The best thing I can say about this week is it’s over. Not a minute too soon.

Purpose of this post is not to rehash the week, or revisit, or reframe.

There are plenty of options available to do that ad nauseum if you didn’t get enough.

What I do want to do is get some thoughts down tonight, some items I will be mulling over entering next week and, of course, beyond.

Beyond is perhaps the key word here, I think everyone including Yours Truly will need to start thinking longer term. No chance this mess vanishes overnight.

Good opportunity to flip the script also.

I tend to be most productive in times of crisis (crisis may be too strong a word right now? but work with me) when I am forced to push back from the table seek solace and double down on my thoughts.

Nothing I enjoy more than Strategy.

When I’m locked in processing thoughts and plans I could sit in the path of an EF-5 unphased until my laptop, pad and pen disappeared in the updraft.

Let’s unwrap the mind shall we? and line up said thoughts ahead of the weekend…

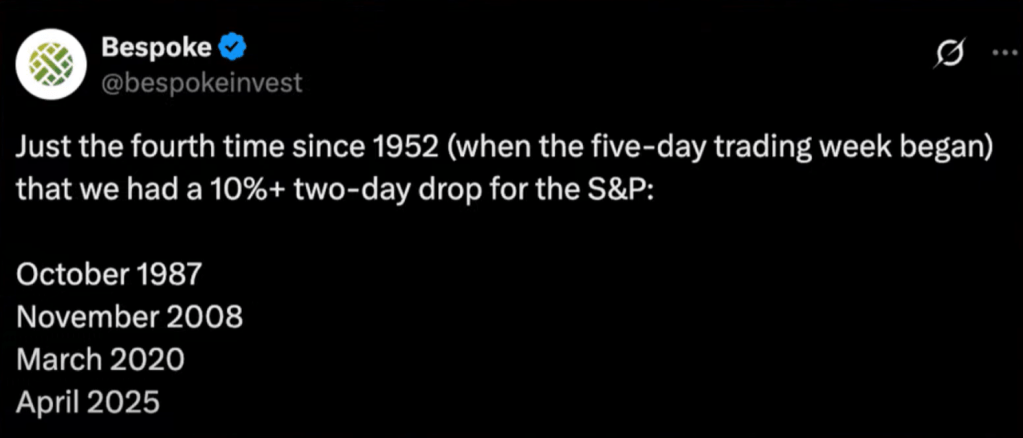

STILL BROKEN AND STAYING BROKEN

Broken chart in WBM terms means prices below all of the pertinent moving averages. 5/20 EMAs and 20/50/200 SMAs.

Not very often we check all of those boxes but welcome to tariff ville.

One of the snips I caught from my YouTube queue was Josh Brown mentioning “nothing good happens below the 200 day moving average”. You are so correct JB.

I would be remiss not to mention the looming death cross as the 50 eyes the 200 (circled in white above). No need for an explanation, the name alone does the work for me.

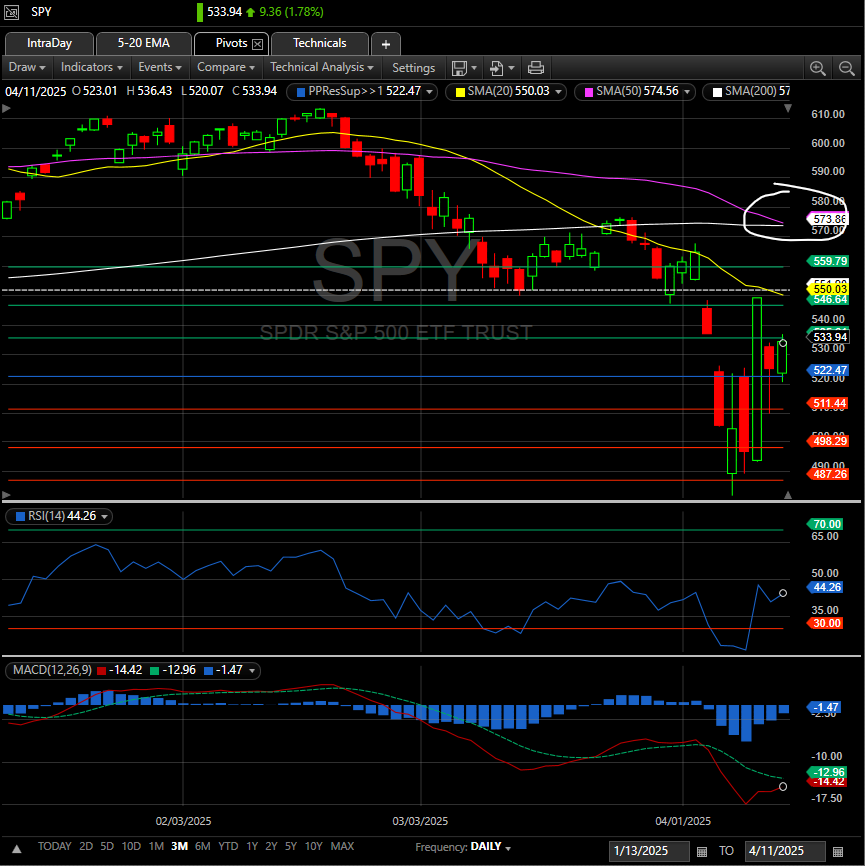

Shorter-term, I like to focus on the 5/20 EMAs. I include charts for the majors at the end of each week for a reason… I want to know where they stand.

