2025 is off to a white cold start, already knocking on 12″ of snowfall ten days in. It took me about three days to clear a path from garage to road, but it felt good getting out in the weather working with my hands. Good for the soul.

Don’t look now but next week we hit the halfway mark in the first month of the New Year, already.

I feel like last year got away from me way too early. If there was a Spring I certainly don’t remember it and the Memorial Day / Labor Day bookends to Summer might as well have occurred on back to back weekends.

When I closed up the deck in late Fall and moved some items downstairs to storage I glanced over at my grill. Did I even use that this year? Nope. First year in the last 30 that I did not grill out even once. Wow.

I entered this year much more determined to slow down the pace a bit, I guess time will tell whether I am successful at doing so. The snow has definitely helped!

Yesterday was a somber reminder of the passage of time for sure, saying goodbye to former President Carter. I kept the Bloomberg coverage up on my screen and just let my thoughts wander.

Row two featured the Clinton’s, W. and wife, Obama and no wife, the President-elect redux and wife. Things between the former Commander’s in Chief seemed cordial, as it should, that day wasn’t about them.

Meanwhile a few feet away, a flag draped casket sat quietly. The well worn, well lived remnants of earthly flesh and bones belonging to a man who would surely be embarrassed by all the attention.

My overwhelming thought monitoring the proceedings was Character. It was on Biden’s mind too since he said the word three times in the same sentence. You either have it or you don’t, as for Carter he was quietly and humbly overflowing with it.

Presidential memories for me start with an early 80’s Reagan, so I was too young to remember those times. Jimmy Carter’s presidency and his quest for peace was simply overwhelmed by the inflationary backdrop. Most people don’t remember the handshakes at Camp David, rather the long lines leading to every gas station in town.

But if there was ever a man that deserved to see the century mark, it was Carter. If there was ever a man that deserved almost 50 more years on the earth following his presidency to continue to fight the good fight of faith and influence future generations through spoken and written word it was him.

That afternoon I walked downstairs to check my bookshelves for some Carter books, sure enough I found several, picked one and brought it back up. I have slowly thumbed through the pages and will likely do more of it this weekend. Definitely good for the soul.

Let’s talk shop a bit.

I was settled into my home office a little earlier than usual this morning ahead of the jobs report. This was the first key piece of data out so far this year and all eyes were on it.

It was a blowout number, 256K vs 160K expected. Anyone sniffing around for weakness was quickly disappointed.

The Fed was already expected to pause in late January, that is now cemented and if anything the discussion now will turn to “are we already finished with cuts?”

That talk may be a little premature. Then again I overhead El-Erian this morning on Bloomberg Surveillance ask someone “what it will take to start talking about hikes”. Hikes? Yikes.

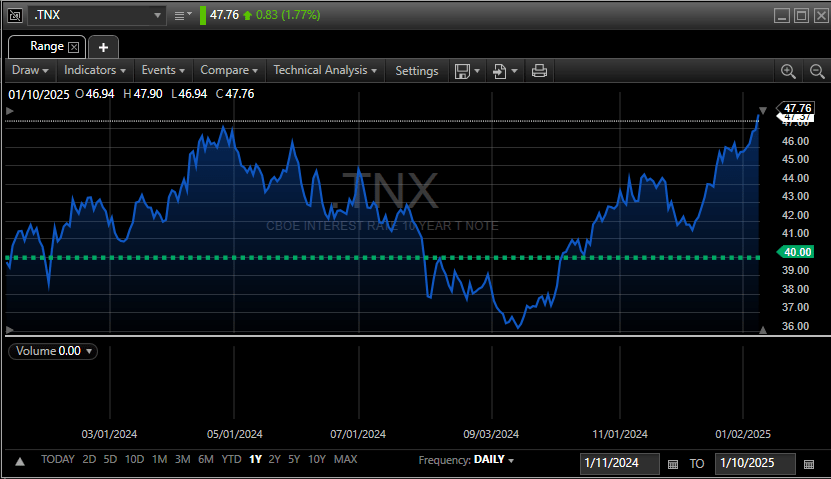

The answer to that is simple really, inflation. The 30 year yield passed 5% on this morning’s report and the 10 year flew past 4.7% passing last Spring’s high.

So rates are telling you the economy is strong, perhaps a little too strong and the next few months/quarters will be critical to see how it plays out.

Eyes and ears will now shift forward to CPI next Wednesday and to a lesser extent PPI Tuesday.

The incoming administration is a wild card, no surprise there, regardless of how well things are teed up it could derail quickly.

Quickly on Wall Street terms now means zero time to react. If you are on the wrong side of a trade at 4pm EST and something hits the fan at 4:01 you are pretty much screwed.

Welcome to the machine.

So what’s the average Joe to do? I will tell you what I am doing.

I am muting the TV. The feed may be active and the lips may be moving in the corner of my screen but the only sound will be the music of choice behind me.

I am muting the podcasts. I will not be glued to every “drop” and be told the same thing over and over by the same talking heads. I will revisit a few very select sources over each weekend, that’s about it.

