cloud deck

: a bank of clouds of a particular type forming a layer at a certain altitude

I remember one of my first commercial flights for work like it was yesterday.

It was late winter, one of those days where the clouds were thick and grey, emitting a light mist that was just enough to make it feel colder than it was.

The flight was not very crowded, I was able to grab a window seat in front of a wing. My preferred location.

We taxied and must have been cleared for immediate because I was quickly pinned to my seat watching the water droplets quickly vanish from the window.

Now inside those grey clouds, there was nothing left to see. Visibility zero.

Not for long. We soon reached cruising altitude far above the cloud deck immersed in brilliant sunshine.

Plastic window shades were being snapped down all around me. I left mine up. I love flying and moments like this are why. Peaceful. Clear.

Up here I feel a million miles away from the earth and all of its burdens, weight, pull. Up here I am above the fray.

The engines soon began to slow, and as we tilted side to side I knew final must be close. It wouldn’t be long before the sound of flaps engaging and we began our descent back through the cloud deck. Visibility zero once again. More flaps.

Soon awash in the same misty grey I left behind, I see traffic moving now. Earthlings below scurrying to and fro like ants. Back to reality.

I have been absent from these pages just about all summer and that my friend was by design! My to do list is now a DONE list and that feels good.

It has also been nice to be away from the desk and away from the news feed. Some troubled times for sure, bullets and bullhorns, parallels to the late sixties are striking.

Thankfully a lesson I learned long ago was if you don’t control the news flow and the narratives, they will control you.

I see we have yet another “government shutdown” looming this week, with the typical finger pointing and endless bickering. You know what? Maybe this time will be different. Maybe this time we do shut down for weeks or months due to the supposedly hard lines being drawn.

At this point I don’t think either party has much to lose. For the right, the market usually looks past these deals, it has looked past everything else this year why not this too, right?

For the left, they are just desperate for a win, anything to make a stand, so I do expect this to get ugly, perhaps uglier than the past. Let’s see what happens.

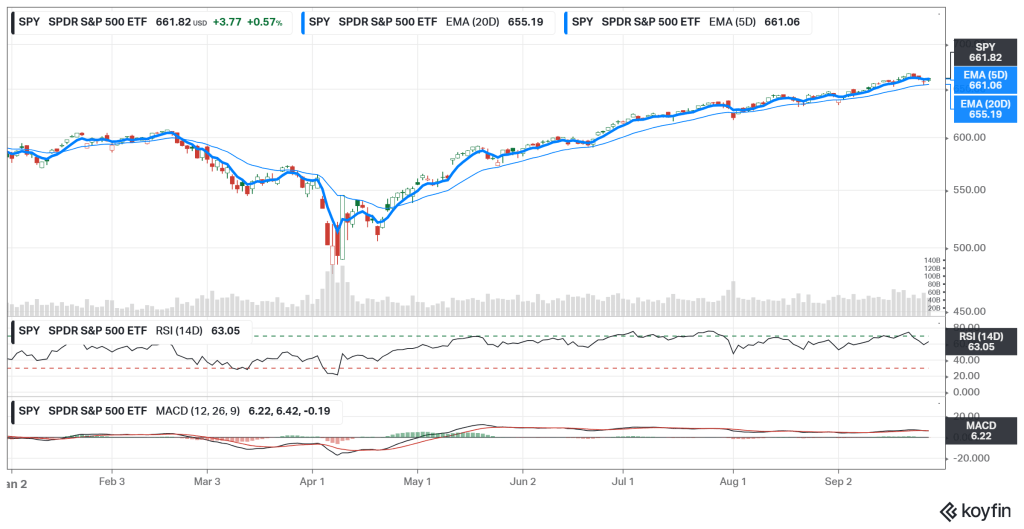

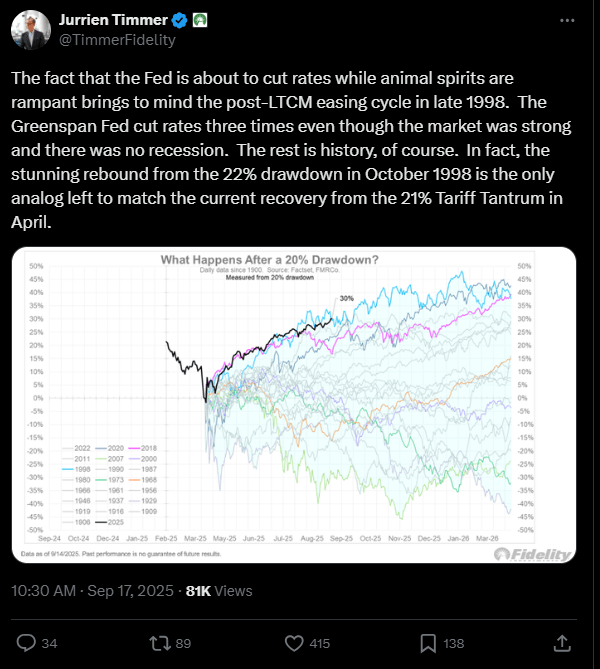

My last post title Blue Skies, Blind Eyes still very much fits, not much has changed since that mid August update. So much for Seasonality, eh? September was supposed to be a bloodbath, Mr. Market didn’t get that message.

