I can feel the midpoint bearing down, the heat has been bearing down for quite some time as it got a nice head start this year.

June was always my bike trip month, preferred due to the long stretches of mild yet warm weather and cool nights. You may dodge a stray shower or two but that was just part of it, no biggie.

Not this year, we have seen “real feels” well over 100 for the last couple weeks, that quickly turns a bike trip into an endurance event, no more stoplights please!

Those days are behind me now, the bikes are nothing more than basement furniture adorning the east end with leather jackets and helmets alongside. My eyes drift in their direction all of the time, which reminds me it’s about time for their semi-annual start up and wipe down.

First half of the year is almost behind us as well, leading into a holiday shortened trading week.

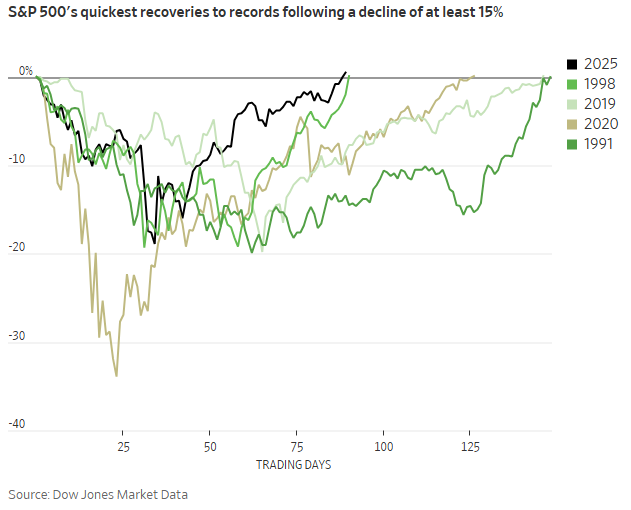

I read in The Journal this morning where this recent rally / recovery from -15% was the fastest on record? Sure felt like it, I will say that:

I’ll be the first to admit I did not see that coming. I was in a larger % cash long before the tariff drama even hit in April but I was equally reluctant to put it to work.

That’s the problem with timing, or trying to time it, and we are all better served to just stay the course and strategically manage it along the way. Jumping in and out is a recipe for disaster.

I still prefer to barbell it, I like to offset my risk exposure with cash because I know how quickly this can change. Markets these days do not allow you to figure it out, they just react and price it in instantaneously and leave you scratching your head wondering what happened.

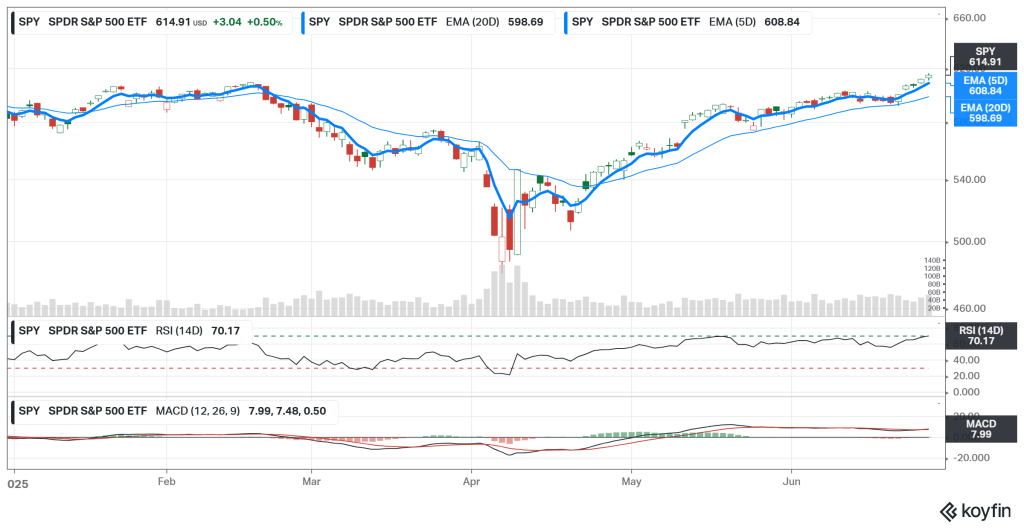

Smooth sailing right now for all the majors, you can follow along in the Weekly Charts section. All the techincals are still green, we have not meaningfully tested the 20day much less breached it:

The market has obviously decided to ignore the reciprocal tariff nonsense, perhaps I should too. Nobody has a clue what they will be, if they will be, when they will be, where they will be! So who cares.

Headline risk fatigue is starting to set in too, Trump’s words and actions are starting to carry much less weight. Amen.

The real evidence for me was how the market shrugged off the Iran bombing. When we marched higher the day after I basically said to myself ...OK, we are just moving on, looking forward to higher earnings, stable inflation, stable employment and lower rates.

Making new highs bodes well, not the other way around. Does it feel complacent? Sure, but looking back on liberation day that was the relief valve, the steam vent the market needed. We were long overdue. It got ugly, it got ugly quick, it looked bad, really bad, now we are moving on.

Like I said earlier, I prefer to barbell it here. I will offset risk with cash, ready for anything at any time. Nothing will surprise me.

The overall sense of chaos and instability remains if you ask me. Have we really solidified or solved anything? Doesn’t seem like it.

The PCE print Friday did tick up slightly, but so did consumer sentiment.

No time to be a hero here, not this far off the lows, but we could easily continue to melt up all summer. I will be looking for select opportunities, those names temporarily left at the station or suffering from sandbag earnings guidance hangovers.

I will continue to be away from the desk most days, outside working in the physical world taking a break from the mental. Good for the soul.

Keep an eye on the Economic Calendar, we have a jobs report this week, released early due to the holiday. Trading will be light and the moves could get wonky.

We have to wait until mid month for another CPI read and end of month for the next Fed decision. It will be interesting to see how the odds play out for a July cut (currently at about 18%) especially with Trump threatening a “Shadow Fed“.

I think that’s a joke but I think most things coming out of Washington are a joke, that’s why I will be outside working with my hands and far, far away from the desk and the newsfeed!

Oh I’m sure I’ll pop back in here from time to time, rant a little, update a chart or data point or two. Then again?….

Until we meet again my friend, enjoy your Summer!

IN CASE YOU MISSED IT LINKS

Historic Rebound Sends S&P 500 to New Highs – WSJ

All Time Highs Are Bullish – The Big Picture

Cybersecurity Primer – SPEAR

Fred Wilson On His Favorite Themes – Howie Town

Manage the Noise – The Big Picture

Rob Arnott’s Firm Says the Time Is Finally Right for ‘Smart Beta’ – WSJ

Welcome to the Age of Excusability – WSJ

Businesses Are Bingeing on Crypto, Dialing Up the Market’s Risks – WSJ