Some housekeeping items first…

I added an Economic Calendar to the main menu of the site because I continually found myself searching for “what’s next”, not just in the immediate timeframe but several months out.

My plan is to update this regularly and get a little more granular for each month as we get closer. I will post the key economic data prints as they come in. I wanted a roadmap for both past and present so this will help keep us between the lines.

Another reason for the roadmap is to plan ahead on what to dread, you know, like presidential debates? We have our first one of those at the end of the month assuming the Republican nominee isn’t serving time.

I will not be watching, I’ll just glance at the WSJ live feed to track which clown says what.

Which provides a very smooth segue to my dominant thought these days…

The more things change, the more things stay the same.

It certainly fits the unfortunate state of politics but also the market as well.

A recent as a few days ago, I was reading commentary from various sources that were singing the same tune of an expected rate cut in July. “Our base case is a July cut…” they say.

I referred to my Calendar to refresh my memory on when the July Fed meeting was and it is end of month, most importantly ahead of no such meeting in August. Big gap to September 18th.

Thought being if we continue to see some softening inflation data and stability the Fed can afford to loosen the belt a little. I can’t recall what the CME Fed watch tool was saying at the end of May, but safe to say it was less than 50% expecting a July cut. Probably more like 33% as it was mid month.

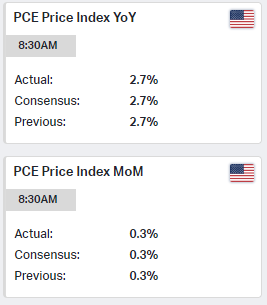

PCE data out 5/31 helped support that case when everything was in line, no surprises:

Less than 24 hours later I couldn’t help but chuckle Saturday morning when I saw the Barron’s cover:

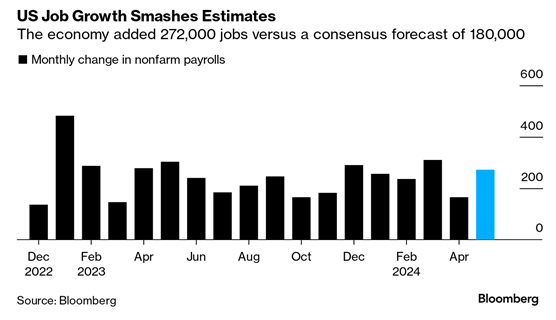

Fast forward to Jobs day today and it seems after the blowout number that most base cases will be adjusted to reflect the same…

Mohamed El-Erian was on Bloomberg Surveillance this morning and he didn’t mince words:

“It does close the door on a July rate cut. I think that is it — almost regardless of what the CPI number says next week,” El-Erian said.

