Stick around the trading game long enough and people will try to pin you into one of two camps: Fundamentals or Technicals.

Some rely on fundamentals alone and consider technical analysis nothing more than self-confirming voodoo crayon art.

Others will tell you the charts and what they are telling you are all that really matters.

One simple fact I wish I had discovered much earlier is the unmistakable forces of supply and demand. A stock price is determined as those two factors compete for supremacy.

Stocks catch a bid when demand exceeds supply, they pull back when supply exceeds demand. It really is that simple. If you can identify where those two levels lie, you can also identify misplaced bets and opportunity.

Considering most trading at larger institutions is a hands off algorithm driven effort anyway, key support and resistance levels do play a role. I’ve watched enough index price action in my time to usually be able to spot what “the machines” are quietly up to.

I like to think of myself as an open-minded fella, not too quick to rule out either side of a well made argument. Same would apply to trading, fundamentals may lead me to a stock, but technicals will almost always determine when and if I actually buy it.

I am also old fashioned. “An old soul living in a new world” as a recent song I heard nicely put it. I like to quietly and methodically study the charts and look for a story.

I heard someone utter the term “pre-COVID” recently, not sure whom but that doesn’t matter because it is more common, especially as many investments have re-tested those levels.

Which brought me to an interesting question…

Is the period from March 2020 to… say…sometime recently after the Fed has theoretically “paused” all just NOISE to be ignored?

Think about it, few of us had ever lived through a pandemic that killed millions and forced self-imposed house arrest for God’s sake. The Fed responded with a bazooka and helicopter money for all, at zero borrowing interest in hopes of saving the planet.

Did they succeed? Perhaps, but all that excess money in the hands of everyone lit an inflation fire we had not seen since the 70’s. Speculation ran amok, business spending increased and valuations became a downright absurdity.

Take ARKK for example, the tech innovation fund of Cathy Wood, first made famous by her outlandishly bullish price targets for Tesla. It was as if her oversized cat-eyed glasses were actually blurring her vision a bit, do you think this is 1999 again? Are you nuts?

The performance and success of that fund lured in millions upon millions of inflows as it quickly became the “in” investment. Valuations be damned, these companies are the future and they are worth whatever they cost and more, much more, 10x more, 20x more!

Interesting view, eh? Bumped up against resistance (aka excess supply) in late 2018 and again in 2019 before releasing the hounds in the wake of pandemic fueled buying. When inflation began to take hold and the word transitory officially left the building for good, excess supply took care of the rest until it finally round tripped early last year.

It has been practically unable to get off the mat ever since. Had you invested a lump sum in mid 2018 and threw away the key for five years, you would have lost money. Negative returns! How’s that for innovation!

It’s easy to pick on ARKK so let’s zoom out a bit and look at a basket of smaller names via the Russell 2000, or IWM.

Jury is still out on just how many of these companies are actually zero earners, in the wake of much higher interest rates, but once again 5 years worth of investing…growing…building…is gone (at least at the index level).

Same exact story. What was once resistance (excess supply) in 2018 and 2019 is now met with multiple tests of demand (any takers?) in 2022 and again in 2023. Remove the COVID era noise and you have gone exactly…you guessed it…nowhere.

The noise is starting to dissipate. Skies are clearing. We are wrapping up the Great Reset.

