So, here we are, month of September already halfway in the books?

I’ve always said after Labor Day Monday you might as well forget about it. Soon it’s all about the pumpkin and then increasingly downhill from there.

I used to dread the exit of summer for several reasons, not any more. I actually welcome it. I enjoy all the seasons now especially with the daily commute removed.

Rain and snow are not met with dread when they are now just scenery.

I digress, let’s talk shop I have a feeling the next couple weeks are going to be a little nuts.

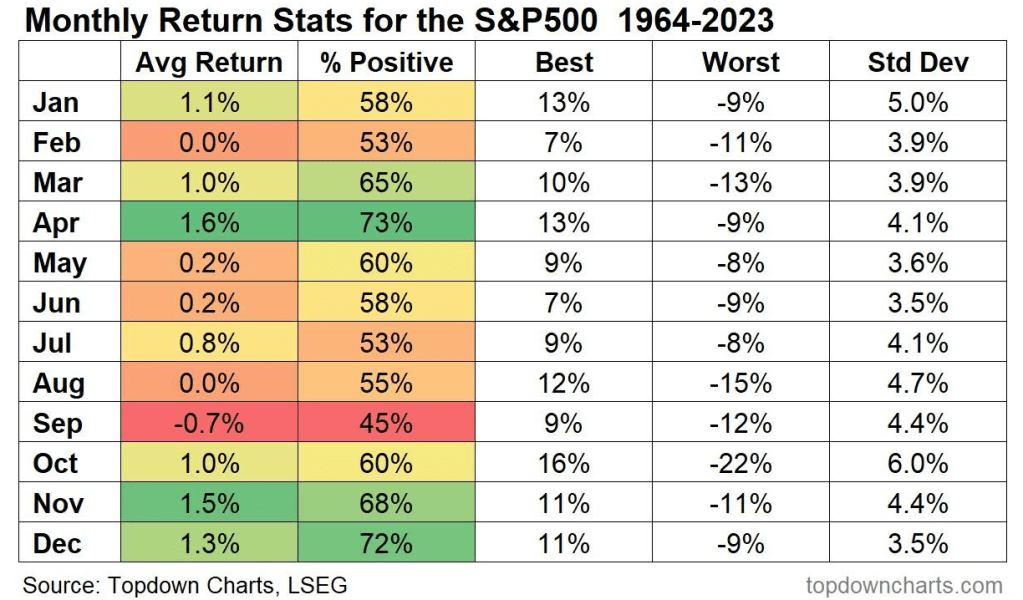

September alone is always a rough month market wise, you can 2x that for the second half of the month, more on that in a sec:

An election cycle normally helps things in Q4, who knows if that will continue this time around. I won’t be talking much about politics for the remainder of the year.

In fact I am firmly with Pope Francis on this one, if you plan to vote (which I do not) just pick the lesser of two evils I suppose. Good luck on figuring out how. Then pray it works out.

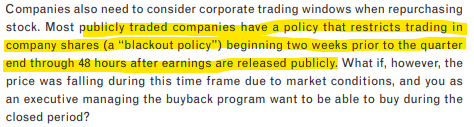

One item fueling the uncertainty ahead will be the upcoming blackout period for stock buybacks:

I would truly like to know what % of the current year’s SPY return can be traced to buyback activity, I am hearing around 10% which I have not validated but also will not argue with.

That flow of capital will soon be stymied my friend. Just in time for the first round of rate cuts and that lessening bid could influence volatility.

As I type this, the odds between a 25bps and 50bps cut are a coin toss. 50/50! I find that hard to believe. If we get what was once a long expected 25 will the market now sell off in disappointment? What do they know that we don’t?! All of this will be in play Wednesday afternoon at 2pm.

Did I mention there is also a full moon Wednesday? Toss that little tidbit in.

There was a note earlier this week from Ally about auto loan delinquencies creeping higher. Cars are critical to most and that is a red flag for sure, even if inflation is on the downswing.

