What a crazy week.

As the temperature warms and the days get longer, I try to limit my desk time a little more each day.

Ideally I am pushing back and headed for the exercise bike no later than noon.

I knew this week would be a little busier with the meat of earnings upon us and reads on GDP and PCE.

Tesla was all but left for dead after failing to meet expected deliveries amid EV headwinds. There was little expectation ahead of earnings but Elon pulled a rabbit out and shifted the focus to accelerating the timeline on a cheaper model.

Which was odd given the fact there was chatter on Bloomberg about abandoning the model completely and focusing on “robotaxis”, God help us.

That was hardly the case and the stock gapped up and didn’t look back, trying its best to break free from a steepening down channel:

Meta, the artist formerly known as Facebook was next up on Wednesday after the bell and they pretty much shit the bed, no other way to describe it.

Zuck said all things AI were going to cost a pretty penny and he was fully prepared to spend it. The Street wasn’t prepared for the magnitude of said spending and unlike Tesla gapping up, Meta headed south:

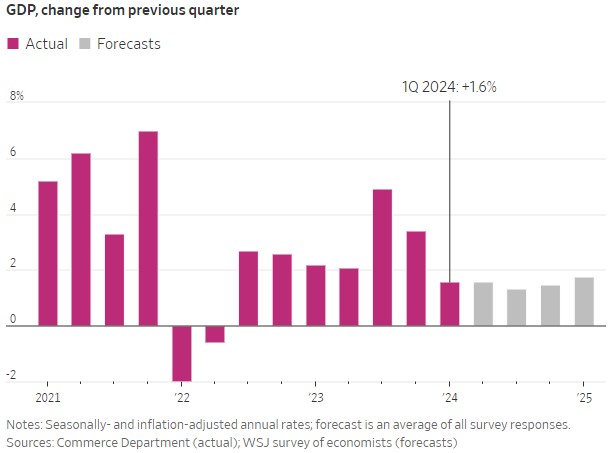

The futures were deep in the red Thursday morning before the GDP print, which showed some slowing growth. That spurred talk of Stagflation Nation, slowing growth against the backdrop of stubborn inflation:

Things improved as the day progressed Thursday, shaking off Meta and the lower GDP in hopes that Microsoft and Google would deliver after bell. They certainly did and both gapped up:

If Google’s move looks a bit extreme, it was, due to their announcement of a $0.20 dividend. Nobody had that on their bingo card. That little bonus combined with increased growth and of course AI hype lifted it well out of its range.

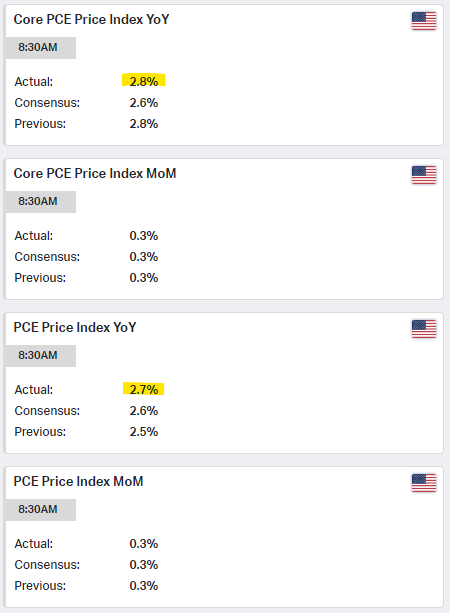

The PCE read today was stubbornly sticky, albeit muted which kept the late week rally intact:

So to put the whipsaw week in perspective, here is a 15-min chart of the SPY:

