Not writing as much lately, sometimes you just need to take things in rather than offer up output. I’ve been devouring books and enjoying every minute of it, so many new titles to get through. I like the quiet pace.

It’s too noisy this year, already.

I feel like I am always clamoring for a volume knob to ease back to the left. I know it will only get worse and that’s exactly why I’m already looking for lower decibels less than a month into the new year.

The great thing about newsletters and blog subscriptions is that you control your content. My reading material drops in my inbox each day, throughout the day and into the night. Very rarely am I forced to scroll or surf.

If you get your news by scrolling mindlessly through Facebook or Twitter I will say a prayer for you. Just be careful what you click on.

The other morning I too found myself wandering off the reservation, not sure how, not sure why but I was soon getting bombarded with, shall we say, “overly biased” political content from both sides. When I realized my mistake, I shut everything down and made the 20 foot trek from my office to kitchen to brew more coffee.

My coffee maker is very well designed but also delightfully simple. It allows 8 cups max and has one button. No clocks, no timers, no milk frothing and no wi-fi access. If I want to control it remotely I will have to throw a shoe at it and hope my aim is good.

Press the one button, it pre-infuses the grounds to release acidic CO2 and three minutes later I have six cups between 198o – 205o F ready to go. Quality and simplicity.

On this particular day as I listened to it drip I reminded myself to stick with my newsletters, from my trusted sources. My YouTube subscriptions. No more noise. No more propaganda.

2024 will require quality over quantity and the remainder of this year, less is definitely more.

Let’s talk shop.

As for markets so far, it would be hard to complain. We got off to a rough start due to some short term profit taking but have been hovering along all time highs ever since:

There is a reason for that optimism being baked in, the Fed pretty much signaled at the December meeting they were done. Battle over, now a matter of when easing begins.

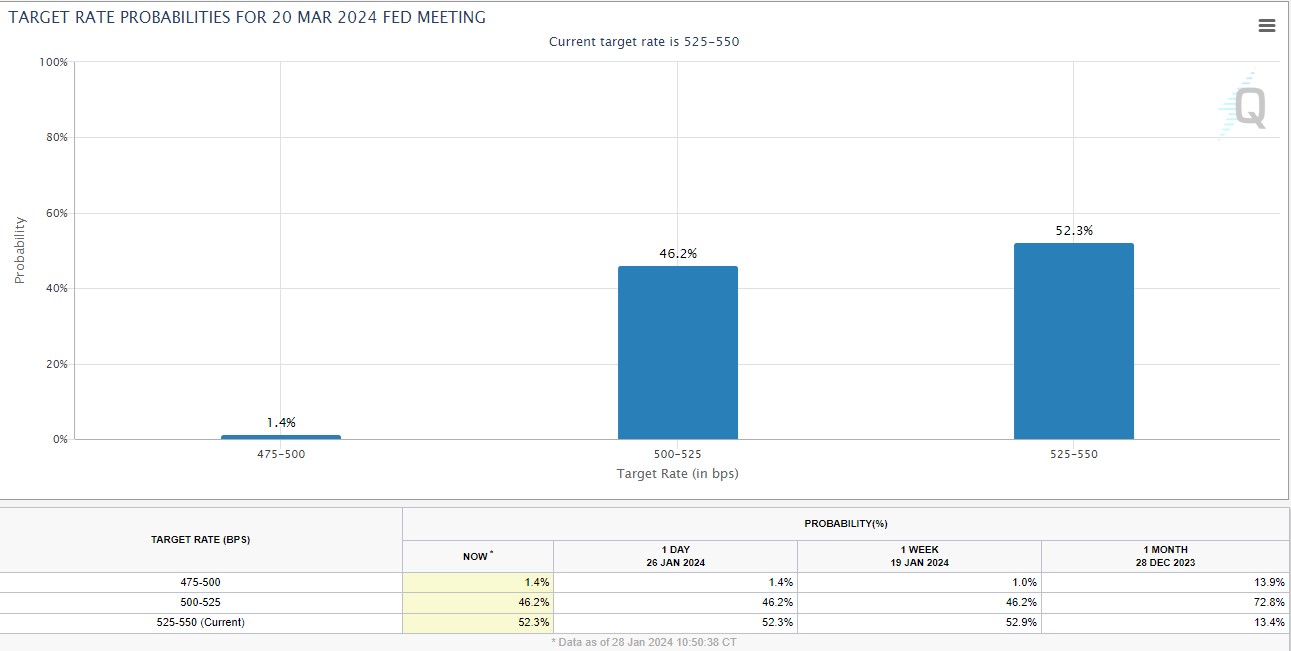

The probability for rate cuts in March have eased a bit since my last post, they are now basically a coin toss. A slight majority feel they could stand pat:

