“You felling OK, something on your mind?” the nurse inquired as she removed the blood pressure cuff from my right arm.

“I’m fine, I think, I guess!…why… is it sky high?” I replied.

“Yes.” she quietly responded. When she didn’t offer to share the numbers I knew not to ask, that would only send it higher.

For years I was in the 120/80 camp. Resting pulse firmly below 60 due to a routine 20 minutes of intervals on the stationary bike every other day or so. I was no athlete, but I was no slouch either.

When I discussed my concern with the higher numbers and the fact I didn’t feel any different with my doctor, he just smiled and nodded: “Things change my friend. Something is triggering you, start taking it a couple times a day for a month or so and let’s see where you average out.”

“More than likely just white coat syndrome, fear of being at the doctor…” he added. “Very common.”

Perhaps, but I certainly don’t feel it. I think that is what scares me most. I chalk it up to yet another middle aged obstacle and make it a priority to reel things in. I have responsibilities, sick days or being laid up is simply not an option.

I guess I need to do a better job at relaxing the mind. It’s easy to get worked up. Especially these days…

Being active in the markets requires a certain level of awareness.

I found myself a little more plugged in than usual recently due to the events overseas. The terrorist activity in Israel is mind blowing, that we live in a world where this can happen. Thousands of lives taken simply for the sake of what?….opposing nationality, ideology, ethnicity, religion? It’s nuts.

If we think it can or will be easily contained, we are likewise nuts.

I don’t watch the news, national or local, I prefer to read it on my terms from my chosen sources. Social media is out of the question, I have been absent from all forms since 2009, they call it a news “feed” for a reason and you have no control over what you are being “fed”.

I chuckle when I see posts of people just now deciding to “quit” Twitter or Facebook. They finally arrived at a tipping point, where the nonsense and noise reached a level that forced their hand. Congratulations at any rate, your soon to be clearer and higher functioning brain will thank you later.

Everything I read, everywhere I look seems to relay the same troubling message. We are now at a tipping point globally and markets will eventually react accordingly.

Let’s get caught up…

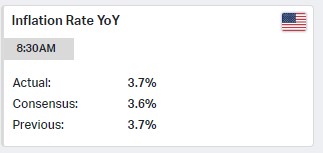

Overall inflation numbers are way down but the recent update shows some signs of stalling out and potential reversal:

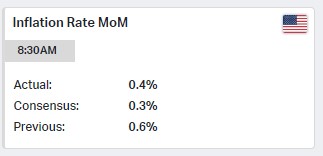

Consumer sentiment numbers out Friday said simply, “we ain’t feeling it”….

