The Summer TO DO list continues to dwindle by the day. A few loose ends to tie up over the next couple weeks then it’s on to Labor Day weekend and the unofficial end of the sunny season will be upon us.

I used to dread the end of Summer and feeling that first morning chill in the air. Not anymore, I welcome it. A few weeks of mid 90 degrees will do that to you!

I feel pretty good about my progress this summer, I should be able to cruise into Labor Day pretty restored. I’ve shed about 12 pounds since this time last year, noticing some strength and flexibility returning.

I have to credit Ms. Oura for that, credit where credit is due. I’m a numbers guy and she has flooded me with feedback along with kindly letting me know my cardiovascular age is about 5 years older than I am.

I’ll buy that.

I would put it closer to +10 if you asked me, because I have firsthand knowledge of exactly what I have put my body and mind through!

Nevertheless, I have made progress. Less weight, less stress. More calm, more contentment. All of which are deposits for tomorrow and whatever challenges lie ahead. It’s a process.

Respect the Process. Reward the Progress.

Let’s talk shop. Been a while and that is by design.

My frustration with the news feed and the status of the world we live in remains. Just have to remind myself to control what I can control and let the current flow.

No reason to sail upwind against it.

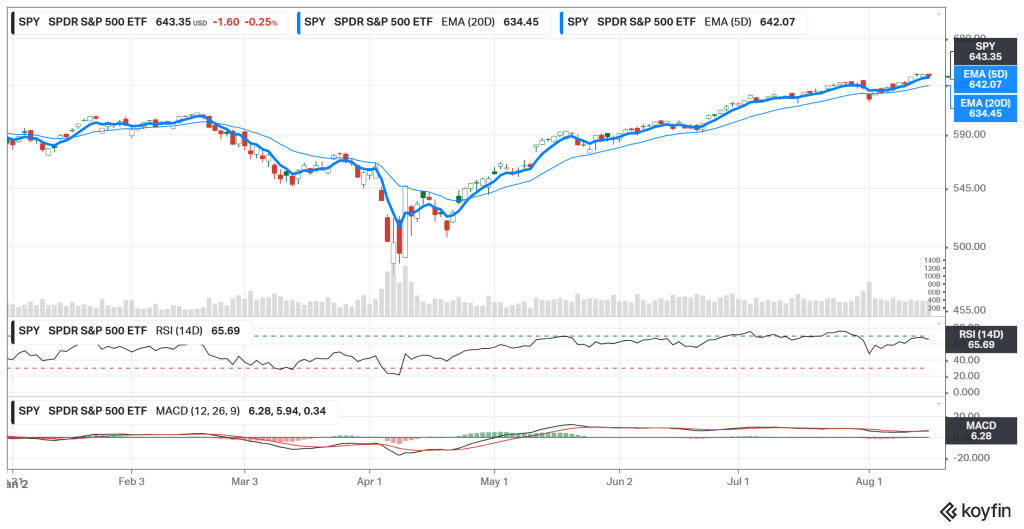

Take one look at SPY here mid August and you will just simply notice up and to the right:

The 5 day crossed the 20 day after a late April gap up and has not looked back. That was the “buy” all clear signal until it wasn’t and we are still waiting for another meaningful retest of the 20. The last one was quickly bid.

Exhibit A on why you remain invested and stick to your strategy in long term accounts. I remained stubbornly in a higher % cash because I was convinced this would NOT be a V-shaped bounce.

Wrong!

Smooth sailing prevails, blue skies and blind eyes abound.

Earnings are holding up. So far the consumer is also holding up, although this latest prelim look at sentiment fell a bit short.

Cracks are forming in the jobs data. Last reading came in 73K below consensus with a tick up in unemployment.

More of a wait and see environment in my opinion, we are caught in tariff purgatory. How do you plan and invest if you own a business (regardless of size) if you have no idea what your cost or supply chain profile will look like in 6 days much less 6 months?

The real fireworks though came in the form of downward jobs revisions for May and June by -258K.

That was bad enough for Trump to fire the head of the BLS (Bureau of Labor Statistics). They were trying to make him look bad of course.

We get Fed Speak from Jerome himself this coming Friday from Jackson Hole, that should be interesting. He made the cover of Barron’s this weekend.

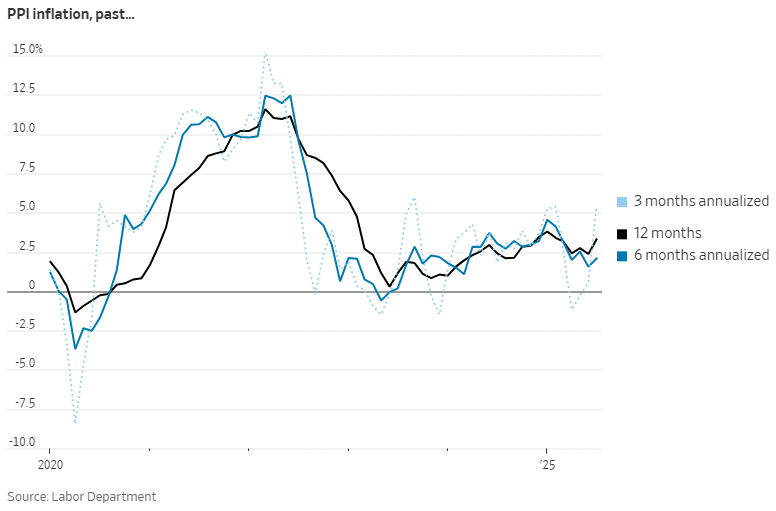

The cooler CPI and jobs data had spurred talk of a 50bps cut in September and was even being priced in. The PPI print put the kibosh on that, wholesale inflation turned north abruptly, no doubt tariff related:

So I guess on balance, earnings and consumer data say one thing, jobs and wholesale inflation numbers are telling us to pay closer attention.

Another observation? No time to be a hero. Stick to your strategy, tighten up stops. Risk management. Watch the charts, let the technicals speak for themselves, supply and demand, it’s really that simple.

The waning Summer has helped me in another way too, by letting go of the reins and getting away from the desk. I am in the process of transitioning most of my longer term accounts to an income focus.

Starting to appreciate value at this stage in my life, income generating assets and not just growth at all costs. I may elaborate on that in future posts.

There are ways to do this and still scratch the itch of wanting to be part of tomorrow’s innovation. Maybe I am becoming an armchair venture capitalist by default?

I like the sound of that.

Reality distortion at this point my friends is off the charts. I have never been a doomer, never been a perma bear, nor a conspiracy theorist.

But I am a tad skeptical. When seas remain this calm, for this long, with storm clouds all around, I’m heading to the harbor long before I see any lightning.

I’ve also been around long enough to realize the quieter the grind up, the noisier the eventual reset will be. Doesn’t matter now though. For now, it’s blue skies and blind eyes.

Even if your eyes do remain closed, do keep an ear open at least for the sound of distant thunder?

If you hear it?

Stow the sails.

Gonna get a little bumpy.