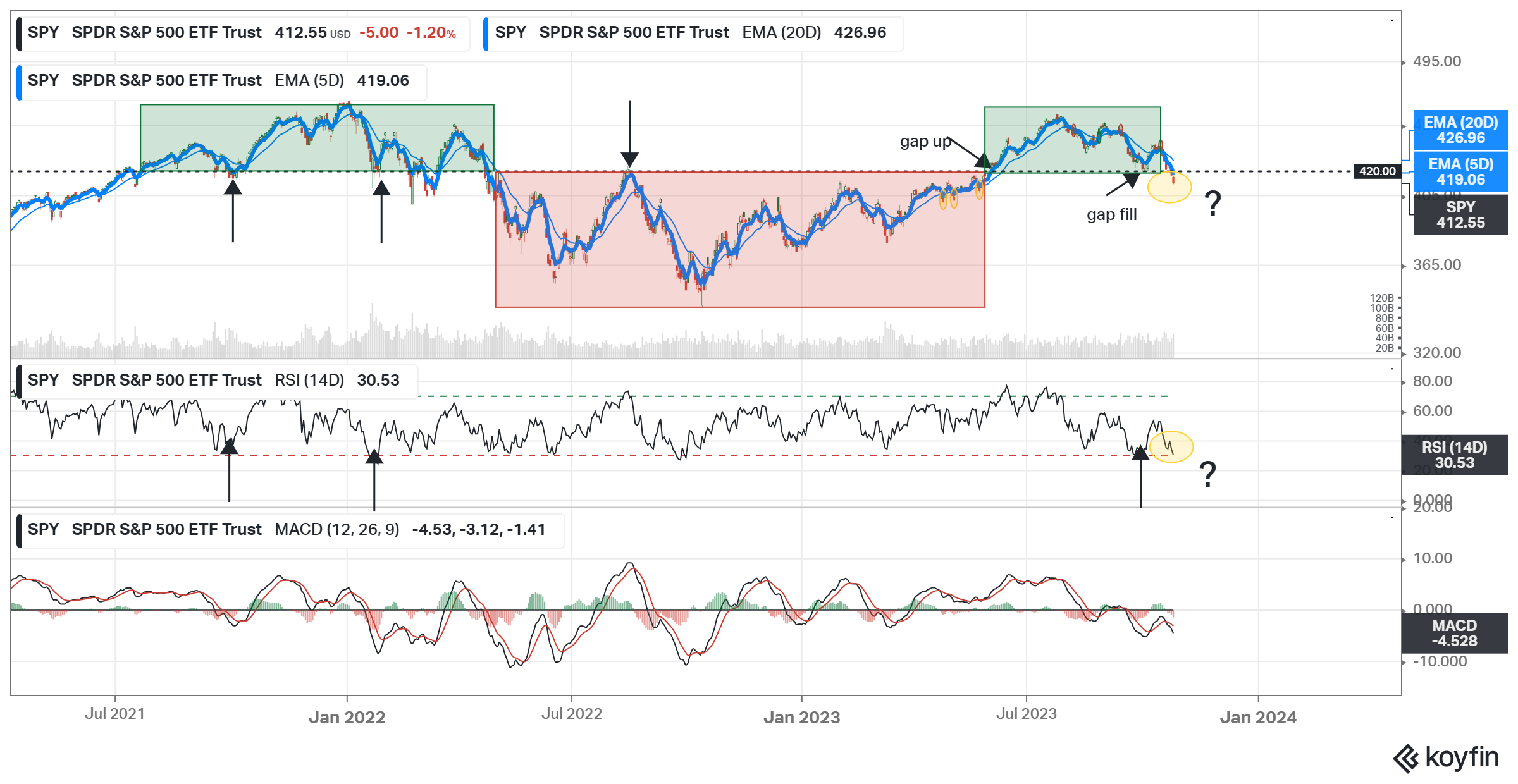

The same type of battle is being waged on SPY at the 420 level. Once again, if you look to the charts to tell a story, the story of 420 emerges.

After breaking 420 in early August 2021, the 420 level was rested multiple times in 2022 until if finally gave up the ghost in early May. Remember what is once support becomes resistance and 420 was tested in mid August and got whack-a-mole’d. And don’t come back until next year!

After a slow grind back, we finally gapped up and over 420 on June 2nd heading higher. The unknown impact of higher rates combined with an increasingly fraught geopolitical landscape had us once again retest 420 in early October. It held, albeit briefly.

Now as we attempt to digest big tech earnings, determine the “true” state of the growing economy and inflation’s grasp, we run headfirst into excess supply. There were no buyers at 420 this time around.

We caught a bid here in the past with the RSI in the low 30’s. If you truly want to believe in a year end rally, then you want to see a strong volume bid back to and ultimately above SPY 420.

These recent earnings have not been bad. AMZN crushed it, proving they have multiple profitability levers to pull should they decide they need pulling. INTC did well. MSFT did well. GOOGL was the stepchild but they also went first.

