Sell in May and go away you’ve heard of. We all have. A recent podcast introduced me to Buy in May and stay. Jury is still out on that one given where are currently trading, but hey time will tell.

With Memorial Day bearing down, bringing the unofficial start of Summer with it, I think it warrants a little level set action on my part. That means grab a chair and a cold drink.

For me these next few months will bring a lot of back deck sittin’ no doubt, searching for an afternoon baseball game to listen to as the market action – or lack thereof – lulls me to sleep.

Doesn’t sound too bad actually!

stepping back

: to stop doing something or being actively involved in something for a time so in order to think about it and make decisions in a calm and reasonable way

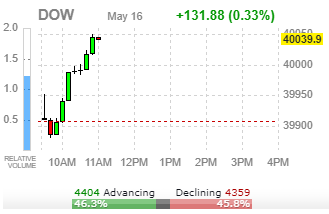

Thursday afternoon as I type this, looks like the Dow crossed 40,000 for the first time this morning, I didn’t even notice until a talking head on Bloomberg mentioned it in passing…

These levels don’t mean a lot, more psychological than anything else, but it’s worth noting we did hit record highs today on the S&P and Nasdaq as well.

Makes one wonder if that little “blip” of a correction in April is all we will see? We reversed off those April lows pretty quickly with several gap-ups along the way, indicating some big money caught offsides and the need to get “re-positioned” per se.

I for one was hoping we could trade sideways for a while, digest if you will before the pre-election months and Fed cut hopes take us undoubtedly higher.

Let’s recap some recent data prints…

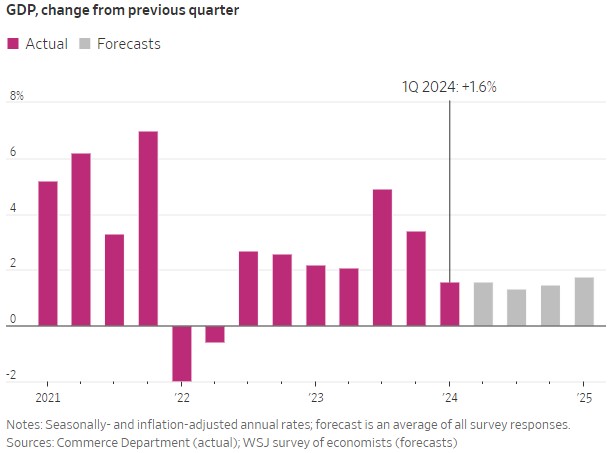

GDP 4/25

Slower growth in Q1 caused a gap down reaction in markets that was quickly bought as people remembered that slower growth is actually preferred in this environment.

PCE 4/26

A gap up quickly followed as PCE failed to meaningfully surprise to the upside, although it did tick up. At some point one would hope these start to tick lower…

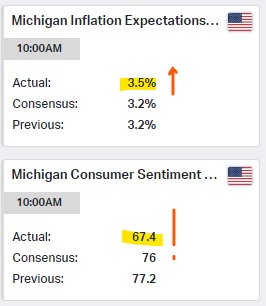

Consumer Sentiment 5/10

The turd in the punchbowl arrived on Friday May 10th. Up to this point the consumer has been rock solid, turning a blind eye to inflation and continuing to spend, glass half full.

The exact opposite turned out to be true that Friday, with inflation expectations higher than consensus and sentiment tanking to put it lightly:

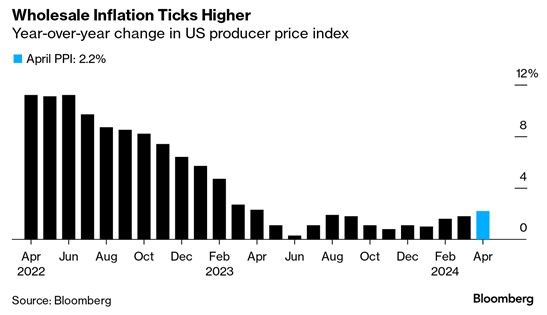

PPI 5/14

Next up would be PPI data on Tuesday, not as highly anticipated as CPI but another “read” nonetheless. Although the YoY figures behaved, the MoM prints certainly raised some eyebrows. Something to keep in mind, as long as these MoM numbers are up, inflation targets remain out of reach for now.

