I found myself in an interesting situation last week as the long holiday weekend drew closer.

The market had been drifting sideways, albeit after some pretty vicious Monday gap-downs that were methodically bought as each week drew to a close.

A buy on Monday sell on Friday pattern had emerged as earnings continued to trickle in. I also noticed we seemed to be running out of steam, not really eager or willing to take out any prior highs.

I started closing positions.

Even positions in longer-term accounts that I had fully intended to hold much longer.

It was as if some unseen primordial force had taken over my right hand and began to make the decisions for me and all I could do was watch.

This continued throughout the week and on Friday morning I was down to my last position in my HSA.

It was as dividend payer and thanks to some dumb luck on entry it had appreciated in recent weeks to a point where the dividend I was seeking to earn was already mostly covered with tax-deferred gains.

I hit sell on that one too.

I watched as it disappeared from the bottom of my screen followed by words I have not seen in years: “NO OPEN POSITIONS.”

Sometimes in the search for clarity or direction it’s best just to ease off the gas, reach for the turn signal and move over to the slow lane.

slow lane

: a situation in which something is not advancing as quickly as others

This market may continue to rip higher this week and leave me in its wake, slumming along at 55mph with “NO OPEN POSITIONS“.

That’s totally fine because I will have the peace of mind to figure out what’s next at a pace I determine.

What I do know is we look extended, toppy and tired. That combo can lead to trouble.

Let’s run through some items on my mind…

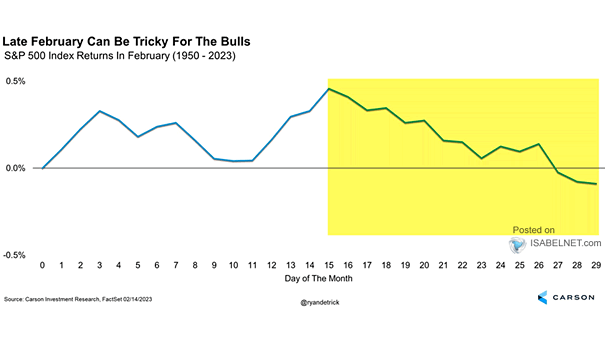

February is one of those months that is historically unkind:

The second half is normally where the most damage occurs:

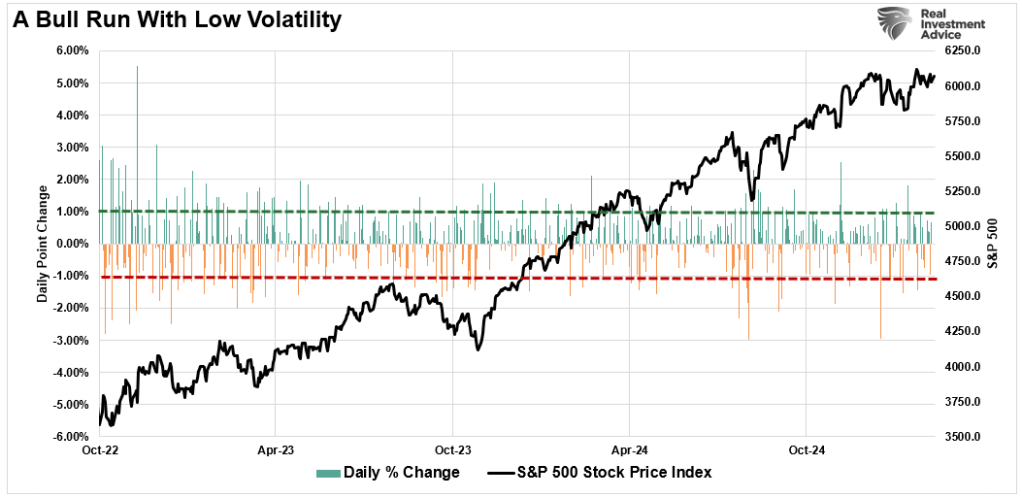

We have been lulled to sleep in recent years with very few oversize moves:

Zoom out to a monthly view and you can see how extended things are:

That epic low vol run has us sitting at lofty valuations:

