I’ve written about Retirement and Solvency before, so some of this may sound like a broken record but bear with me.

In fact I didn’t plan to address them any further, unless something changed that impacted my opinion or my own personal status.

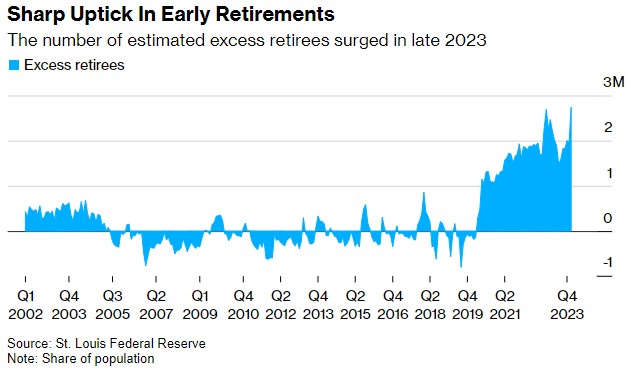

Several days ago… I read a Bloomberg article that pointed out the increase in new retirees above plan and something I had never heard before: “excess” retirees. Not going to ask how they came up with that figure but nevertheless…

Take a look:

Anything stand out? For me it’s easy to see the timing directly coincides with the pandemic. I am of the opinion that Covid forever changed the way all of us feel about working…forever.

There also comes a point in time where enough is simply enough. At the very least many feel inspired to redefine how they feel about future work.

We also have to consider markets are at all time highs which has worked out well for those who stayed the course.

I do still wonder though…how many are truly ready?

➡️ READY FOR CHANGE

I’m not sure exactly when I hit peak burnout in my previous career, it would come and go in waves but eventually reached a tipping point around the time I turned 40.

I was done. I knew it and could no longer hide it.

I developed a plan I called “325”, which simply meant “Three to Five” years, as in be mentally and financially ready to call it quits in “Three to Five” years.

Leaving the workforce in my mid 40’s would definitely put a strain on my finances but I was determined to find a way to make it work. I crunched the numbers in my sleep.

As luck would have it, I would be rescued from that abyss by someone I highly respected and was eager to work for. It was a dream assignment that extended my stay but I knew it would also be my last.

On a warm March day in 2020 with Covid raging, we closed up shop and started working from home. Later that year, our new CEO seized on the opportunity to thin the herd with a buyout offer. I was a firm Yes.

This is when things got real, when the planning took on a whole new level of intensity. Over two years later, I am still finding cracks in my original planning, items hidden in shadows that I didn’t fully uncover until now.

Hopefully something I share below will help in your own planning and thought process.

For anyone considering an early retirement, be prepared to plan, think and re-think time and time again before you actually take the leap. Saying “no thanks” to that paycheck is one of the biggest decisions you will ever make.

📃 THE PUNCH LIST

One of the best ways to start this process is by creating an endless list of questions. What questions do you have? What do you need to define? What are your biggest concerns, your greatest fears? What are you most unsure about? What do think you have figured out?

Write them all down the old fashioned way, pen and paper. I pulled up a chair outside on my deck and filled a notebook in about a week. One question just leads to five more! You will know you are doing it right when you wake up at 3am and stagger to your desk to jot something new down.

As the list grows, your plan of attack and your strategy will become clearer. You will find yourself circling back to specific topics, those will become top priorities.

I vowed not to try to answer or address them all overnight. In fact I vowed not to try to answer any until I had what I thought was a pretty exhaustive to do list.

No two lists will be alike. Every situation is unique…age, marital status, asset base, income sources, debt levels, plans, priorities, on and on and on. The important thing is to get it down on paper.

I narrowed down five topics that consistently floated to the top for me. Yours may differ slightly but these are five boxes that absolutely must be checked somewhere along the way.

✅ ELIMINATING THE DEBT ANCHOR

Nothing will derail your plan any faster than debt.

Any unpaid credit cards or personal loans need to go asap. Ditto for car payments. You don’t want to be in a position where you are drawing down assets to make debt payments for liabilities.