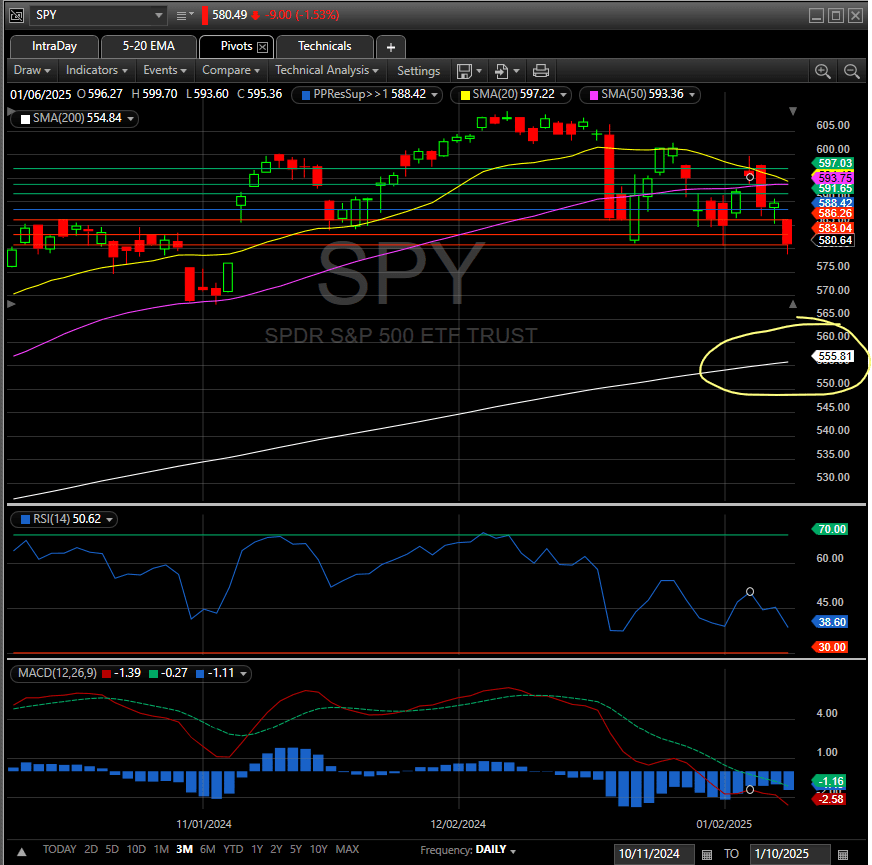

I am watching my preferred technical indicators, mainly 5 and 20 EMA’s on the majors and up to 20 ETF’s and/or stocks of my choosing. If I find something new? Something old gets removed. Time to narrow my field of vision and limit distractions.

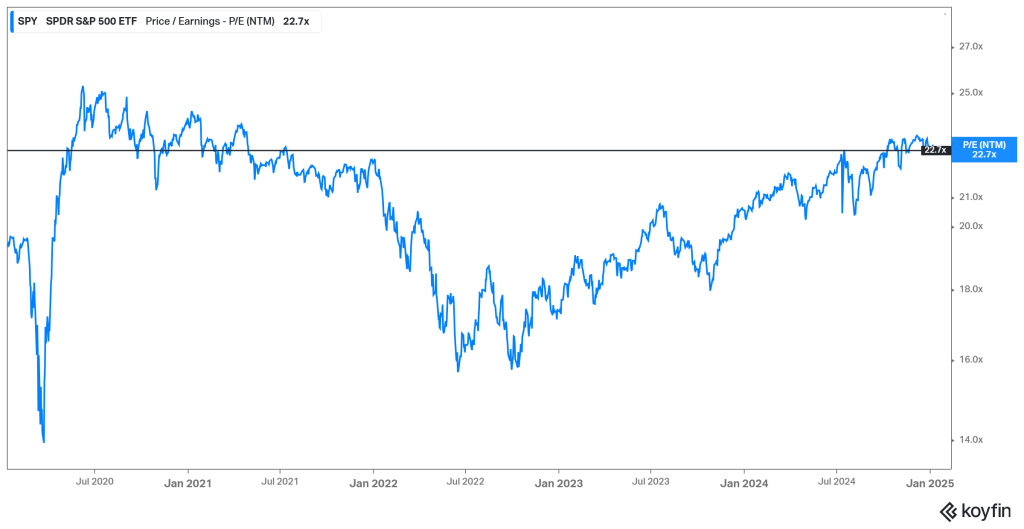

I am watching earnings. I need to see if they are strong enough to continue to justify the (elevated) multiples. If they appear too high, they can be resolved with sideways churn/chop just as easily as a 10% elevator drop several floors overnight.

As for now, the 5/20 EMAs and Breadth tell me we are in a holding pattern and that is best case. SPY is rolling over, QQQ is rolling over and IWM has already rolled over.

Anytime I think “the bottom is in” or we are “done” I always pull up a chart that includes the 20/50/200 SMAs. Do that for SPY and you will see the 200 day down around 555. A re-test of the 200 day is always just a matter of time.

You will also see the 20 day getting ready to cross under the 50 day, not good. The breakaway election gap at 577 is coming into view, that may provide a source of support but I wouldn’t count on it.

Takeaway? Not the time to be a hero. Let it play out.

If you are like me, you may not even hear it when it does…

All for now. Have a good weekend…