Last day of September.

Last day of Q3.

I keep reminding myself that after Labor Day it’s all downhill, you know that, but I think the hill is getting steeper. Leaves are already changing, hell some leaves are already falling!

Can we just slow it down a bit? What’s the rush?!

It’s been over two years now since I was gainfully employed, I had long imagined a slow moving clock on the wall and days and months dragging on for what seemed like an eternity.

Didn’t happen.

If you are mulling retirement, now or in the near future, just keep that in mind. Something will fill up the time, you may not even know what it is yet, but it will be there.

Trust me.

If you wake one day to find time is actually moving faster than it did years ago you are definitely not alone. I think part of it is your mind has more time to not only create things to do…but discover all of those things you should have done already. Slacker…

Your mind is always working on the list whether you even realize it or not.

Best way to slow it all down is to pour a cup of coffee, grab the Moleskine planner and pen, ThinkPad and head out back to find a comfortable chair. Raise the lid and get to bloggin’.

And here we are…

No shortage of things to write (worry) about as we march into the other 25% of 2023, take your pick: UAW strikes, government shutdowns, Taylor Swift taking over the NFL?

Rumor has it she will be at MetLife this Sunday! Tickets sales are off the charts!

OK, So we Jets fans have something worth looking at? Whatever. Go Jets? Pains me to even say it now.

Don’t get me started on football.

I digress.

Let’s move on to the UAW.

The labor movement is alive and well. Biden was the first sitting prez to visit a picket line I see. He’s also the first one to use the lower deck stairs of Air Force One because it reduced his steps by 2/3 and gives him the best chance of not busting his ass on camera.

One of my favorite podcasts recently had a guest who shared an ominous prediction which he casually stated as (presumed) fact: Only Tesla and Toyota will emerge (survive) to produce automobiles in the future.

Really?

Say it ain’t so. Merle said he wished a Ford and a Chevy… would still last 10 years…like they should. I own one of the latter that has made it 24 thank you. A proud moment awaits me next year when I can add an antique plate to the chrome bumper. Remember those?

Once again let’s slow down a bit. Let’s drop a gear…

Of course Elon himself had to weigh in, saying this latest “movement” could bankrupt the big 3. We’ve been here before and I would have retired 10 years earlier if I had enough sense to buy Ford at $2.

I digress.

I will however admit it does feel different this time as we all contemplate how this impacts the EV adoption trends. No worries, Trump has already said he will harpoon all of the EV related mandates, so hang in there Detroit, your savior awaits? Or not…

Don’t get me started on Washington.

I refuse to read political articles, it’s headline mode only for me, mainly because 1) it’s hard to avoid those and 2) that it is all I can stomach. As the subject line in my daily Bloomberg email reminded me early this morning:

Whether our government will actually be open for business as you read this is anybody’s guess. There is nothing more to say other than refer back to the graphic above.

