Enjoying a quiet Sunday afternoon, snow covered lonely deck outside the window to my right. The ice storm hit exactly three weeks ago today and I expect remnants to linger well into next month.

I like winter now, a stark contrast to how I felt about it in a former life. These days I am just as content sitting by a fireplace as I am sitting beside a firepit.

I also expect the Spring fever to hit soon though, I look forward to feeling the sun on my skin. All in due time.

We have a new President, I won’t be dedicating any time here in this venue getting into that other than to simply say: buckle up.

You are just like me… along for the ride.

Anything is possible going forward, nothing will surprise me. Why should it? Better yet, how could it?

The market has been steadily marching higher since mid month, leaving some gaps to fill in its wake. Breadth has been improving, technicals are flashing strong buy signals.

What could possibly go wrong?

Well, how much time do you have?

Let’s not go there, let’s keep the glass half full for now because like I have said in prior posts, things are teed up quite nicely going forward.

However…there WILL be bumps along the way. This ride will be anything but smooth. I will also say this. When they do show up? You can expect them to be large and to move swiftly.

No time for complacency.

Let’s talk shop a bit.

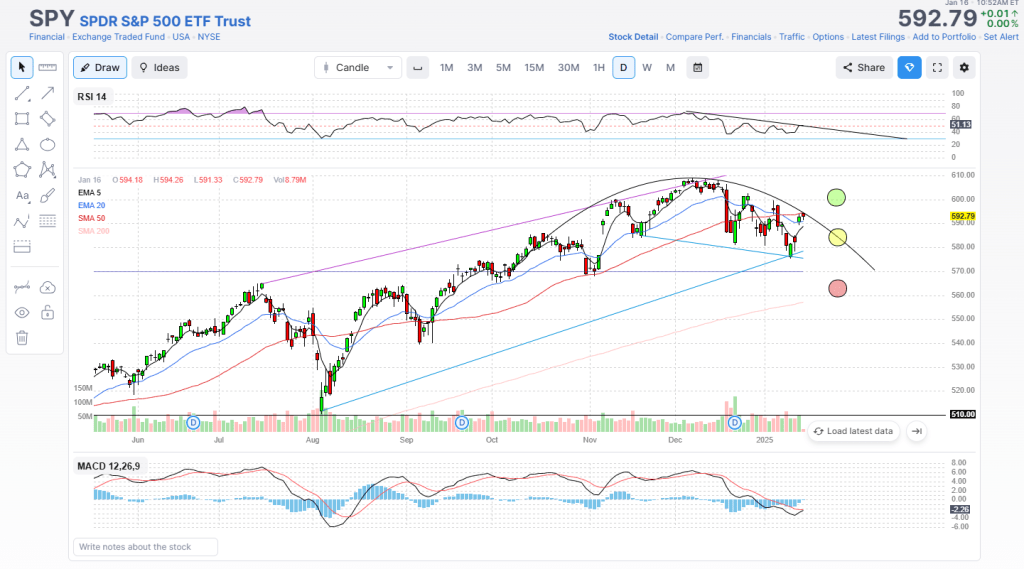

When we first gapped up in mid January, my eyes were drawn to a possible rollover pattern that would be tested that day. There were three possible outcomes: sideways/up as the EMA’s bullishly crossed, sideways/down to ret-test the up channel and finally a full rejection back to the 200 day.

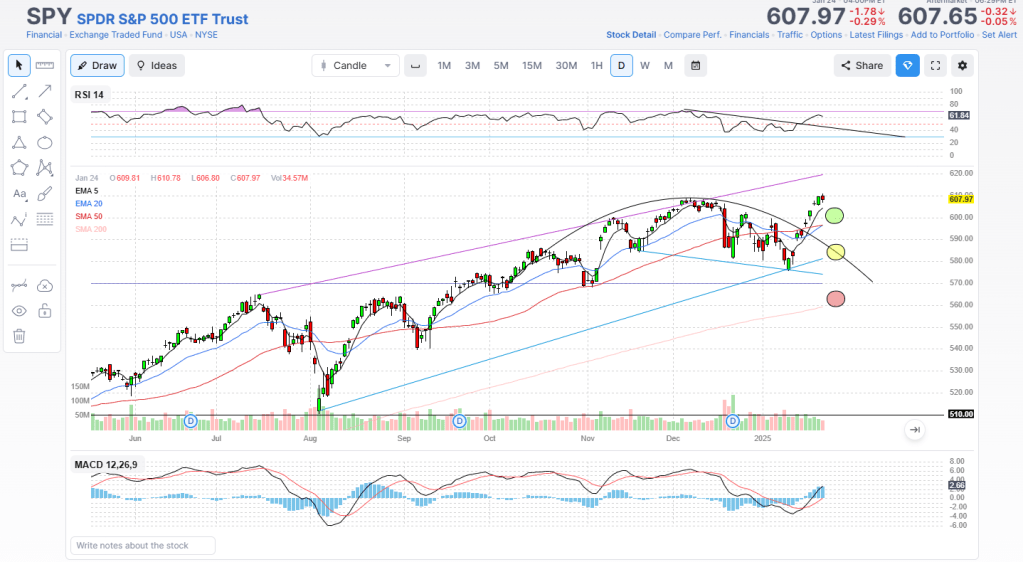

Turns out it was neither of the above and we continued higher without the sideways part. With the RSI back above 50, the up channel is confirmed to still be very much in play and the rollover was quickly negated. For now.

At this point, with tech earnings on tap, the next hurdle will be breaking away from that 609ish level and not putting in a double-top. Perceived guidance from the tech earnings this week will decide that fate.

Keep an eye on the bond market, especially 10 year yields. They continue to remain stubbornly higher, potentially pricing in some re-inflation? Borrowing costs will remain higher. There is an ongoing debate on the street about what level the 10 year will become a true headwind for stocks.

My take on that is once we breach the 4.79 mark (again), which equates to a 2 standard deviation move, equities will start to reflect that pain.

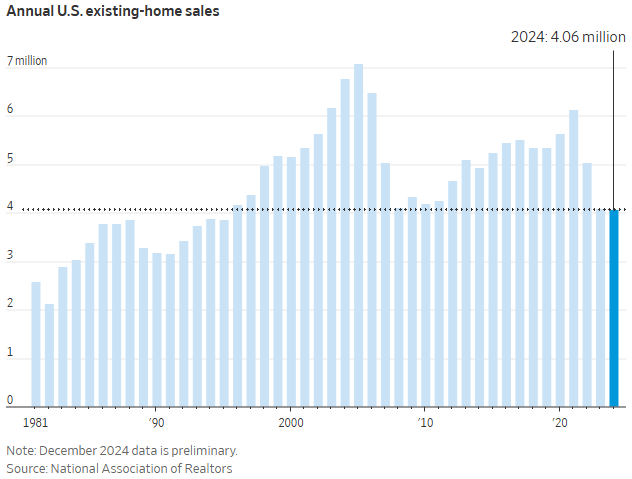

The housing market will continue to be in the deep freeze until we see that 10 year ease up. Even with coming off the worst year since 1995.

Lastly, credit card trends could be at a tipping point and highlighting more household strain than anyone wants to mention. High rates, high balances, minimum payments being made.

Time will tell how this all shakes out.

The jury is out.

As for now?

Keep your seatbelt fastened…