A few short years ago, things were much different.

I can remember wrapping up some year end positioning in late 2021 and holding a couple of promising investments: one a recent technology IPO, the other a recent financial IPO.

The outlook was bright for both, but there was a problem. A fast moving freight train of a problem called inflation bearing down. I recall the word “transitory” being thrown around along with “not to worry” opinions abound.

By year’s end my two largest holdings had already started to roll over but I reminded myself they were investments, not trades and to focus on the future, not today.

If I could turn back time, I would tap Mr. “Investor” on the shoulder and remind him there are things called “market cycles” and the Fed, who is already mercilessly behind in this battle, is getting ready to hike like you have never seen. Sell.

When they do, your long duration newly IPO’d tech stock is going to crater. Your financial darling isn’t going to fare much better because the tail wind of easy free money that lifted it post IPO is going to vanish like a fart in the wind. Sell.

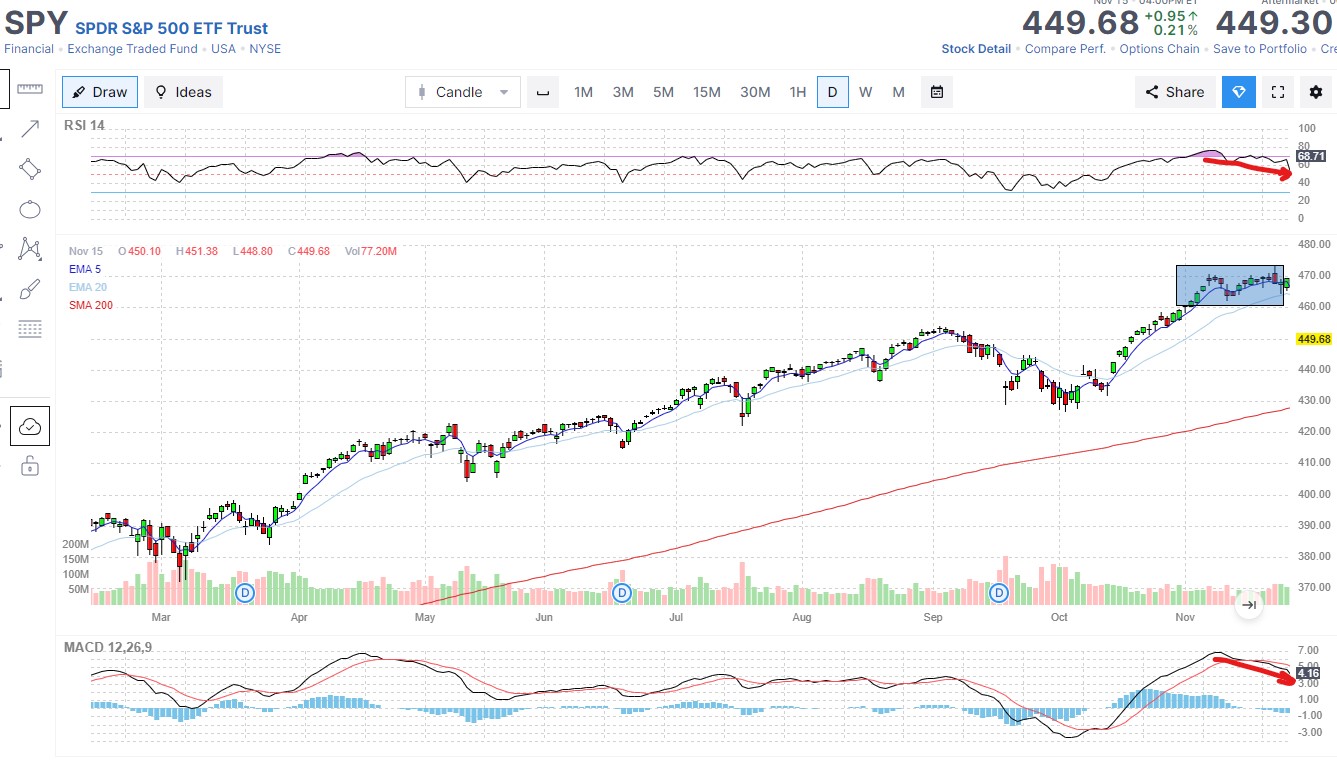

Two years later, exhibit A:

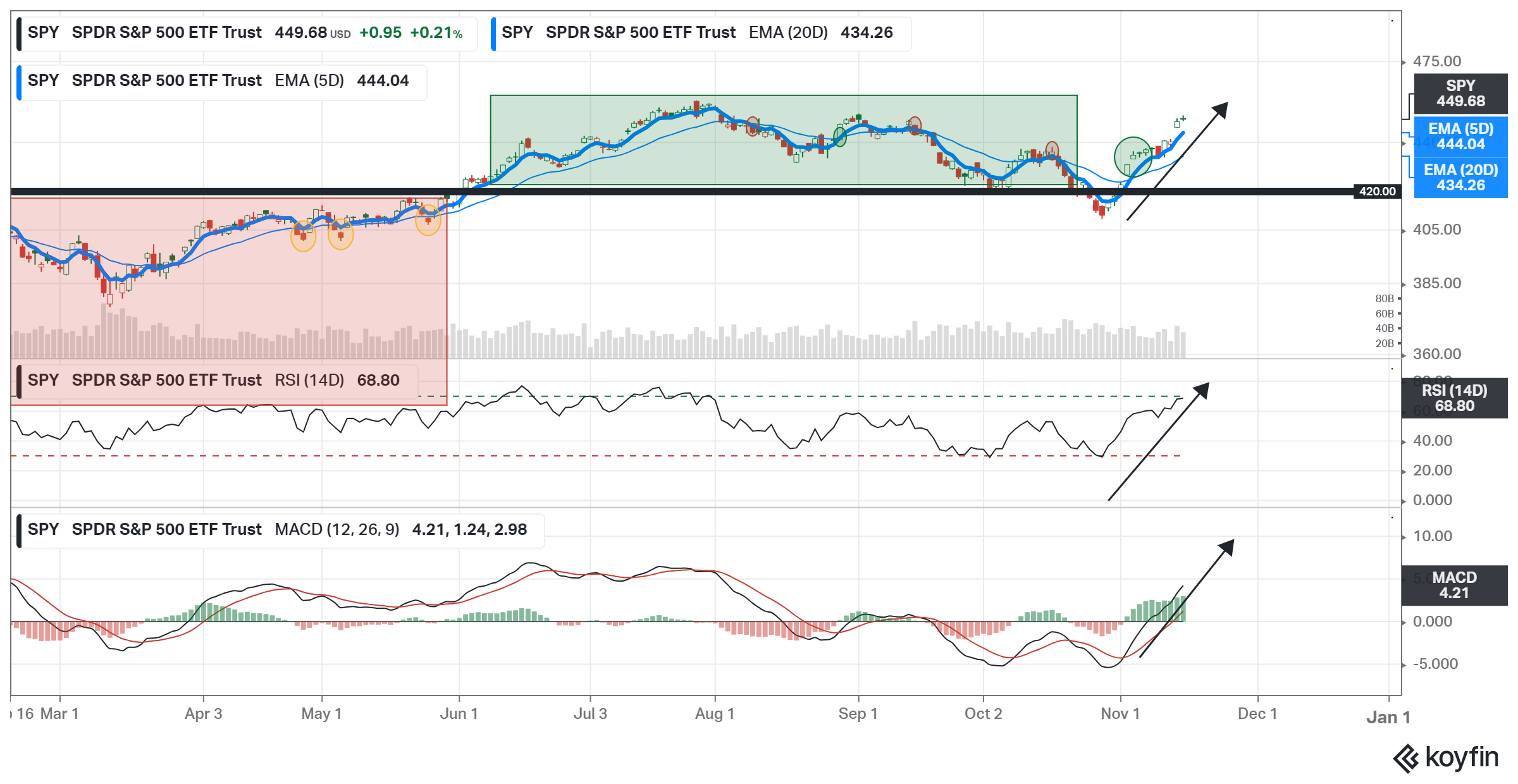

Readers will recall this chart above. It shows just how behind the curve the Fed was. Right around Nov 1, 2021 the street started to realize what was coming (I did not) and they began to slowly let the air out of the equity balloon. It was a methodical slow bleed as not to alarm the masses.

Note how the drawdown started just before the hiking campaign began.

Note how the drawdown continued as the hiking campaign continued.

