2023 was an interesting year for market participants, to put it lightly. I spent some time skimming through my posts, the themes, the overarching message. Was quite the journey.

“The Recession that Never Came” would be a good summary.

“Inflation Infatuation” would also work.

I cannot recall a time in my life where it was discussed more. Perhaps if I was old enough in the late 70’s I would have something to compare it to.

I scrolled down to my blog archive search box, typed “inflation” and hit enter.

I counted 39 posts that mentioned the word.

The only possible term that could beat it is “Fed”. So I tried that one.

42 posts mentioning the Fed. We have a winner!

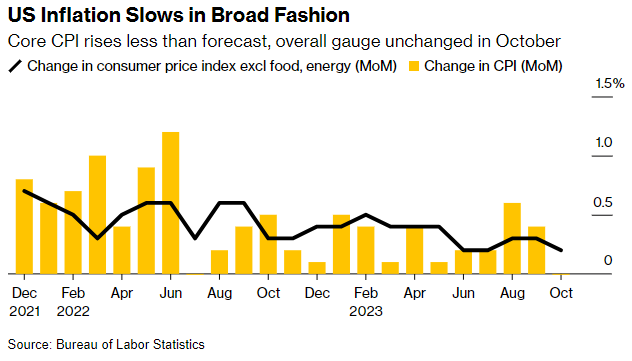

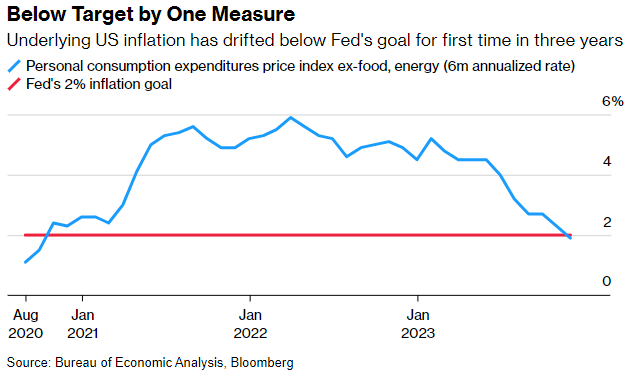

As for the Fed fighting Inflation, it’s as simple as this chart, also present in many posts this year:

They fell behind, early, but embarked on one the most aggressive hiking campaigns in history and to their credit, were able to bring CPI readings down much quicker than anyone expected.