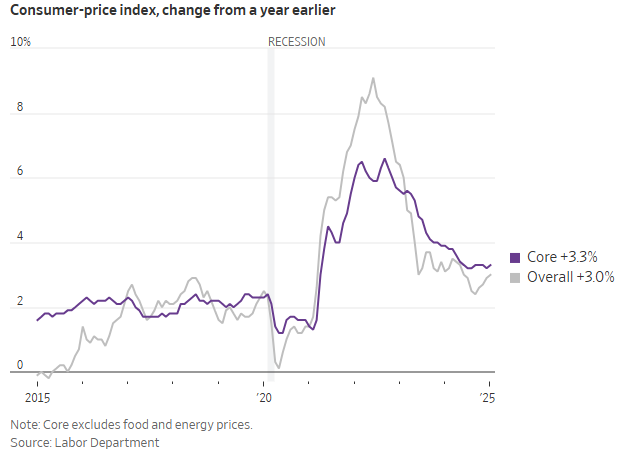

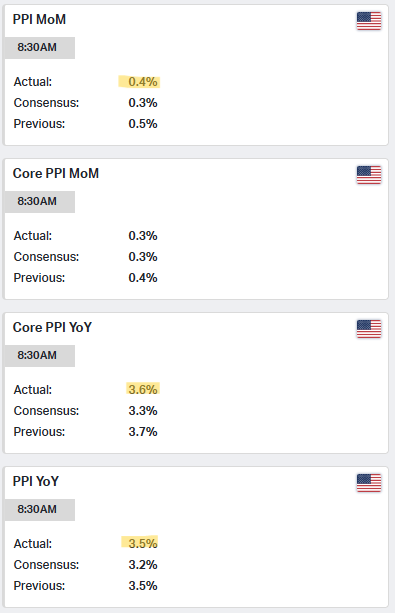

Inflation metrics have stalled and have started to tick higher:

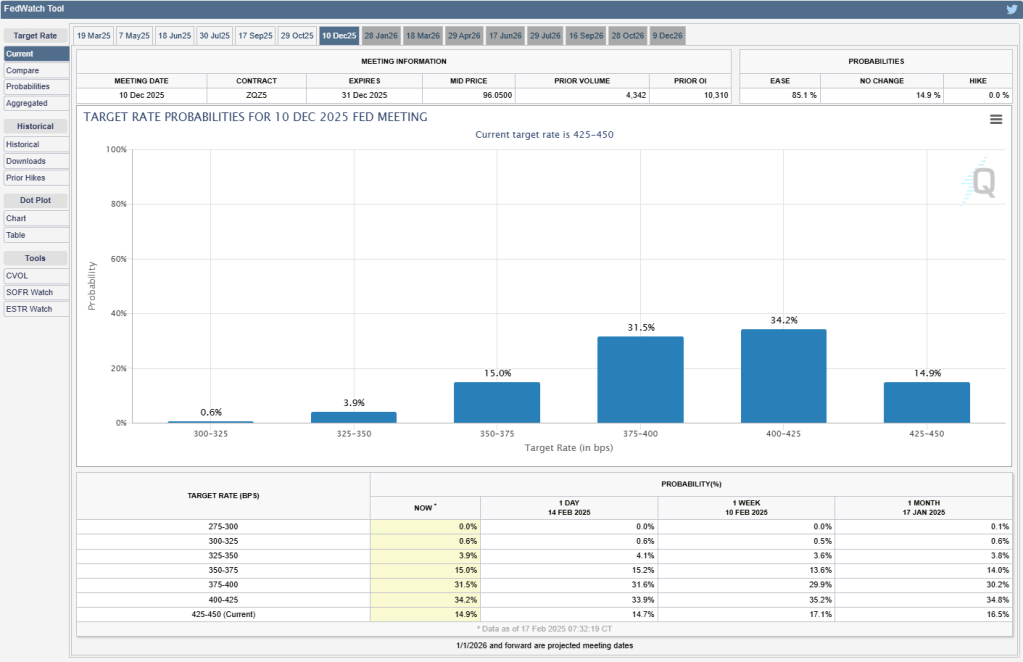

Rate cut expectations have cooled dramatically with now a 15% chance of NO further cuts this year and a 34% chance of only one:

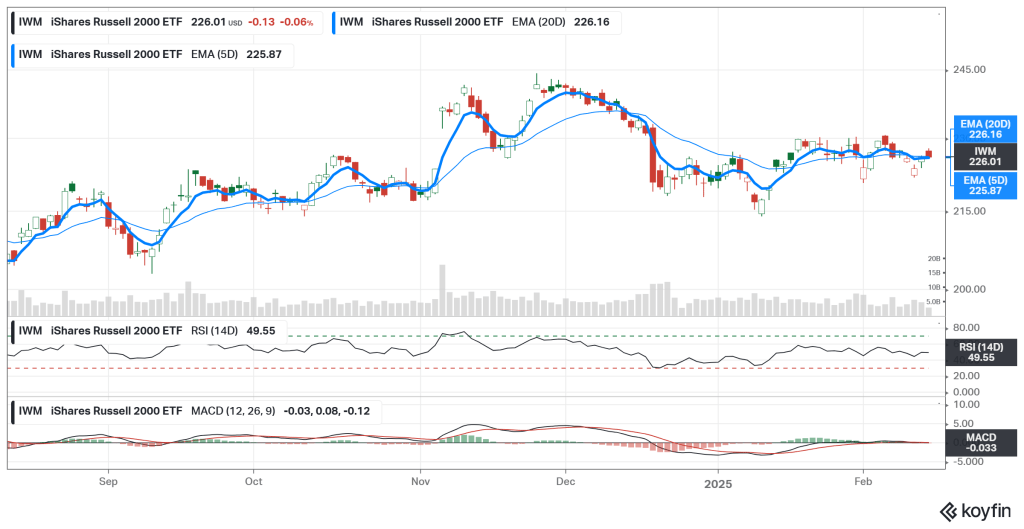

Small caps are moving sideways just not sure what to do with the potential of rate cuts evaporating:

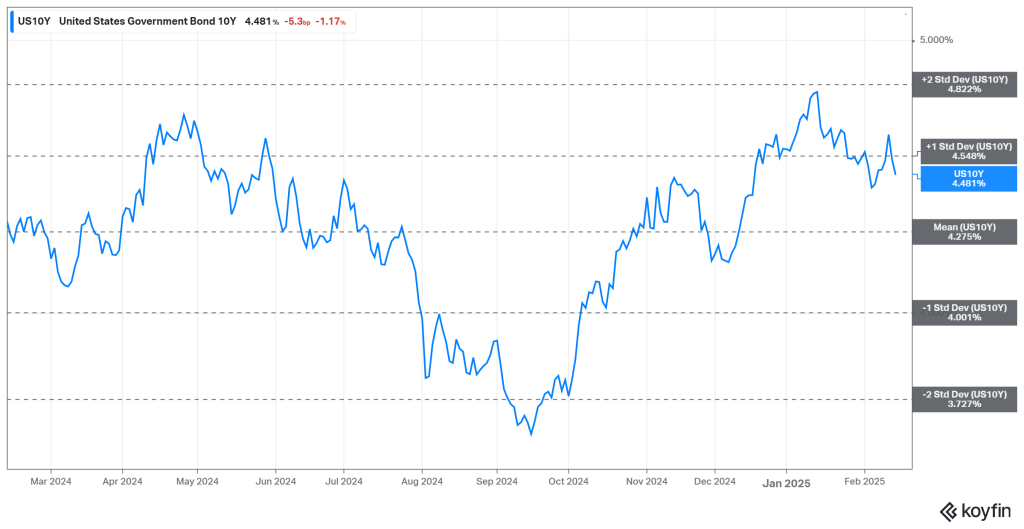

Lastly, 10 year yields remain stubbornly high in the absence of a legit bid for bonds which puts pressure on borrowers of all shapes and sizes:

I made a conscious decision this year to turn down the volume. I spoke about that in January Muted.

There will be plenty of time for me to catch up with the talking heads when and if I choose to do so.

It turns out to have been one of the best decisions I have made. It has allowed me to focus and narrow my field of vision to what really matters.

I am sleeping well and I am eating well. I am exercising. I am reading. I feel well surrounded by adequate margin allowing me time to think.

If I were fully invested right now I am sure none of the above would be the case.

There will be plenty of time and plenty of opportunities ahead to dial up the risk.

For now…I need some of the fog to burn off.

For now…I will be just fine here in the slow lane.