: the last part of an aircraft’s flight path before landing, when the plane is aligned with the runway and descending

Getting my pilot’s license was always a dream of mine.

I had it slotted for a “40 something” goal, assuming my asset base would have expanded to a point where I could afford a more expensive endeavor.

Like many things in my past, it too never happened. I know exactly why though, because I knew I would be the guy on the news who emergency landed on a four lane freeway at rush hour!

On a motorcycle trip I could get lost at the drop of a hat, going in circles (literally) or backtracking 50 miles at triple digit speeds because I was pissed at a wrong turn made two hours ago.

So imagining myself trying to fly a plane, correctly…much less landing it…preferably on a runway was sort of a pipe dream and I decided to keep my feet on the ground where they belong.

As we meander into the month of September, all eyes will be on another final approach per se, that of the Fed as they embark on a clearly telegraphed cutting cycle.

Is it too late? Should they go 50 bps? Incoming data and market action over the next two weeks will further fuel that debate.

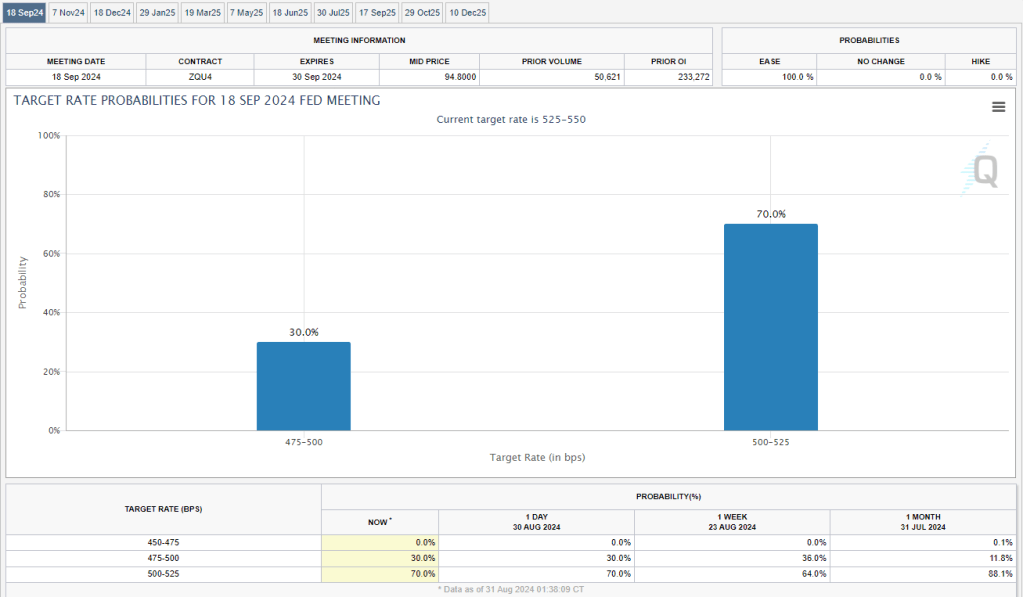

As of today, it’s exactly 30/70 for the 50bps/25bps to be announced at 2pm Wednesday, September 18th:

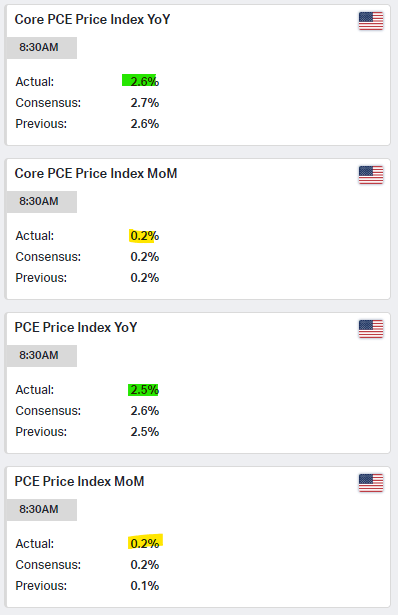

Is it too early? Doesn’t matter they are going the minimum 25 bps regardless. It would have taken an extreme PCE read Friday to consider standing down and that didn’t happen:

SOFT LANDING?

