Jotting down some notes and realized it had been a while since my last post. Almost a month.

As the temperatures increase and the weather improves my focus tends to migrate to outside activities and away from the desk.

Always a good thing.

I also haven’t been able to find the motivation or inspiration to write or keep tabs on markets and events like I usually would.

I’m exhausted with the entire landscape…markets, politics, the overall state of the world and everything in between.

Been here many times before and when I get back here, mentally, I simply get silent and stay silent until a sense of control or understanding returns.

I have always tried to keep politics outside my sphere of influence.

Thing is though, any market participant with non-trivial amounts of capital at risk almost has an obligation to “keep tabs”.

I do that by reading, not listening. The mute button is and will remain my confidant in the months and years ahead. I am thankful to look at the bottom right hand corner of my screen and see mouths moving, yet hearing nothing.

Even in silence, I still get nauseous scrolling through the headlines and skimming the content.

Tariffs. Inflation. Rates. Recession. Wars. Ceasefires. Interviews. Insults.

Exhaustion.

As I sit and think, which I do a lot of, I realize what we are lacking today is depth. There is none. It has gone extinct. Why?

The superficial sands on every surface swirl about, left and right, up and down, reacting to every change in wind direction and speed.

There is no depth.

No resistance. Only reaction.

That’s an extremely difficult environment to trust in or build upon, regardless of your agenda.

In terms of markets and investing, I’m not even trying to navigate it anymore and certainly not trying to predict the unpredictable.

The formula is slow things down, broaden my horizon, barbell my risk, narrow my focus to the technicals and let it play out.

This market is and will continue to be defined by headline risk, I will let the price action alone dictate my moves, not the reasoning (or lack thereof) for any perceived move in and of itself.

In other words, I’m channeling Pink Floyd for the foreseeable future:

I have become…Comfortably Numb.

Let’s talk shop…

RALLY FOR THE AGES

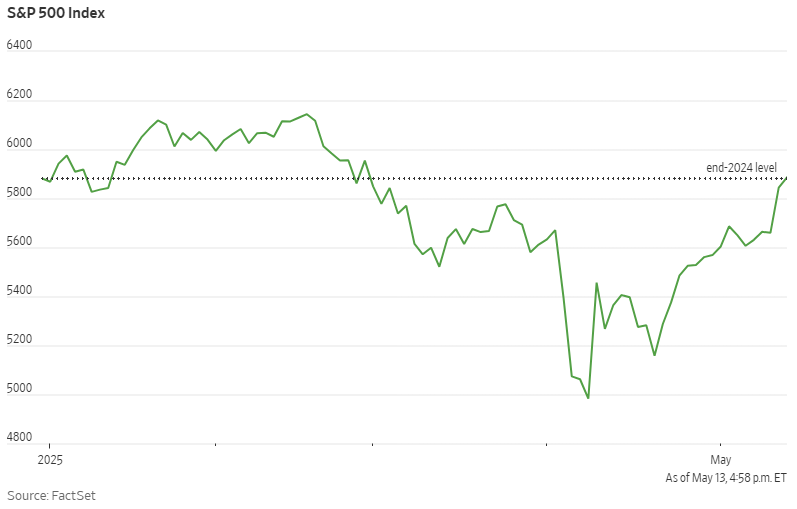

The swoon we witnessed in April was gut wrenching. It was -1000 every single day it seemed until Trump finally flinched and (temporarily) pulled the plug on reciprocal tariffs.

That “pivot” led to a huge reversal candle and it’s important to note the top and bottom of that day:

Make no mistake, now that we have rallied this far this fast, this administration will NOT want to see a retest of those levels. In their minds, that “yippy” overreaction is now in the past and they will not want to be second guessed or tested.

Whether it was short covering, traders and hedge funds caught offsides, doesn’t really matter. This is the kind of rally that happens in bear markets, real face rippers that lull one into a misplaced complacent sense of calm.

Now that we are levitating here back above the 200 day, levels that were once resistance weeks ago provide a backdrop of support.

I would expect some backfills and re-tests as we move sideways and digest these moves, which could take all summer.

