My home office is in the front of the house where a formal dining room should be.

The bay windows provide a nice backdrop and it’s a very comfortable place to work and write until summer arrives.

The monster magnolia does all it can to block the rays until late afternoon, then it gives up the ghost and the heat begins to creep in to my right. Time to pull the curtains and close up shop.

I walked by my desk Friday and it was squeaky clean and eerily quiet in the middle of the trading day no less.

Welcome to a long, hot, slow Summer.

I don’t mind it actually, it gives me a chance to focus on odd jobs around the house. Replacing earnings season with learning season also gives me a chance to read and work on strategy for the second half.

A quick glance at my overall portfolio shows 73% in cash, with a few accounts sitting firmly on the 100% mark. Which is very odd for me…

Reason for that is simple, this market has turned into a one-trick pony. NVDA. The 10:1 stock split only helped fuel the fire. Party like it’s 1999?

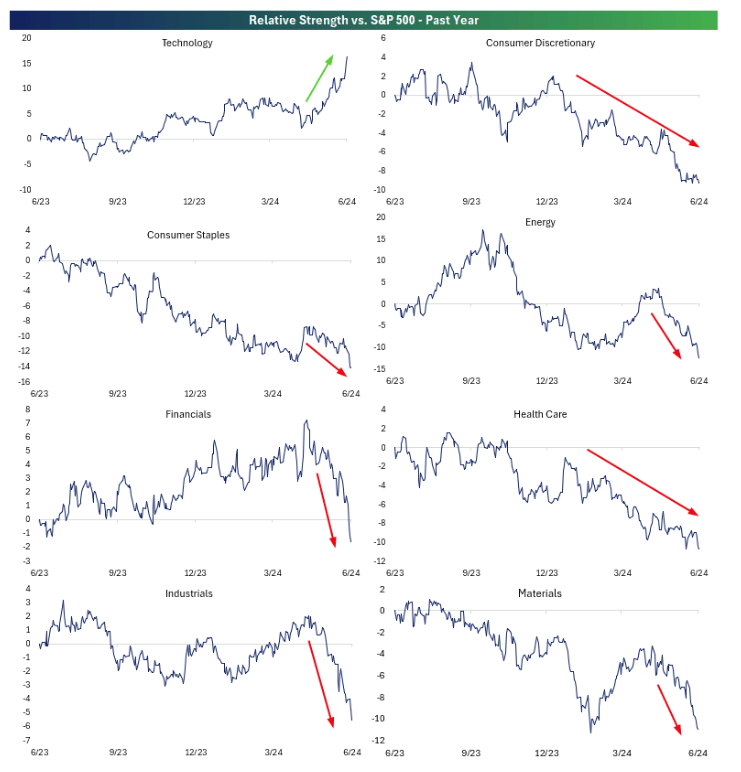

Everything other than technology is either lagging, tired or rolling over:

I hear a lot of chatter about market breadth deteriorating and the overall lack of “participation”. The gravity of the AI revolution can only pull so hard.

I am trying to wrap my mind around where I need to be going forward and I am struggling. Big time. I’ve learned over the years to recognize and respect the indecision and push away from the desk before I rush to feed the need to do something, anything!

Which is exactly the time to do nothing.

TWO CHARTS TO WATCH

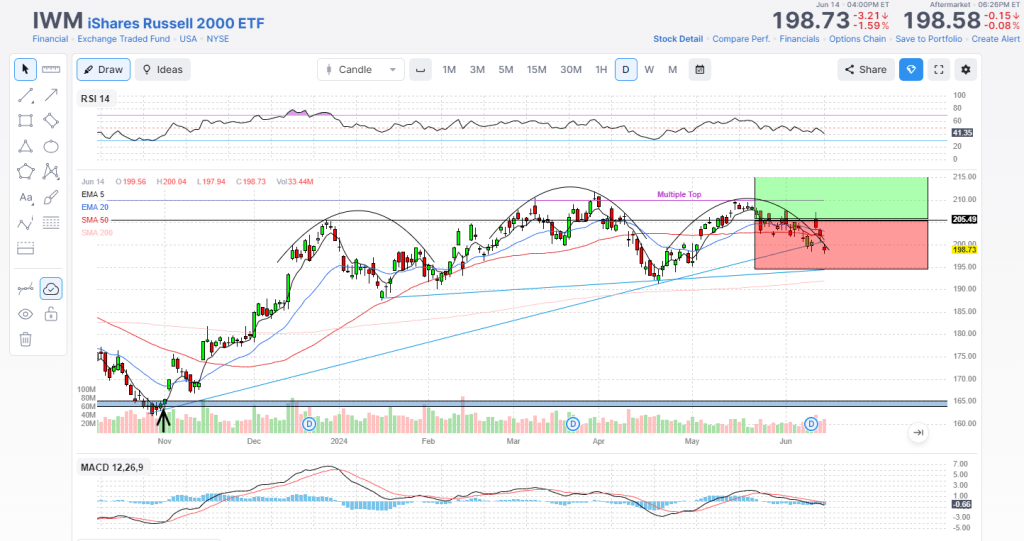

As we (hopefully) get closer to end of (the hiking) cycle and start to get some rate relief, small caps theoretically should join the party.

