Didn’t have to be this way folks!

But that doesn’t matter at this point, the damage has been done and “the patient” who was supposedly recovering is in fact slowly bleeding out.

You and I are at a distinct disadvantage because we’re not privy to the private conversations. If there is in fact an end game, we have no idea what it is or when it will manifest.

If there are in fact negotiations, talks, “deals” being made, let it be known that time is not on our side.

Until then all we can do is wait for the next headline or social media post, then wait to see how the market reacts.

There is no denying this tariff rollout was embarrassingly bush league with bogus math and flawed strategy.

When the baseline 10% was announced markets actually rallied after hours. Didn’t last. When the reciprocal visual aid made its glorious debut, the market quickly began the process of pricing in the circus.

Step right up folks, greatest show on earth, was that the message intended? Was anyone shocked that assets of all shapes and sizes began exiting the country for days? They shouldn’t be.

The 90 day “pause” that quickly ensued was simply a desperate attempt to save face and stop the bleeding. That newly applied bandage is also quickly saturating given the fact we can’t match or retake the pause bounce highs during the last six sessions.

The only thing… that keeps us above the abyss going forward is substantial progress being made in a short amount of time. I’m not talking about weekly progress and certainly not monthly. It must be daily.

If we don’t see start seeing daily progress? Buckle up. Some scenarios from a trusted source.

So… what I am watching other than the headlines…

technicals

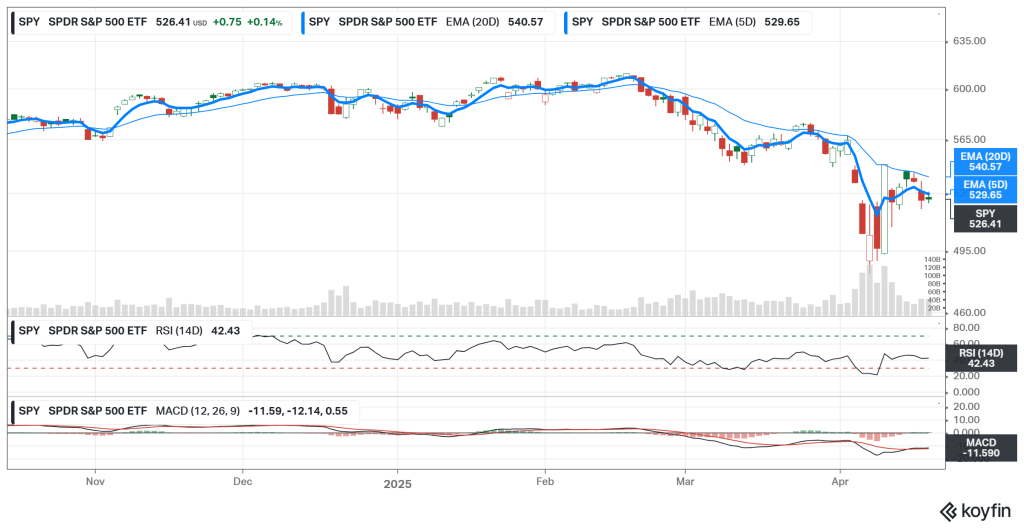

Charts remain broken, pause or no pause. Looking at SPY, hard to believe we lost the 5/20 EMA signal on a bearish cross back on Feb 24th and have struggled get back above the 5D:

Some additional sideways chop will bring the two closer, but I need to see the 5 close above the 20 with decent volume before getting too excited about getting (and staying) long.

I have been a buyer recently especially in longer-term accounts because it is literally so painful to buy. I know when it hurts this bad and I have to shut my eyes and hold my nose to do it, it’s time.

The VIX although still elevated continues to normalize and should drift back toward 20 barring any sell-off reacceleration.

A lot of chatter this week about whether the recent 10yr spike from 4 to 4.50 was isolated, knee-jerk if you will, and will continue its retreat back to and ultimately below 4.

If we start to see “sell everything” come back into focus (equities down, dollar down, bonds down/yields up) that will put added pressure on D.C.’s timeline.

EARNINGS

Banks are out of the way and things heat up this coming week. GOOGL will be the first mega tech to test the waters Thursday after the close.

Most are expected to get a pass on guidance, since nobody has a clue what the future holds. Delta provided a couple of alternatives, if anything expect projections to be vague.

Perhaps those who reaffirm with the “as long as” or “barring unknown trade impact” will be taken at their word and not overly punished.