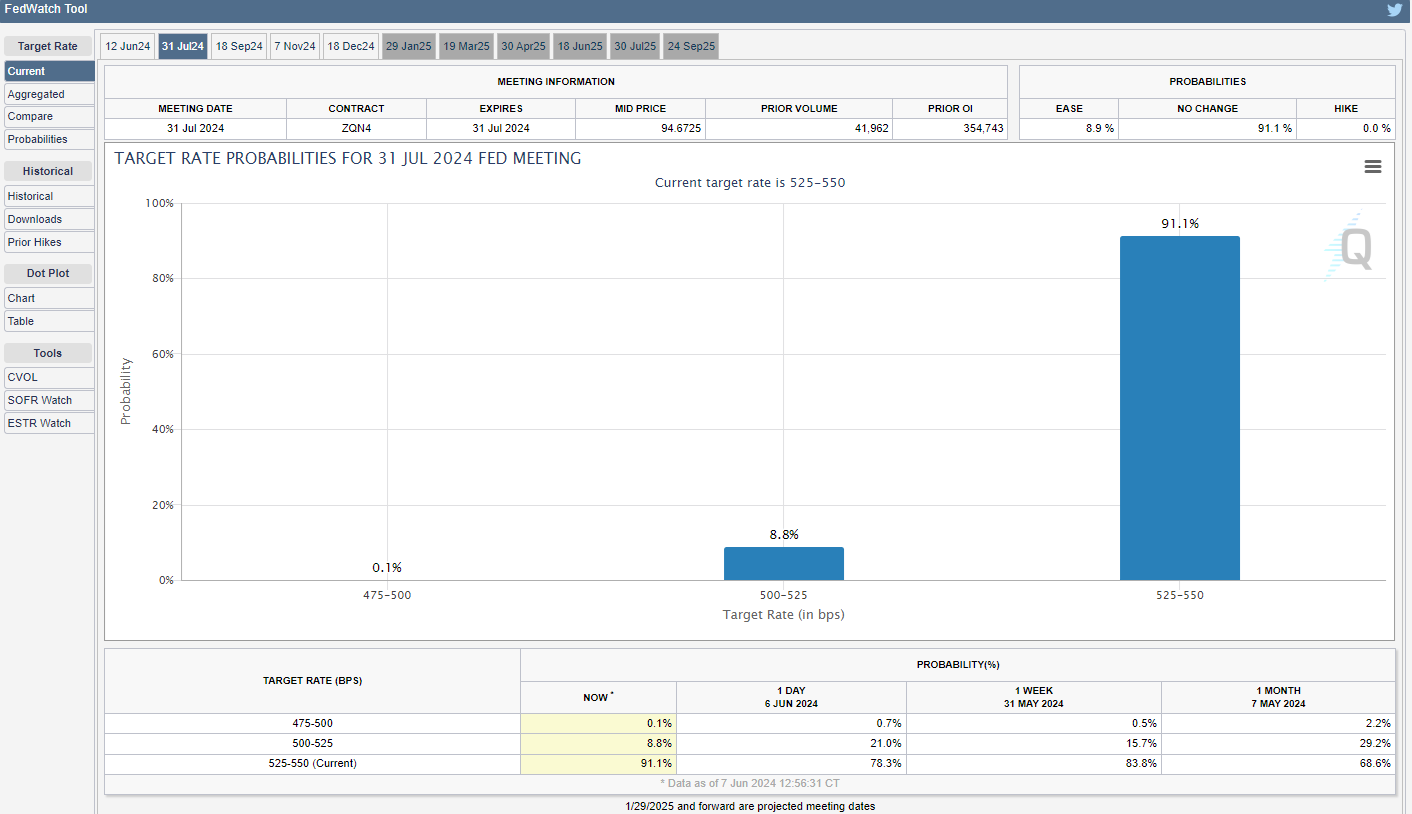

His comment also reminded me of the CPI read due next week, if it were to come in unexpectedly hot that would further bolster the stand pat in July camp. Worth a look at the updated CME Fed watch tool for July:

So a pretty busy docket next week with 10yr and 30yr auctions, Fed meeting and both CPI/PPI due. Could make for an interesting week.