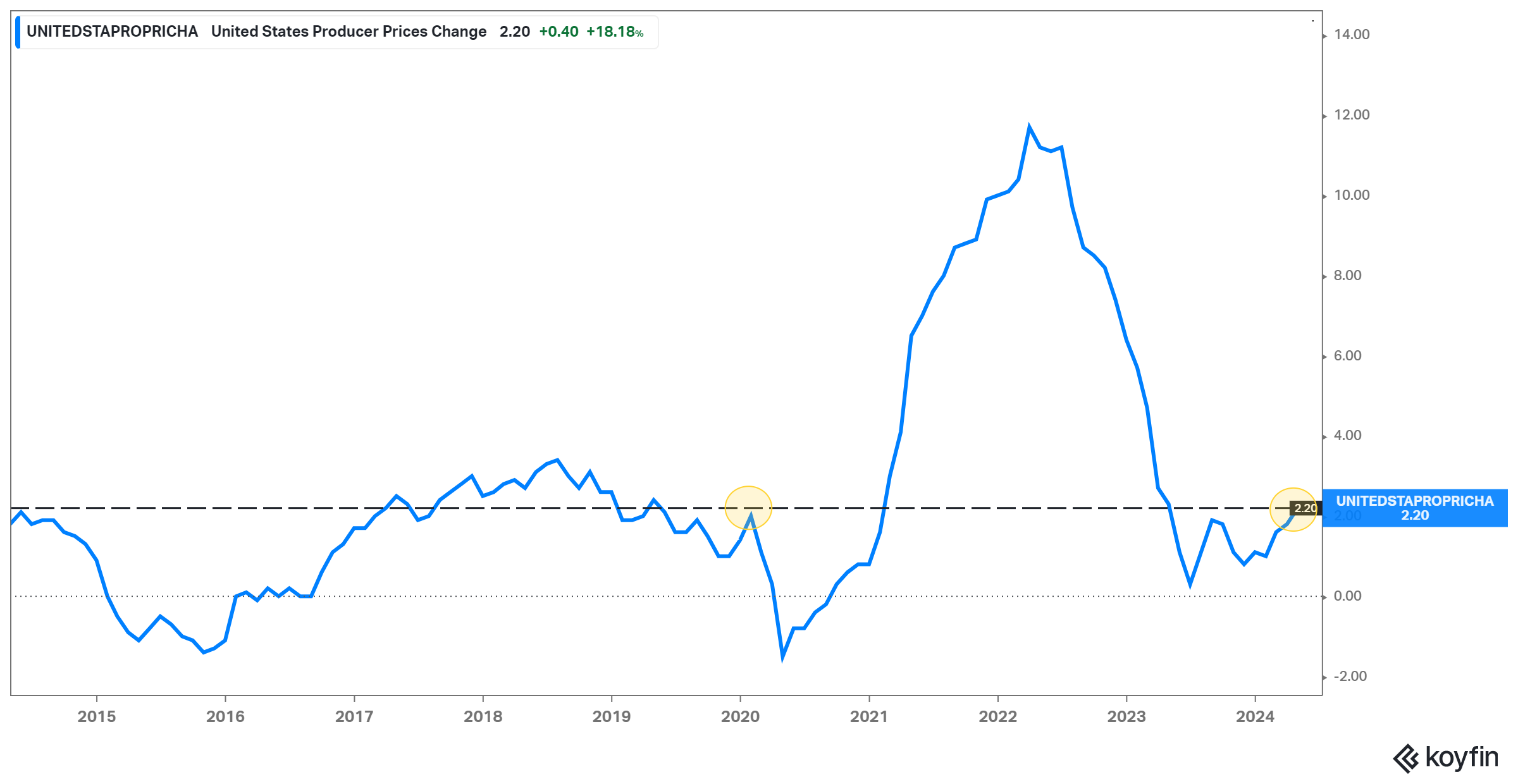

One item of interest, as Barry Ritholtz pointed out while on Bloomberg that afternoon, was that PPI has round tripped back to pre-Covid levels. I though that was interesting and pulled up this chart on koyfin to help illustrate that point. Maybe it was transitory after all, eh? Noise.