If we do see punishment simply due to acknowledging the facts (i.e. NOBODY HAS A CLUE WHERE THIS IS HEADED WHY SHOULD WE?) that is an unfortunate side effect of just looking for an excuse to de-risk even further.

SUPPLY LINES and SELLER EXHAUSTION

Once I started viewing overall support/resistance levels as simply demand/supply lines, especially for individual stocks things got a lot easier.

You can’t really question the price action when it just reflects desire to own or lack thereof.

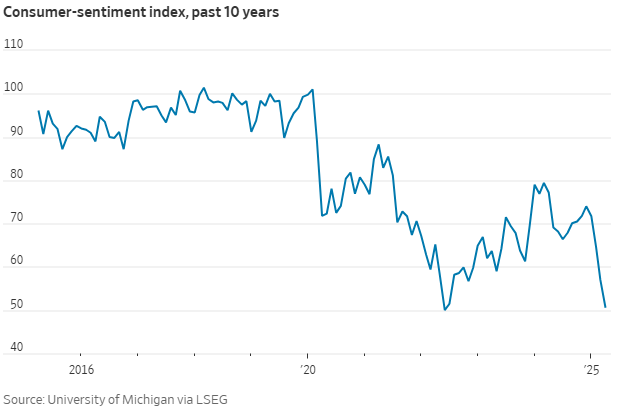

Sentiment is washed out, I don’t think that’s up for debate.

Next up will be just an overall lack of selling pressure. That doesn’t mean a V-shaped bounce, although that could absolutely happen, it just means the demand/supply lines have leveled out and we can consolidate until something positive happens. Something good!

THE POWELL PINCH

I knew almost immediately after Powell started speaking the truth about tariffs and the potential impact to the battle they have been waging for quite some time, he was toast.

Trump wasted no time letting him know he was behind the curve yet again and should be lowering rates into the abyss simply because he knows that would instantly put a backstop (albeit temporary perhaps) to this chaos.

Stopping the equity/dollar/bond bleed would also give the White House what it has very little of: Time. Time to work.

Now here’s the rub…

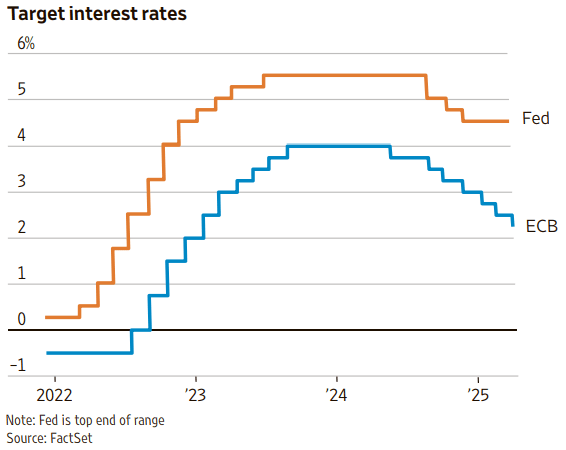

I agree that spot Fed Fund rates should be lower. They are allowing extra room to maneuver, insurance, space, margin whatever you wish to call it because they do not want to get this wrong.

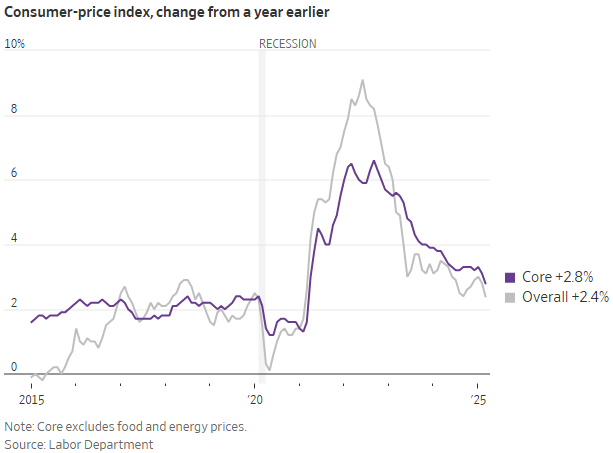

Inflation reengaging after the cut cycle resumes is their worst nightmare, especially after the progress that has been made:

The next Fed decision is 13 trading days away and as of this writing there is only a 13% chance of a cut.

All that said it will be interesting to see how this plays out in real time over a short amount of time.

Once again, we end on the mention of time.

There simply isn’t much of it available for this situation to be truly resolved.

The market is a discounting mechanism. It rewards clarity, growth and visibility. It punishes vagueness, regression or any hint of obscurity.

In other words, it punishes directionless ambition.