optimum

: the amount or degree of something that is most favorable to some end

maximum

: the greatest quantity or value attainable or attained

The dimly lit tree in my foyer is circa 2007.

When I purchased it that first year of home ownership it was an 8 foot novelty. A remote control allowed me to switch between color and clear, fade in and out, all at 4 different speeds. High tech stuff.

Seventeen years later it is an incandescent relic from a prior era clinging to life. My guess is it sees the curb before it sees the foyer again.

Not so fast though. Still plenty of time left to kick back and enjoy the last few weeks of what is left of 2024.

Recaps and of course forecasts are popping up, that pace will pick up into year end. I’m sure they will all sound the same, bull market and bitcoin! HODL, YOLO, FOMO to the moon we go!

It’s been a while since I have seen this much overall bullish market sentiment exiting a year.

In fact I have started tuning out many of my favorite podcasts because the echo chamber is alive and well. I myself am glass half full entering 2025 but I grow very tired of optimum maximum very quickly.

There are some very crowded trades out there. Many many second floor dancefloors well above max capacity with one exit yet the music plays on. I’ve seen it again and again since the late 90’s.

Experience is the teacher of all things.

Julius Caesar

As you can see in the Weekly Charts, we were reminded this week of two things: 1) Markets do in fact still sell off and 2) they hinge on every Fed action, every Fed word.

I was at my desk early last Wednesday morning before the presser looking for things to sell, typically any higher basis lots in the green. All accounts. Let’s take some risk off.

Reason was simple, the market was screaming for an overdue pullback and the Fed decision seemed like a prime sell the news event. If they reneged on any rate cut expectations for next year, that would likely just add fuel to the fire.

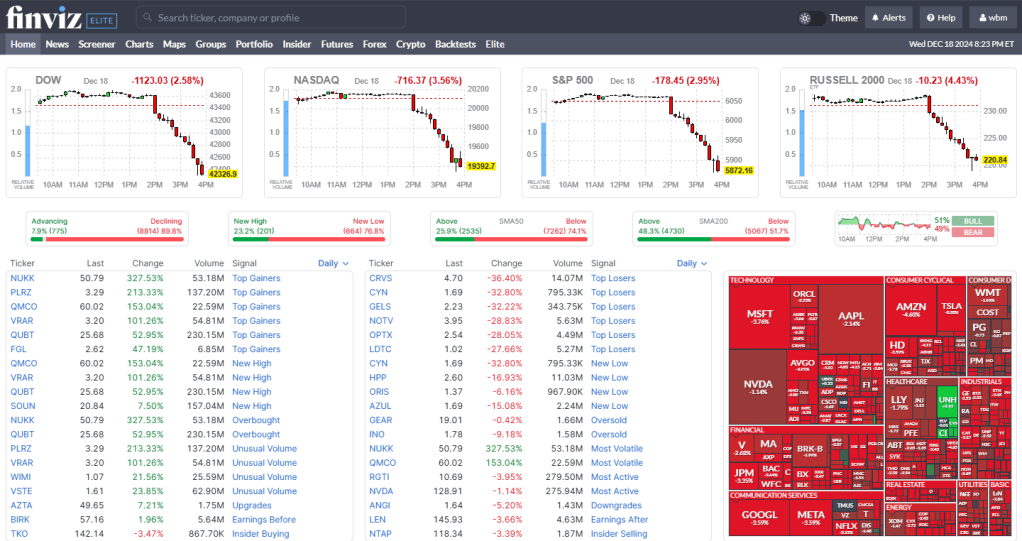

Here is a screenshot of finviz at the Wednesday close.

I listened to the presser as I always do while watching the underlying bid disappear from everything on my screens. Been a while since Dow -1000. That was on the heels of 9 straight losing sessions in recent weeks.

