At some point early last week I started doing something I rarely do, looking at out of the money SPY puts several months to expiry.

My reasoning was my gut. I have been very tactical in 2025 with little trust of anything or anyone, be they words or actions, especially coming out of Washington.

I went so far as to sideline an entire IRA in cash since mid February as we appeared to be rolling over from inauguration honeymoon fueled gains.

Then I made a mistake.

I decided to have faith.

I chose to see the glass half full and chose to put some risk on, put some idle money to work ahead of “Liberation Day”.

Having avoided most if not all of the recent carnage I knew I could not (and should not) remain on the sidelines forever.

Plus it seemed like given what had transpired already this year, surely sanity will prevail on Wednesday. Whatever is ultimately announced will likely be conservative in nature with a muted, perhaps even positive reaction.

Joke’s on me.

Not only was I wrong about a positive reaction, I was dead wrong about anything conservative and laughably wrong about sanity prevailing.

What I did realize, clearly, fully, without question was the sanity sails are neatly stowed away and likely to remain there for some time.

The market reaction Thursday and Friday was brutal but anything but shocking. Why wouldn’t it dump? Why wouldn’t we breeze past correction territory and set eyes on a bear market and beyond?

Why would anyone be willing to invest a dime into an environment when there is now zero visibility into future revenues / profits / margins / capex / hiring / growth?

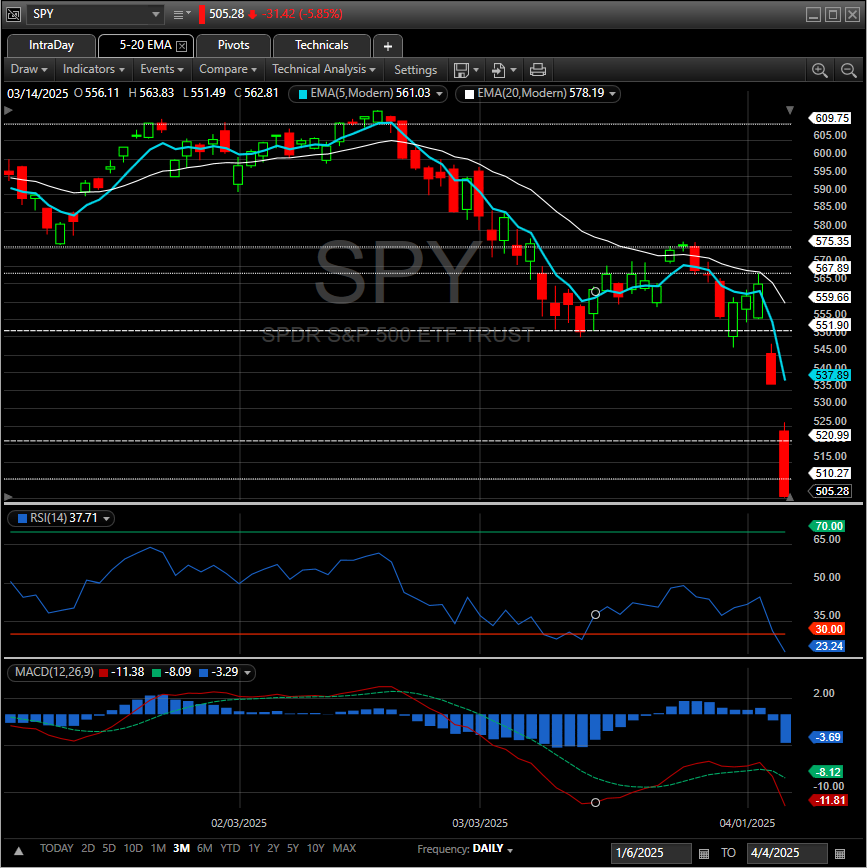

The charts are broken. All of them, not just a few.