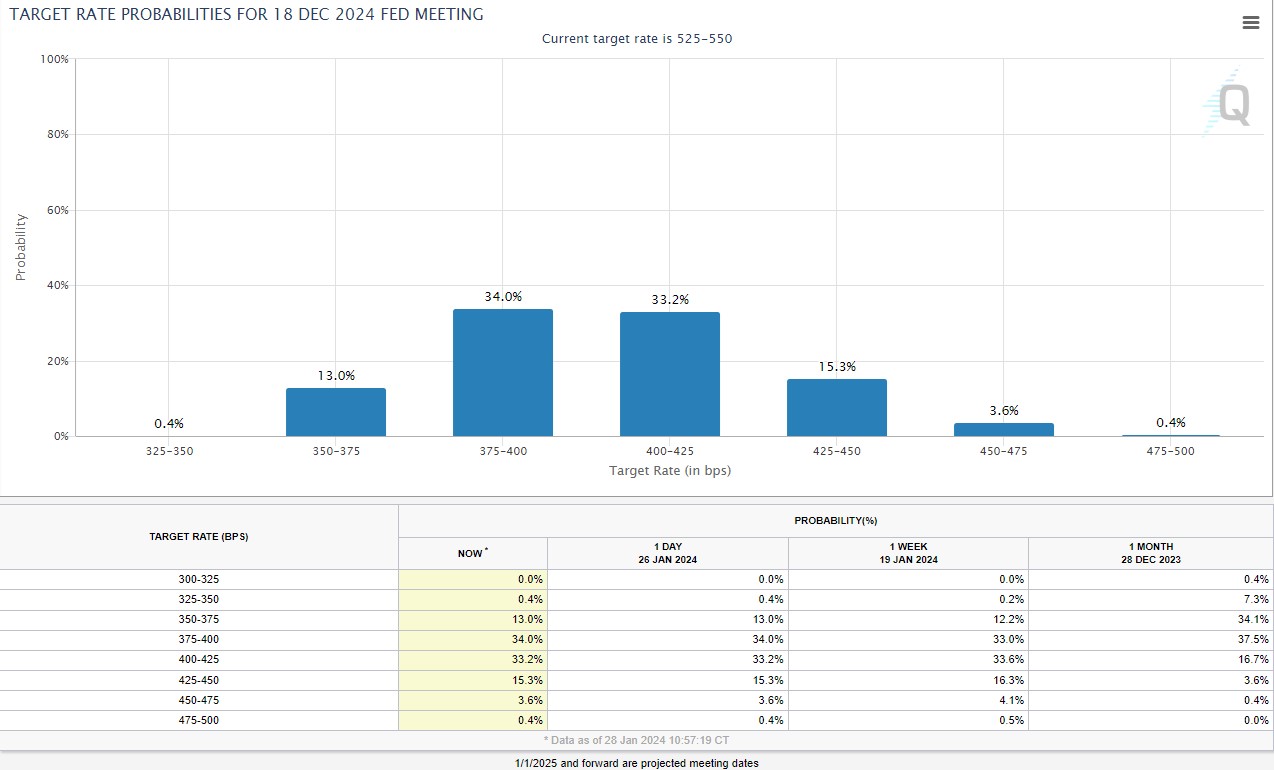

Also worth noting I suppose, that full year cut expectations are also being pared a bit, with a slight majority still expecting the full 150bps:

We have been hit with a plethora of econ data since my last post so it’s worth a quick refresher. No denying the recent data was positive across the board.