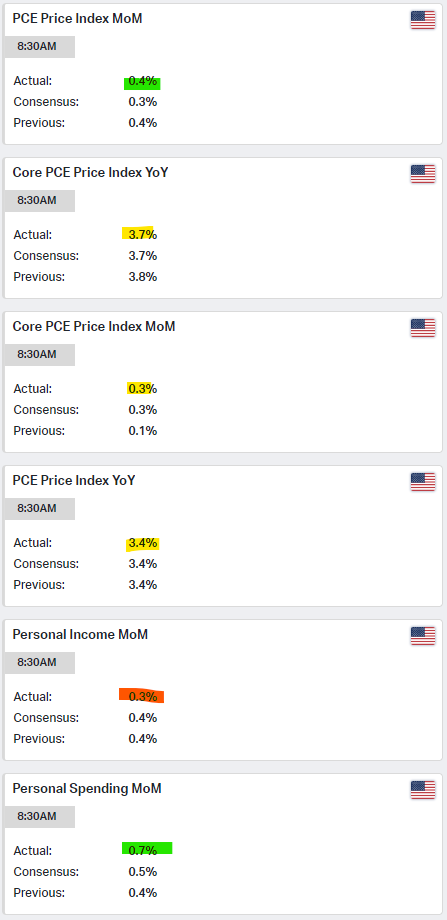

Inflation data out Friday was stable, no big surprises:

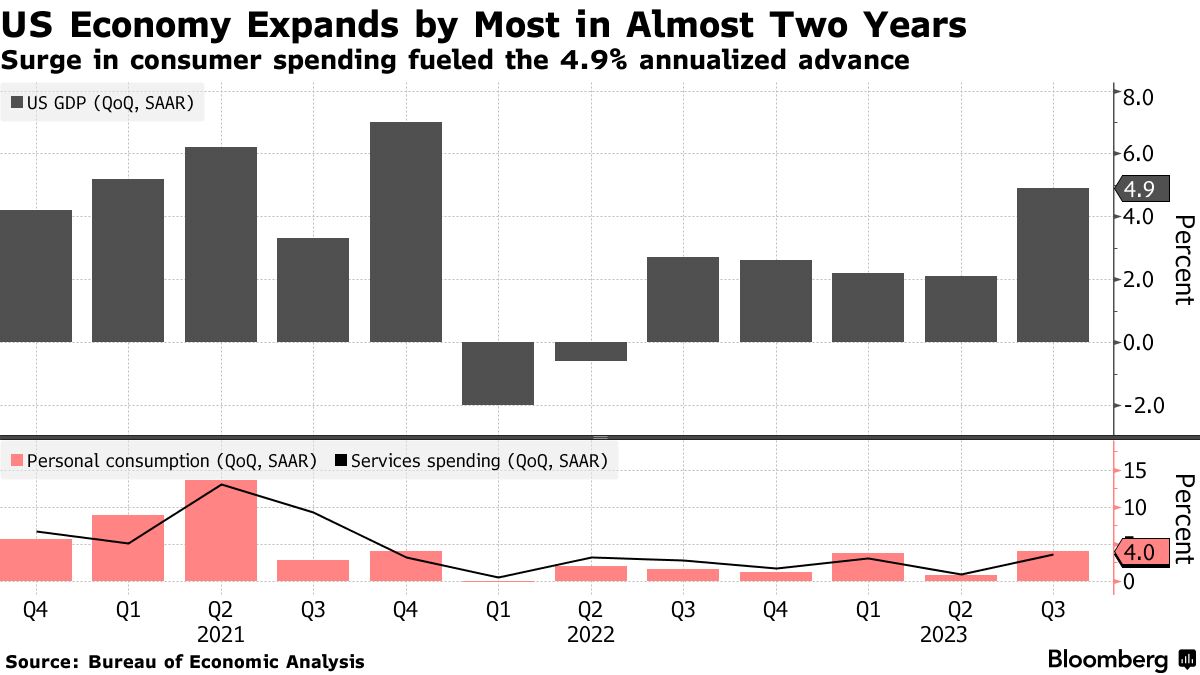

Bottom line there are many reasons to still be glass half full. An expanding economy is normally a good thing, runaway inflation is not and the latter seems to be stabilizing.

If good news becomes good news again and we can get back above SPY 420 and more importantly, stay there, consider the glass topped off for a possible Q4 rally.