5 crossing above the 20 = long

5 crossing below the 20 = to the sidelines, possibly short at your own risk

The 5 crossed below the 20 on Feb 24th and is still there. Heeding that warning and sitting on your hands when it happened would have you dry as can be under roof well before the heavy rain set in.

A shirt dotted with only a few raindrops dries very quickly.

That’s also my reminder why to place stops.

I digress!! Where was I? Oh yeah. Broken. Broken charts.

All of these moving averages overhead now become resistance, take your pick, doesn’t matter. We will bump our heads until we don’t.

That sideways chop could take us to Labor Day. Tests and re-tests. Any vacations planned? Still time to save your sanity.

If you see some easier or quicker than expected “punch throughs” on those averages pay attention with a glance at MACD and RSI. When we do move higher it will not tarry, see the “pause bounce” as Exhibit A.

HEADLINE RISK

I have to think we are skewing positive here at this point. Any more deals, especially with China would bode well short term.

Is there anything left that would drive massive downside moves?

Hold that thought…

BOND YIELDS

No secret D.C. (or simply DJT) wants yields lower, especially the 10yr. Lower 10yr yields equal lower borrowing costs, period. That’s the end game.

Don’t look now but we appear to be headed higher instead of lower…

I also hear we have about 9T debt due to be rolled, refi’d if you will, this year. I have no idea when and it doesn’t really matter. What matters is being able to roll that debt to a lower rate.

EARNINGS

JPM actually raised guidance today which shocked me, I was almost hoping they would withdraw any future guidance because of this tariff sh*t show but I will never question Mr. Dimon.

If he says higher then higher it shall be but he did also mention the storms that lie ahead. In the end he is no different than you or I, he too must simply wait and see how it plays out.

Tech earnings will be a different story. How willing are they to … “guess”.

We shall see.

FED VOID

Next Fed meeting is May 7th, three weeks from this Wednesday. On the surface that seems to be around the corner. If the bond market pukes next week that may suddenly seem miles away.

Inflation reports this week were best case…

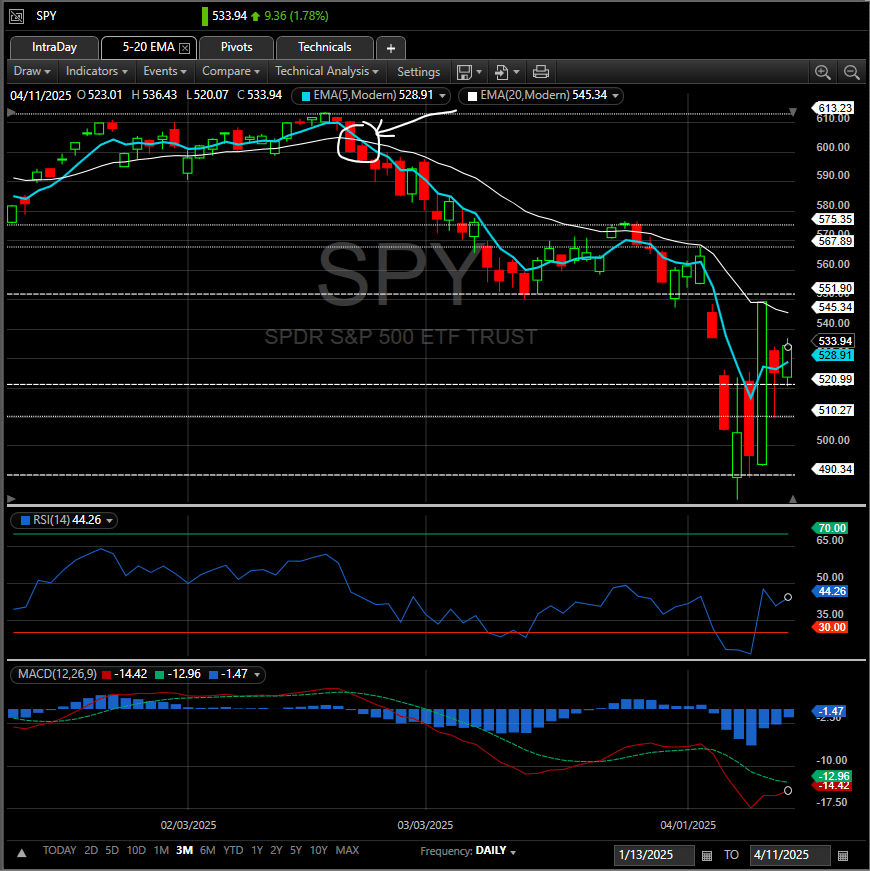

Consumer sentiment and inflation “expectations” were worst case…

Which all make the case for the Fed preference to stand down and rightly so. They have ample room to maneuver.

I don’t see the need for any emergency actions.

Then again, I didn’t see the need to drop the economy into a blender and start randomly pushing buttons either.

Have a fantastic and hopefully restful weekend…