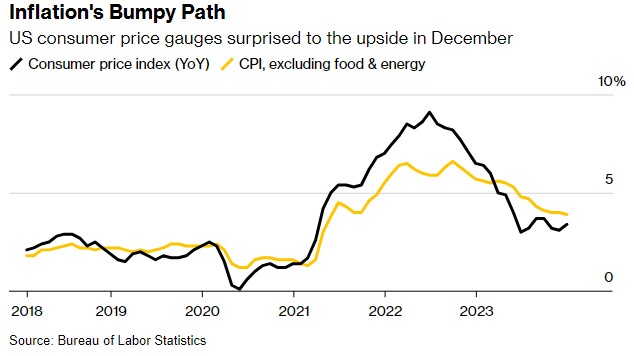

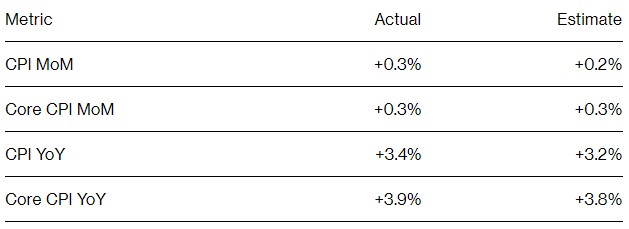

CPI ticked higher but nothing alarming:

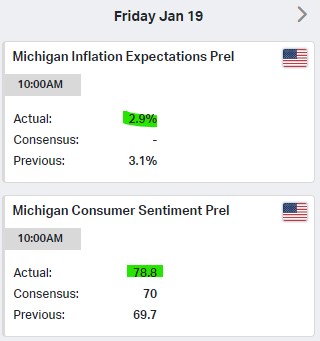

Consumer sentiment is strong and inflation expectations are backing off as well:

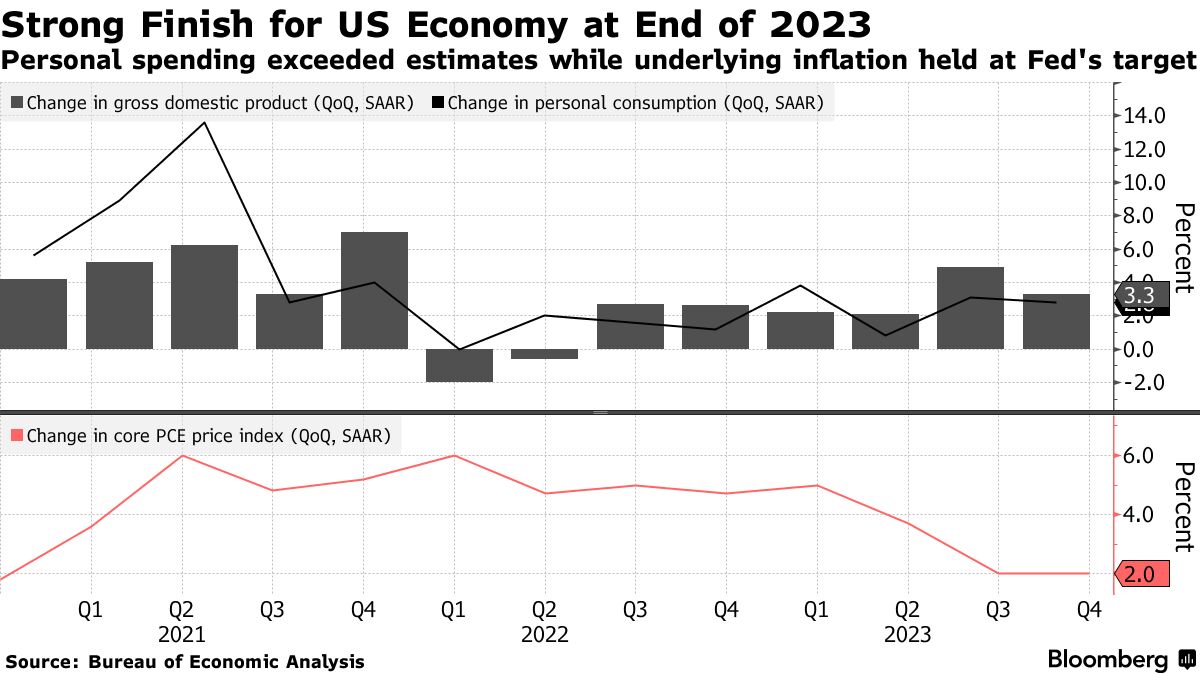

GDP for Q4 surprised to the upside at 3.3% indicating strength while the underlying core PCE the Fed watches closely remained pegged to their 2% target:

All the letters combine nicely to spell “Goldilocks”. We quite possibly could have already touched down but just didn’t recognize it.

