Enjoying a Sunday afternoon on the deck today. First one of the year.

Only sound is Braves Radio 680AM to my right offset by the faint hum of a zero turn a few acres to my left.

Feels good to be back out here.

A quick check of the calendar reveals mid April, tax day tomorrow for those who need that reminder. This is my first post in April, which may seem surprising to everyone except myself.

Nothing much to say.

In fact I can queue up posts from late 2023 that are still very much in play. The current narrative is very long in the tooth and equally as tiring. I usually keep a Bloomberg stream active in my office and I find myself finishing sentences for the interviews.

….yeah yeah, higher for longer….yeah, yeah, we may only see 2 or 3 cuts this year…yeah yeah…

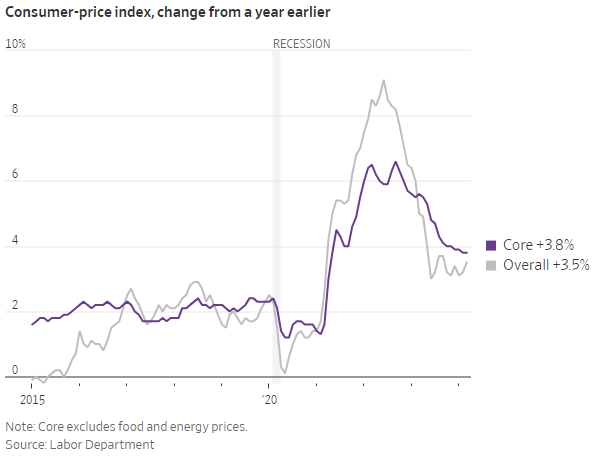

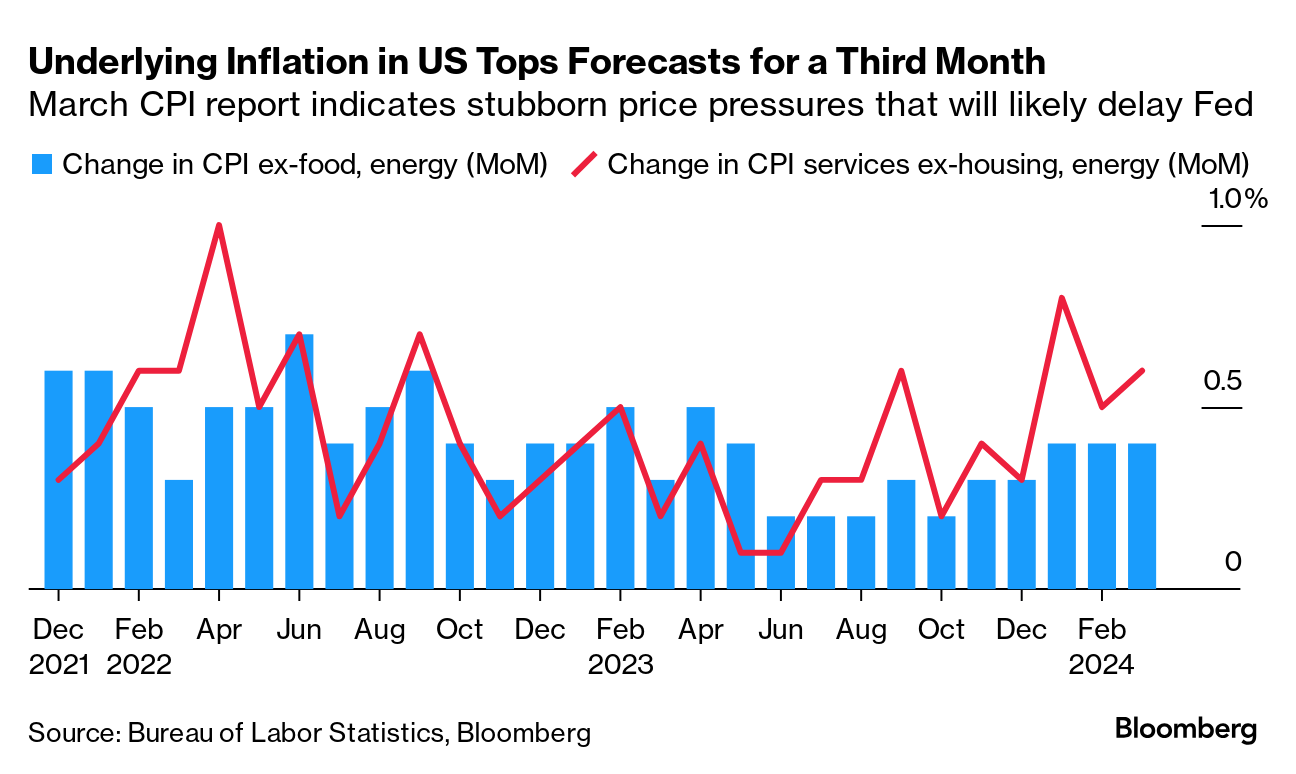

If you missed it, CPI surprised to the upside last week and that spooked markets a bit. One could easily argue it has not only stalled but is starting to tick higher? Not what the Fed wants to see.

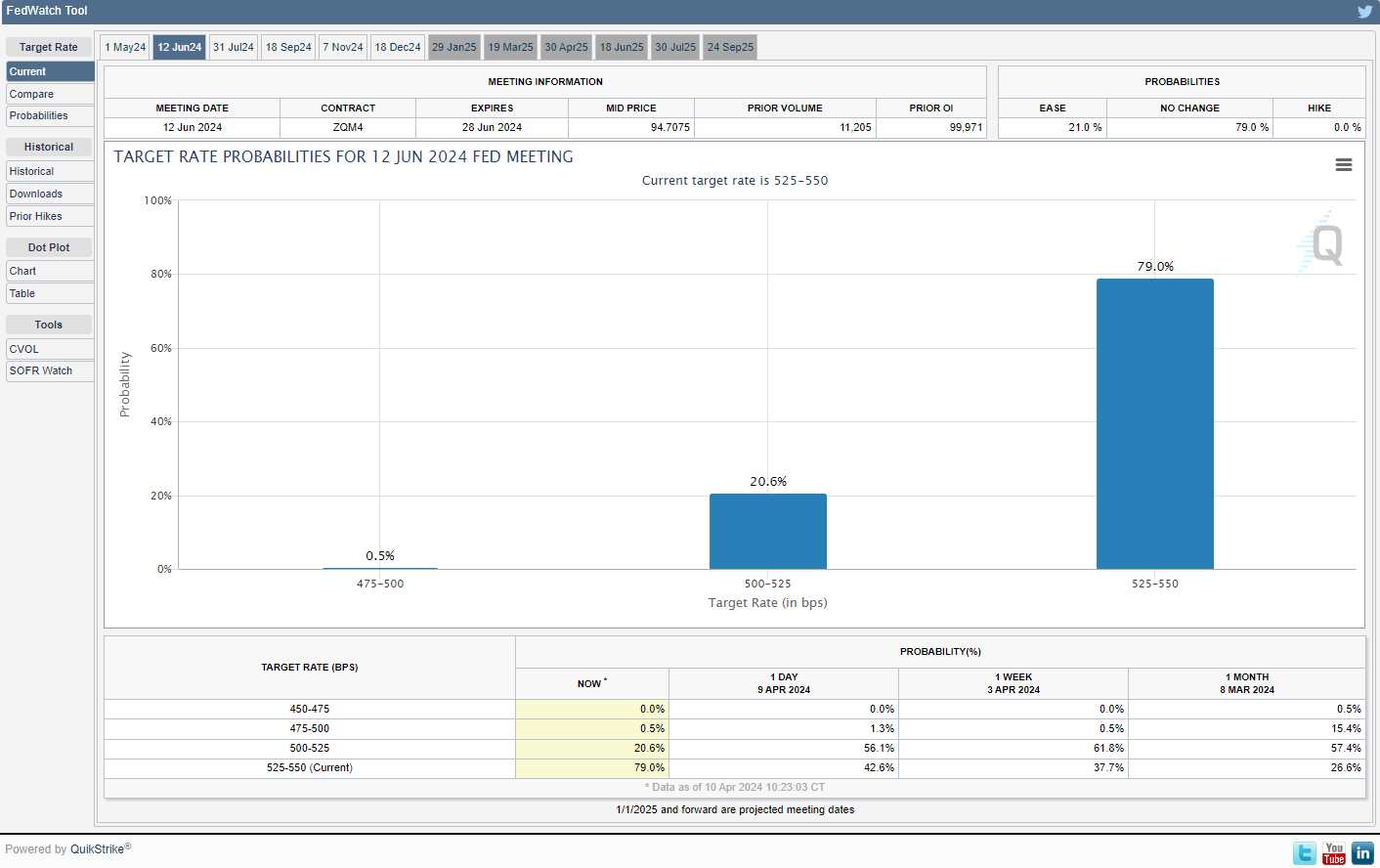

Given that print, it’s worth checking in on where rate cut expectations lie. Everyone is antsy for cuts sooner than later but will need to cool their jets, even more so now.

