.

What the market quickly realized post tariff roll out blow out, was… this is worst case, reality is likely to be much more subdued, impact much more muted.

Thus a slow steady ascent up and to the right off April lows.

As of this writing we are still very much within a BUY/LONG signal, which for me is anytime the 5D EMA crosses above the 20D EMA (green arrows above).

We do appear to be losing steam and it is worth watching for a rollover as we exit the year, there are a lot of paper gains that could be quickly locked in if sentiment begins to sour.

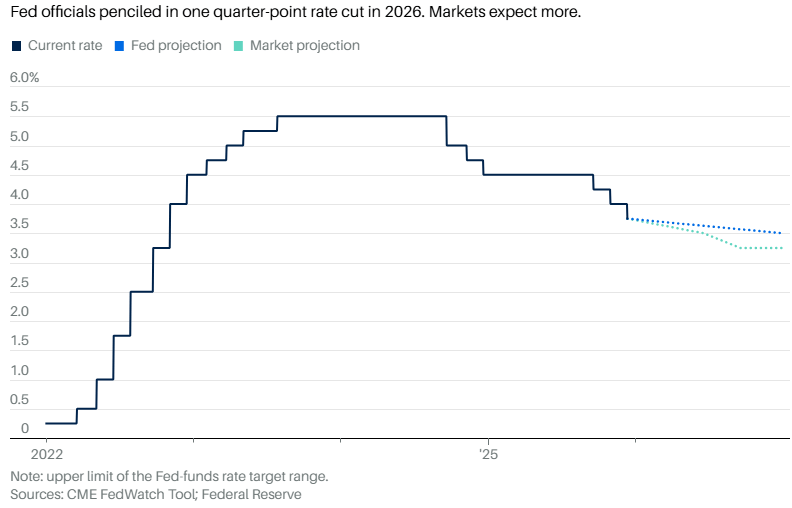

Fed came through with a 25bps cut today, albeit with three dissents (two to stand pat, one for 50bps) for the first time in six years?

All eyes now will be on the trajectory of future cuts in 2026 vs. what the market is pricing in. Once again the market at all time highs and likely making new highs before the ball drops, any surprises could be met with the sell button.

As of this writing, the market is still a bit more optimistic for cuts in 2026:

CAN THE BULL RUN CONTINUE?

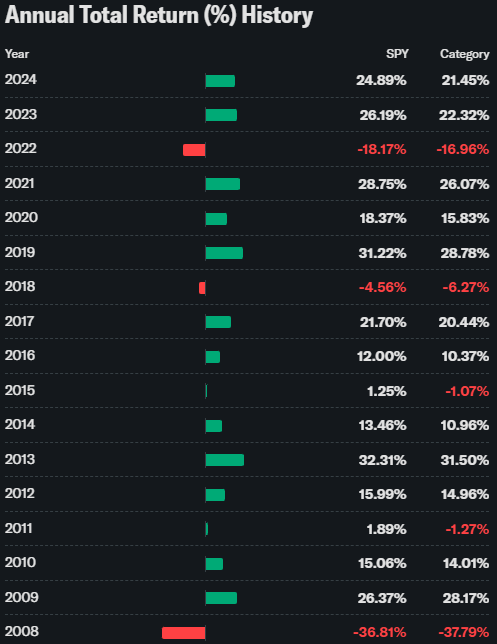

Depending on how the next few weeks play out, we could be sitting on three 20%+ return years for SPY in a row. When you look at returns back to the GFC, it’s easy to see how many expect nothing but UP:

Earnings have been strong this year, no denying that fact with still more than 80% of the S&P exceeding in Q3, the highest since 2Q21. We are now in the middle of a rate cutting cycle which should help the higher growth names going forward (as if they need any?).

The midterms will play a role, but there will plenty of time for earnings reads and inflation/economic prints beforehand.

When I revisit the chart above, my overarching thought is to be prepared for a sideways to down year. At some point in 2026 we will check back and test some of the longer dated moving averages. Just one man’s opinion.

When that happens, in relation to the midterms, would determine if we add another green bar to that chart above.

I am doing a lot of research on dividend names, value names that would benefit from any type of meaningful rotation early in 2026. You don’t have to look far to see attractive yields on “non exciting, non AI” names that would be a good place to hide from any drama.

If we do end up with a flat 2026, collecting dividends along the way will look very good in hindsight. Even better if sector rotation allows those same (dull/boring) names to outperform.

WHEN WILL WE REACH PEAK DEGENERACY?

The overlap between markets and gambling is frightening. It will only get worse.

What started with pandemic isolation driven zero commission trading has morphed into 0DTE options and the ability now to place a bet on ANYTHING. Name your game, name your outlet, name your price.

Do I really need that ETF if I can just place a bet the market will be higher than blah blah blah in three, six, nine months? I’ll take the over on SPY 750!

Where does this all end?

Although I have never bought and sold anything in the same day, in my entire 25+ years being active, I am still a trader at heart. I love the chess match, the research, the timing, the execution.

I also like the thrill that comes from planting a seed on a mispriced asset and watching it turn into what I think it can be, what it should be, slowly over time.

It does not happen in zero days, I can tell you that.

We’re already starting to see some wagering corruption leak into sports, get ready for more. It’s sad really.

Even markets these days, can you really trust the action behind the scenes? It is starting to feel more like a simulation to me everyday, an accelerating bastardization of the underlying mechanics.

What’s even more frightening is we have yet to truly see all the machines head for the exit for days, for weeks at a time. What happened back in April will look like Mardi Gras if and when that happens.

Regardless, the market remains the best place to create wealth over time, with over time being the key. The latest generation has lost sight of that, perhaps forever.

I was glad to see 5x leveraged ETF’s being pitched get the ax. I would say do the same with 3x while you are at it. 2x is here to stay, but leave it at that.

That’s enough of a rant for now. I digress!

I just wrapped up 1929 by Andrew Ross Sorkin, fantastic read.

It inspired me to dust off some other titles already in my library about what can actually go wrong when complacency takes root.

I will be revisiting those over the cold winter ahead.

This a great time of year to read and reflect and factor in some “what ifs” to next year’s plan.

A MOMENT IN TIME

I end with a piece of advice, I know I don’t normally do that via this forum but this time of year it warrants making an exception.

Holidays can be stressful. Memories flood the hallways of the mind with relentless persistence, amplified by the season, more so than any other.

One item that helps me keep everything in perspective is to remind myself that this is simply a moment in time.

You will never see it again.

Chances are next year will be different.

There may be some faces no longer with us, some will have moved on or away, some may be gone forever.

But what we do have, what we all have is today. It’s up to each one of us to make the best of it, enjoy it.

Take time to linger, take time to listen to those closest to you. Spend your time wisely.

At some point you will look back and it will only be a memory, you won’t be able to recreate it, you won’t be able to relive it. Just a memory.

That said, it’s best in every possible way that you make the most of today.

Take full advantage of this moment in time.

Happy Holidays.