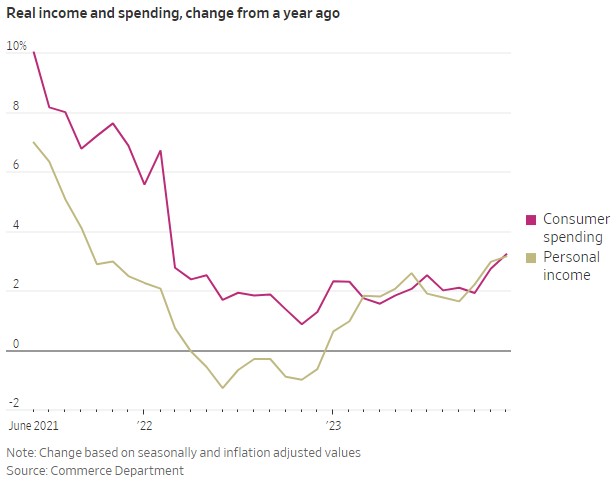

Also worth noting that consumer spending and wages are up MoM. That was really the final box to check in my opinion, the consumer will need to remain resilient for the economy to do the same:

That gets up caught up so now what?

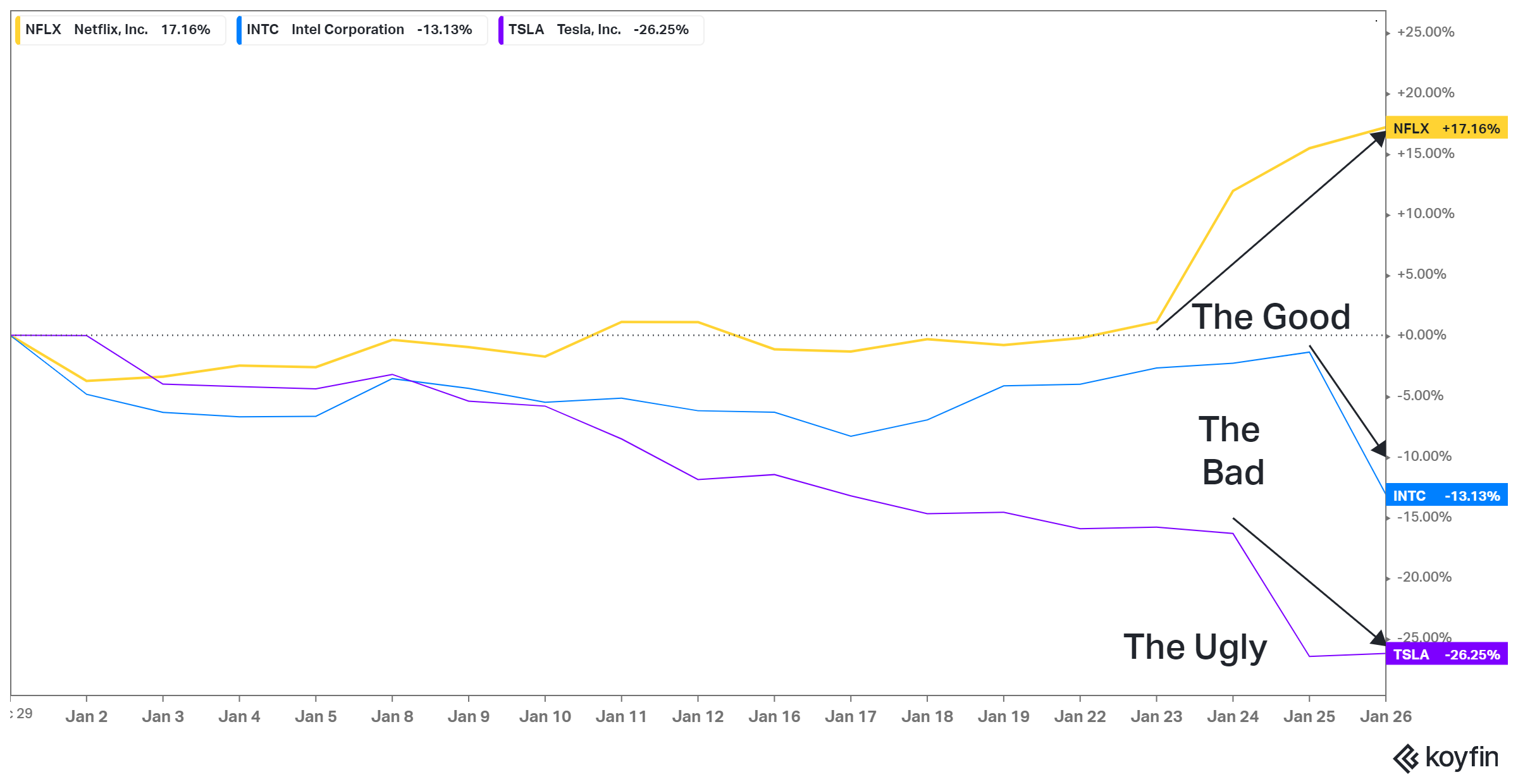

Big tech earnings kick off this upcoming week and should set the tone as we await the Fed meeting and presser on Wednesday 1/31. Earnings reactions are likely to be anything but muted if Netflix, Intel and Tesla were any indication:

A lot of chatter about “event risk” lately with more earnings and Fed speak on tap. I can see that, anytime you are perched this high above the moving averages there is risk period. Lest we forget, stairs up, elevator down.

The Fed will be ready to react (or not) accordingly in the months ahead. They can sit on their hands at any hints of stubborn inflation or they can slowly ease to keep the economy moving forward. I think they are in a very good position.

I would be remiss not to mention Four Issues: Two Wars and Two Lame Ducks.

The situation in the Middle East escalates by the day and Russia will continue methodically battering Ukraine. Just pay attention to both, this is no time for war fatigue or to think we are immune.

The situation in Washington? One Lame Duck will continue methodically battering the other, all the way up until November, until one Lame Duck eventually rises above the other.

God Help Us.

I for one will not be casting a vote.

Go ahead and hit me with failing to do my patriotic duty or whatever else you deem necessary.

If it was lunch time and you gave me the choice between a stale mayo sandwich or a spicy mayo sandwich, I would look at you with a blank stare before quickly walking away. Ain’t happening.

So don’t judge me when my choices are limited to equally unacceptable outcomes…

There is not a day that goes by that I don’t speculate on the portfolio impact of either, uh…sandwich, but too many unknowns are behind the curtain. Perhaps more clarity with time, one would hope.

FUTURE SELF

Continuing with my simple formula I outlined in Reflection, I was ironically somehow directed back to a previous article in the WSJ that also touched on Future Self. I have not read the book mentioned but finished a very similar one last year. You can find it my Off Duty Pursuits.

I have been stuck on this concept recently and keep going back to it, which speaks to the power of the exercise itself.