Moving on…

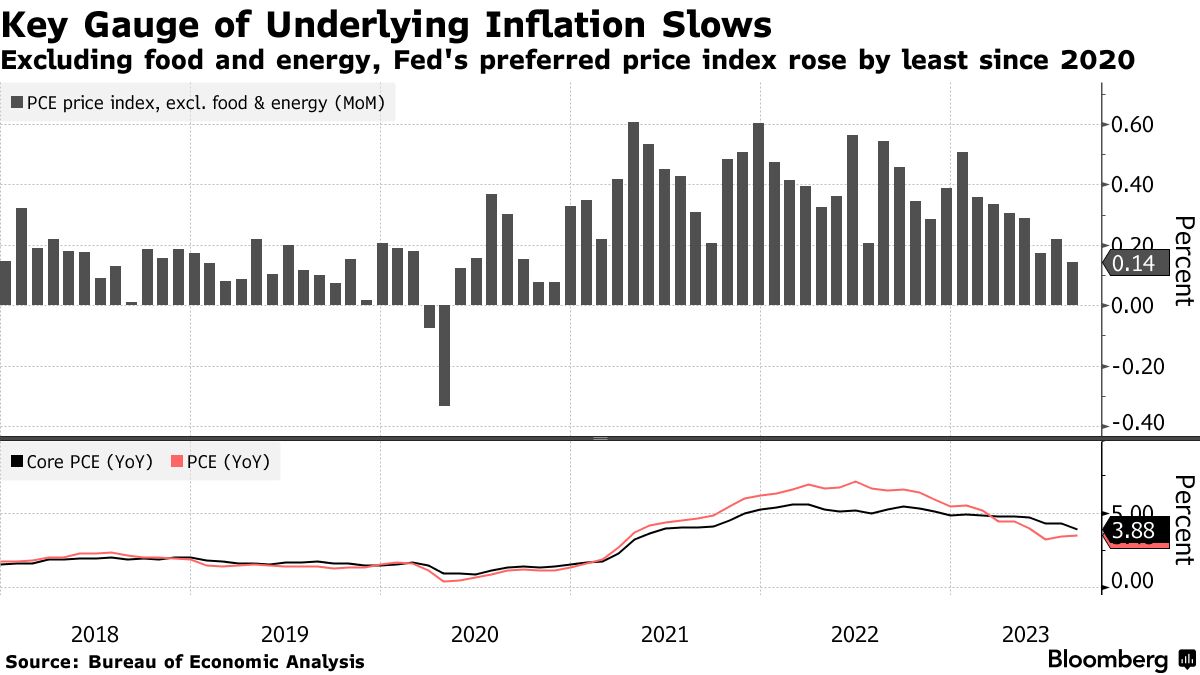

More favorable inflation data Friday should help keep the Fed on the sidelines for the remainder of this year:

Don’t tell them that though, they still want to keep everyone guessing.

Most eyes are shifting focus further ahead to 2024 now, debating if and when we start to see some reductions. It’s a slippery slope though when you consider what may cause said reductions.

We are late in the current cycle no doubt, but it’s much too early to start talking about cuts. Just one man’s opinion. The new dot plot reflects lower but the lowering pace continues to moderate:

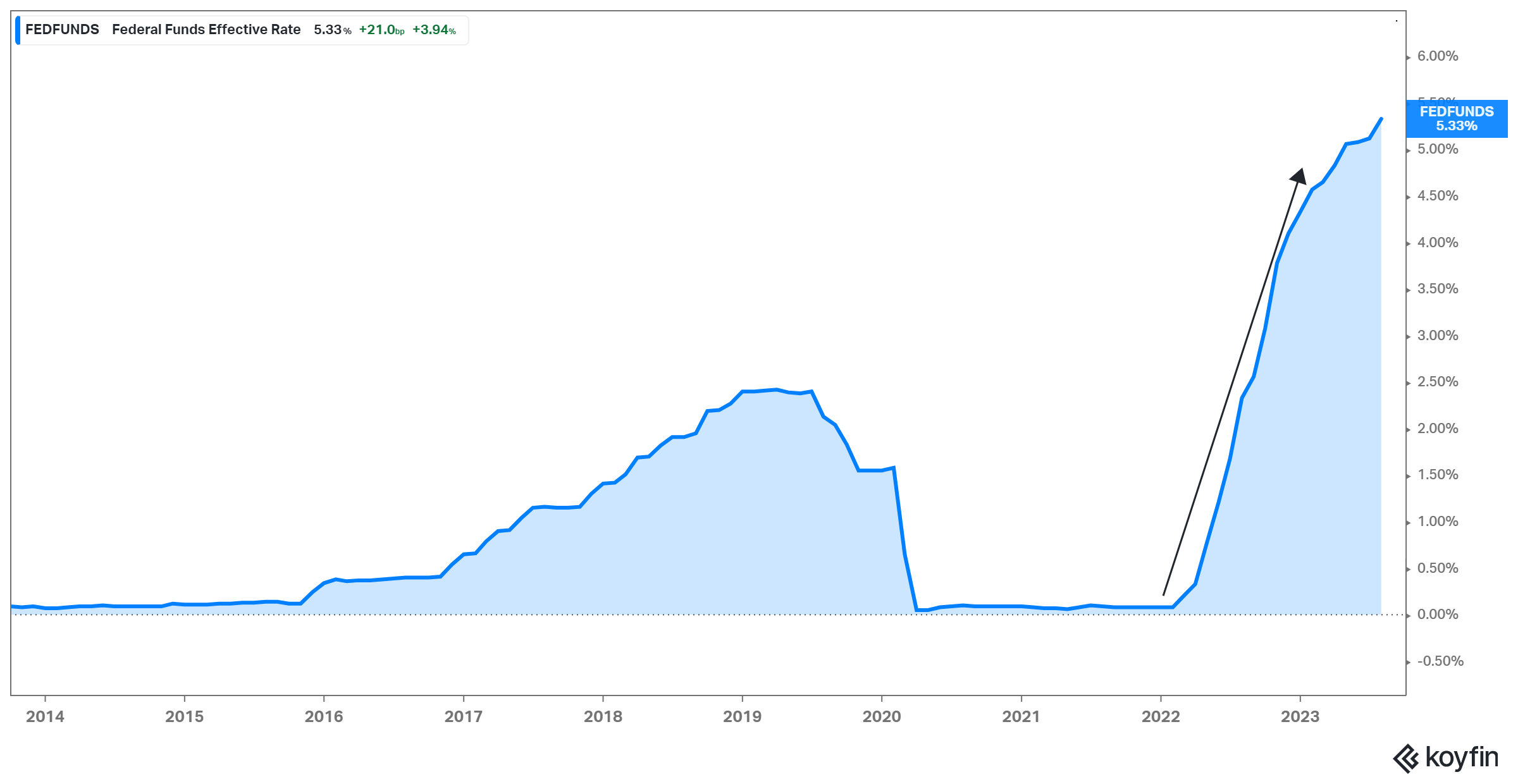

I would simply remind readers to remember the pace of hikes we just went through is unprecedented. The slope if you will was insane:

Jury is still out on just how much of this has filtered its way through the fabric but consumer cracks are starting to form. Earnings now include “theft impact adjustments”. Retail theft is up and there is a reason for that my friend. Ends aren’t meeting.

To the charts…

Took longer than I expected but we did eventually get a textbook gap fill on SPY at the bottom of my trading range that was outlined in these pages ad nauseum:

Even though we bounced, if you revisit that chart above you can still clearly see that it is broken. The finviz defined up channel was busted long ago and the unfilled gap proved to be the magnet I felt it could be.

Enough self back patting, allow me to introduce a new “optimist”…”glass half-full” channel that could be in play. This new symmetrical up channel lines up with the October lows. Re-entering the channel (green arrow) could be in play. Drifting away (red arrow) could be in play. Take your pick.

If you like the green arrow path but want to know what could possibly lead to the red arrow path, may I present Exhibit A:

Stocks, especially longer duration tech stocks do not like these rates. When you bring it all forward the present value of those “expected” sales and profits look much smaller. I am already getting sick of hearing the phrase “higher for longer” because equities of all shapes and sizes shall surely struggle amidst that backdrop.

Facts are facts.

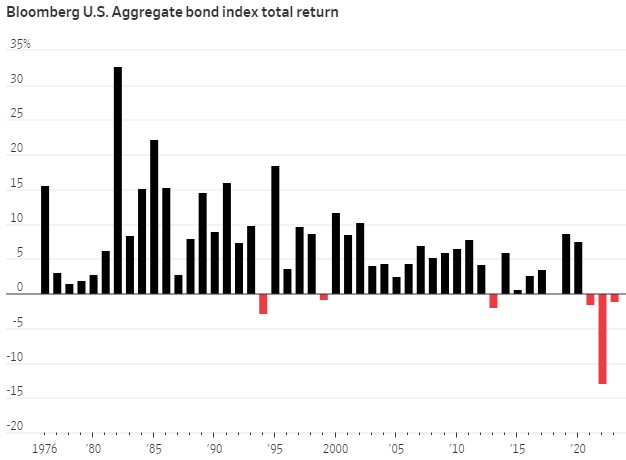

There is a lot of talk on the street about a “bond glut” and at this point I am wondering myself just what will cause bonds to catch a bid. Flight to quality? If we get the red arrow scenario I outline above will the smart money (finally) flee to bonds?

If they do, yields will retreat and they may reverse this trend:

Been a while since we have had 3 down years in a row for bonds, the portfolio diversifier gone missing. If the sheet hits the fan in Q4 and money flies into bonds, this could reverse. Possible, but not holding my breath.

Pre-election years tend to start trading north, up and to the right in Q4, but is this year really comparable?

Been a while since we enter that election year with rates this high.

Been a while since we enter that election year forced to choose between two total buffoons.

Don’t get me started on Washington. If you missed it there was a Republican debate this week, I didn’t watch a second but I wonder which one of these yaps Trump ultimately picks to run as Veep?

I DIGRESS!

All for now, I have rambled enough.

I will end with this. Regardless of your investment timeframe just remember cash in money market funds is earning 5% right now.

Two, three short years ago that was simply a dream. I didn’t think we would ever see it again, period.

I was wrong and as I force myself to look ahead into the abyss of “higher for longer” and an election year fitting of a Monty Python skit (at best) this is the only silver lining. I can rest easy knowing that one side of the barbell is earning 5% risk free.

That allows some liberty and some flexibility with the other side.

Not exactly sure what to expect as October and Q4 looms.

For now…I will just try to slow it down a bit. I’m in no hurry…