Retail Sales 5/15

Retail sales data yesterday was another notable item when paired with the recent sentiment data, the consumer is finally showing some signs of exhaustion. Lingering inflation will do that to ya.

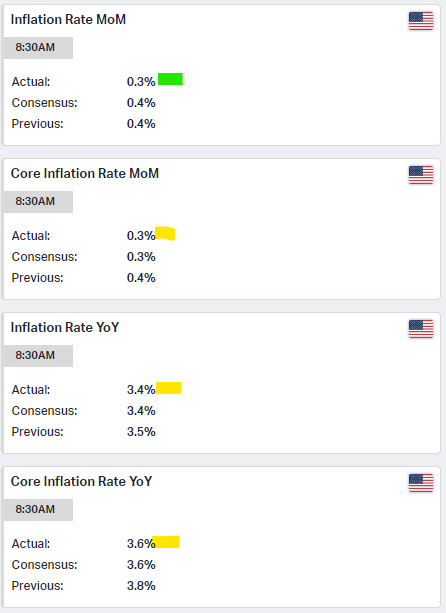

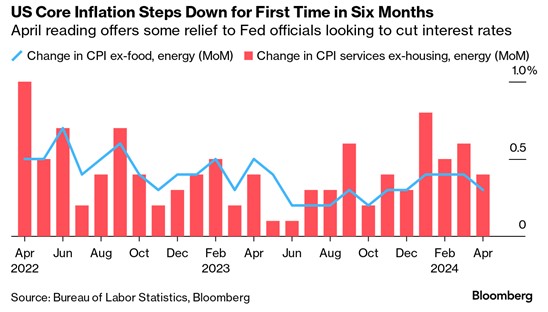

CPI 5/15

The marquee event of course was CPI Wednesday, all eyes were on those numbers and it was basically a non event, which is not a bad thing. Most fell in line with consensus expectations and the baseline MoM number ticked a bit lower:

I suppose the biggest takeaway from all of the above, at least my takeaway is “respect the process”. Whether you want to call that higher for longer or something else, it is what it is. Let it eat.

Don’t forget also that higher rates accompanied by a strong economy indicates growth. Which is a good thing. As long as companies continue to prioritize profitability with steady revenue growth, the rest will take care of itself.

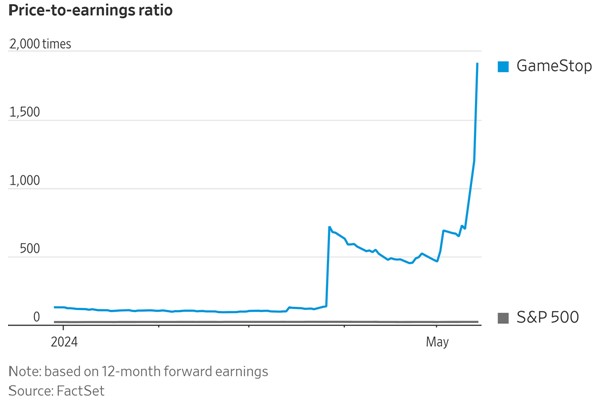

I would be remiss not to mention some other shady shenanigans taking place this week. The meme stocks were back. Evidently “roaring kitty” decided to post a picture and the “apes” took that as a sign to return to shit stocks in force.

You cannot make this stuff up folks.

This is the world we live in, where one jackass tweet with NO WORDS can add millions to the market cap of a zombie company…just because. Good post from Howard Lindzon on this insanity…

Another side of me, I cannot lie, as rediculous as all of this is, I think it’s also funny as hell. Hedge funds licking their wounds from a small but focused army of retail “investors”. Only in America.

Not to be outdone, Tupperware (yes…that Tupperware) was running higher as well. I had no idea Tupperware was still trading publicly period.

