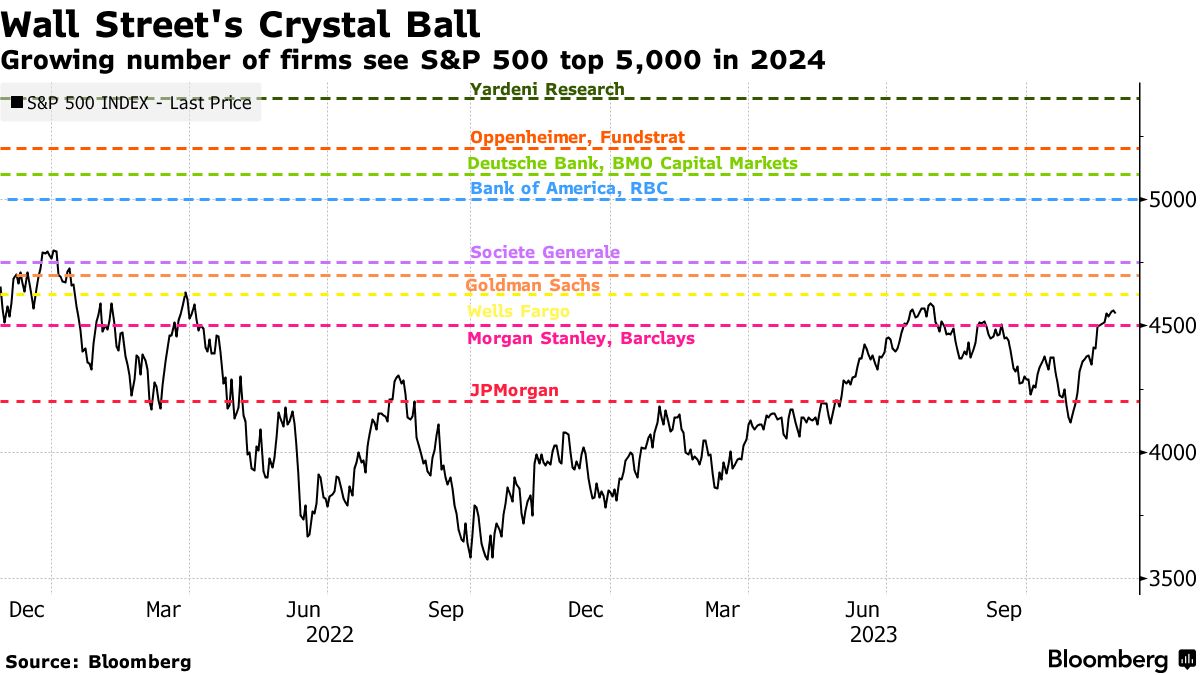

Ah the predictions.

This is the time of year everyone puts out their “Top 10” or perhaps their “Guesstimates” where the major indices will end up.

I enjoy reading them all, mainly for entertainment, but you can look back at predictions for 2023 to see just how slippery that slope is.

I am elated not to be in that business.

What you will find here however is an honest assessment of what thoughts and themes I find front and center as we start 2024 with a clean slate.

Shall we Doc?

Indeed sir. You may proceed.

RATE DEBATE

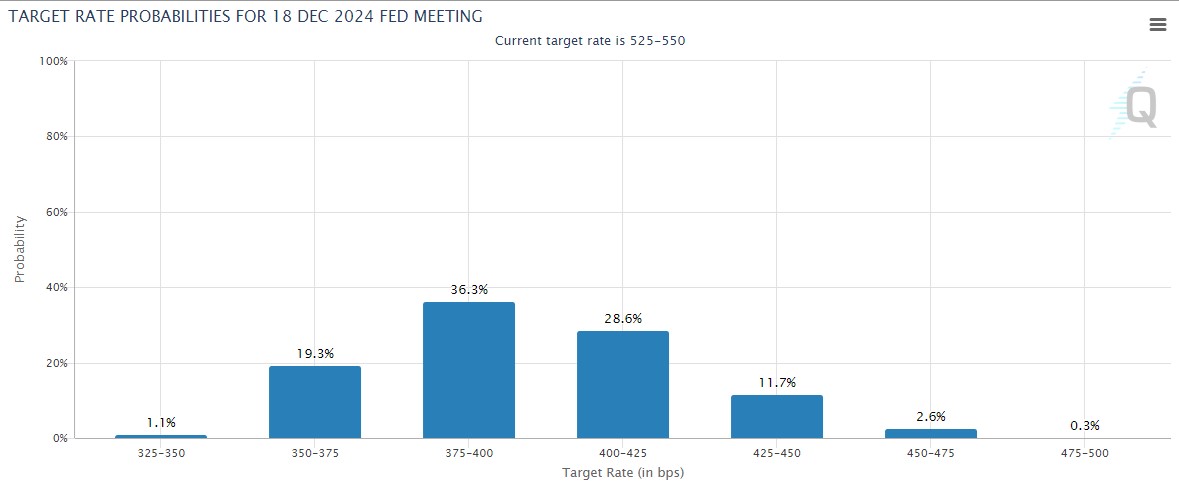

Let’s start with the obvious. The only thing on trader’s minds since the quietly confident dovish Powell did not push back against the possibility of rate cuts (soon) is when those cuts actually materialize.

