I learned to drive a stick in a rusty black Jeep CJ-7 in the fields and backroads behind our neighborhood.

I could barely see over the steering wheel and the clutch felt like it stopped at the front bumper. I remember puling myself to the edge of the seat and just hoping I could reach it, much less engage it.

The Jeep sported a 3 speed manual with matching 3 foot long lever, it was definitely a challenge for my small arms. Reverse was top left almost touching the dash, 1st was lower left, 2nd was a mile long up-over-up reach to the top right, 3rd was a gentle long pull straight to bottom right resting at the passenger’s left knee.

Marty Robbins played on the tape deck and I was not allowed to touch it. “Watch where you are going…” Dad said if he noticed my eyes wander to the radio as if I wanted to switch it up.

If you pulled 3rd you better be on asphalt or level ground, preferably both and preferably pointed straight. I have no idea what size the motor was, but based on my memory of sound I am thinking V8.

I spent a lot of time undecided on what gear I needed, which led to me push in the clutch and coast… in neutral for a while. Usually I would slowly toggle the gear shift back and forth from left to right as I tried to gauge my speed and make up my mind.

“Son why are you doing that?” Dad would say, “just put it back in 2nd and leave it, that’s all you need!”

“I know, I know, sometimes I just like to kick her out of gear and coast for a while…” I said.

What was really fun for me was to try to time it just right so it regained power as smooth as silk. Time it wrong or pick the wrong gear and you either stall or you ride the bucking bronco!

The latter was always good for a few laughs. Dad would make it more dramatic by pretending to fall out or get strangled by the seat belt as I desperately tried to make adjustments to stop the chaos.

When I did my second ever track day in June 2012, I remember my instructor asking what I wanted to improve on the most as we both stared at the menacing BMW S1000RR sportbike. Mine was #23.

I said “I want to be quick, but smooth…on all of my downshifts on entry…all of my upshifts on exit.”

“I want to time them just right, you know…be consistent, no guessing.”

He laughed and wiped his brow, his helmet still in hand: “Don’t we all. Don’t we all. Follow me…”

The Fed too has hoped for perfect timing and has also been ready to coast for a while, aren’t we all as we try to acclimate to these higher rates?

Nobody expected any increases this week, it would just be a matter of how hawkish the presser was.

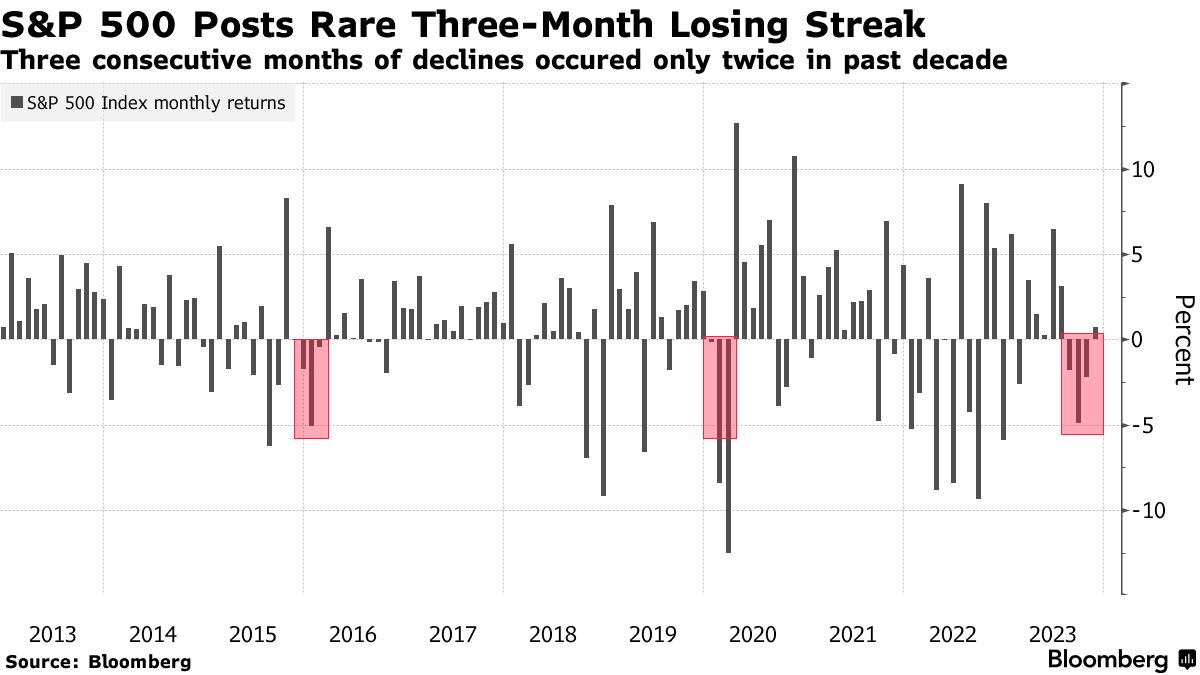

After wrapping up 3 month losses for only the 3rd time since 2015 the market was no doubt desperate to put October behind it.