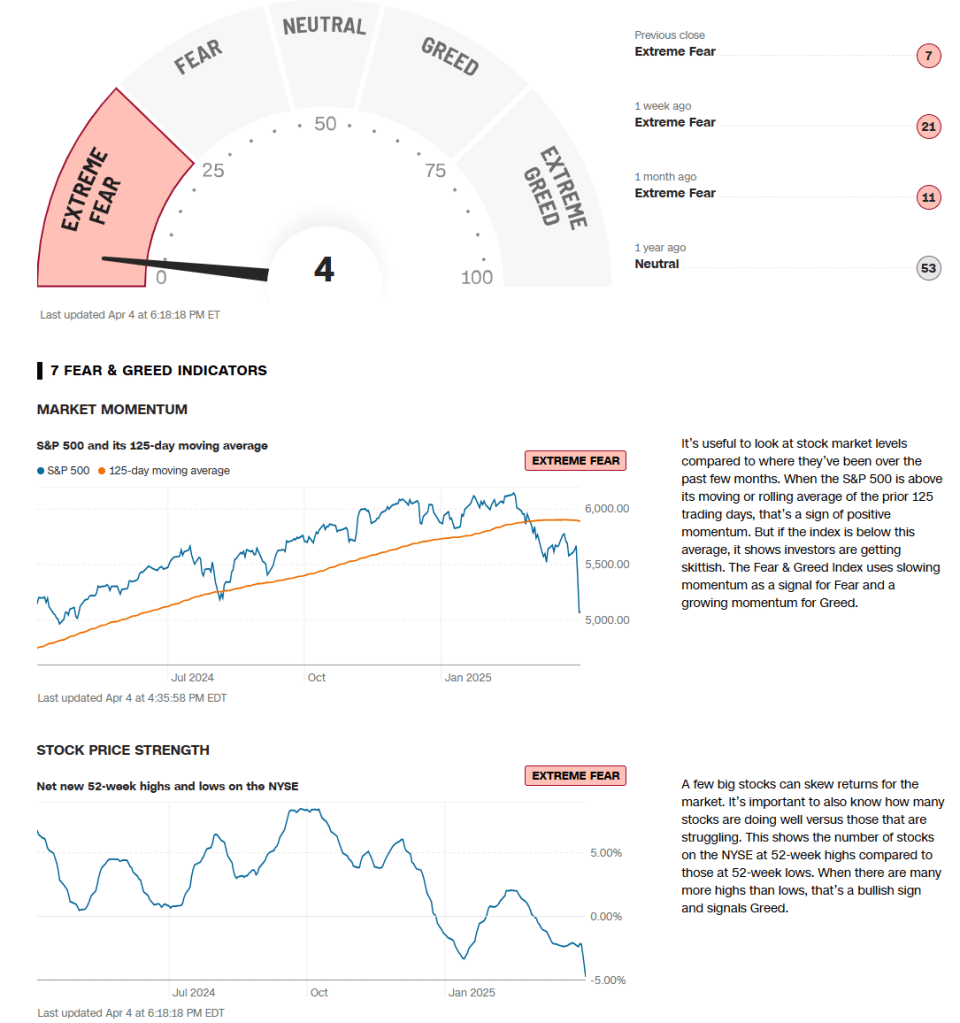

Here is the Fear/Greed gauge from CNN Friday, it’s almost pegged:

A reaction like that screams imminent reversal bounce but if it appears will it last? Should it last? OK, name the catalyst.

I’m staring at three pages of notes and I was planning on going over the numbers, charts, key takes. Not going to do it.

It’s not worth my time to rehash this week or speculate on a potential outcome when the entire state of global trade as we know it is in flux.

I’ll leave that up to those paid to do so. What I will say is this:

We may have just lost 2025 in early April, barring a timely and complete 360 pivot away from this three-ring circus of self-inflicted chaos.

If you study JFK’s actions during the Cuban missile crisis you will find him purposely and continuously surrounding himself with a myriad of different voices and opposing opinions.

His job was to simply listen in earnest to the point of exhaustion before ultimately making his own decision. In silence.

That said, what I do at times like this is 1) breathe… and 2) take a step back and relentlessly seek perspective from people much smarter than I.

I implore you reader to do the same.

Pardon my sanity… in a world insane. – Emily Dickinson

ONE INTERVIEW

Bloomberg was fortunate enough to have Howard Marks on Friday morning and Lisa Abramowicz put on a clinic on how to get the most out of a key guest at a key moment with very little time to do it. Here is a hint: you let them speak.

If you listen to one interview in an attempt to make sense of what has transpired this week and what it potentially means going forward, please make it this one:

SOME LINKS

More recommended reading if you remain curious and can find the time:

Trump Pushed The Red Button…Now What? – Howard Lindzon

Liquidation Day or Liberation Day? – Lumida Wealth