October usually isn’t much better, I can recall some scary Octobers. Given the fact September was so tame, will October pull double duty? I will have to see it to believe it.

My preferred momentum “buy” indicator is the 5 day EMA crossing and closing above the 20 day EMA. I dedicate charts to each of the majors to track this.

Any meaningful test of the 20 day since the April Obliteration/Liberation Day lows has been quickly bid:

So what is baked in you may ask? Simple… EVERYTHING.

It’s useful to remember the market is a discounting mechanism, what you see being reflected now is an expectation six months out, not six days.

The market expects Goldilocks perfection going forward. Low rates going lower. Strong economy. Stable employment. Stable lower inflation. Strong earnings.

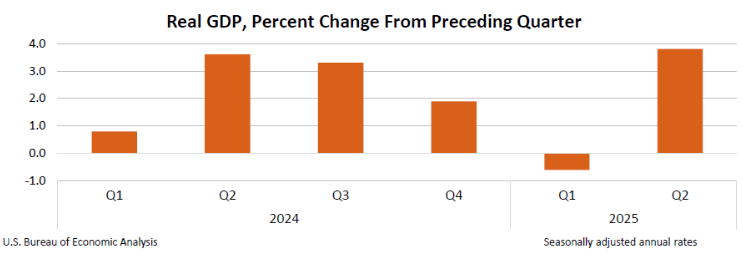

So far it has been just that. A slowing economy continues to be a primary risk yet Q2 GDP for the final read was just revised up – again. AI infrastructure spending anyone?

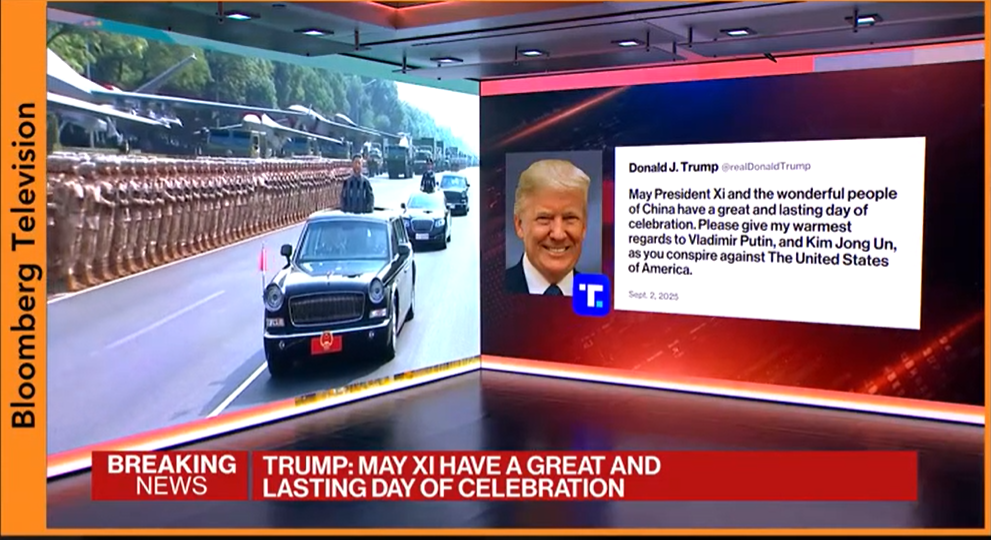

At this point Geopolitcal risks/events are being ignored. It would take something extremely severe involving the US for that to change, but you can’t deny the sabre rattling is getting louder. More frequent.

Outside of hard to quantify margin compression, tariff impact remains muted. The market reaction since April has clearly telegraphed that. Until some type of long-term systemic harmful impact ultimately manifests itself, tariff talk is just noise. It’s impossible to price what you cannot clearly define.

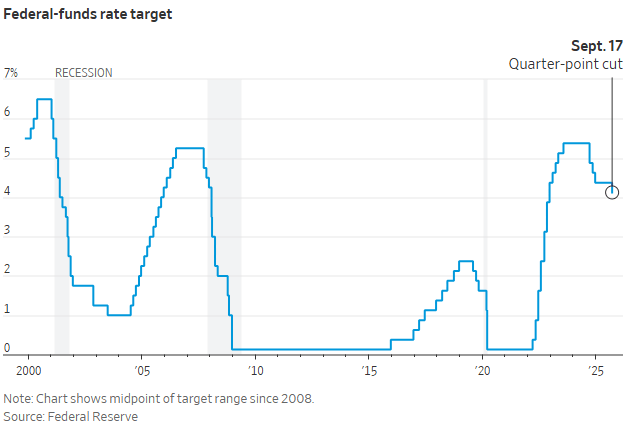

The Fed has thrown in the towel on tariff related inflation too. At this point the job market has their attention, further potential weakening leading to the latest 25bps “insurance policy cut”.