There are two sides to this coin. One, the economy / earnings remain strong, inflation continues to ease and it becomes prudent to ease so not to impede the progress. Two, the economy / earnings start to show cracks under the pressure and cuts are needed to continue (i.e. not derail) the progress.

The FOMC minutes basically said “lower sometime by end of 2024”. In other words, we have no idea when, quit trying to time it, it will be data dependent.

Doesn’t matter, the Street will still be timing it and talking about it ad nauseum. As of today chances of a March rate cut of 25bps stands at 69%. Fast forward to December and the majority are still looking for a full 150bps lower:

Assuming the CPI prints continue easing and leaning toward 2% target, the focus itself will lean toward the Fed meetings and more importantly the pressers for clues of looming cuts.

Here are the Fed meeting dates for 2024:

Given the outsized moves in late 2023 and the uncertainty / anticipation surrounding the dates above, I would expect a more volatile 2024 with more sideways consolidation and whipsaws along the way.

GOT GUIDANCE?

S&P EPS growth for Q4 is expected to come in at a modest 1.3% YOY, but it is positive nonetheless. One chart from FactSet caught my eye recently and it was the EPS “down” revisions against the backdrop of the Q4 rip:

Best visual I have seen that speaks to just how far the market got ahead of itself in Nov/Dec. On a positive note, all these down revisions tee up potential “beats” come earnings season in a few weeks.

I am not sure the “beat” in and of itself will be enough in 2024 though. We will need to see some “beat and raise” and the tone of the calls will be mission critical.

There were some massive price resets last year coming off conference calls. Unless you owned the name or had it on your watchlist you may not have even noticed.

There was simply no appetite for excess spending and lack of profit margins against this backdrop of higher rates. Block (ticker SQ: formerly known as Square) was a prime example. I won’t get into the specifics behind the move but I want you to instead focus on the magnitude of the moves after Q2 in August and Q3 in November…

Block traded north of $80 ahead of its Q2 report and fell over 50% below $40 in the three months that followed. Cut in HALF. The market then rewarded a renewed focus on the core business and profitability by returning the stock to $80 prior to year end:

I’ve been at this a while now, over a quarter of a century to be exact. The magnitude and the swiftness of these price “resets” are mind blowing. Its nothing for a stock to be down 20 or 30% after hours during an earnings call. I saw it at least a dozen times last year.

The same could be said for upside potential I suppose. There are many names that took those 20 and 30% haircuts who have yet to recover but have been busy righting the ship.

It will be all about guidance in 2024. The sector is irrelevant. Tech, Financial, Industrial, doesn’t matter. How these companies guide into 2024 and potentially beyond will drive the bus. Traders will need to see how they have weathered this storm and what they see going forward.

If you really, really want to get into the weeds on earnings, here is a 35 pager from FactSet.

CONFLICT CONTAINMENT

If you haven’t noticed, there are wars simmering around the globe.

First with Russia and Ukraine, now with Israel and Hamas. Violence in the middle east is nothing new, there probably hasn’t been a week in the last 50 some odd years without a headline or nightly news coverage.

When it comes to Geopolitics and frankly, all out war, I am no expert. I pay attention to events on the global stage but I am in no position to weigh in nor am I qualified to opine. I will leave that to other bloggers, other outlets.

What I will say however is this whole theatre feels like a tinder box with flames flirting close by. The potential for escalation and “broadening out” is always present. Cannot be denied.

Daily headlines also suggest this is going to take some time. The US will no doubt play a role, whether that falls within protecting International waterways or coaxing any potential negotiations.

Make no mistake, we are not immune to engagement, regardless of our preference. All it takes is one mistake or ill advised action and conflict containment may be a thing of the past.

My thoughts and prayers are with the innocents caught in the middle of these unfortunate and more importantly, these unnecessary events.

What further complicates this situation for us stateside is what awaits us in the Fall…

ELECTION FOR THE “AGES”

One thing I haven’t mentioned is the looming government shutdown (Jan 20th?). I guess it’s hard to mention because it seems to me there is always a shutdown LOOMING. There is always a government default LOOMING. It’s a shit show.