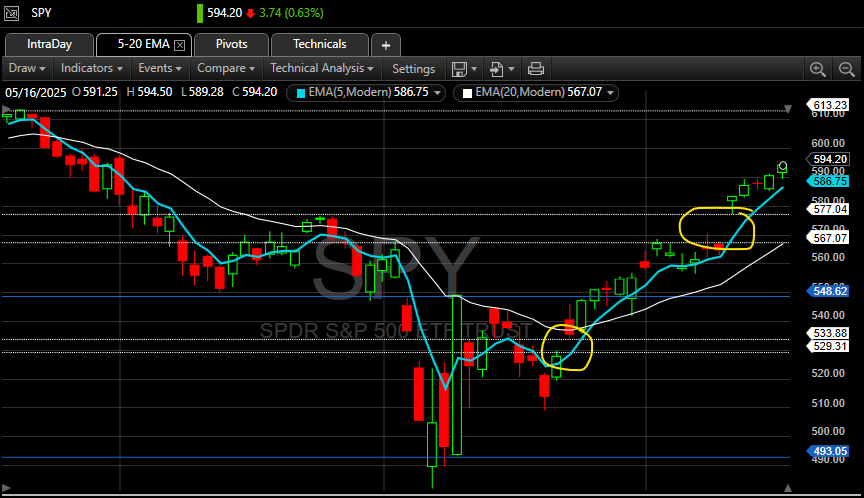

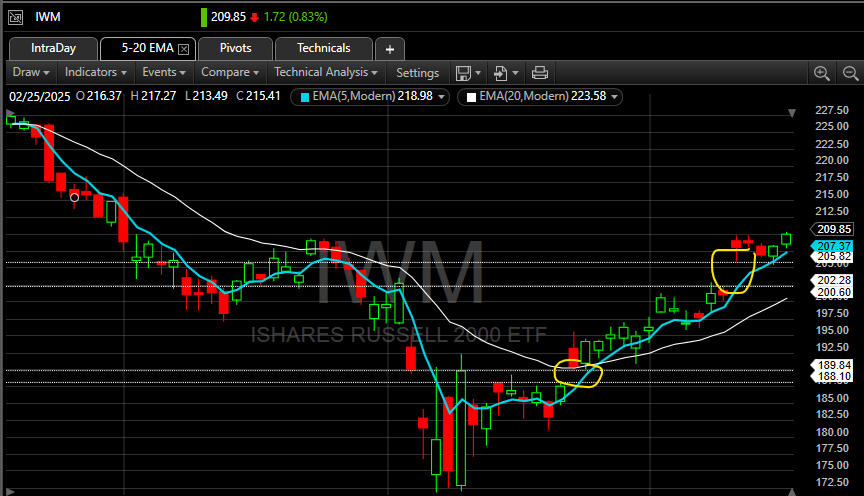

ALL GAPS GET FILLED

Anytime we gap up and rally higher, I mark those levels on SPY and IWM. So called “breakaway gaps” on high volume can be left unfilled, however in this environment given how fast we can reverse, I am in the all gaps get filled camp.

That said, we have a few looming large. SPY at 567 and 529, IWM at 202 and 188:

Those levels will likely turn into gravitational magnets if we start to drift in that direction. Be advised.

BEST CASE IS NOW FULLY PRICED

Just when everyone thought the world was ending, a thought we should all probably hold to be honest, I am already hearing the phrase “like it never happened”.

What trade war?

The deal with the UK was a chip shot from the fringe. The deal with China was meant to look substantial and stoke optimism.

That remaining 30% China tariff is still very high and we are already hearing from some major retailers about passing along that “tax” to customers. That of course is being met with attacks from the person responsible for the tax.

I was under the impression the market rallied because of a “pause” allowing for specific country by country negotiations?

Scrap that. The quote Friday was now we will be “telling people what they will be paying to do business in the US”. Rally for the ages will do that to you. Confidence returns.

OK. One question, is that cost (tax) still going to be based on bogus math and flawed formulas? Does the market know that? No? Well you may want to tell it since we have already instantly priced in best case.

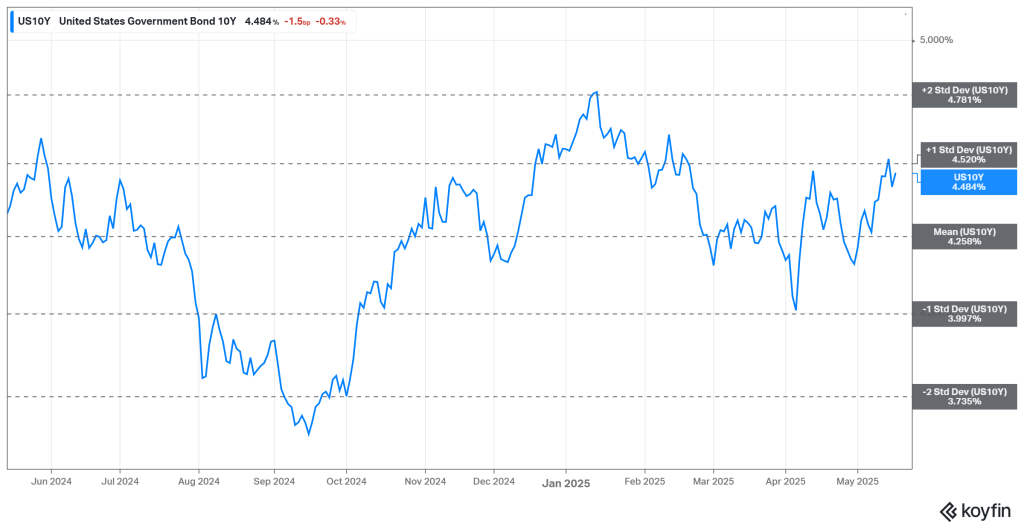

YIELDS ARE CALLING BS

Under the canopy of blue skies recently due to the equity rally, another metric has refused to budge. Yields.

