Investors and Wall Street alike fixate on big round numbers.

I immediately think back to watching CNBC in 1999 and DOW 10,000 hats being passed around the floor of the NYSE.

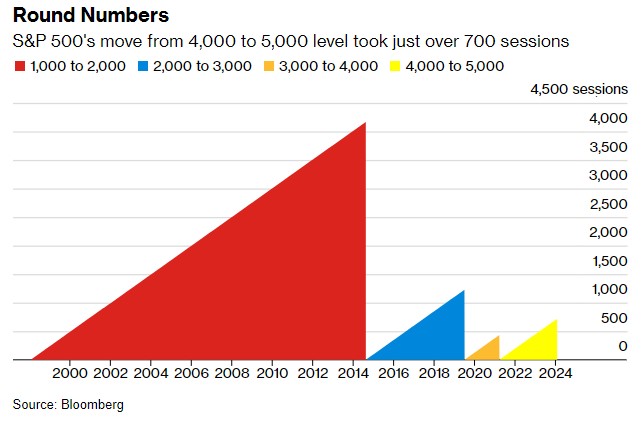

We reached another milestone Friday when the S&P 500 closed above 5,000 for the first time. Bloomberg posted an interesting graphic showing how many sessions it took to reach each 1K milestone:

Anyone recall that 15 year grind to get from 1,000 to 2,000? Seems like eons ago but I remember in 2009 during the GFC when we dipped back below 700 and freaking out a bit.

The “tech wreck” in 2000 didn’t hurt me too badly, I was young and was just getting started on my financial journey. It was good medicine though, I closed my E*Trade account in June of that year when I realized I didn’t know what the hell I was doing and bought a motorcycle.

I do recall the 2009 bottom, at that point I was a little over a decade into investing and I remember taking a 50% haircut in some of my accounts. It was a great time to buy, given my age, but that certainly didn’t help the pain of the present!

One of the toughest things to do at times like that is holding the line. Not selling. Not selling everything.

I remember conversations with co-workers that did just that. One, two, three years later many had remained on the sidelines and missed a quick recovery.

I’m not sure what’s worse, locking in the initial loss or the realization you wouldn’t have lost anything had you just stayed put. Personally I think the latter stings even more.

STAYING THE COURSE

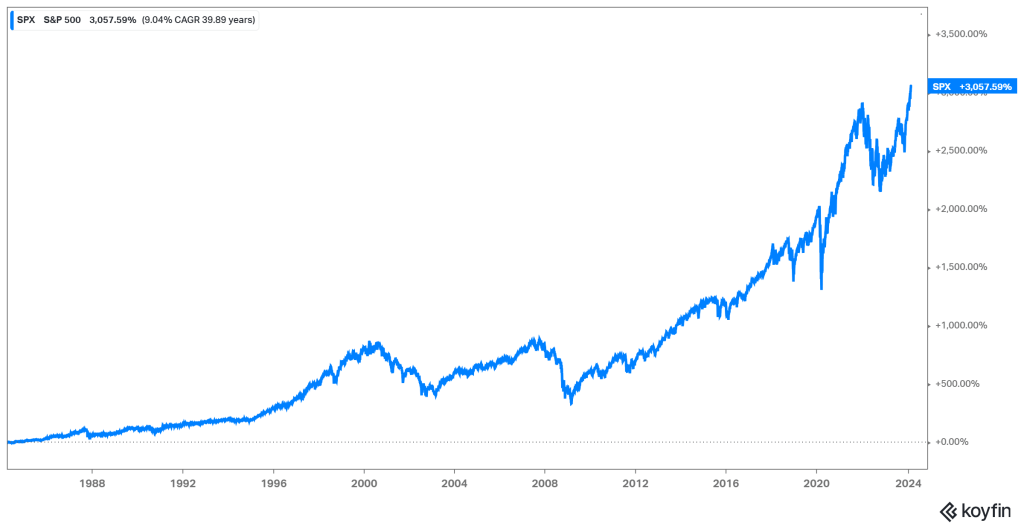

Fast forward to today and the indices are once again making all time highs. The GFC pain and the quick down swoon from the Covid panic in March 2020 all seem like distant memories.

Want to know who performed the best over the last say, 20 years?

The answer is easy.

The average Joe or Jane, that’s who. The person enrolled in their company 401(k) and who tried to max it out each year with consistent monthly additions into diversified funds over time.

They re-balanced their account every year, rarely ever more than that and once again sold high and bought low with very little effort or thought required.

Those account balances are now sitting at all time highs, a reward for being disciplined and following a simple, time tested approach.

TRADE SMALL

The lure of outsized returns will always appeal, to everyone. The phone calls get made, the questions get asked on how to always do better. Am I missing out? Should I be in something else?

We see charts for stocks like Amazon and Apple over the same 20 year period and realize the multi-millionaire possibilities! WHY DIDN’T I JUST BUY APPLE? OR AMAZON?

What most fail to realize is even if you do get lucky and catch a long-term winner early, chances are you will NOT HOLD the position long enough to reap those outsized gains!

Exhibit A: I actually did buy Amazon once, it was inside a small portion of my 401(k) which was self-directed and I purchased 100 shares at somewhere around $120/share. I sold later around $200, happy with that gain and ready to move on! I did the math once what those 100 shares would now be worth and I vowed to never do that math ever again!

Not everyone is Warren Buffett. Not everyone is going to able to 1) pick the stock and 2) be disciplined enough to hold for decades. The exact opposite is true with ETFs and funds inside something like a 401(k). Your choices are limited (probably a good thing) and you are much more inclined to hold over time and consistently add over time.

If you do get the urge to trade, or enjoy doing it, just keep it small. A small brokerage account totally separate from your retirement funds if you must. Once you start dancing in and out of positions in your retirement accounts you are much more likely to underperform. Badly.

I enjoy doing the research and making investment decisions for all of my accounts. I will also be the first to tell you had I kept it simple in the retirement accounts and just dollar cost averaged over time I would be much better off! Not to mention it would have been much easier!

GRAVITY STILL WORKS

I will also say at these levels, it’s easy to feel bulletproof. When you open that brokerage statement or retirement statement and see all time highs, the chest tends to swell.

I like to remind myself and others of the old adage: Stairs up, Elevator down.

For those early in the journey, buying cheaper shares is a good thing. For those a little further along or in retirement, being forced to sell cheaper shares may not be a good thing. That said, this is probably not the best time to be chasing high flyers if you sport a healthy dose of grey up top like me.

So regardless of how good things have been, it’s important to mind the mean and remind ourselves that gravity does still in fact work. We will correct at some point.

Even so, those who keep the short-term moves in perspective, follow their plan and just simply stay the course will still come out ahead in the long run.

Thanks for reading…