If you know me, you know I follow Braves baseball pretty intently. A child of the 80’s, I grew up watching afternoon Braves games on TBS.

It was always sunny in Atlanta, or so it seemed to me as a kid.

This year has been challenging to say the least, I read this morning where we lead the league in one run losses, nine ten to be exact.

To make matters worse, four five of those came in the last FOUR FIVE DAYS! You kidding me? I have been hitting power off on the remote speechless way too many times.

It’s a long season…at least that is what I keep reminding myself as part of my therapy mired well below the .500 mark in June.

Time to get outside and get busy, stay away from games on TV. I prefer radio play-by-play anyway, call me old school, but it slows things down and allows me to keep tabs but focus on being productive elsewhere.

Exactly what we all need right now, markets included, a little slowness. Summer months should do just that, barring any unforeseen drama of course!

Speaking of markets (and drama), this recent rally has been no joke lads.

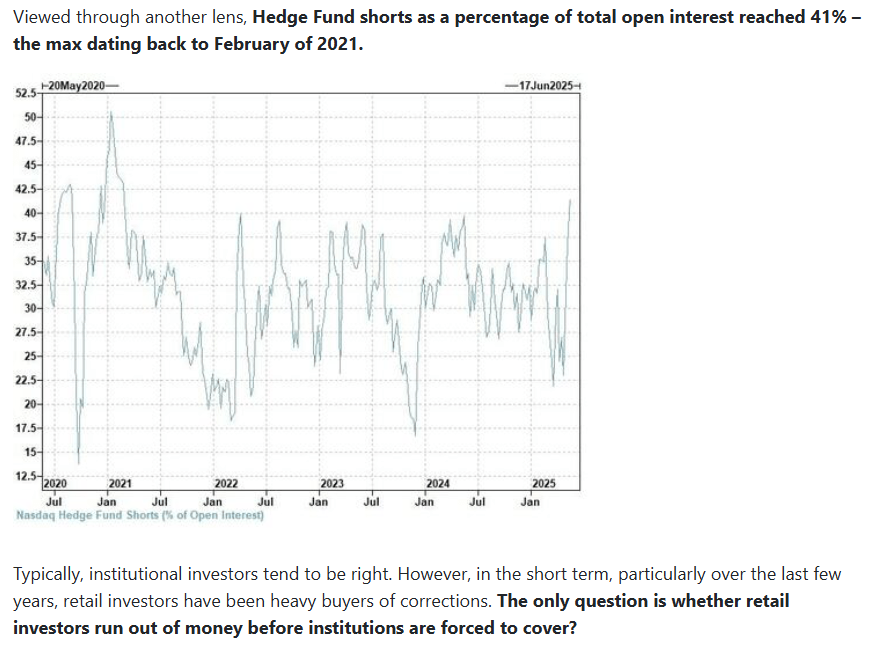

Supposedly retail is driving the bus as much of the “smart money” has been caught offsides. “Relentless Retail” dip buying on the other side of some massive short positions…

That graphic above may be a little dated but my point is this recent melt-up has occurred while may large players were/are positioned for the exact opposite.

Up to this point the recent data has been OK, no big surprises in the jobs data this week, unemployment steady, PCE came in light at the end of May, sentiment ticked up, all clear right?

Well, no, I guess the main question rolling around internally between my ears is “has anything really changed materially on the trade front to warrant this sudden V snap back?”

Once again it seems we have fully priced in an all is well scenario. Is that really the case?