I will admit it’s queued up nicely for the Fed, outside of the early August Yen carry hold my beer moment, the markets are behaving relatively well.

That said however we are at a make or break moment technically.

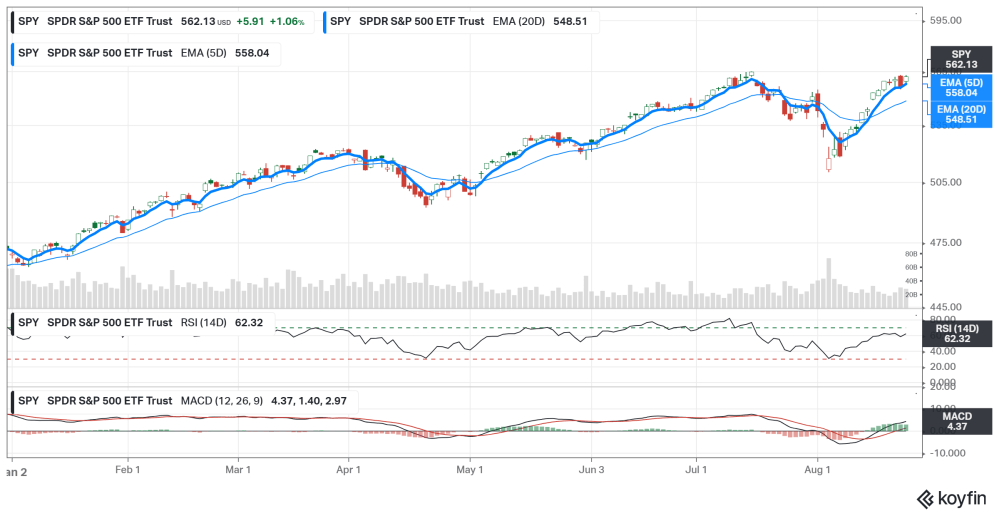

The V-shaped recovery off the Aug 5th low has been swift and has held like a champ. However (there is always a however by the way) what glares at me looking at SPY is the unfilled gap b/w 544.96 and 548.88:

I am firmly in the “all gaps get filled” camp. Always have been. I have ignored it in the past only to get schooled again and again.

The move Friday has attempted to break out of a rollover pattern. That could very well continue into this week. That gap will (eventually) be a gravitational pull on the futures and the index trying desperately to cling to it’s 5 day EMA, which has been above the 20 day EMA (buy signal) since 8/15:

NOW WHAT?

Other than the fact the trading desks will start to fill back up after the holiday, I guess the next real Market mover on tap will be the Friday 9/6 jobs report.

That is followed quickly by another CPI and PPI read. Oh yeah, there is also a presidential debate slotted in there for 9/10, that should at minimum be quality entertainment to say the least.

Will the debate move the the markets? Dunno. If I do decide to get out of my 100% cash position this coming week I may be compelled to go right back into it if the upcoming debate is as “challenging” to stomach as I think it will be.

Never considered myself a “doomsday prepper” but even with “Kamala” now opposite Donald instead of Joe the selection of slightly varying shit sandwiches is still very much in play.