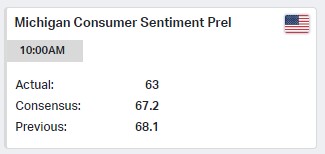

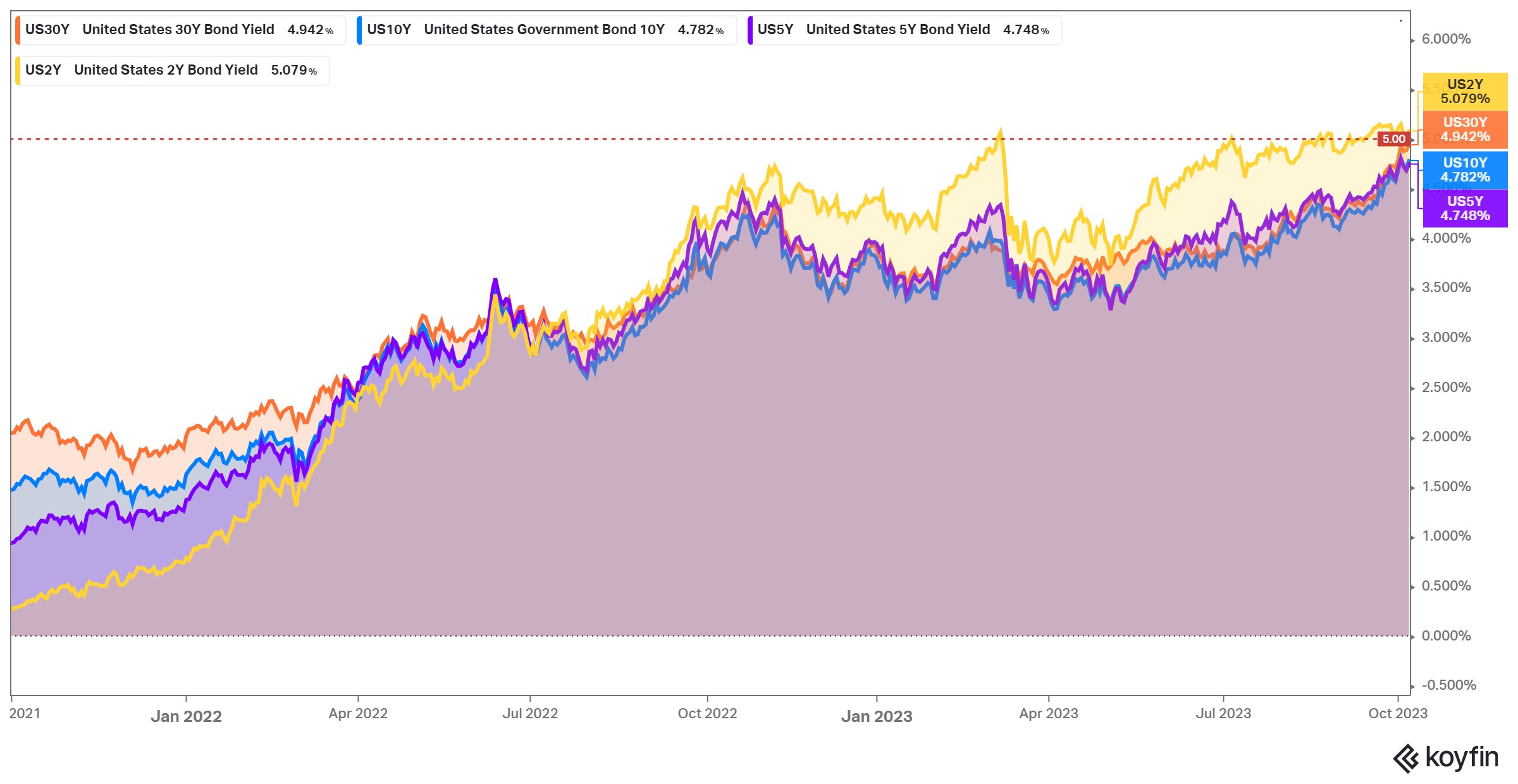

Bonds of all shapes and sizes continue to fail to catch a bid. The Fed is out of the market, QT replacing QE and it’s up to international players, institutional and retail buyers to pick up the slack.

I am watching the 5% level on the 10yr, if we break through that barrier I would assume the long end will ultimately re-steepen to 6% or 7%:

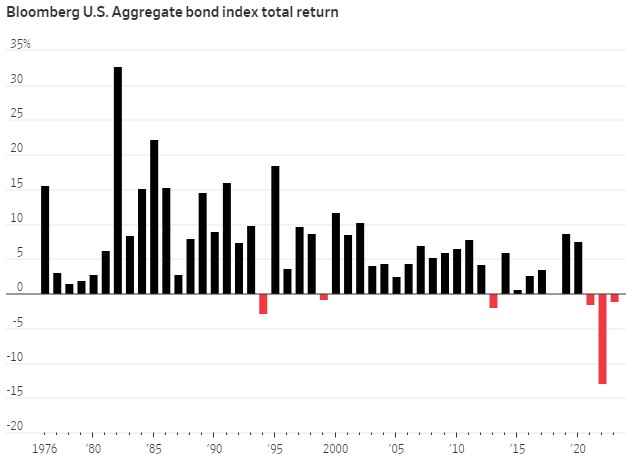

If this trend continues, we could be seeing the third straight year of negative bond returns, the portfolio diversifier gone AWOL:

Jamie Dimon has stated publicly he would not be surprised to see a Fed Funds rate of 7%. Yikes. I noticed this weekend in the WSJ that the average 30yr mortgage was now over 8%. New car loans were not far behind. One must wonder how much damage that will do going forward.

If I emerged from a coma and you showed me the GLD chart, I would ask… what happened in March and October? The answer would be multiple bank failures and an ever widening war theater:

The “optimist” up channel on SPY is definitely at risk entering earnings season with the backdrop of increasing tension in the middle east. Note the declining RSI that keeps bumping its head against resistance:

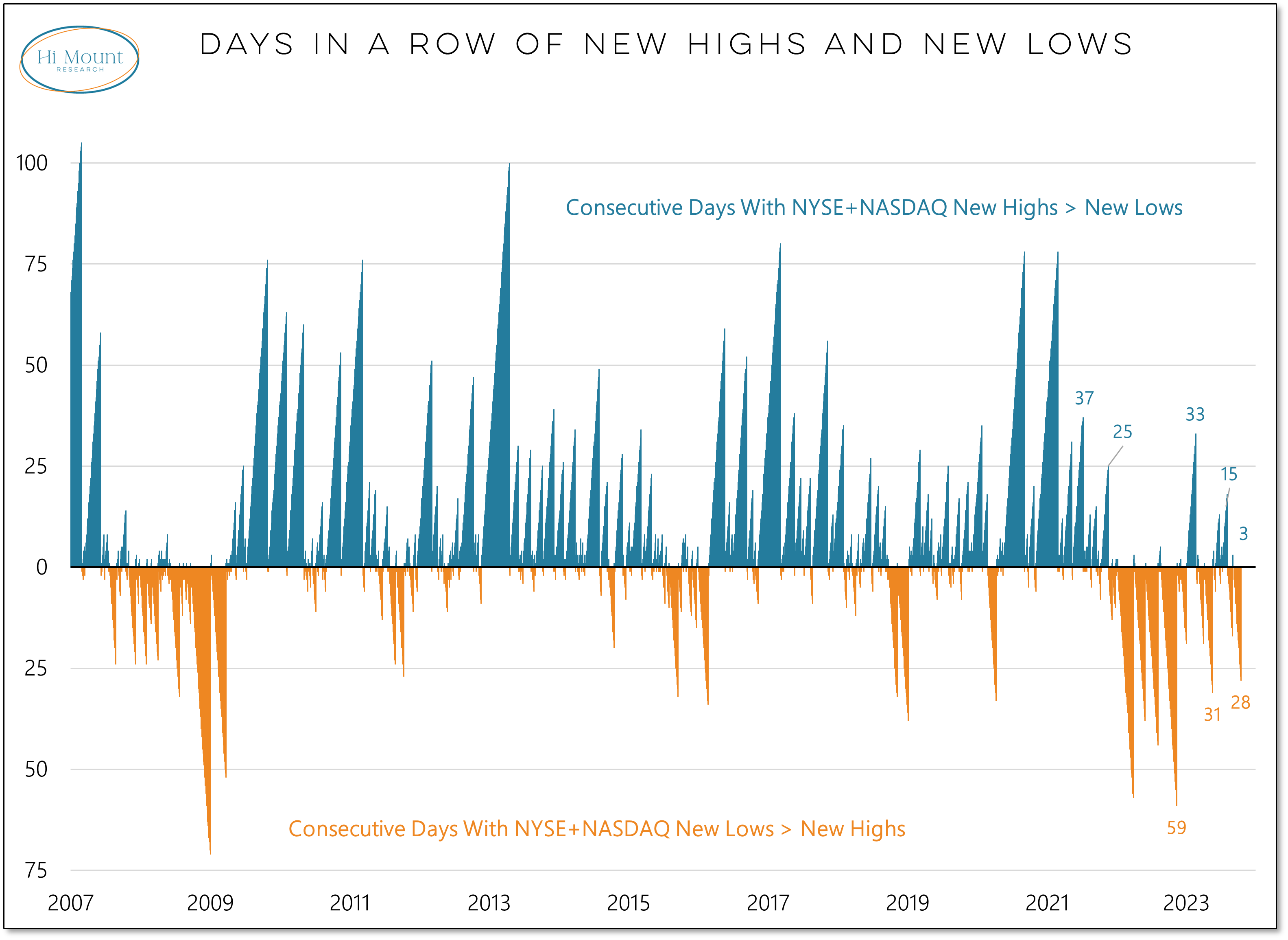

In terms of overall market breadth, this chart from Hi Mount does a nice job showing the recent increase in new lows, which points to very sketchy environment going forward:

Bottom line things are on shaky ground entering earnings season. Headlines from overseas will continue to dominate news rooms and any moves will likely be accentuated and easily influenced.

ON BALANCE

I started my morning like I always do. I walked to the bedroom window and rotated the blinds to allow the equally divided warm rays of sun to fill the room. I showered, I dressed and moseyed on to the kitchen to grind up 55grams of fresh coffee.

Staring across the deck at the changing leaves in the distant tree line as I took that first sip, I realize I am fortunate. I am thankful.

There are many innocent souls that will not be able to experience those simple joys again. They did not deserve their fate, nor will those that will die in the coming days, weeks, months ahead.

On the home front, I must take better care of myself so that I can continue to take care of others. Failing to do so is simply not an option and sitting on the south side of age 50 now is a wake up call.

The years behind are gone. Forever.

The future is not guaranteed but I can impact and influence its potential by making deposits now toward my future self, not withdrawals.

From a Finance Stance, I need to do what is necessary to sleep well at night. That is really all that matters at this point. If that means taking on less risk and more sitting in cash, so be it.

Opportunity will arise in due time.

For now, we calm the mind.