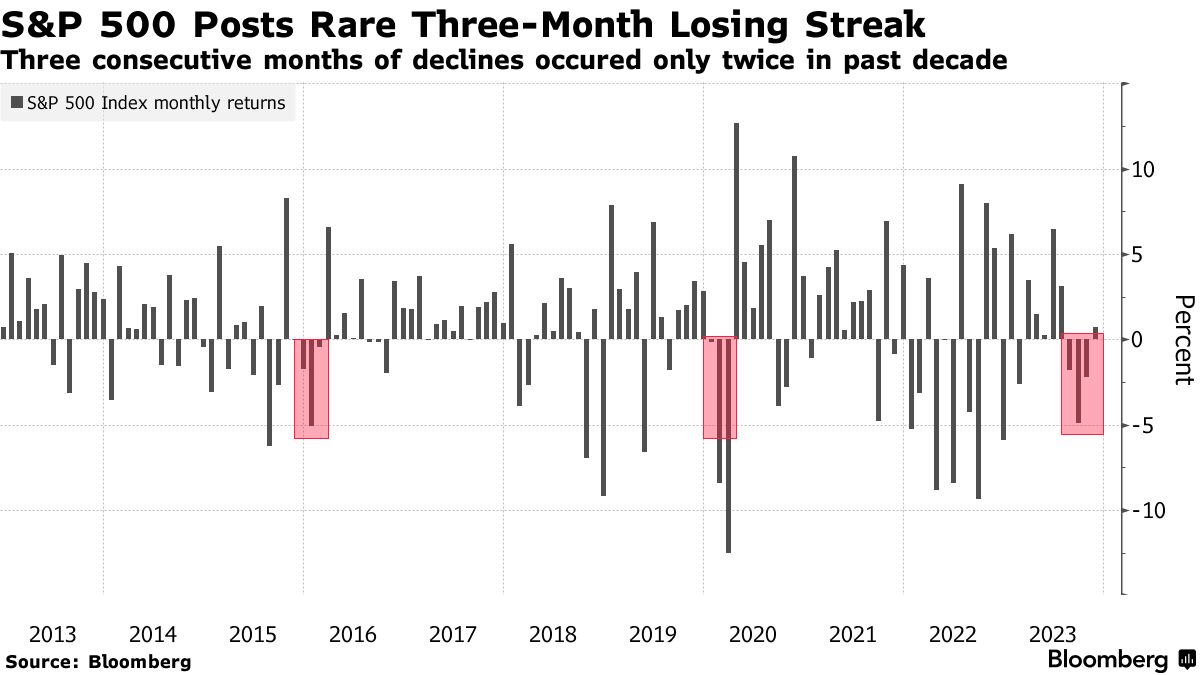

The market had their doubts as did I. I recall an S&P 500 steadily drifting lower in October against an ominous backdrop of rising yields:

Higher rates, lower stock prices:

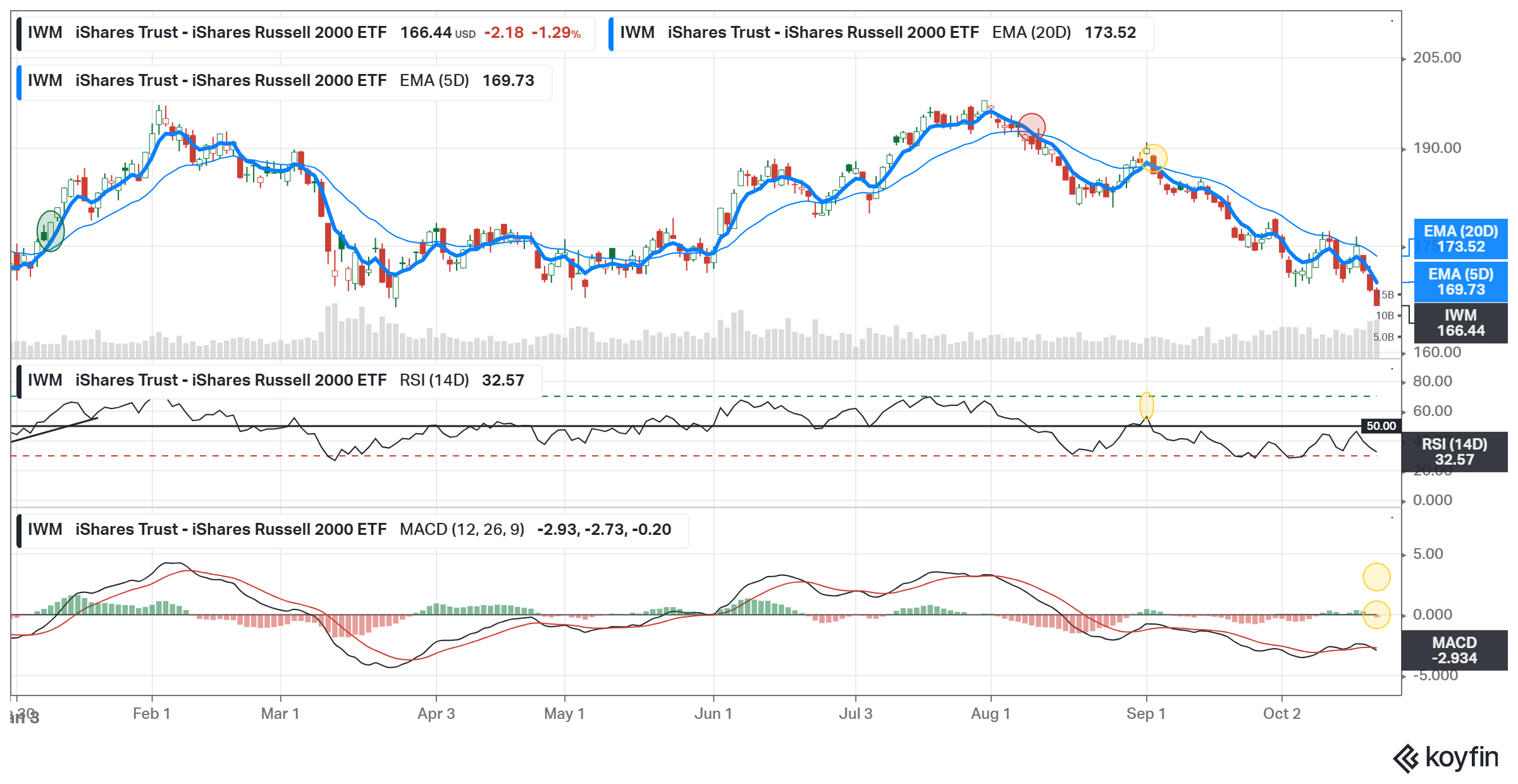

Wondering what small caps were doing around this same time? You don’t want to know.

Suffice to say things were not looking particularly good around late October for equity markets. I would be remiss not to also mention the geopolitical backdrop in the middle east.