The house and mortgage is obviously a point of debate and there are many factors to consider:

What is the balance remaining? Is the interest rate locked? If so, at what rate? Are you still able to itemize deductions and claim the mortgage interest paid? If you have paid for years and the outstanding balance is low relative to available assets, is there an emotional lift to zeroing out the balance? Downsize?

This one is tough and I encourage several second opinions, preferably from pros. Depending on income sources after leaving the workforce, you may be totally fine making a mortgage payment well into the future and do not want to reduce your asset base by paying it off.

Regardless of how the mortgage plays into it, any debt payments that extend into retirement will weigh on your plan. They will hold you back. Any and all are best removed if feasibly possible.

✅ HEALTHCARE PLAN

You may be surprised to see this at the top. Certainly was not at the top of my list either. That quickly changed.

Anytime before age 65, you are relying on your employer or the ACA exchange for basic health coverage. I left the workforce 7 years before I was eligible for any employer assisted coverage which meant I was on my own. In fact leaving early meant I forfeited any help at all for 17 years.

Thankfully I have an HSA for medical expenses but that doesn’t help me at all with monthly insurance premiums*. My Silver high deductible plan for 2023 was over $500/month, I switched to a Bronze plan this year and now it’s over $500/month!

*You can use your HSA for COBRA premiums. This can help bridge the gap allowing early retirees to use pre-tax dollars to keep their current employer’s plan for 18 additional months.

Paying $6000/year for health coverage for the next 15 years until I am eligible for Medicare will cost me $90,000. Luckily, there are subsidies available to reduce that monthly payment in advance or at tax time with credits if my overall income falls within certain guidelines.

That’s why it is so important to be able to accurately estimate your income (and manage it if possible) if you are purchasing a plan on the exchange. The income must fall within a specified range to qualify for assistance, which can be larger than you expect.

Bottom line, you need to know exactly what your health insurance coverage looks like, what it will cost (per month and over time) and how you will cover that cost until your mid 60’s**. Not to be taken lightly.

** You can use your HSA for Medicare premiums, part B, D and Advantage plans, but NOT for Medigap plans. Yep. More to think about.

✅ DETAILED SPENDING PLAN

When the income easily exceeds the outgo, budgeting is optional. Many gainfully employed are fortunate to be in that position. Most simply choose not to because they hate it.

When you start to contemplate retirement, especially early retirement, something that was perhaps once optional suddenly becomes critical. The sooner you see where you stand the better.

You will need to define all baseline monthly income/spending and also any variable income/spending that occurs during specific months only.

Whether you use an app or a spreadsheet for the task, detail is your friend. Leave no stone unturned.

You have to define it before you can refine it.

If you don’t have a spending plan in retirement you are flying blind. Almost any article you find that discusses early retirement will key on managing spending and rightly so.

It’s never too early to start developing a spending plan.

✅ ASSET BUCKETS AND AVAILABILITY

This one is fairly straightforward but will be unique based on age and your investments. At a minimum you want to separate the liquid/taxable/deferred accounts.

If you are fortunate enough to have a pension, and more importantly access to it, that will ease the drawdown burden. I am eligible to draw (a reduced one) as early as 55 or (a full one) as late as 65. I am undecided on date, but neither option helps me right now at this moment.

Liquid accounts are first in line for use, taxable accounts will follow closely behind. The taxable accounts can also be used to create dividend income to supplement shorter term needs without necessarily selling the underlying asset.

Roth IRA’s are helpful given the ability to withdraw contributions tax-free at any time. This allows them to provide a bridge between taxable and true tax-deferred retirement accounts like 401(k)’s and traditional IRA’s.

The magic age of 59 1/2 for penalty free 401(k)/IRA withdrawals is will publicized, keep in mind there are options that do allow penalty free access earlier (research 72t’s and Rule of 55 for 401(k)s).

Breaking the assets down into virtual buckets and tagging each with targeted availability dates is a key step in the fifth and probably most important box.

