Planner’s Corner is a series of posts on financial planning topics that relate to personal experiences, preferences, and opinions of the author. As with any content on this site, nothing is intended to be personal financial advice. That is, after all, personal. The author recommends a fee-only CFP® for your personal plan.

“So, how’s retirement? Any surprises?” you ask.

“I no longer look forward to weekends” I reply.

Say what?

That one is always a shocker but it is 100% fact. When every day is essentially the same, the weekend is no longer something to be celebrated, except for more sports I suppose.

“The second is easy also. Healthcare cost.”

If you take nothing else away from this blog but some cool black and white photos…….Don’t underestimate your (early) retiree healthcare cost. Run the numbers 2, 3, 4, 5x before you take the leap.

Takes me back to my financial planning courses, I wanted to jump right into investing and options and learn all about P/E’s and NPV’s. I dreaded the insurance segment because it wasn’t nearly as exciting, this was way before Jake from State Farm and Mahomes made it cool.

Yes you can be insurance poor, but looking back I realize now that a lifetime of saving and investing can go up in flames before your very eyes if you are underinsured or unprepared.

I took the reins early in my career and opened a Health Savings Account or HSA. If that terminology is new to you, you may want to start with my post on the HSA Trifecta here.

I knew at some point I would be able to invest those HSA funds and in theory that gave me the option to create a growing “bucket” just for future healthcare costs.

Had I not made that decision, I am not sure I would have been able to leave the workforce when I did. Forget about pensions and 401(k)’s and Roth IRA’s, none will help you pay for healthcare at least until a certain point in time.

I guess technically the Roth could the earliest, but that would be a misuse of funds.

I digress…

So what are we looking at exactly?

I was in my late 40’s when I left work, so let’s assume after 18 months of COBRA coverage I am trying to bridge a 15 year gap from age 50 to 65.

First of all COBRA is expensive. If you find yourself laid off, quit or retire early, you will be eligible to continue COBRA coverage from your employer for 18 months with no questions asked. But it will cost you so be prepared.

I signed up on the spot for one reason and one reason only: I knew I could pay COBRA premiums from my HSA! I could tap those pre-tax dollars that had compounded nicely over the years to buy me some time, literally, before I was forced to buy an individual policy.

When it came time to buy a plan of my own, I did so on my state marketplace which was relatively straightforward and dare I say painless. I think the process for ACA plans has come a long way.

I had several options to choose from, several providers, I decided to stay with the provider I had while employed (and also under COBRA) simply because I was familiar with them and that would (potentially) ease my transition into the abyss.

I chose a “Silver” plan, which was a little more expensive than “Bronze”, cheaper than “Gold” and I felt it struck a nice balance. The monthly premium was in line with COBRA unfortunately, but I could always downgrade later.

My employer plan had a deductible of $1,500 and a max annual out of pocket of $3,000. Expensive, but when paired with a funded HSA easily doable.

My shiny new Silver plan from the marketplace sported a deductible of $4,200 and a max annual out of pocket of $5,950. Yikes. So I am on the hook for the first 70%, they help with the remaining 30% and then mercifully cap me. My annual out of pocket potential just doubled.

When it came to evaluating and estimating my costs, I just went straight to the max out of pocket, that is the absolute most it will cost me each year.

One bad luck event or major “procedure” during the year and those figures will evaporate like a mist in the wind. Keep that in mind in terms of risk management…..

I think back to 2013 when I tried to be 15 again and ripped my ACL in half after failing to land a jump on a dirt bike. I maxed my out of pocket cost that year in about 10 seconds, 5 of which were in midair.

The solvency question to answer for me was two-fold:

- How many years can you cover the monthly premium? COBRA out of your HSA bucket for 18 months then out of your liquid/taxable bucket for the remaining 13.5 years?

- How many years can you cover the out of pocket maximum tapping your HSA?

Note: My annual Rx cost is (thankfully) very minimal compared to these figures so I will omit those for this exercise. They wouldn’t move the needle anyway.

For simplicity let’s assume my HSA is worth $50,000 with no dividends or annual returns, we will get to those later.

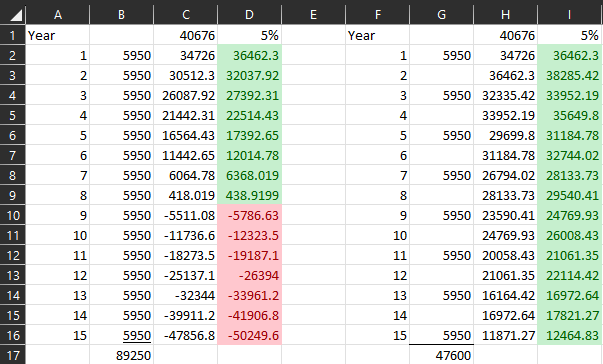

My COBRA premium was $518 for 18 months so that trimmed the HSA by $9,324 total. I am left with a balance of $40,676.

With a starting balance of $40,676 how many years can I cover the max out of pocket “possibility” for my healthcare cost?

$40,676 / $ 5,950 = 6.8 years. So I better hope for some healthy years between ages 50-65 because I can only afford the max out of pocket for less than half of those years.

Assuming 5% interest or rate of return will extend that out to ~8 years. If you assume you only hit the max out of pocket every other year the math works for the full 15, as it should.

For me personally being able to cover max out of pocket for half of the 15 years is probably enough but that is a personal decision based on your medical history, needs and overall peace of mind.

If I were going to cover the full 15 years risk free, I would need a starting balance of about $65,000 earning 5% per year -or- $89,250 if it was earning zero.

HSA balances tend to be smaller simply because of the skimpy contribution limits ($3,850 for individual, $7,750 for family in 2023). So even while investing the funds, you can see it takes many years to amass the type of amounts needed to bridge that gap to Medicare.

Now you know why I designate a large portion of my HSA to high dividend payers, I need to know something is coming in to help offeset these potential costs!

This also helped me in my early years of HSA accumulation, by re-investing dividends each month, the snowball effect starts to kick in, something you will not fully appreciate until later.

You do not have to have earned income to contribute annually to the HSA, which is good for early retirees.

One final note on monthly premiums. Once COBRA paid via the HSA is long gone, you have to foot the bill yourself from taxable sources. That also takes some passive income planning on your part.

You don’t want to think about it, just make sure something is there to cover it (like dividends). It’s like water or electricity at this point, it’s a utility and the price of admission.

As I told someone recently, by retiring early, I basically created the equivalent of a 15 year car payment for myself just to secure health insurance. It’s sobering when you do the math:

$500 x 12 x 15 = $90,000!

That number looks even bigger when there is no employer paycheck. Trust me.

Depending on your income, you may qualify for subsidies that can reduce your monthly payment up front -or- boost your tax refund after you file and include what was spent on premiums. Many early retirees are “in between” income sources and are prime candidates.

I am still trying to navigate the best way to reduce my total cost.

I hope this little back of the napkin exercise helped get the wheels turning on what your future healthcare costs may look like.

Bottom line, it’s never too early to plan, especially if you are considering pushing away from the boardroom table early!