MARKET rundown

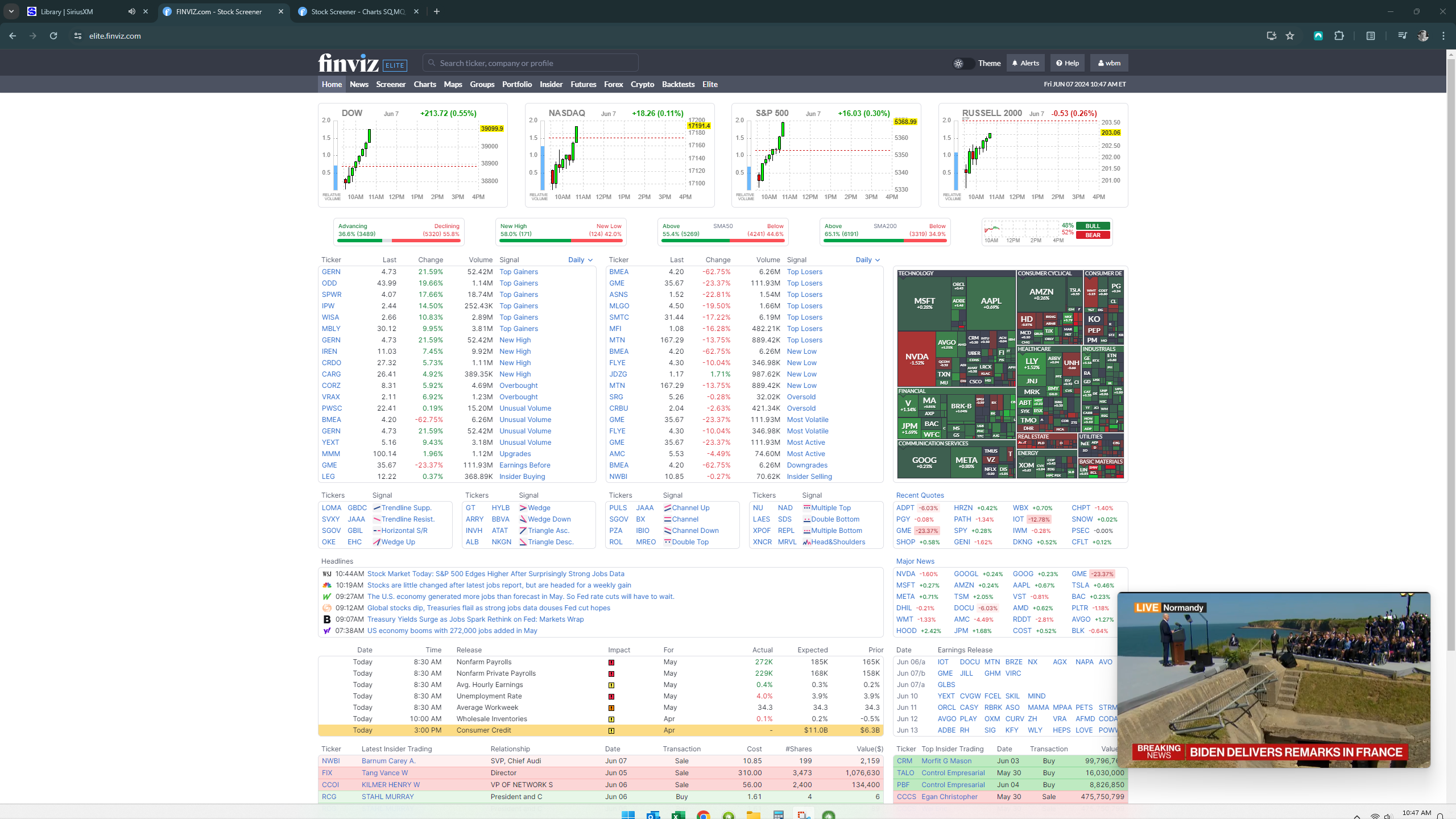

The broader market has continued to shrug off any attempt to pull back meaningfully, buy the dip has continued to work. In fact the futures took a big hit this morning on the back of the jobs data only for the cash open to – true to form – make it a non issue:

That said, some very interesting observations have caught my attention recently, like this LinkedIn post from James Bianco that was shared on the Risk Reversal podcast:

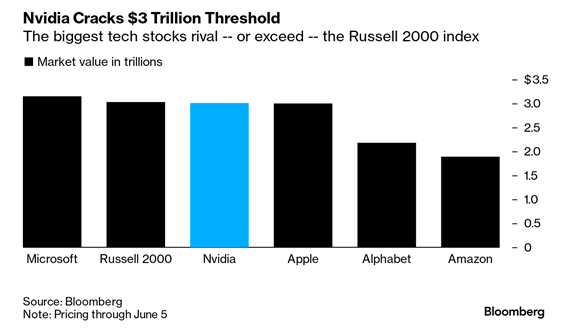

So in summary, 54% of the S&P 500’s gain YTD can be attributed to just four stocks, which account for only 19% of the overall market cap of the index! For the record, we have not been this highly “concentrated” in such few names since the 1960’s.

So what’s next?

Do these names continue to carry us?

Do these names catch a cold, sneeze and cause the entire market to shit the bed?

Does the broader market and small caps catch up or at least prove they too are in the game?

The latter is exactly what I am watching. I want (need) to see the “equal” weight S&P and Smalls move higher for me to be convinced this market indeed has staying power.