✅ SOLVENCY ANALYSIS

I remember a frequent point of frustration in my working years was drowning in data and not being able to make any sense out of it. We knew the data was there, readily available, but turning all that data into usable and actionable material took a lot of time.

At some point you finish a working “model” that helps provide a clearer picture of whatever you are trying to analyze. Once the model is validated and accurate, it’s just a matter of keeping it updated with new and current data.

The exact same method applies to your retirement plan.

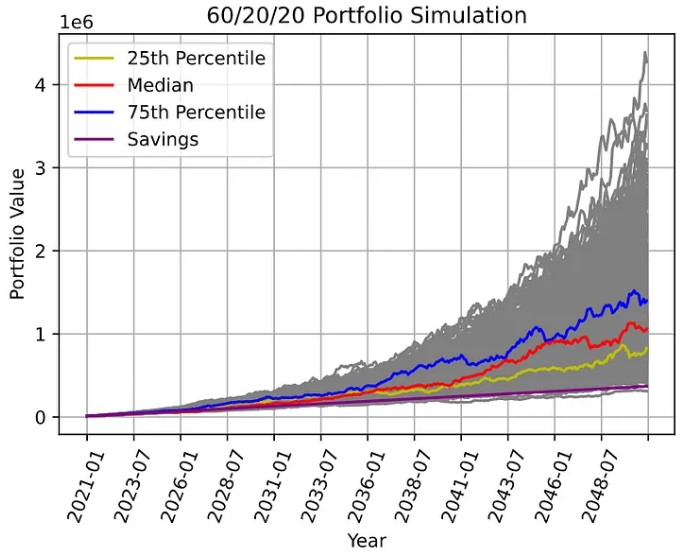

Planning firms will take all of the data we have discussed above and run “Monte Carlo” simulations or something similar that provides a glimpse into the future. Does our spending plan work? Are our savings adequate? Do we run out of money?