Only a 20% chance of a cut in June:

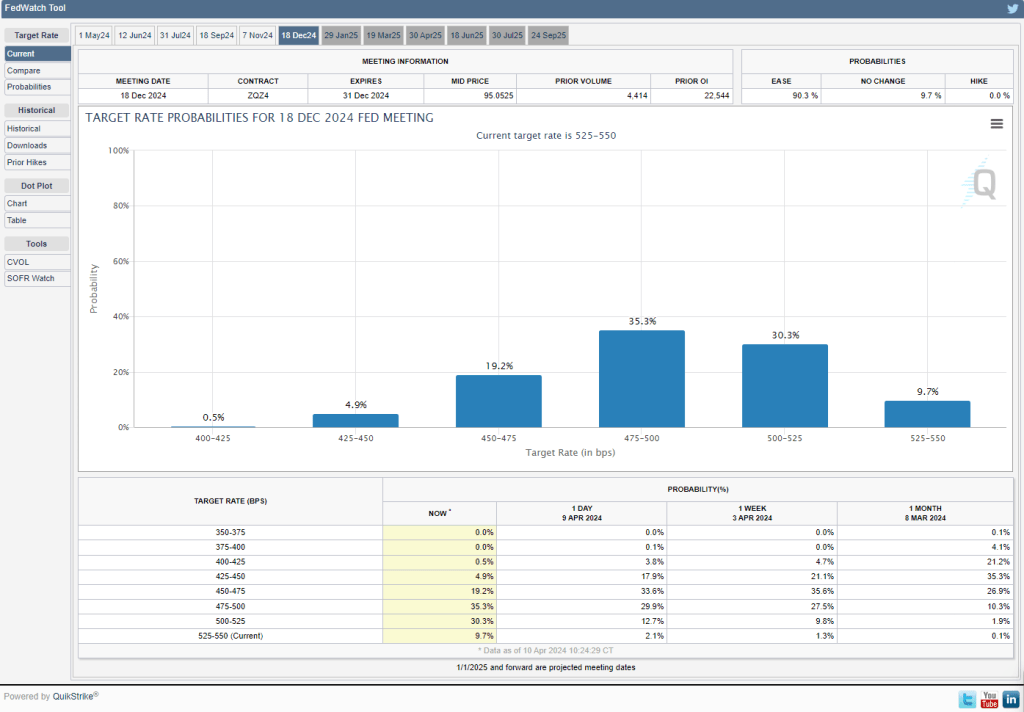

Amazingly enough, a similar 20% chance for 3 cuts exiting the year. Majority now leans toward only two:

Amazing how quickly we went from “when not if” to “if not when”. Listen closely and you will hear some pundits calling for zero, a few others saying the next move will be higher not lower.

Let me just say the markets are not remotely priced for a hike.

So other than the fact the Fed does have some rate cuts in their back pocket, there is not much that excites me entering the warmer summer months.

I have a feeling I will be staring at a blinking cursor for a while, prompting me to say something, anything.

Let’s revisit some charts.