I’ve seen this before in business, career, financial planning topics when something very simple yet very powerful hits home and frames up a perspective that is suddenly undeniably clear.

Turning 50 recently hit me like a ton of bricks. My whole life has been spent planning, building, preparing and suddenly you wake up to find those years firmly behind you.

Just like the volume knob I was searching for earlier, there damn sure isn’t a rewind or redo button either. You are what you are, you are where you are, it is what it is. No going back, only forward.

Which brings me to today.

I am starting to view portions of those previous 50 years as a heavy backpack I no longer need. It feels good to wiggle my shoulders away from the straps and let it fall to the ground behind me. No reason to carry it any further as my focus shifts to the future.

I have no idea what the next five, ten, twenty years will bring, none of us do. I am optimistic but I also know that for me personally parts of it will be very unpleasant.

It would be easy for me to seek comfort now, escapism, denial just based on the road that lies ahead. Just make things as easy as possible now and deal with later, later. Hope for the best.

There is also an alternative.

Sacrifice some of the comfort, escapism and denial now and work, now, to improve my overall health and state of mind. This does two things: One – it prepares me physically and mentally for the near future and Two – it makes deposits toward ensuring my best product is out there many years from now.

The article talks about how most people who attempt to view their Future Self cannot and their brain patterns mimic those of when we try to imagine or relate to complete strangers. I can see that and that is exactly why I don’t attempt to define it, or picture it clearly. No one can.

I just realize whatever that Future Self version is, it can be improved upon by every action I take today. It can also just as easily be sabotaged.

That’s kind of where I’m at mentally so far this year.

No resolutions, concrete goals or timelines.

Instead there is just a Process that I know without a doubt will lead to Progress. It is up to me to respect it and follow it, but it comes with much less pressure and risk of abandonment due to missed benchmarks or deadlines.

When I left the workforce several years ago I built a financial model to let me know when the music stopped so I could plan and manage it accordingly.

No such model exists for life.

I just want to make sure that as long as the music keeps playing…I can still dance.

Thanks for reading.