TAP ON THE SHOULDER

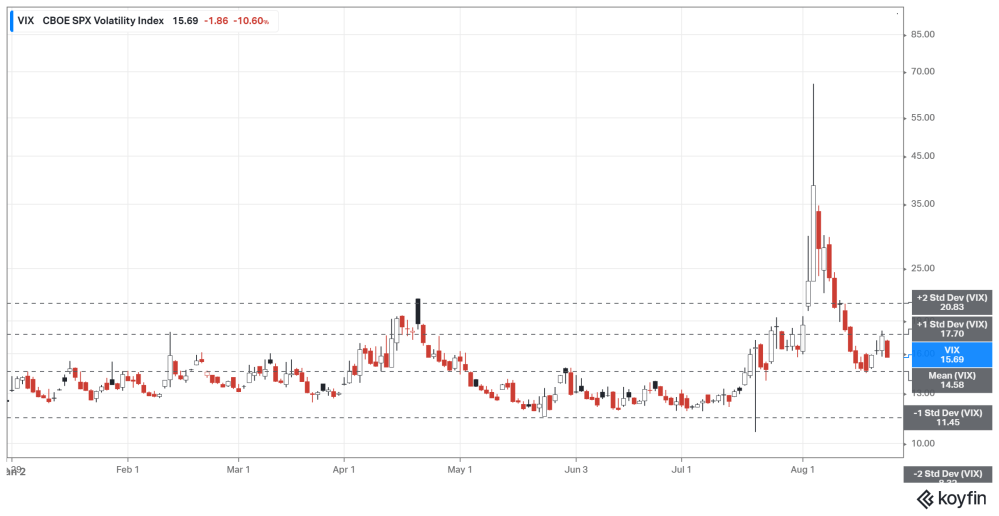

What happened in early August was a reminder, a friendly tap on the shoulder of what can happen:

Many Market participants whether trading or investing have been lulled to sleep over recent months/years with what I will refer to as “compressed” volatility.

Picture a spring or coil that has been compressed slowly but indefinitely by an unknown force until it seems that it will never do anything else but just sit there. Right up to the point where it doesn’t.

“Compression” ultimately leads to “Expansion”. Simple Physics folks.

Whether early August was it is anyone’s guess. That’s not the point.

The point is remembering what it DOES look like when it DOES eventually happen.

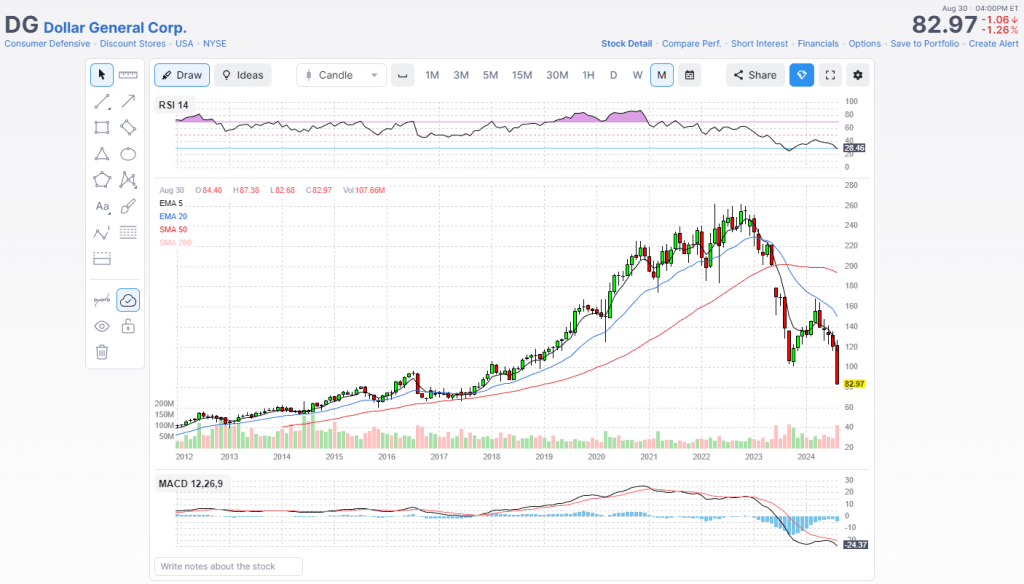

There are subtle signs out there that Joe Consumer is still very much feeling the pain. Dollar General anyone?

A 25bps cut in September is not going to instantly end that pain overnight.

It’s a process.

The plane is on final approach.

How it ultimately lands is yet to be seen…

Welcome to September, where it is partly sunny, partly cloudy with a 50% chance of…anything!