That sound you hear is the wringing of hands, the pacing of feet, the gnashing of teeth.

It’s January! Everyone knows how important January is! Stock Trader’s Almanac spells it out for us: ”As goes January so goes the year.”

Better yet, “As goes the first five trading days in January, so goes the year!”

Well that sure puts a lot of pressure on Monday.

While I will agree there is some relevance to seasonality on the Street, I don’t put much stock into the old axioms of folklore like the ones above. They are cute and nostalgic, but irrelevant today.

After having both a November and December to remember, let’s not put too much pressure on early January. Those who refrained from the “Sell” option on their drop down menus those last few days of December did not hesitate any further on this side of Auld Lang Syne.

Who could blame them?

The past is past however and lest we forget another old stand by: nothing goes up forever.

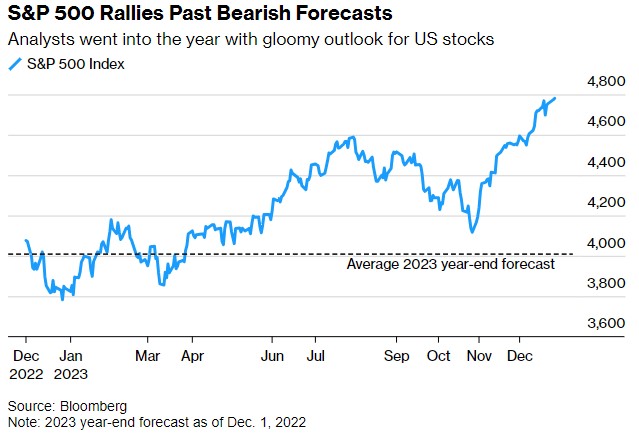

Rough start, but before any panic ensues, it helps to zoom out for a little perspective what this minor pull back looks like given the late 2023 moves:

Feel better? We’re not even (halfway) back to the +1 on a 1yr STD DEV view. We needed to let off some steam here and even if it continues to SPY 450, it still doesn’t warrant impending doom.

You can blame the Fed minutes which provided ZERO clarity on timing of rate cuts.

“In their submitted projections, almost all participants indicated that, reflecting the improvements in their inflation outlooks, their baseline projections implied that a lower target range for the federal funds rate would be appropriate by the end of 2024…”

FOMC minutes

So, lower target sometime by the end of 2024. That leaves the door open for basically, everything.

My advice? Not that I give advice mind you.

Relax. Read a book. When they come they come.

If anything? Hope the economy remains strong enough to allow / sustain higher for longer.

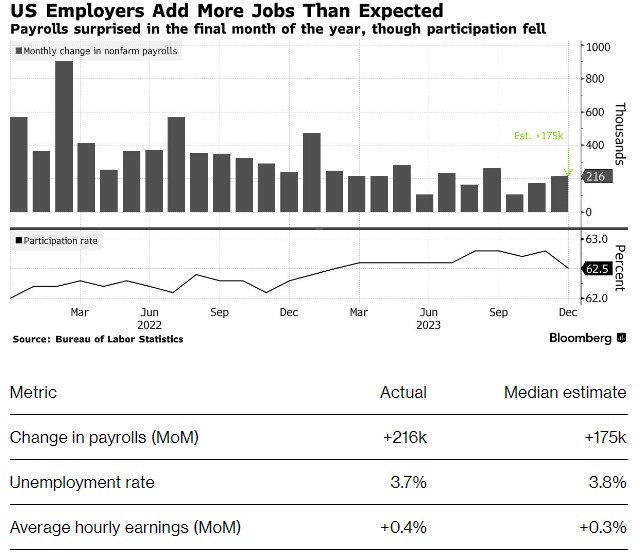

The market overall seemed on edge ahead of today’s jobs report, which came in pretty hot combined with an unemployment % that didn’t budge:

If anything I would have expected the futures and Friday tape to retreat further on this news, more fuel to speculate on Fed rate cut delays well beyond March.

I think the weak start of the year front loaded and priced in that reaction ahead of time. We tried to rally this morning but it would peter out by end of day.

More hurry up and wait in front of us next week with the CPI due Thursday and PPI data due Friday. I would expect some additional sideways to slightly down consolidation ahead of those numbers and that is not a bad thing.

The March rate cuts being priced in, the Christmas miracle if you will, are slowly coming back to reality. The Street is still holding out hope however, even after today’s jobs release. CME’s Fed Watch tool sits at about a 64% chance of a 25bps cut in March:

The jobs report didn’t move the needle by the way, we were already sitting at 63%, so odds actually went up on that report, go figure.

All eyes on CPI now Thursday but to be honest we may go the entire month of January before the cloud deck rises after earnings start to roll in and the Fed meets end of month.

So as eager as we all may be for clear direction, clamoring for more clues is the likely scenario.

I like how things are shaping up for 2024, the bumpy start aside. If we nail this soft landing (Janet says we already have) and earnings hold up, regardless of the rate cut timeline it could turn out to be another good year for equities.

Sounds like a good time to relax. Read a book.