They briefly did just that after the Fed “pivot” back in November but have struggled mightily this year to make new highs.

A quick glance at the IWM chart shows a classic Head and Shoulders top, while finviz mentions the multiple top as well:

Note the mid-week head fake above 205 only to fall back below 200. Your next support level is around 190 which catches the bottom of the next channel. I drew in the red and green boxes so I can monitor the direction as we cruise through summer and enter the second half.

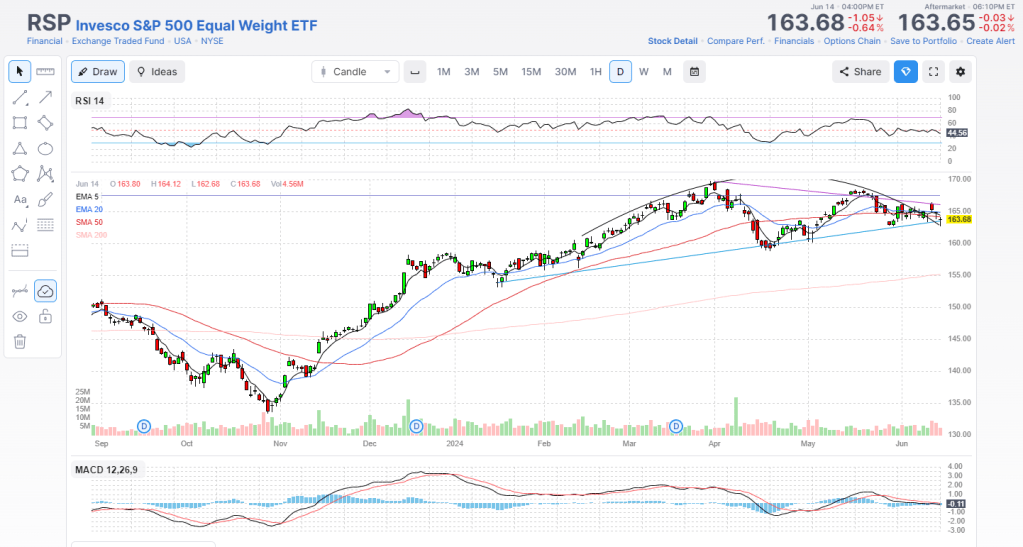

Chart #2 will be the Equal Weight S&P 500 via RSP:

Ditto for a mid-week head fake here like IWM, and we now sit right on the base of the upward channel support.

The 200 day moving average for both IWM and RSP is a ways below. Time will tell if we have a slow summer melt up or slow summer sideways move.

Bottom line folks, grab a comfortable chair and a book. Gonna be a long summer.

Anyone remember what accelerated selling into a vacuum looks like? It ain’t pretty but given where we trade at one cannot entirely rule it out either. Keep that one on your Bingo card.

I guess the Presidential debate late June will be the next item of interest, for the masses that is. Not I!

WBM THE ARTIST?

An engineer / financial planner by education it’s hard for me to find ways to use the right hemisphere of my brain:

This time of year I find myself searching for ways. My reading material gets a little more laid back, thought provoking. You will see that reflected in my Off Duty Pursuits page of recent reads.

I guess my blog helps me scratch the never ending itch to write and that is one creative outlet. I used to love to draw as a kid and at some point I have plans to pick up a paintbrush and give it a go!

When I picture myself in the basement standing at an easel with classical music in the background I literally start to smile and chuckle a bit. Salvador Dali! Far contrast from the trading desk.

Challenge yourself this summer! Learn something new.

If you’re not getting better, you’re getting worse by default.

RECOMMENDATIONS

You may recall my Spring Cleaning post where I cut back on subscriptions and overall digital footprint. Fantastic decision. I still pay for my WSJ, but only receive “The 10 Point” daily email and a .pdf version of the daily paper.

Here are the other few inbox items I recommend, one daily but most only weekly:

Bloomberg Surveillance (Daily) / Bloomberg Wall Street Week (Saturdays) – signing up for one gets you both. The Surveillance email recaps the (hands down) best 6am-9am morning show on finance TV without the need to tune in. The Wall Street Week email does the same every Saturday for the iconic Friday night broadcast that us fossils used to catch on PBS.

Trade Risk Weekly Recap (Saturdays) – excellent 20-30 minute video of key market moves, technical levels, sectors, breadth, etc if that’s your jam.

Lumida Ledger Weekly (Sundays)- fellow blogger Howard Lindzon plugged this one and it’s new to me but I really like it. Good final read on Sunday evenings before the new week begins.

Weekend YouTube Views:

The Compound and Friends (Fridays) – Downtown Josh Brown and Michael Batnick interview a guest every Thursday and the episode drops on Friday night. I kick off my weekend with it, every week.

The Week In Charts (Saturdays) – fellow Jets fan Charlie Bilello with another excellent weekly recap with lots of charts as the title suggests.

All for now!

I will probably check out until after the July 4th holiday unless I get…inspired?

Wouldn’t count on it.

Thanks for reading!