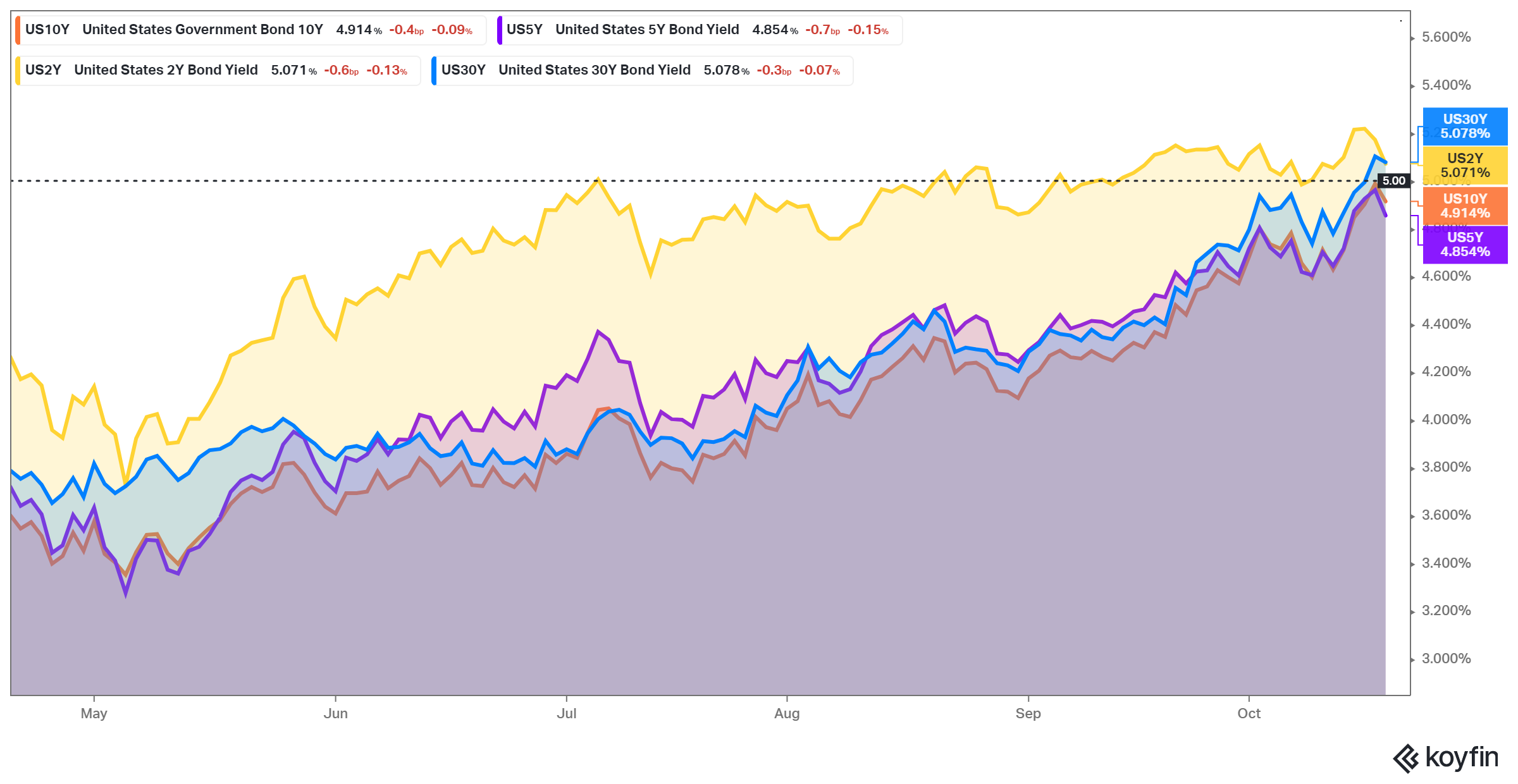

Another compelling reason to stay on the sidelines in 2023 was cash was no longer trash. It was earning, for the first time in a very long time:

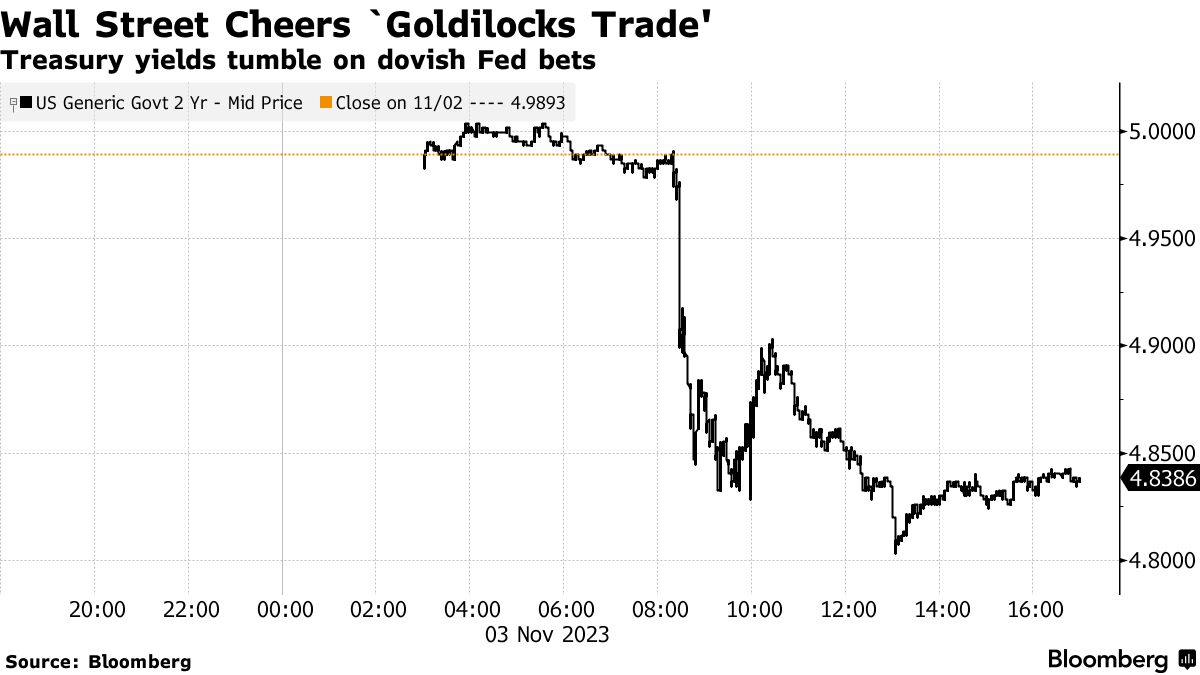

An interesting thing happened in front of the Nov 3rd jobs report. The market starting catching a bid.