All of the above is simply one more reason I find myself wanting to take a few steps back from this market and let it play out a bit before…dare I say…leaning in once again.

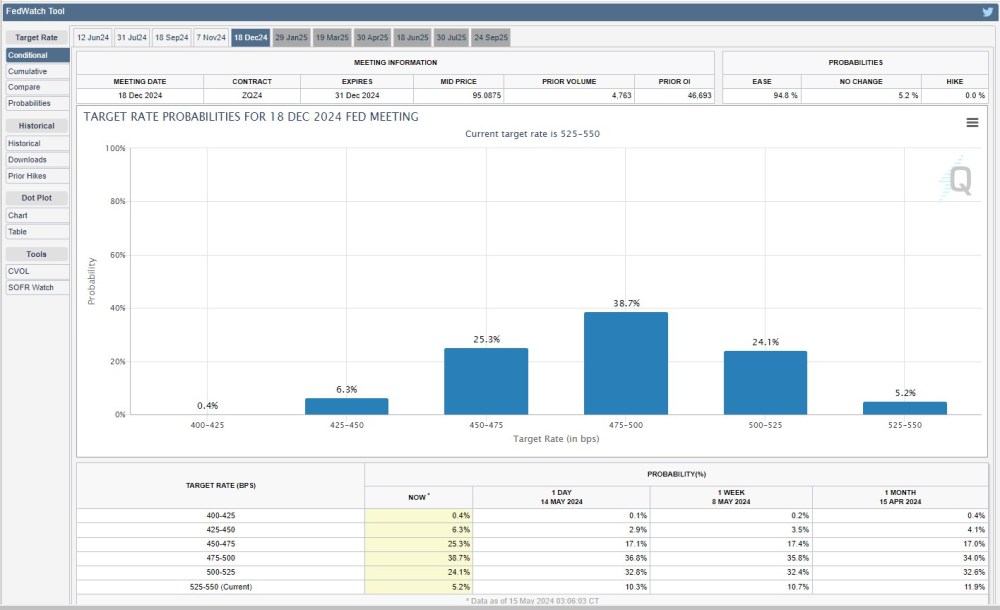

I guess we should check in on rate cut expectations on the heels of the data this week, these may be a little dated but looks like we are at 33% for 25bps in July, another 33% for 50bps in November moving closer to 40% for 50bps by end of year.

So call it two rate cuts by end of year, I would say that is “fair”, but as we get closer to the election anything could happen.

Speaking of said election, sounds like the Biden camp has decided to go on the offensive and propose some debates? Trump quickly agreed, I guess he assumes he will not be in prison?

CNN will hold the first on June 27, audience free (which I think is fantastic, no fuel for either derelict) and ABC will hold one later in September. God help us.

Levitating above the 200 day

Let’s talk technicals. A part of me is wondering if a re-test of the 200 day is in play for this summer, prior to the election. We were about 12% above it in April before that “reset” and as of today we are getting north of 11% again.

A summer grind sideways to lower to the 200 day may be just what the Dr. ordered before things get silly this Fall. Just saying.

The longer we defy gravity and melt up, the more painful it will be when the simple laws of physics do catch up?

CALENDAR

Since we are all “data dependent” here is a rundown of some key dates to year end:

CPI: June 12, July 11, Aug 14, Sep 11, Oct 10, Nov 13, Dec 11

PCE: May 31, June 28, July 26, Aug 30, Sep 27, Oct 31, Nov 27, Dec 20

Fed: June 11-12, July 30-31, Sep 17-18, Nov 6-7, Dec 17-18

GDP: Q1 read on May 30

Presidential Debates: June 27, Sep 10

I will leave you with some recommended reads worthy of your time:

Why “forecasting” is a fruitless exercise…

On foreign policy and the 2024 election…

Common sense advice a sentence at a time…

Amazon CEO Andy Jassy breaks down all things AI in his shareholder letter…

The economics of Generative AI…

Why the data center is the new unit of “Compute”…

All for now…

Turning my attention to welcoming the Memorial Day holiday, afternoon baseball games and a market that (with any luck literally) puts me to sleep.

Thanks for reading!