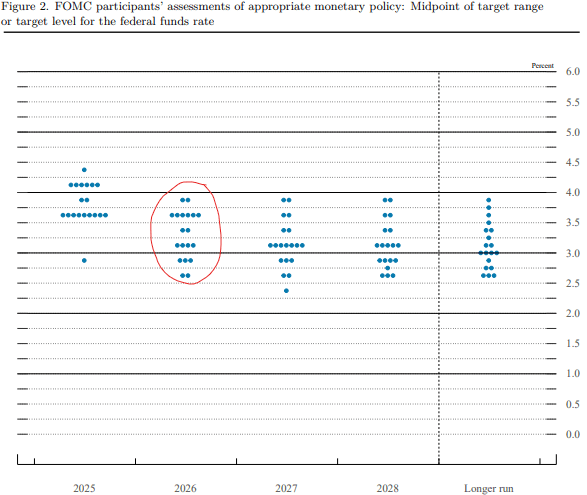

They still have a considerable amount of flexibility to ease if they choose to lean into it:

You also can’t deny the fact we are cutting into perceived strength, which is rare:

Their next meeting is not until late October, so there will be plenty of jobs prints and a new CPI read to read from. A slippery slope awaits them and you can see why Powell made it clear “there is no risk-free path”.

For those who did not see the dot plot, here it is. My biggest takeaway was the wide dispersion in 2026. Nobody has a clue and that is not that far away:

Yields have come in a bit, which is also helping to keep a bid under the market in general. With the 10yr dropping, we have been dancing around the 6% level for 30yr mortgages, a level that appears to be a tipping point for buyers and sellers alike.

Gold at record highs, when is that ever a good thing? Is that a worry over future inflation or a worry over future Armageddon?

I heard the term “melt up” last week from a pundit and I thought they were referring to this summer when they were in fact expecting it to occur through NEXT summer. As in we are just getting started. Wow. OK.

Fact is nobody knows anything. Those who get paid to act like they do must predict the future, speak confidently about expected paths, potential pitfalls. No thanks. Much easier just to blog thoughts and opinions when I choose!

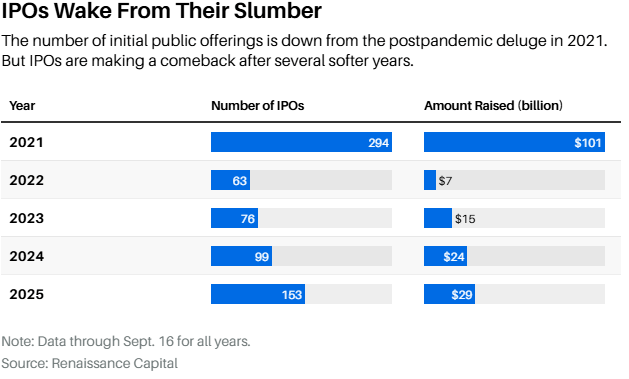

When it comes to frothiness, per se, it’s always good to keep an eye on IPOs. This topic made the cover of Barron’s last weekend and although we remain far removed from 2021’s mad dash, the market for new issues is picking up.

This is a tricky one because it is also a sign of a healthy market backdrop, finally after years of suppression. As an avid armchair venture capitalist, I would love to see a revival there and some exit opportunities for BDCs.

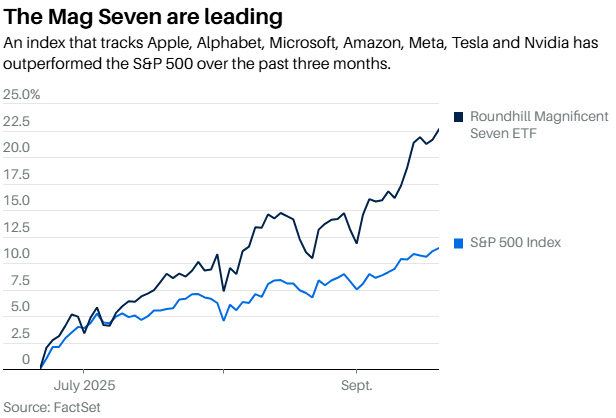

It’s also useful to remember just how much of this market strength is being carried (i.e. propped) by a handful of names:

The punchbowl is big, the punchbowl is full, the ladle is large and the glassware is sparkling. Enjoy it while it lasts.

My last thought, no time to be a hero. Not the time to be fully invested, anywhere in anything. Those who rebalance, raise cash and keep a clear path to the fire escape should fare pretty well.

Beware the nice, slow, steady, peaceful climb…

Interesting times folks.

We live in a world where almost every visible line is either thinning or vanishing completely.

Just when you think something still matters you get proven wrong.

Everything is cloudy, everything is grey, everything shielded by a cool mist.

Just keep in mind we all have a personal choice to stay lost in that fog or seek clarity outside of it.

Better yet, get above it and stay above it.

We have a choice to stay above the fray.