I was watching the 420 level pretty closely on SPY for continuation of the breakdown. We briefly dipped below that line into oversold territory before gapping higher:

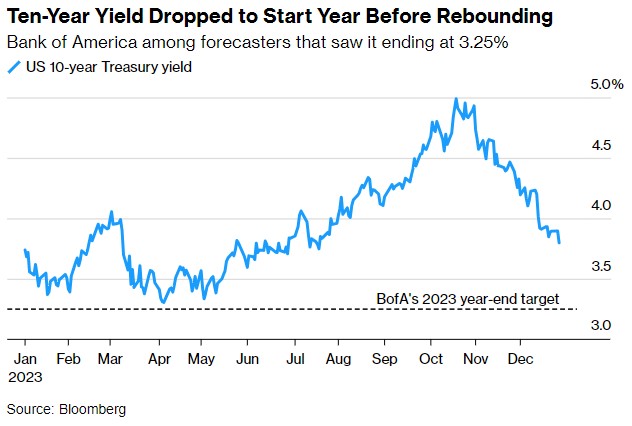

Yields reversed, quickly:

What’s going on here? Markets were on the edge of the precipice a month ago? Everything is OK now? Are we front running something?

Are we on the verge of a Fed pivot?

Is the CPI release on 11/12 going to be that good? It would:

Wow, OK so now we can just wait on the last Fed meeting and presser in December. Key here is to get a feel for their “posture”. Get a feel for their “confidence”.

Full disclosure: I watched the presser with a split screen, and I spent more time watching JP than I did the S&P five minute chart. He was relaxed. He didn’t push back at all. Go ahead and call it a pivot.

