: to adjust precisely for a particular function (again)

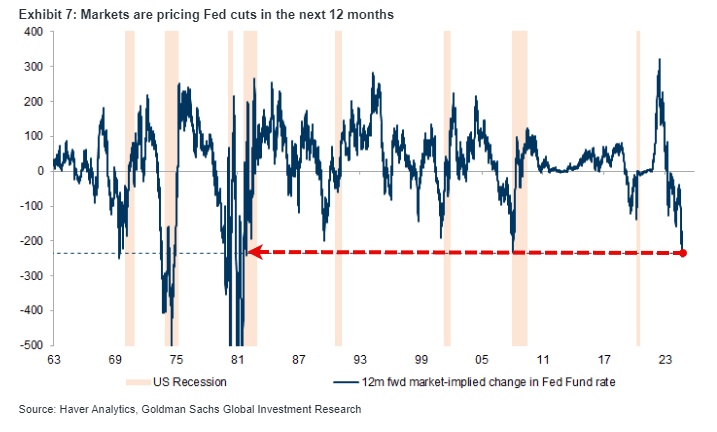

Looking back I suppose it was the jobs data that did it, there had to be a specific reason the Fed went 50bps after practically telegraphing 25bps for so long.

Right after standing down on 7/31, the jobs data released two days later (and coming in way light) revealed there might be a problem under the hood.

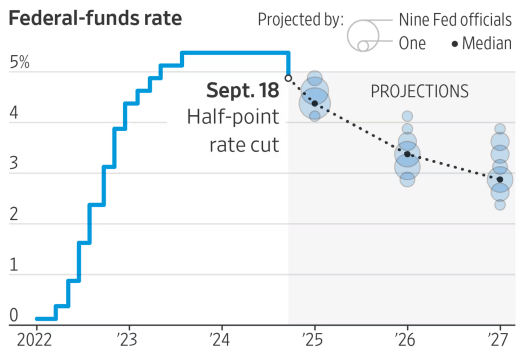

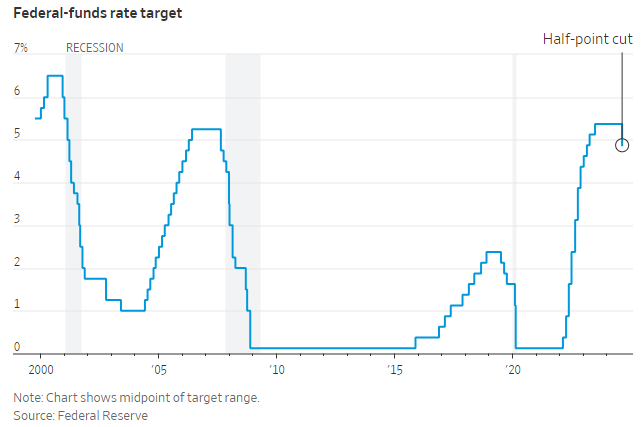

I was surprised to see the odds of a 50bps cut above 50% heading into the meeting, at one point well above 65%. Looking back on it now, I agree with it. It was the right move and a mere blip on the chart when you compare it to the pace of the early hikes.

The next meeting is not until Nov 7th, light years away in terms of the data and newsfeed we will encounter up to the election. Better to go big now, the data supports it, be prepared to do the exact same thing again in November if need be. Ironically as of today, we also sit right around 50/50.

Markets were unsure what to make of it all after the announcement, but ultimately rallied back with a vengeance Thursday and held the line Friday. More on that in the Charts section if you so desire.

As I mentioned in a prior post, seasonality is not in our favor in the weeks ahead so it will be interesting to see if we continue to print new highs. We also continue to shrug off Geopolitical events, I guess we have our own problems?

We get GDP and a fresh PCE read next week, those will be the next items of interest on the Calendar but the Big Kahuna is now behind us.

I suppose we will see how it all shakes out in the months ahead.

All for now, I leave you with some items of interest from the previous week for your casual perusal: