A quick glance at my last post reveals a hint of nervousness, distrust and it looks like I ended with “I need some of the fog to burn off”.

Well, I’m still waiting!

Clarity does in fact manifest itself on occasion through chaos, something we should all hope for in the months ahead.

I haven’t been writing lately because I don’t have much to say, everything mentioned in The Slow Lane post still applies.

My mindset is still in wait and see mode, although I did finally put some trades back on at the end of the week, I will explain why in a sec.

We have been lulled to sleep in recent years, I see and hear the complacency in every corner of the market. The uncertainty globally right now just does not mix well with that environment.

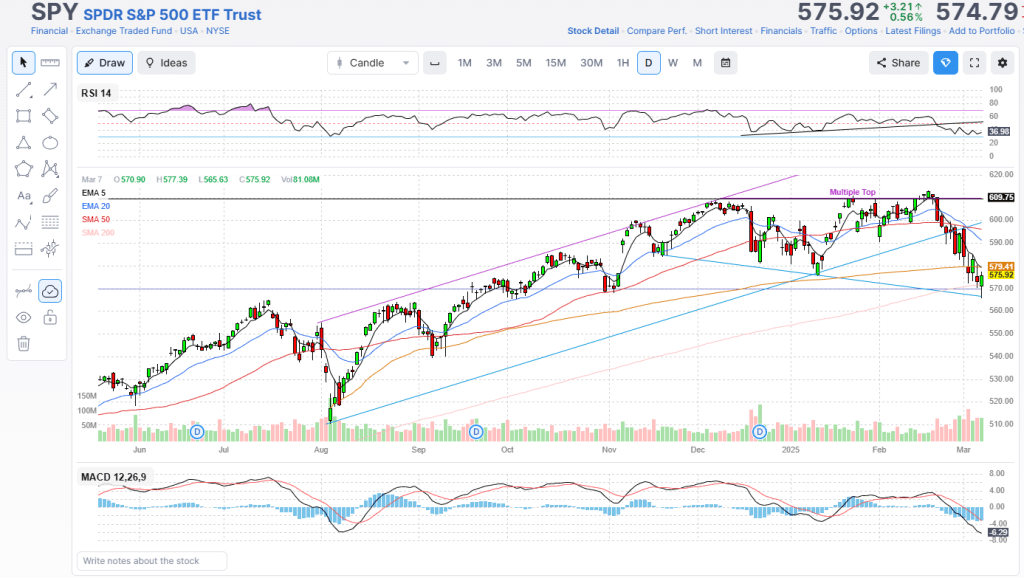

The Charts have been busted for a while, “busted” being my term for when the 5 day EMA drops below the 20 day EMA. That usually means trouble ahead or at the very least a stall/shift in current momentum to be aware of.

In addition to the 5/20, I like to also zoom out and apply the more traditional 20/50/200 day SMA and it had been a hot minute since we had visited the 200.

That all changed last week…

Not unexpected. Once we filled the gap at 585 it was almost a certainty to go ahead and test the 200. Not to mention we just needed to go ahead and get it over with. We actually lost it further Friday until a lunch hour stick save stopped the bleeding.

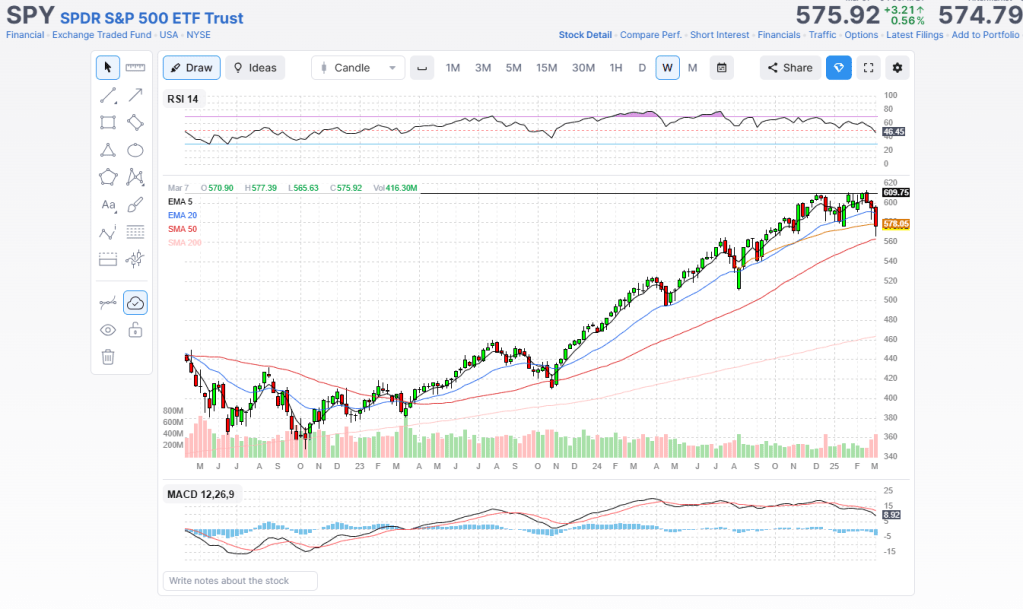

Zooming out I see a couple of things. First, this move is not that big and second, it clearly has room to get bigger if we fail to bounce here. Sideways digestion is an option as well.

It helps to remind myself the bull market is still intact and still in control, a drawdown here and there is expected and quite honestly necessary. Rip currents are always there and will eventually find you. You backfill, test, re-test, digest, regroup and ultimately hopefully resume your journey.

rip current

: a strong usually narrow surface current flowing outward from a shore…

Having mainly been on the sidelines since mid Feb, it was time for me to put some risk back on. Everything will still have a very tight leash though, I will need to stay nimble for the short term.

I am starting to see some individual names also dance around and below their own 200 day SMA, starting to see some forward PEs come in from nosebleed levels. Whouda thunk it?

Longer-term, I am experimenting with an extreme version of the well known barbell strategy. One of my two IRA’s is entirely in cash. 100%. Not something I recommend (in fact, re-fresher course, lest we forget, nothing you read here is something I recommend).

My reason for doing this? It allows me to sleep at night for one, it also allows me to focus on being tactically aggressive in one account and not worry about being too early buying dips. If something gets even cheaper later, I can pick it up…later… in account #2.

This is where cost basis management comes into play too, I like to scrub off higher basis lots to raise cash along the way.

Seasonally? March is not too bad, especially recently and when we spend the first week or so in the red. Earnings season is wrapping up, I would expect the volatility to dry up also.

I still think the one wild-card (the one wild-card not getting spray tanned oranged? between press briefings that is) is our old friend inflation.

Powell says we are “in a good place”, I agree, now we just need to stay there. Economic Calendar tells me CPI is coming up this week, that print could determine the March fate.

Meanwhile I will be doing what I have been doing all of 2025…

…avoiding podcasts…

…muting the television…

staying informed by reading instead of listening.

It’s amazing how peaceful that is.

The only thing I will be listening to are pitch counts coming from Spring Training games on the office radio. Every day at 1pm my friend.

Who knows, if I have something to say, I might even write a blog post or two along the way.

Happy Spring…