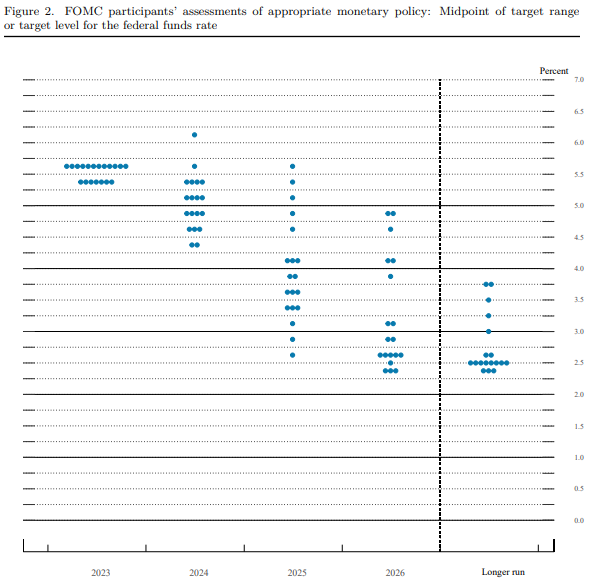

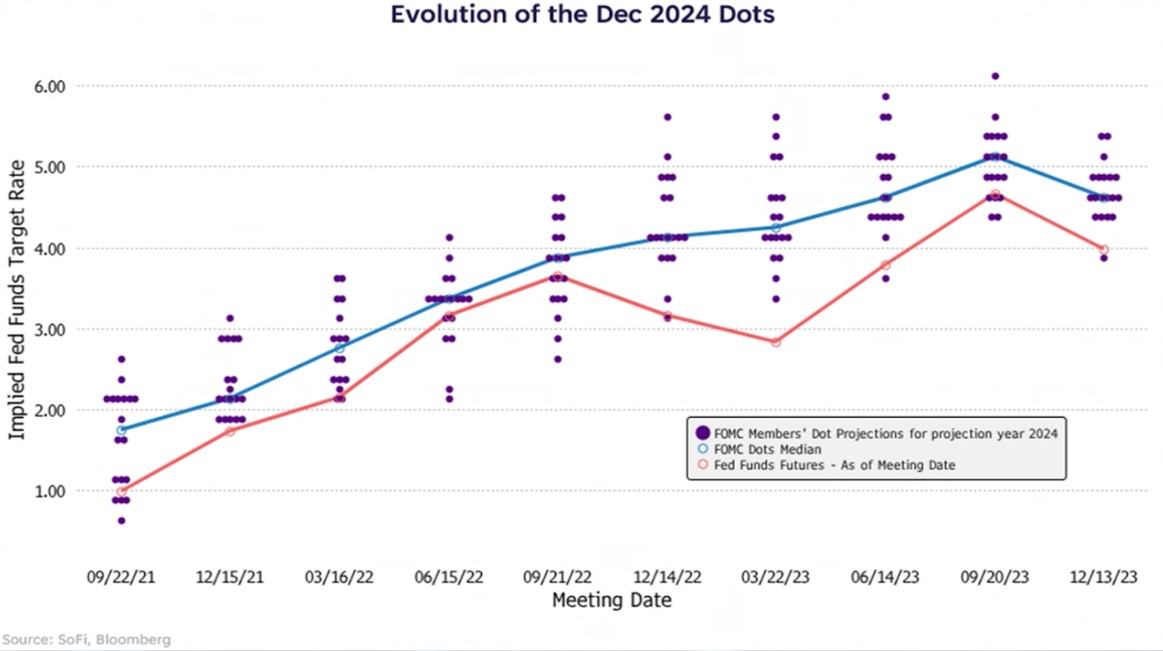

The new dot plot (right below) compared to the previous release clearly showed the planned cuts in 2024 :

Viewed another way, in this chart from SoFi, you can see how the 2024 dots have “evolved” over time. The market is pricing in more (of course) but you can see for the first time that “higher for longer” is now clearly in question:

I still say the posture coming out of the December Fed presser caught some big money offsides. When you gap up and run like we did to end the year, this was just a massive repositioning taking place.

There was a lot of talk about “rotation” and small caps, which were basically left for dead a few short weeks earlier, made new 52 week highs. What was more mind blowing was how fast they did it. This tweet (are they still called tweets? X’s?) from Bespoke was one of my favorites:

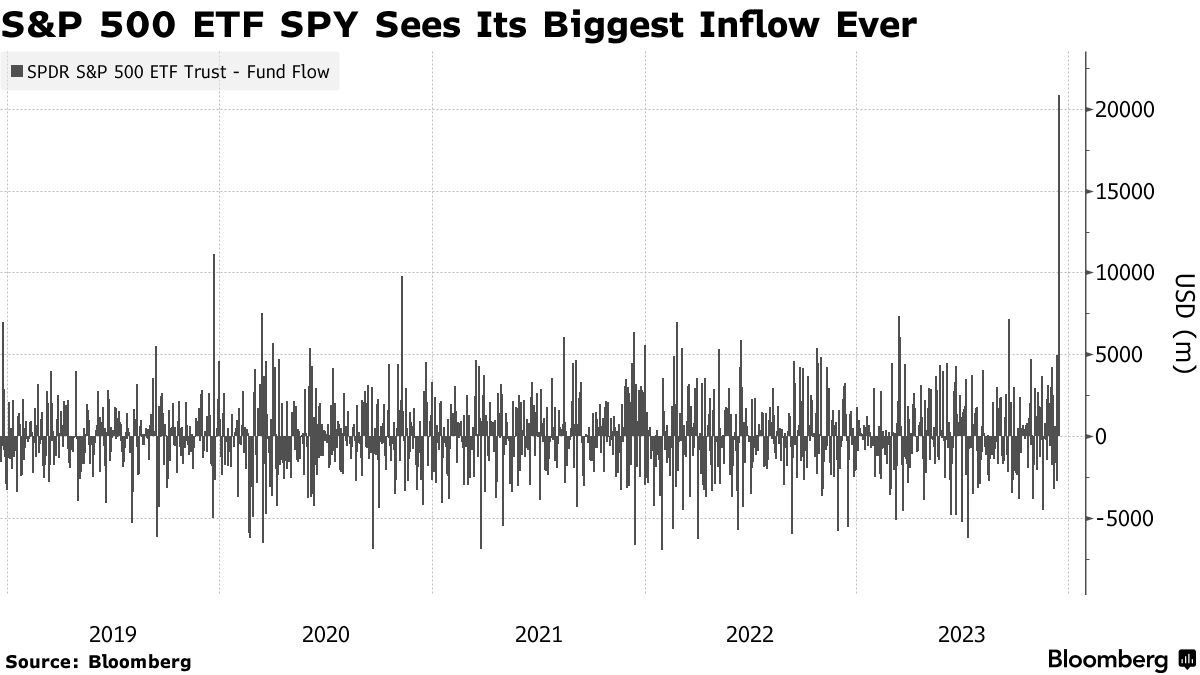

Wasn’t just the Russell, there was a day in December when SPY saw its most inflows ever. Ever is a long time:

If you were to show me that chart above and ask me, seriously, what would cause a move like that I am not sure I would even have an answer. It’s nuts.

The news would only get better from there, with the PCE release on 12/22 putting a cherry on top of said Fed’s sundae:

Hard to argue with that progress.

I haven’t mentioned rates much during this end of year Chartapalooza, but they were no doubt a factor as well. After hovering around 5%, the 10 year began a slow steady retreat:

Keep in mind, rates fall when bond prices rise or catch a bid. So this was the everything rally in full effect. Money was pouring into bonds at the same time it was pouring into stocks.