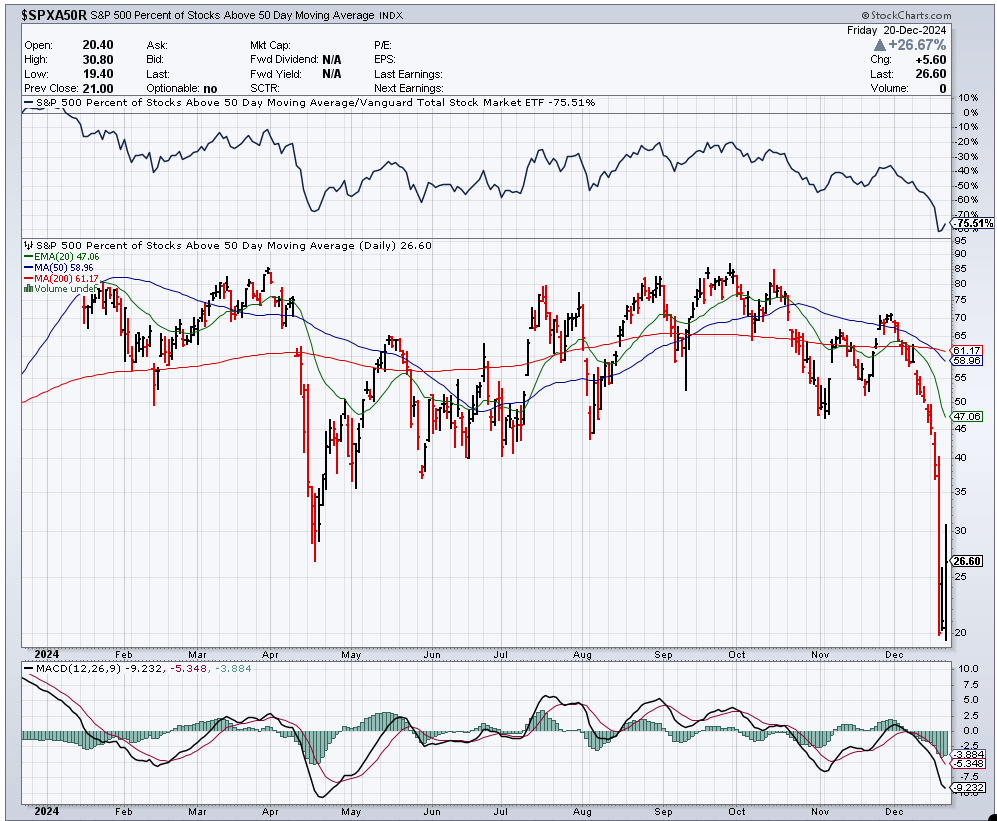

In terms of the overall breadth reset, it’s worth a look to see the impact on how many S&P stocks were left trading above their 50 day SMA.

End of week bounce but no denying the massive reset.

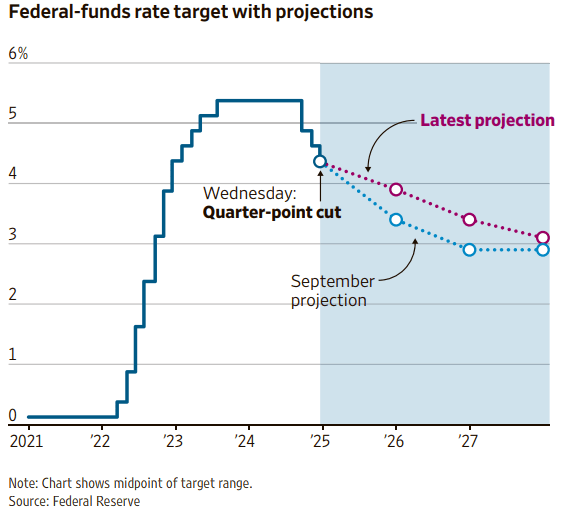

Everyone expected a “hawkish” 25bps cut which is exactly what we got so what’s the problem? I think this WSJ graphic depicts it best:

Not only did they pull back on the pace of future cuts, but on the overall number of cuts expected as well. The Fed is clearly looking ahead to the impact of the incoming administration whether they want to admit it or not. Mr. Market wasn’t priced for that little development.

I think the Fed did the right thing by telegraphing fewer cuts on the horizon based on recent data but it’s hard to swallow when accompanied by a 25bps cut now. Mr. Market does not like mixed messages.

My hunch was right and I was able to take advantage of that reaction and reduce my basis on some names, but we could have just as easily ripped 1000 points higher post Fed, we are in that type of environment.

My opinion the rug pull Wednesday was needed and with all the charts broken technically nearing year end, the best case scenario will be several weeks of sideways to down digestion as inauguration day nears.

As for 2025, I can easily see more upside albeit via a bumpy road. It will be difficult to screw this soft/no landing up but given the uncertainty and wild card in D.C. anything can happen.