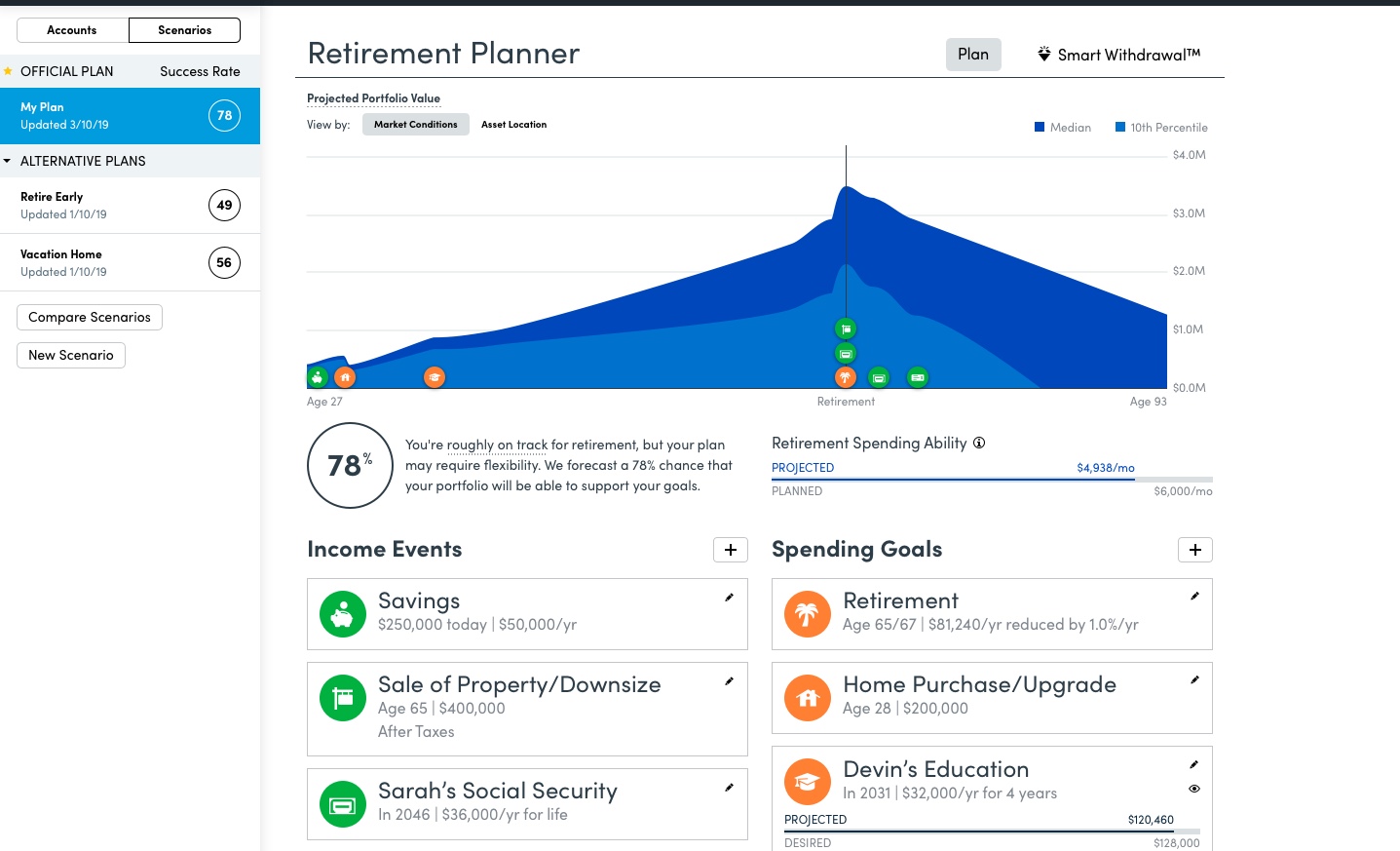

The most popular online Retirement Planner is Empower (formerly Personal Capital). It takes budgeting and spending one step further and combines your assets to gain a clearer long term picture. I have not used it personally, but you can read a good review of the product here.

One of the popular sample output graphics you will see online is the one below from their Retirement Planner which is basically a graphical representation of your solvency:

If you are starting to feel intimidated with all the data and graphics, don’t be. These tools are evolving and becoming easier to use by the day. If you do the homework first by creating a detailed spending plan, many of these online tools will link to your existing accounts and do the rest.

Instead of going online, I decided to create my own Excel based version. I am certainly not alone I am sure there are many more detailed versions available with a quick online search.

Don’t stop short of calculating your solvency. It would be like walking away from a baseball game after the 7th inning stretch with the game tied. You just don’t do it.

However you do decide to evaluate your long-term solvency, it’s that final step to let you know exactly where you stand.

ON BALANCE

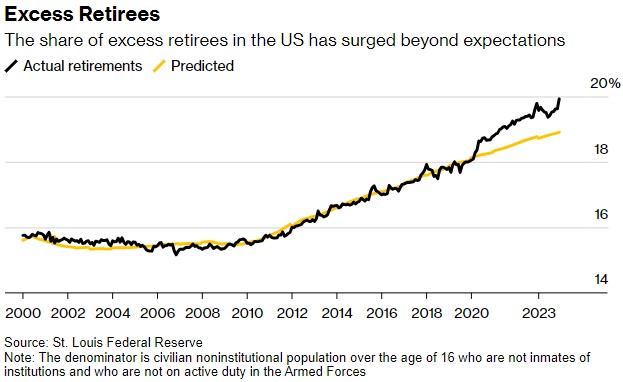

It’s no secret the baby boomer generation hits peak age 65 this year. That plus the retiree stats we started the post with and the simple fact markets are at all time highs, it’s easy to see the landscape is continually changing.

Timelines aside, my key takeaway from a journey already underway is that the planning must start long before the date approaches. Detail is your friend. Detachment is your foe.

As for the journey itself, just be sure to include a healthy dose of margin and flexibility. You don’t want to be operating close to the edges of anything.

Be ready to adapt. Take plenty of time to reflect and reduce areas of little value.

Lastly? Try not to allow all of the “planning” to prevent you from enjoying today.

Thanks for reading…