Our selective memory has quickly forgotten that mere weeks ago, this was the true metric that mattered. Not stocks (“can’t really watch the stock market” – remember?) but yields. Borrowing costs. Mortgages. Loans.

Should the treasury market lose its bid, should large holders of US debt decide they just really don’t want to own it anymore (why? I don’t know, maybe because they are tired of the rhetoric from the pompous ass in the Oval?) yields will remain high.

Higher yields or rising yields can eventually stifle the best of rallies. Food for thought. Equities may have rallied but consumer sentiment has done anything but:

NO WIN FOR FED

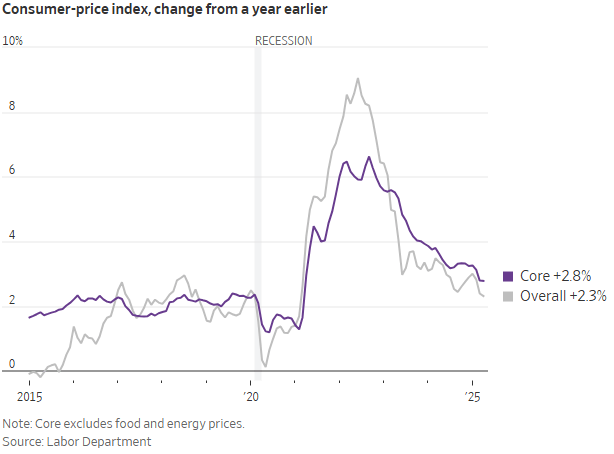

Inflation has cooled. Dramatically. There is no denying the fact serious progress has been made.

Many will argue (including myself) that spot rates remain too high given the recent prints but I am also willing to give the Fed the benefit of the doubt because future outcomes have been thrown into a blender.

Good luck setting monetary policy when trade policy potentially impacting prices is changing by the hour.

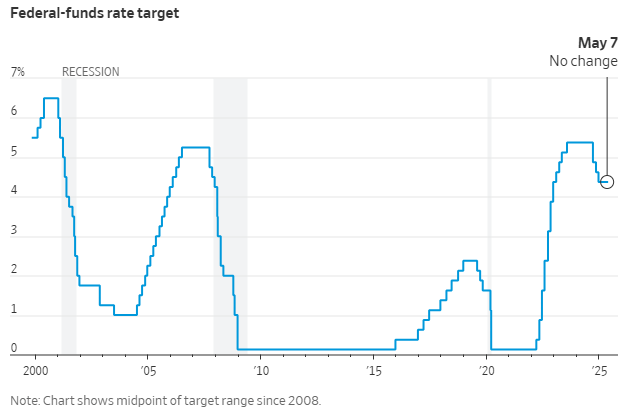

What they do have is flexibility. This is not a baseline of zero they are working from, they have plenty of room to lower and lower quickly if conditions deteriorate (or improve for that matter) to warrant it.

As of this writing, there is ~8% chance of getting a 25bps cut on June 18. That is a low % and that date is a mile away. If they stand pat in June? The next meeting is end of July, as in July 30. There is no meeting in August.

As Powell has said repeatedly ad nauseum “they are in a good place”. But man is it going to get uncomfortable as that June meeting approaches!

If the market tanks, they will get the blame. If the market rally stalls, they will get the blame.

If yields move higher, they will get the blame. If yields fail to move lower, they will get the blame.

Better stock up on your meds JP, you are going to need them!

INTERNS AND ALGOS

I would be remiss not to mention we are entering a period where things are supposed to be … slow.

Trading desks will be emptying … soon.

So at a time when the reins are being handed to interns and algos, the entire world balance remains in flux.

What could possibly go wrong?

That concern may be overblown to be honest, if anything this summer may provide a backdrop for even more fog to burn off and our old friend clarity to at least make an attempt to creep in?

ON BALANCE

If you are like me and wondering exactly what the end game is, the Treasury Secretary took the time to pen an op-ed to help explain it. It’s definitely worth the read for those looking to maintain hope.

I will also say I agree with some of it, conceptually, but time is not on our side. It reminds me of all the talk of “infrastructure improvement” yet I still get bent rims from potholes and cross the same rusty bridges?

As long as this administration continues to envision and push for stateside mass manufacturing of consumer electronics I cannot take it seriously.

Trump can harass Tim Cook all he wants, he is not going to make iPhones in America.

Cars? Trucks? Heavy Machinery? Equipment? Yes. iPhones? No.

There is also a storm brewing on Main Street, in small businesses across this country. Many will not survive long enough for this trade war to work itself out.

I also see where Bruce Springsteen is a target. The Boss? Say it ain’t so.

He’s a target because he is speaking his mind, he is stating his opinion loud and clear. Freedom of speech, right? Nah, not anymore.

Where is all of this headed?

I have no idea. You will probably know long before I do.

Hopefully some of the price alerts I have set will prod me into paying attention from time to time.

I’ll be outside, working with my hands, getting dirty under the canopy of blue skies and puffy white clouds.

I will be enjoying the summer wind, trying not to think about the superficial sands, shifting beneath my feet every day with every gust.