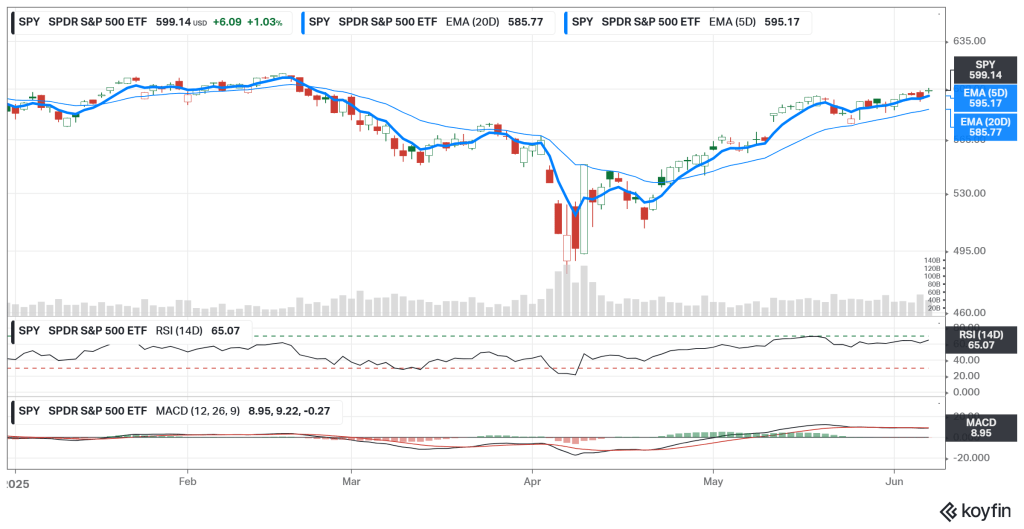

Time will tell but for now The Charts do not lie, and they are saying BUY/HOLD with the 5/20 EMA cross to the upside still firmly in play since late April.

There is a massive unfilled gap on SPY lurking around 575, look for that to fill at some point during a likely sideways albeit bumpy Summer.

There is another one way back yonder at 534 in the middle of Trump’s “pause rally” green candle range. Do all gaps get filled? If they do, filling that one will be a little painful kiddies!

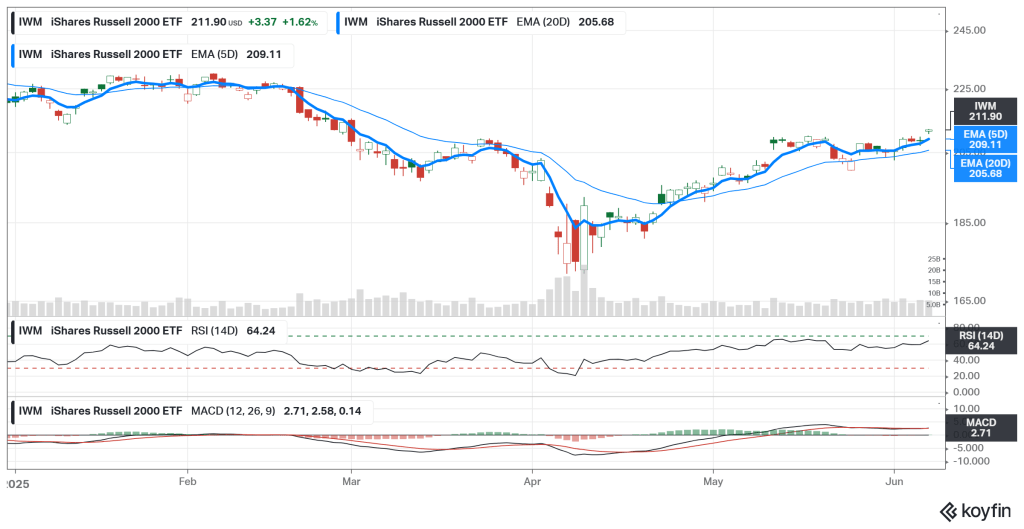

Small Caps have a few gaps of their own, a newly created miniature one at 210 and the old one at 190:

If we turn South for whatever reason, these will come into play. But for now, bulls are in control until they are not. Climbing the wall of worry as they say.

I am noting the prior day’s closing low every morning to see if we break below it and close there, that may be a sign we start to drift lower.

Headline risk is coming back into play now also as we look to possibly re-test the highs. Lower volume could lead to some whipsaws here and there but I would expect the majority of Summer trading to look a lot like…Summer trading.