I was watching the price action during the press conference, the screen put on its normal show, moving to and fro, but at the end of day we finished firmly higher. It had a rather distinct “yeah we’re done” tone and the markets responded on cue.

Easy Jay… I was saying to myself, don’t undo what you just did by opening the barn door too far. Yields had settled much higher in recent weeks, “doing some of the work for them” as media is keen to observe.

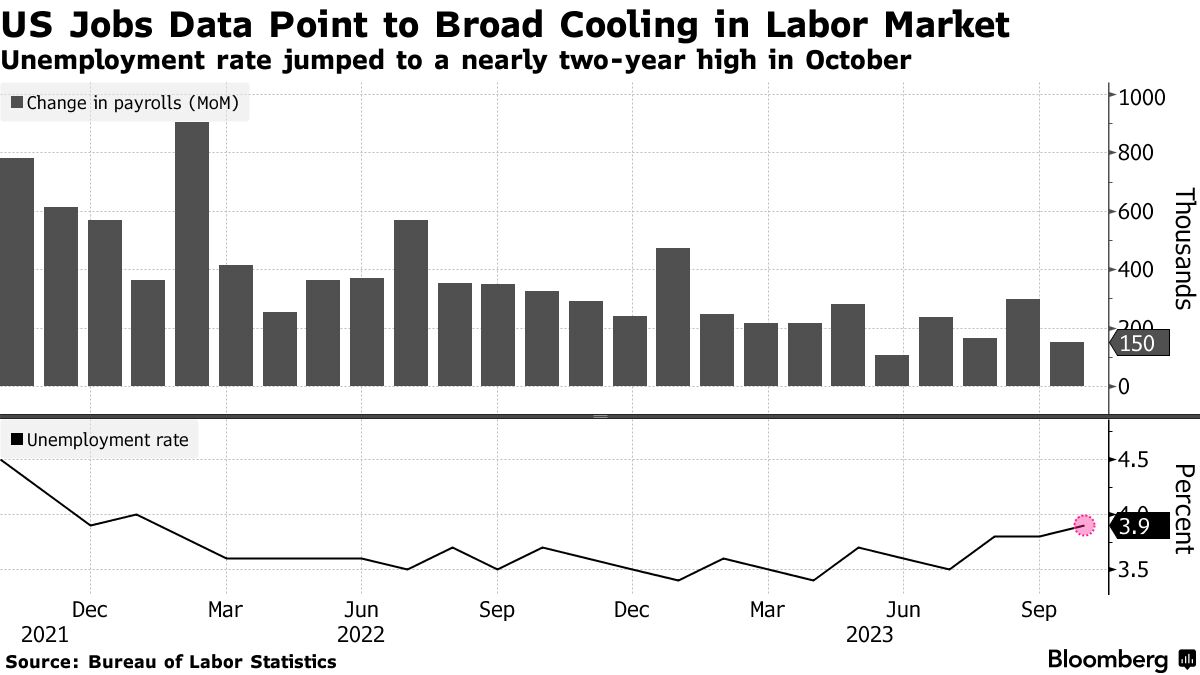

Next up would be jobs Friday and it did not disappoint. Fewer adds than expected with a slightly higher unemployment. Remember it’s all counter-intuitive at this point, slowing = cooler = lower inflation track = no more rate hikes.

All in all, back to back gap-ups greeted us Thursday and Friday morning. Yields that had settled firmly higher over recent weeks retraced as bonds were heavily bid. Victory for the 60/40 camp.

It was only a few trading days ago we were on the precipice, looking to lose it all. It reversed on a dime:

Readers will also know my 5/20 EMA crossover buy signal rule. We will be there Monday absent any type of pull back! I am just concerned we got here too fast.

Jay kicked her into Neutral folks.

Now we coast.

Just don’t take your eyes off the road because it is anything but smooth sailing ahead. Geopolitics will be front and center. There also is still a very firm “recession coming in early 2024” camp due to the lagging effects of the hiking campaign.

Time will tell.

As for markets, what I will be watching for is follow through. Anytime you gap up this dramatically, the tendency is to give some of it back and/or fill those gaps over time. It could also be just expedited repricing based on new information.

Short trades, both for equities and bonds are no doubt being unwound exiting this week. It will take some time for those waves to disperse and see where we truly are.

This is seasonally a good time for stocks, starting the best 6 months of the year. Keep in mind at some point the Fed will need to cut rates, the debate throughout Q4 and early 2024 will be trying to determine just exactly when that will be…

…and just exactly what will drive it.

In the meantime however, it is reassuring knowing the Fed is done and I am perfectly OK also kicking her into Neutral for a while…to coast.

Jury is still out whether we are heading into the storm or out of it.