I will forgive you, Mr. Investor, for failing to recognize what was about to happen on November 1, 2021. Just don’t let it happen again.

Fast forward to November 2023 and what you see is a market trying to “reprice” the soft landing scenario in earnest.

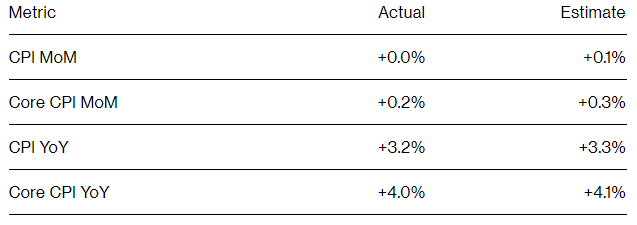

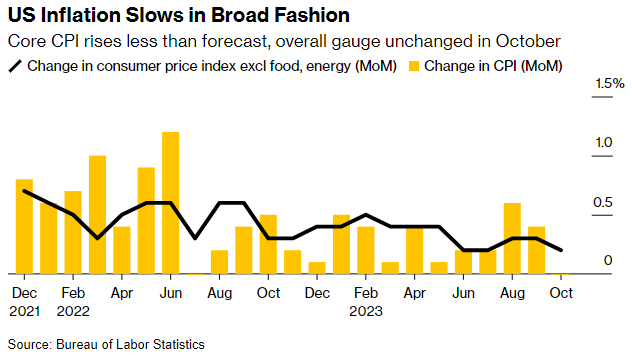

The numbers out this week were good. No reason to beat around the bush, they were good. Christmas came early for the Fed. If you missed any of the prints, here is a rundown:

CPI

PPI

Good, Good and Good.

I mentioned in my last post the Fed had kicked her out of gear. Well, suffice to say Jay Powell is now back in gear doing celebratory donuts in the parking lot. As he should.

The magnitude of the index moves this week tells me there was a lot of (big) money on the wrong side of this trade. This is a massive unwind, leading to some massive face rippers:

Small Caps were on the verge of extending multi-year lows into the abyss before also turning on a dime:

If we are going to reverse or pull back from here, smalls will no doubt lead the way. I want to believe but I also know higher for longer is going to take its toll here.

I also would be remiss not to mention these large breakaway gaps are leaving…well…gaps…that may need to get filled. In this type of short covering unwind they are inevitable. Just watch the levels if we start to pull back from here.

I will fully admit I got caught up in some of the hard landing overly bearish narratives earlier this year and had to unwind some trades myself that turned on me. I’m a stubborn hard headed fella and I don’t like being wrong. The market however can disagree for much longer than I can afford to wait to be right.

This whole soft landing thing is real.

While I do think it’s perfectly OK for Jay to do some donuts in the parking lot, I also know he will keep it short. The car will soon be parked, sunglasses back in the glove box, suit coat back in place, tie straightened as he walks back to the office while smoke clears behind him.

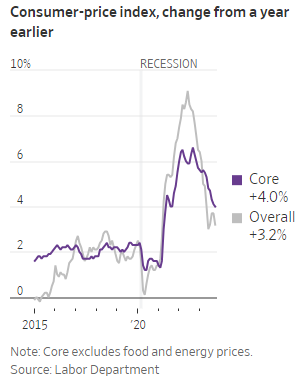

After all, this war has not been won…yet.

I also think the chatter about rate reductions is ludicrous at this point. Some think that is what the market is trying to price in now, rate cuts and when. I disagree. I think this is just a massive repricing after being caught too far offsides.

If we are cutting rates early in 2024 it will not be because of anything positive happening.

I beg to differ sir.

The housing market is on ice and will remain so well into 2024. Geopolitical drama is here to stay well into 2024. The election as it stands today is shaping up to be a three ring inept geriatric circus.

Inflation however, is officially packing its bags. The long term 2% target which a few months ago looked like a dream is already coming back into view.

I am not chasing this rally, I am using it as an opportunity to do some house cleaning, selling some lower conviction names that are suddenly catching a bid. Halfway through month 11 is no time to be a hero, especially with cash earning 5%.

Might be a good time to read up on market cycles, especially late ones as we enter the holiday season?

Indeed sir.

Let’s not repeat the mistakes made in November 2021.

Let’s get ahead of 2024 before we say goodbye to 2023.