I added a link to Jobless Claims at the top of my Economic Calendar, that will be updated weekly as we go through the Summer. I think an uptick there may be the first indication of trouble under the hood, we quietly matched the October prior high this last week with the third weekly uptick:

All eyes will be on the two inflation prints this upcoming week, CPI on Wednesday followed by PPI on Thursday.

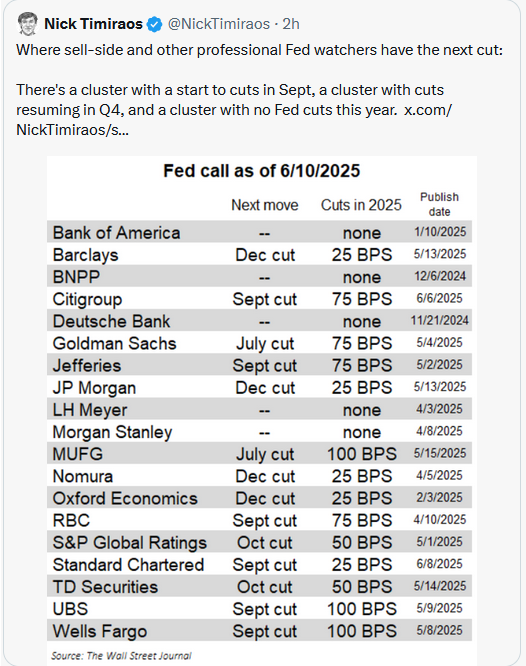

Look for Trump to continue to pummel and prod Powell if those come in light, the next Fed meeting is a not too distant Wednesday 6/18. As of this writing, there is a measly 2.6% chance of a cut.

Trump can bitch and moan all he wants, there is little reason for the Fed to cave here and any lowering would be just that, a cave.

I would expect the focus in DC to shift to the tax bill, which should be just as entertaining as the spoiled bromance occupying the headlines.

As if anyone with half a brain expected the two largest egos on planet Earth to coexist happily ever after. Please.

I honestly think Musk just got pissed that Trump tossed aside his NASA pick Musk’s close pal Jared Isaacman the same way he tosses anyone aside who does not comply and bend knee to the American Emperor.

Isaacman was a fantastic choice for that role by the way, experienced, young, brilliant mind with good bipartisan support. Just one problem, he was not ALL IN on Trump’s agenda. Not all in? Fired. Disposed of. Tossed aside.

It’s all a joke, top to bottom, left to right, with no end in sight. Get comfy.

So we cope by turning a blind eye. It’s much easier that way, much easier to stomach the lack of character, lack of moral compass, lack of depth I think I called it in my last post, much easier to just look away.

I myself remain Comfortably Numb so I cannot pass judgement on those who go about their lives also muted. There is no alternative at this point.

I digress!

To those who remain fully invested and have weathered this recent storm I salute you. See, turning a blind eye does in fact come in handy!

My cash %’s are way too high, very uncharacteristic for me but I simply can’t ratchet up risk with this backdrop.

Note I didn’t say uncertainty. The only thing certain is uncertainty.

I said backdrop. The environment, the atmosphere if you will in which we are forced to operate within and the thumb which we are forced to operate under.

Don’t try to wiggle free, it’s a fools errand.

Just keep the remote close by and the mute button an index finger press away. Power down and get outside sounds even better.

That’s where I will be, casually yet consistently whittling away at my list of projects trying to avoid the lure of sunbaked patio furniture.

Whether making substantial progress on that list or absolutely none, I will be accompanied by the soothing sound of pitch counts echoing from a distant radio.

I’ll be in the slow lane.

Now, let’s get some runs!

IN CASE YOU MISSED IT LINKS

Stock Market Performance As Summer Arrives – RIA

Governments Face a Choice on AI – WSJ

A Historic Missed Opportunity – The Big Picture

AI Is Learning to Escape Human Control – WSJ

Hegseth Warns of ‘Devastating Consequences’ Should China Seek to ‘Conquer’ Taiwan – WSJ

JPMorgan’s Jamie Dimon Predicts ‘Crack in the Bond Market,’ Citing U.S. Fiscal Mess – WSJ