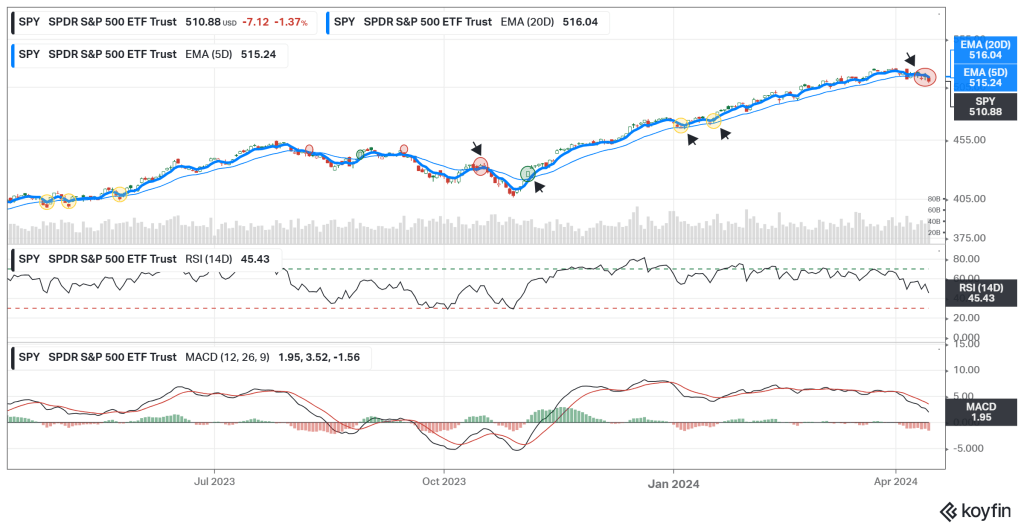

Ever since the Fed took their victory lap in early November, the market has been on autopilot after throwing a buy signal on November 3rd. My preferred signal is when the 5 day ema crosses the 20 day.

Fast forward to today…and…

What you see there on the tail end of that chart my friend is a confirmed sell signal, first one since October. There were a few close calls at the start of the year, but nothing followed through.

The RSI is below 50, weakening. The MACD is falling, faster. Not to say all of this could reverse on a dime Monday, but the signals are what the signals are. Time for a breather.

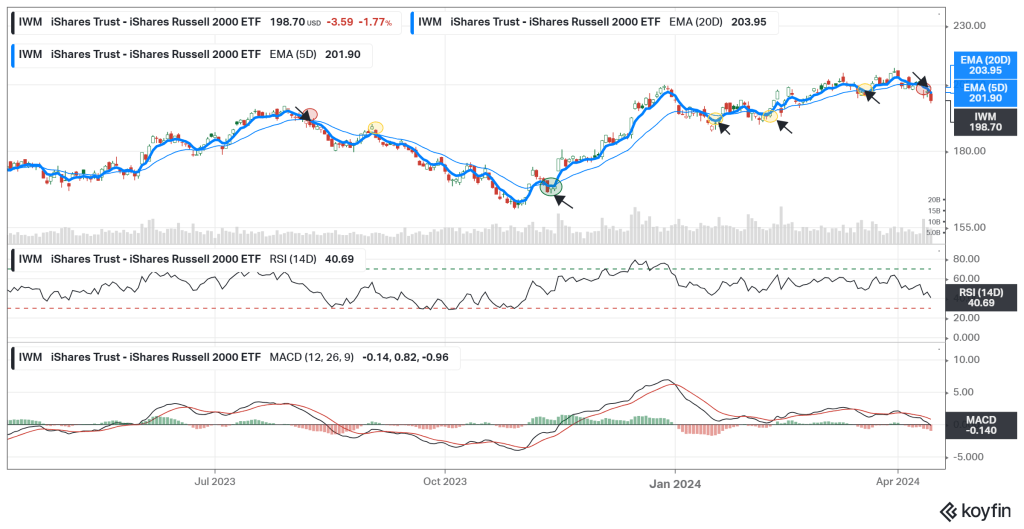

Small caps are in worse shape and just cannot get any continuation on that attempted breakout:

Yields have been curling up, as the bond market attempts to reprice higher for longer”er”. North of 4.5 could be problematic for the 10yr but not nearly as much as 5.0 should we eventually get there. When we cross 5%, 30-yr mortgages will soon cross 8% and that is never a good thing:

Remember the VIX? No? Remember when it settled north of 20? No? Neither do I but it too is starting to curl north:

Meanwhile lest we forget the Middle East is on fire (literally) and an election looms for those of us stateside that is about as appealing as a colonoscopy prep. Been there done that.

Braves just won 9-7 on a home run when they were down to their last strike.

There’s probably more to say but it seems like a good time to close the lid on this laptop and switch over to Roots and Boots on WFPK 91.9.

Soak in another Sunday afternoon back here on the sunny side of earth.

Until.