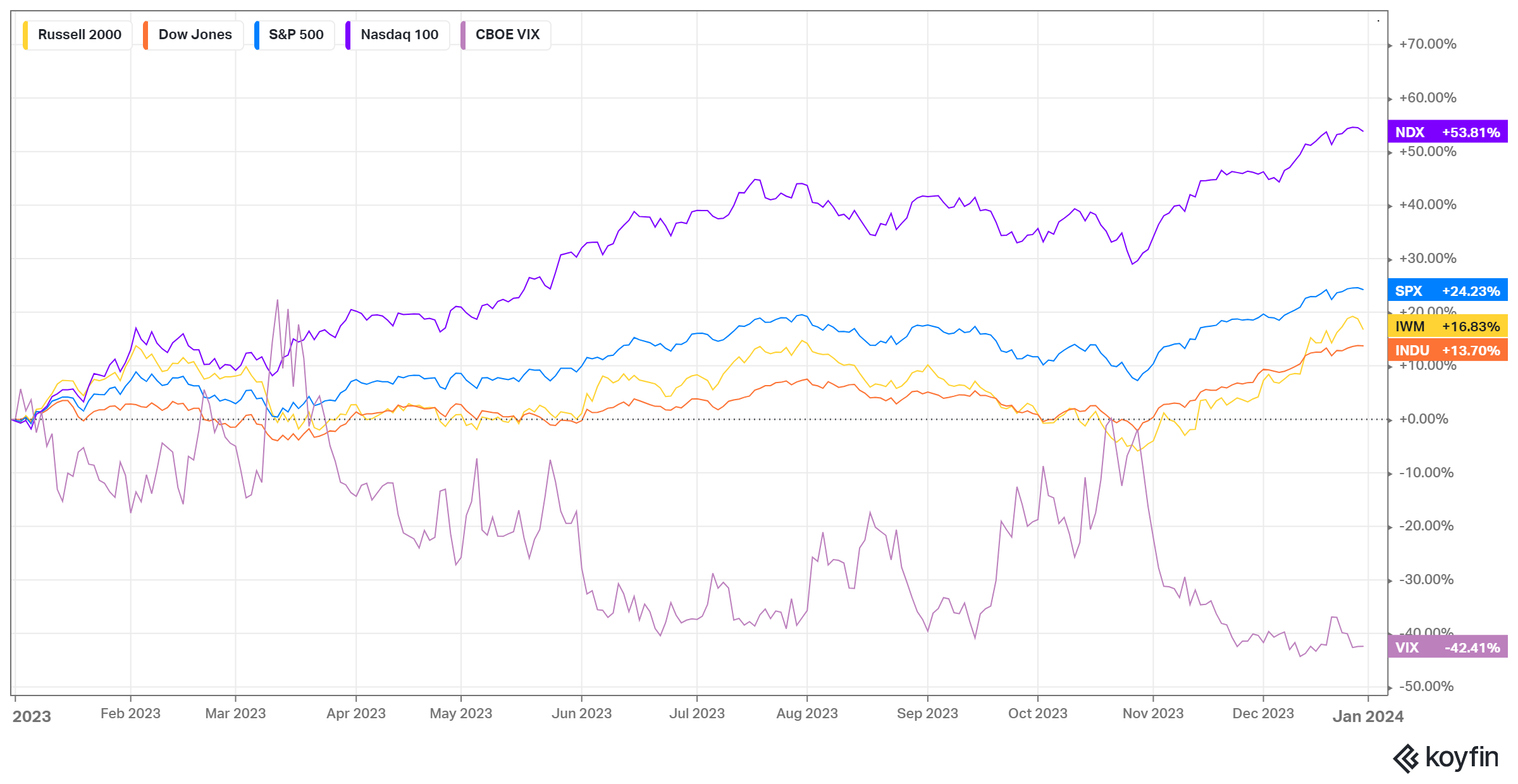

So where did we end up?

Here is the year end snapshot from my Koyfin landing page:

Note how small caps were negative on the year mid October only to finish UP over 16%. That was a remarkable move.

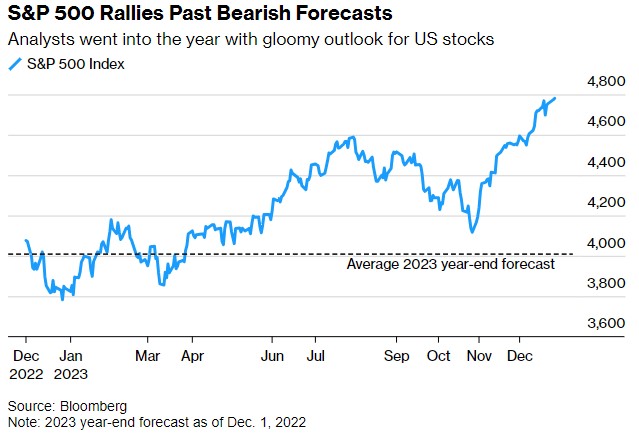

There is a lot of chatter this New Year’s weekend about everyone getting it “wrong”:

I am sure over the next few days I will be able to read how much of the Nasdaq (and SPX) over-performing was due to the “Mag-7”, so I won’t try to extrapolate that here.

I don’t know about you but I’m tired. Kudos if you made it this far.

My brain hurts after that little exercise and I still have a dozen articles saved in my Chrome reading list waiting for me. Plus the weekend Journal to get through.

I have some thoughts on 2024 (thoughts, not predictions…) but I will save those for a later date.

No reason to mix the past with the future, eh?

Happy New Year and as always, thanks for reading.

See ya in ’24!