Wild ride last week.

As expected the Fed held steady on Wednesday, with lots of familiar language in the presser. They “want to be certain” and are “prepared to move”.

Powell did put “in September” on the table for cut number one, which was already priced in, but by mentioning the month by name he confirmed it for any doubters.

Fast forward to Thursday and Mr. Market decided to let off some steam. Not totally unexpected, given the new month and sell on the news effect.

Friday was a little different story…

The 8:30 jobs report shit the bed not once but twice, first by adding a measly 114K jobs well below the 175K consensus while the unemployment ticked up to 4.3%. Both readings way cooler than anyone expected.

The media pundits took it from there, stoking the fire and suddenly soft landing talk was replaced with “renewed recession fears”.

It amazes me just how swiftly everything re-“characterizes” and re-“prices”. It’s almost comical.

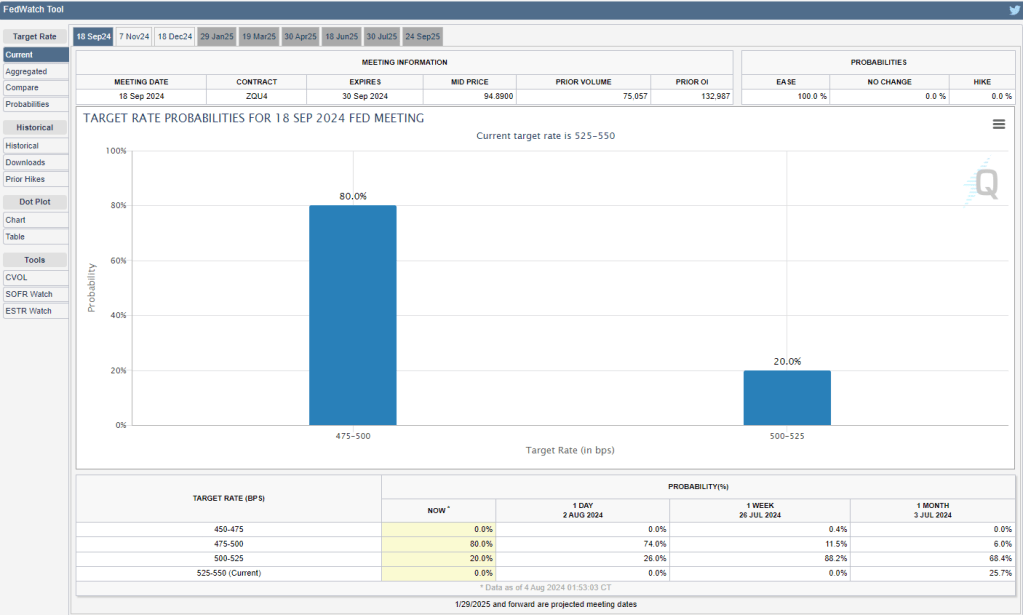

Case in point, broader index moves aside, the market is now predicting an 80% chance of a 50bps cut in September! So over the course of two trading days, the consensus went from “get started with 25″ to ” GET STARTED WITH 50″!

Rather than bombard the post with charts, just take a look at my new Charts page which I added in recent weeks. I will update these weekly, more so if conditions warrant it.

I will keep an eye on SPY/QQQ/IWM as well as VIX levels, 10yr Yields and the most recent overall yield curve.

For the major ETF’s, my preference is to track the 5 day and 20 day EMAs, alongside the RSI and MACD. A very proven and back-tested method for getting LONG or SHORT/NEUTRAL is when the 5 day EMA crosses above or below the 20 day.

For the VIX and 10yr, I prefer to chart the daily close against the MEAN and +/- 1, +/- 2 STD DEV. As you will see for this particular weekly close, both are well extended for the first time this year.

The yield curve just gives me an update on where we stand with the 2s/10s inversion and hopefully normalization as the year progresses.

I may add to these over time but for now I will just keep it clean with these particular views to keep a finger on the pulse.

August tends to be a low volume month, which given the way it started could lead to some large swings. According to my Calendar, here are some key dates to watch ahead:

August

- Wednesday 8/14 – CPI👈

- Friday 8/16 – Consumer Sentiment

- Thursday 8/22 – Saturday 8/24 – Jackson Hole Economic Policy Symposium

- Friday 8/23 – Consumer Sentiment

- Thursday 8/29 – Q2 GDP

- Friday 8/30 – PCE👈, Consumer Sentiment

All for now.

Enjoy what’s left of summer and we’ll see you in September.