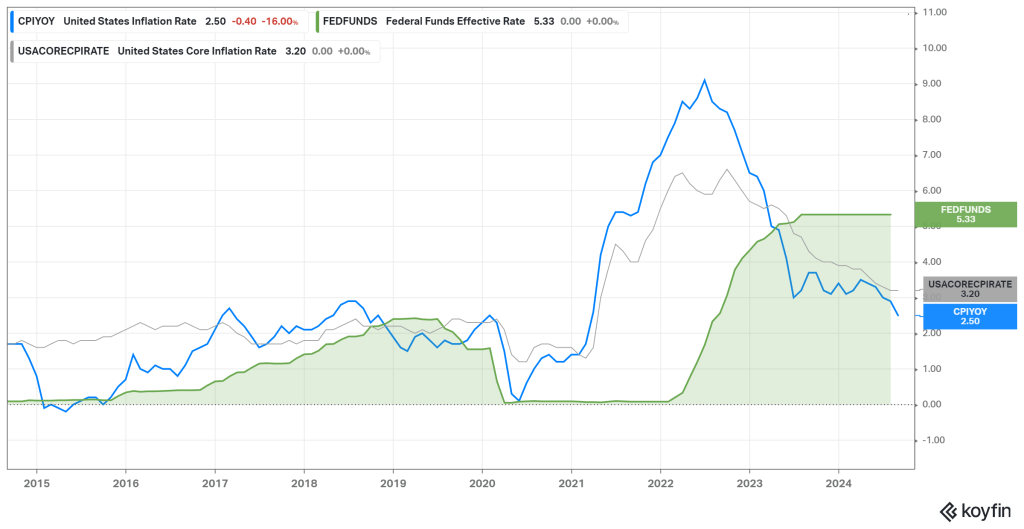

I suppose it’s worth revisiting one final time just how swift this hiking cycle was and how long we have been camped out higher. I always compare Fed Funds to CPI so you can see the lag effect:

They were clearly late to react and you will find many that are saying the exact same thing now on the other side. Time will tell.

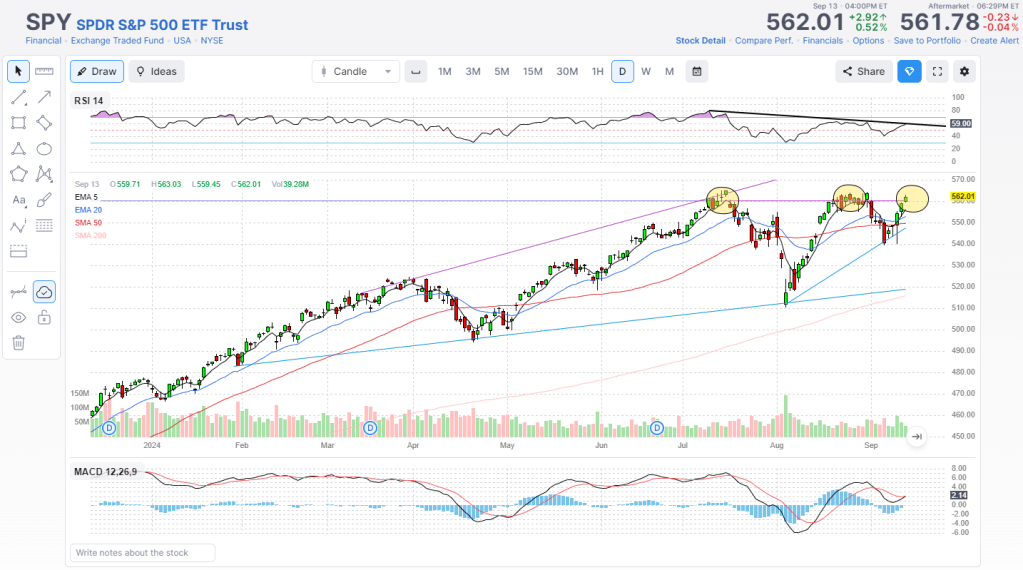

Although dip buyers ruled this prior week, it will certainly take some “fortitude” for that to continue. If we rollover here or pullback from the prior highs again, a third time, that could make for a rough couple weeks:

We have some moving averages below that would act as support, I also can’t help but notice the 200 day converging with that lower bound range of the up channel. A retest there would certainly get some attention.

As we speak however, at least for now due to the stick save this week, buy signals are being triggered galore. You can see the rundown in my Charts section. This exact same time last weekend I was noting sell signals.

I would keep an open mind these next few weeks, anything can happen. We are finally getting the cuts that have long been anticipated, to what extent they have (correctly?) been priced in is the real reveal.

If you want to read more perspective on a weekly basis from folks much more intelligent than I, check out the Lumida Ledger weekly newsletter. It drops every Sunday and is worth the read.

ON BALANCE

Sometimes outright “planning” is a fool’s errand when you have too many potential outcomes. If you are like me you will ultimately lean one way or the other, stubbornly biased until you get blindsided having never really considered what was behind doors 2, 3 and 4.

Happens in life, business, trading, you name it.

A better alternative is to “frame” those potential outcomes, whether it is 2 or 20, you decide. Then take the time to ask the right questions until each potential outcome clearly comes into view.

Take the week ahead for example. What if the Fed does cut 50bps? What are the potential impacts? Frame it up.

What if they stick to 25bps and the odds are firmly leaning 50bps before the announcement? Are we headed lower? What could that look like? What are the support levels? Frame it up.

Another thing I like about this method is once the process is complete, I can walk away.

No paralysis from analysis and I am not committed to any one specific outcome. Bias in any form is also eliminated, at that point I am just waiting for the cards to be dealt in front of me.

I am getting better at applying the same concept for more personal things and I am finding it works just as well.

When bad news hits or even when things take an unexpected positive turn, I’m not overly surprised and can react accordingly. Calmly and decisively.

I know what that looks like.

I had it framed up.

Have a good week.