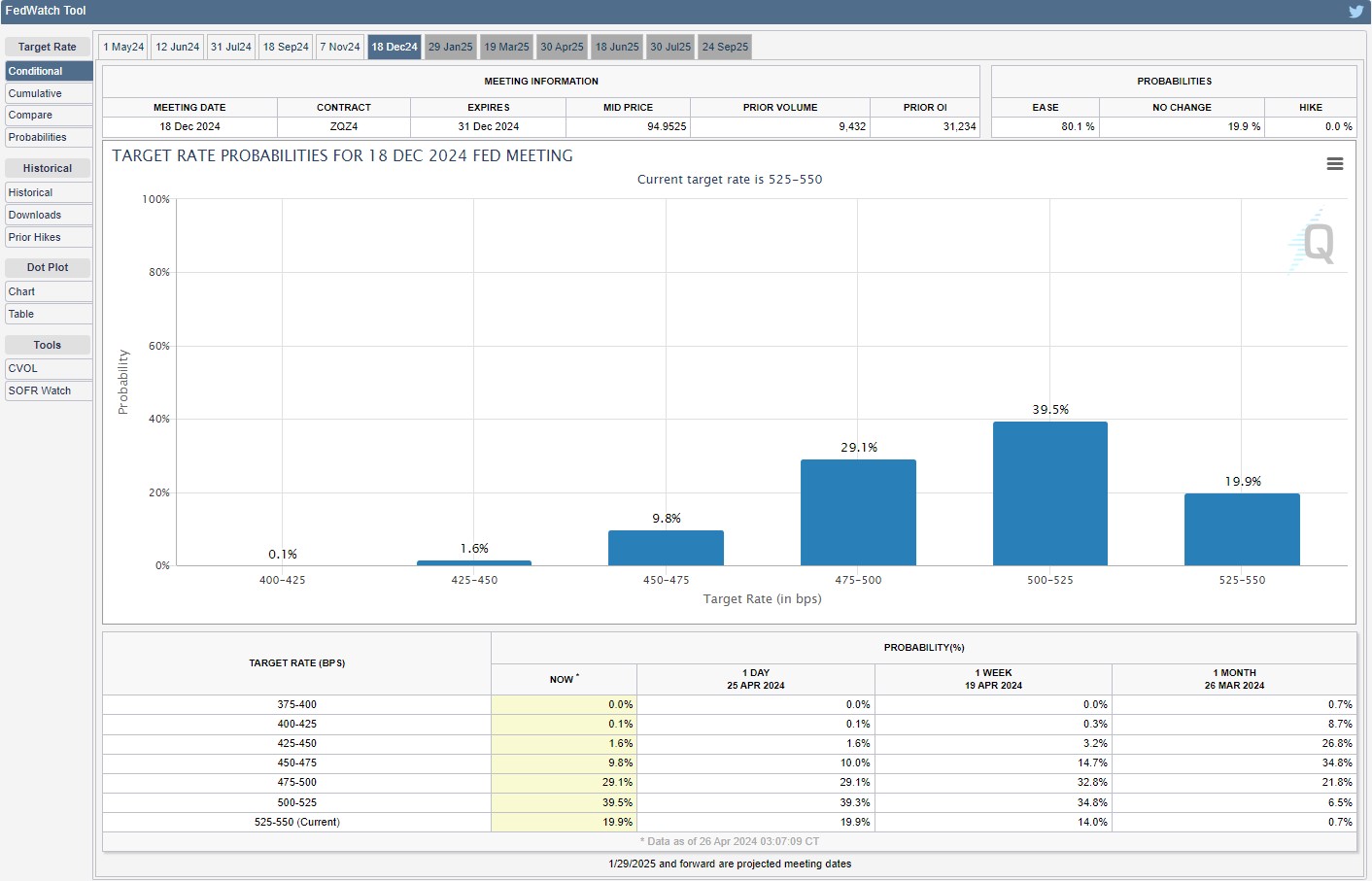

So after all of that, where do we stand on rate cuts you ask?

Well allow me to retort!

They are going extinct with quickness, with the majority now only expecting one for the year:

So what now you ask?

Most eyes will be on Amazon (Tues) and Apple (Wed) next week to provide a final glimpse into the state of big tech but there are plenty of consumer names on tap as well.

Amazon will be most interesting simply because they cover the gamut…AI, cloud, transportation, consumer, media. There is no better barometer and they have been pulling cost cutting levers for several quarters now.