So much so that the Street has pretty much turned a blind eye to it. What used to move markets as deadlines, dare I say once again, LOOMED, were suddenly non events. I suppose everyone finally just resigned to the fact somehow, someway, the clowns on both sides of the aisle were expected to figure it out… preferably in time.

I digress. We have a bigger problem to worry about.

At some point this year, as much as we all desperately want to move past talk of inflation and possible “landings”, another topic will soon overtake it all. It will dominate headlines, consume consumers and fuel the doomers.

Election years are normally positive for markets, if we make it through this one with that statistic still holding water we will have pulled off a miracle.

I have nothing positive to say about a Trump Biden rematch. If that is the best we can do as a nation, if that is the best menu you can put in front of me, I’ll take a hard pass.

I just hope prior to November neither of these individuals are on the ballot. There is too much at stake moving forward on the global stage to roll out the same ‘ol for four more. We need new blood.

Markets may view a Trump sequel as a positive development, perhaps, but they also must be willing to stomach the chaos. I’m not sure I can to be honest.

ON BALANCE

I try to be a glass half full fella and will be the first to say: the stage IS set for a positive 2024.

The majority of the heavy lifting is behind us. I expect the headwinds of inflation to slowly fade into the background. I expect continued resilience from us, the consumer, willing to travel and spend even more so than last year.

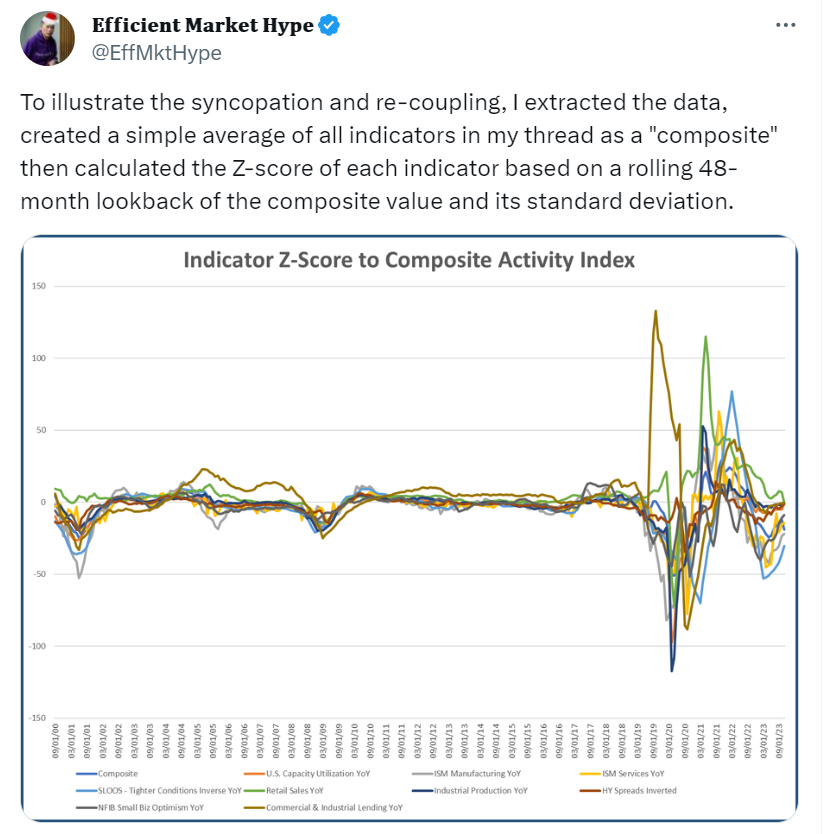

We still underestimate just how much the Pandemic upset every metric known to man. Those waves of dispersion are just now starting to settle.

I love this tweet combining several economic indicators (retail sales, manufacturing, lending, etc) pre and post pandemic:

Dispersion settling aside, we unfortunately may also be in the eye of a hurricane.

The eye of a hurricane is a very calm place for a very small period of time.

As we get closer to November, I expect the winds to shift. The key will be anticipating that reversal of direction and to be nimble in front of it.

My mind drifts to the scene in “A Perfect Storm” where Capt. Billy Tyne (George Clooney) thinks he has made the successful turn away from “the monster” and the sun briefly shines through the porthole beneath the deck drawing the attention of his crew…

It then turns dark again.

“She’s not going to let us out.” he calmly utters, as he begins to furiously fight the helm once again.

That is a fitting theme for 2024…

The storms will come and go.

The sun will no doubt shine, very brightly at times.

Then, in the Fall, it will likely turn dark again.

It’s still early though, early enough for a totally new landscape to emerge…

A sea change perhaps, that will alter our course of fate.

Stay Tuned…