We had a front row seat this week to the three-ring circus this could quickly become given the new “voices” being heard.

I’m certainly no fan of Trump but the inept alternative was even worse and not viable. Thankfully sanity prevailed and everything is teed up pretty nicely to make substantial progress in many areas if egos and ethos remain in check.

Time will tell.

The world is a much different, much more dangerous place that it was in 2016. The Geopolitical arena is a tinder box while various allied governments seem unstable at best. That backdrop cannot be ignored.

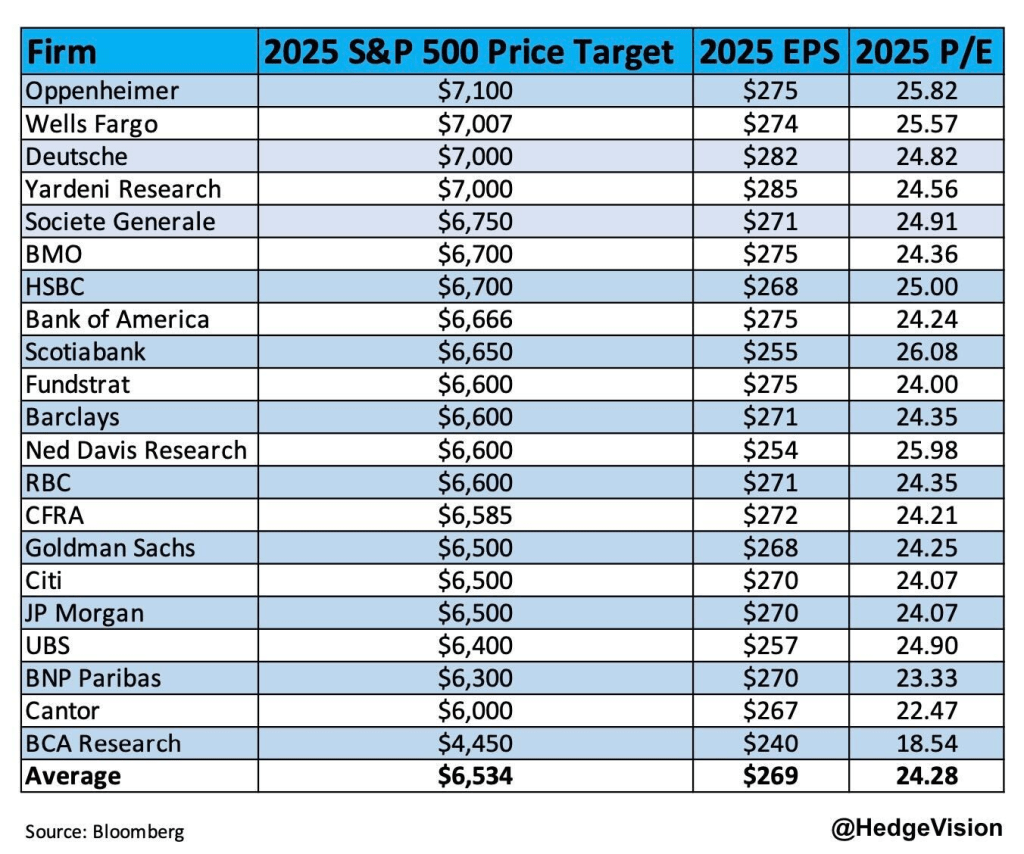

I put little little stock in economic or market predictions but it’s at least worth seeing where the majority of the Street sees things playing out:

Two things to watch for: Stagnating corporate profits and/or the inflation fire re-igniting. Either or both are certainly possible and could derail the lofty expectations.

I think it’s more important than ever to enter the new year open minded and mentally prepared for chaos. To what extent that chaos is shrugged off market wise will depend on the timing. Also like it or not, Powell and Co. still drive the bus and will for the foreseeable future.

Best to stay invested but also stay nimble with any shorter-term holdings and keep some dry powder handy?

Most resets these days happen after hours and given the overzealous environment we currently reside in, those resets will be swift and they will be substantial.

Experience is the teacher of all things.

Julius Caesar

For now we relax and let 2024 slowly fade away. I think my tree has another week or so in the tank surely.

Settle in with a good book by the fireplace and contemplate every now and then just exactly what 2025 and Trump 2.0 may look like.

One thing is certain.

It’s going to be interesting.

Happy Holidays and Happy New Year.