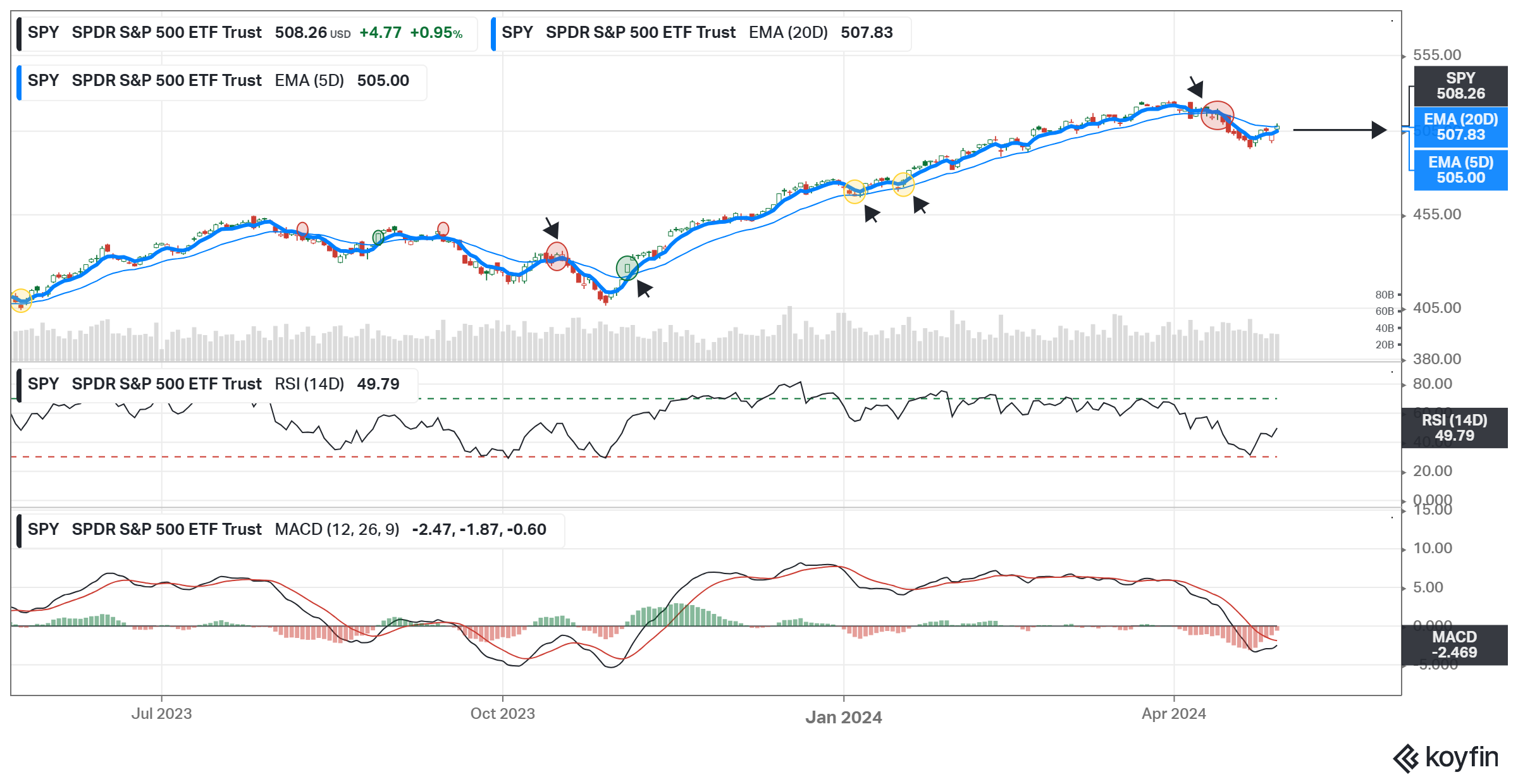

Beyond earnings, I think its worth noting the major indices are now starting to consolidate sideways and that pattern could continue…for a while:

Of course the 5/20 EMA cross to the upside (buy signal) is very much in play next week but I would rather see some further sideways digestion if you will.

The Fed will announce absolutely nothing Wednesday. In fact I could probably script the presser notes tonight while watching this baseball game……..

“We are data dependent and although we have seen very hopeful signs of inflation continuing to abate, we are in a very good position in terms of monetary policy and do not feel the need to react prematurely.”

Let’s see how close I am.

In other words my fellow reader, get comfortable. Hopefully you don’t need to borrow any money anytime soon and you can enjoy 5% yields on idle cash the remainder of the year.

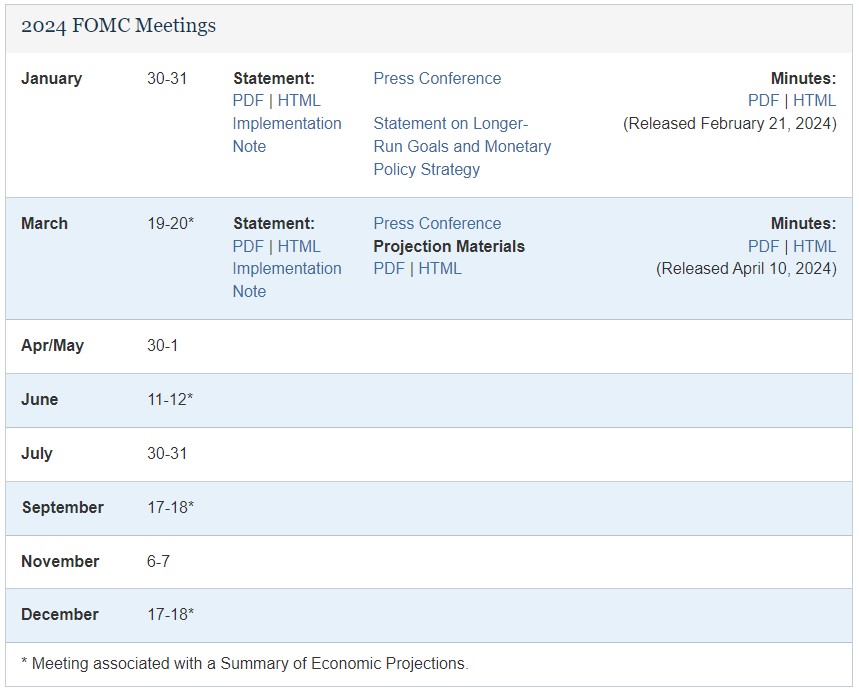

If you want to mark anything on your calendar it will be the future CPI prints. We will have two before the June 12th FOMC meeting (May 15th and June 12th). Note the second is on the actual morning of the FOMC meeting itself.

Mark my words before that June Fed meeting there will be talks of a possible hike on the table, which I think is ludicrous but I fully expect the banter.

All for now, thus endeth the lesson I have a baseball game to watch.

If the season ended today, this would be your World Series matchup my friends. Chop Chop.