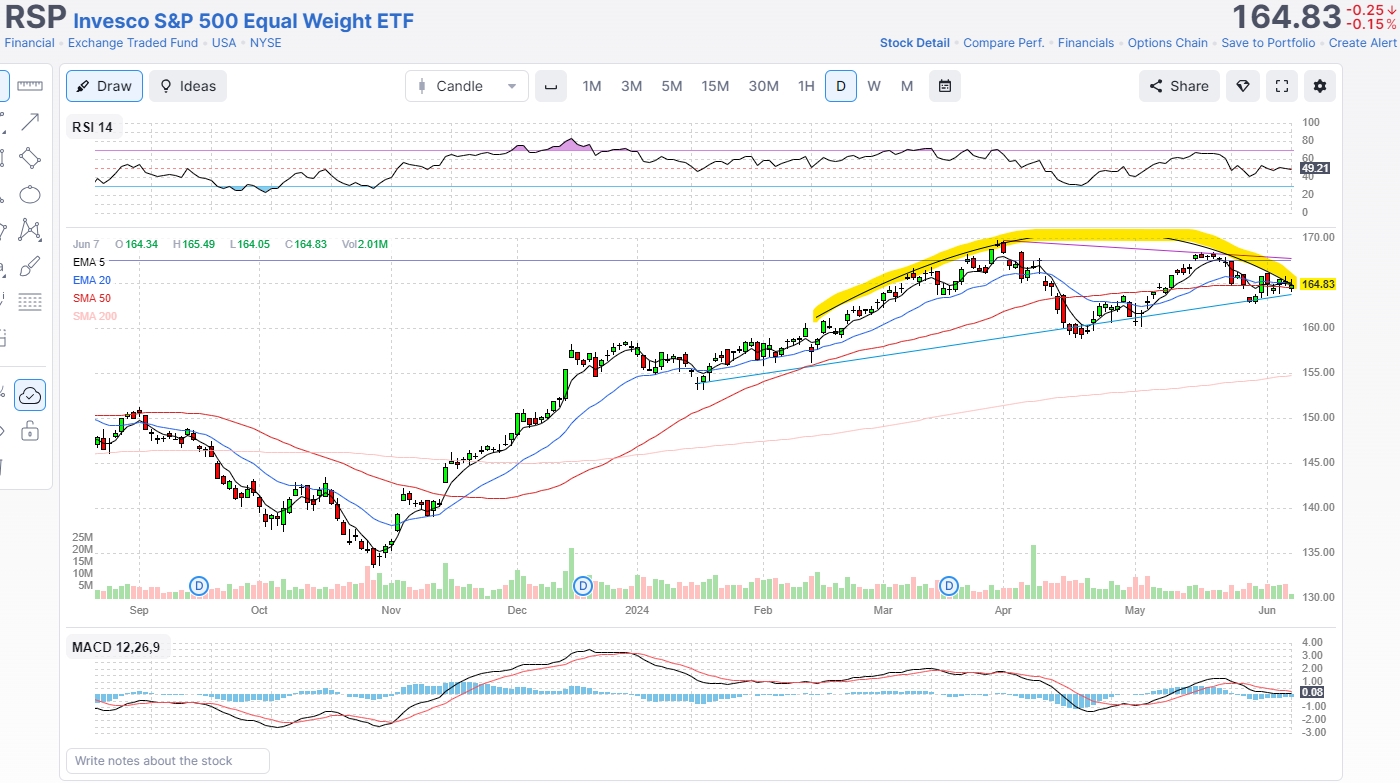

Charts for those two (via RSP and IWM) look different but tell a very similar story…

I highlighted the overhead arch I drew in, a classic Rollover pattern that is sitting on the support of the upward channel base that started early this year. Time to resolve one way or the other.

Same for smalls, via IWM, only this time I highlighted a classic Head and Shoulders topping pattern, with today’s candle resting on a similar upward channel base like RSP. Time to resolve one way or the other.

Stay tuned…

LUNACY RETURNS

Last but certainly not least, I would be remiss not to mention:

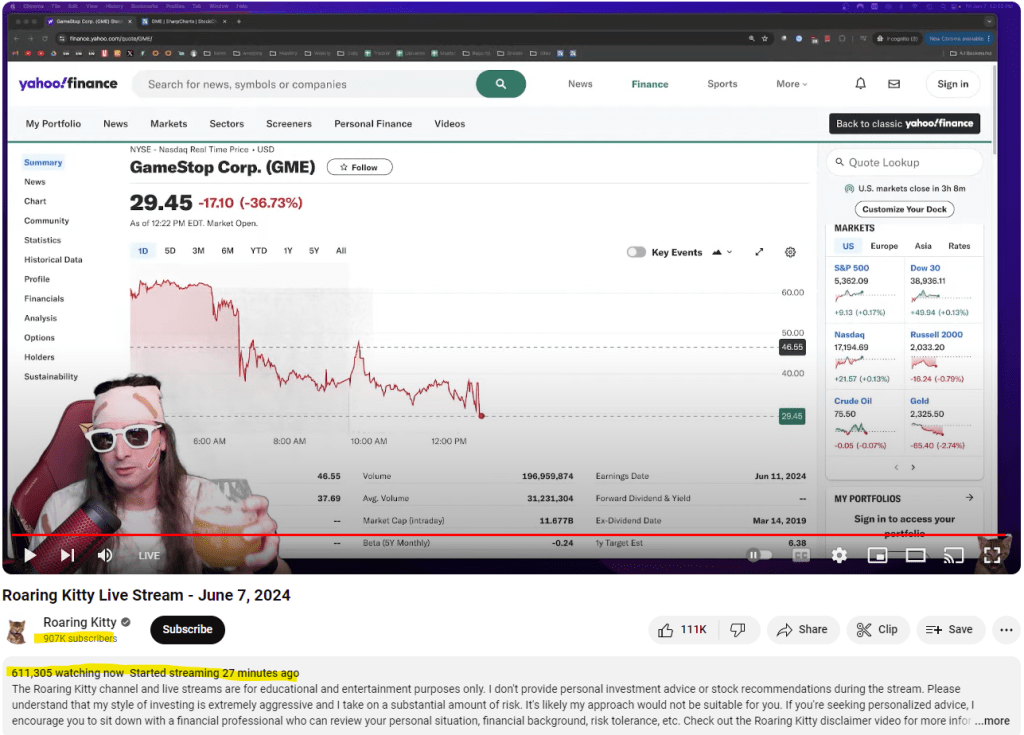

Behold the power of a wristband/headband clad dude on YouTube with the single handed ability to influence half a million invalids and halt trading in an already worthless retail gaming chain. The company itself is beside the point, does it really even matter?

As he toasts his glass (with what I wonder?), the stock has been halted once again, this time down 36%. Wondering how many of those 611K watching were actually long calls hoping for a miracle run to 100 today?

I just turned around to my trading desk and I see GME is in fact trading again, around $28 with over 250M shares changing hands.

Now, if none of the above makes any sense to you, or perhaps you have never heard of any of it and are scratching your head wondering why I am even talking about it? Forget about it. Certainly don’t waste one minute of your time trying to find out.

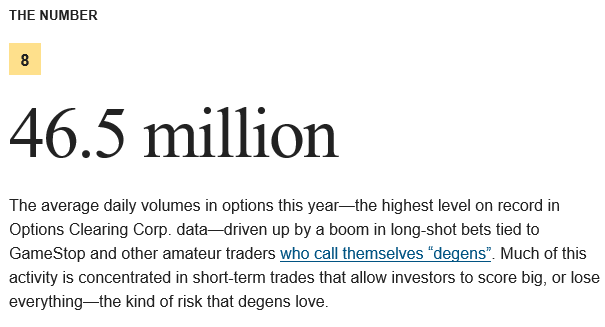

The only reason I mention it here is because it scares the hell out of me. Exhibit A from my WSJ 10-Point email this morning, I give you point #8:

This is where we are folks. We are back to meme stock mania, full stop.

We are back to meme stock mania at a time when fewer stocks seem to matter than the number of fingers I am using to pen this post.

Is the economy really that strong or is everything just getting caught up in the wake of the great AI chase?

What happens when the music stops?

ON BALANCE

I tried AI for the first time the other day out of curiosity. I had a question, why not give it a shot?

I wanted to know how many paying customers a company (investment) that I was considering had. Could it tell me? I asked and patiently waited, prepared to marvel at this new end all technology.

My response was finally ready and as I leaned in to read it started with the following:

At the end of 2021, [Company ABC] had over [xxxxxx] paying customers.

It then proceeded to proudly highlight some “insight” from the 4Q21 earnings call without me even asking! Thanks!

I closed the dialog box…

Last time I checked this was the year 2024. I would prefer to make my investment decisions on data a little more recent. Oh well, maybe next time.

I leave you with some recommended reads/listens:

The AI Revolution is Already Losing Steam

All for now…

Enjoy your weekend!