Somewhere in this here realm we call the blogosphere I recall reading or hearing someone who said the following:

“Buy the election, Sell the inauguration”.

A very quick Google search reveals the source which also just happens to be one of the best weekending podcasts on the planet that I never miss:

This dropped on November 15th, 2024.

I can’t remember what I had for dinner so I am wondering how I remembered the title so clearly yet failed to heed the advice, ya big dope.

I was also planning to run a little backtest to see where that long-then-short would have put me but I can’t do that either, not good for my health.

Today I see good ol’ POTUS in full attack mode early, letting Powell know this is all his fault and only he can fix it. OK.

As I mentioned over the weekend, time is not on our side.

Working some “deals“?

Finalizing some “deals“?

Can we please see your… “deals“?

Otherwise we are going to slowly bleed this out until the next Fed meeting. Should we sell in April and go away this year?

Forgive me if I seem a little “Yippy”.

Watching your net worth evaporate by the day will do that to you. I am wondering how many people just look at quarterly statements…

Open the Q1 that hits the email or mailbox in early April …. “Say What”?

Then you make that fatal mistake of tuning in to your financial media outlet of choice and start keeping tabs. Red. Red. Red.

Enjoy a relaxing Easter weekend with your family, tune in Monday morning hey maybe we can gap higher and turn this around? Red.

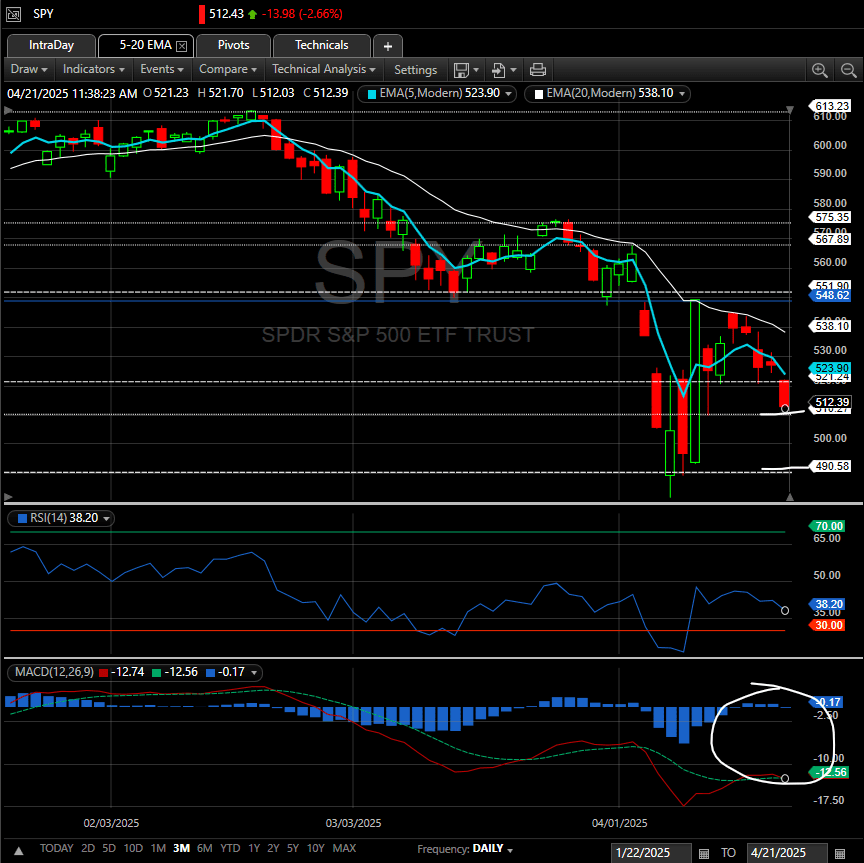

We are now testing the 510 lows made in early August last year, retracing the “pause” bounce piece by piece and appear destined to retest the bear -20% below at 490 next.

The MACD was trying to show signs of life but appears to be rolling over now as well. RSI remains pinned well below the 50 line. What does that mean for those who don’t follow the technicals? It means nothing good to see here, move along.

So a refresher course on Sell America:

✅ Equities down

✅ Dollar down

✅ Bonds down

✅ VIX up

✅ Gold up

Only way out now is a decent sign of progress (whatever that is at this point) or another flinch. From someone, don’t really care who. Do you?

Don’t worry, only 12 more trading sessions after today until the next Fed decision and there is only an 11% chance of a cut then.

They may be taking the heat for rates being a tad too high given the recent deflationary prints, but they have absolutely nothing to do with the Deep Red you see in markets every day.

That my friend is due to the ham fisted execution of a deeply flawed plan.

I ask once more…

Are you not entertained?

RECOMMENDED IF YOU MISSED IT

Lumida Ledger – Trade Deficit Delusions and US Dollar Drama