Planner’s Corner is a series of posts on financial planning topics that relate to personal experiences, preferences, and opinions of the author. As with any content on this site, nothing is intended to be personal financial advice. That is, after all, personal. The author recommends a fee-only CFP® for your personal plan.

An article in the WSJ recently addressed a very common dilemma many of us will likely face:

Whether to accept a lump sum cash buyout offer for their pension.

So I am writing this one as a refresher for myself to vet out my thoughts because I fully expect to see that letter in the mail at some point from my former employer.

The Basics

If you have worked for a large legacy company, by legacy I mean one that has been around for 50+ years chances are you have a pension coming to you. Ditto for any public sector employees.

Most are structured as single-life annuities, meaning at a pre-determined age (normally 65) you are eligible to receive a fixed monthly payment for the remainder of your life. Some offer options to allow the payments to continue for a surviving spouse, but the single life payment is most common.

In my case, I can start payments as early as age 55 at a reduced amount. Similar to social security timelines, the longer I delay the payment up to age 65 the larger the monthly payment will be.

Pensions are going extinct for the most part, due to their high cost to the employer. They would much rather lay that burden at your feet and just match 401(k) contributions.

Companies will also routinely offload those future obligations by offering buyouts, which are lump sum cash payments targeted primarily to former employees. This gets it off their books so to speak. Keep in mind this is still retirement money so it would need to be placed in tax-deferred retirement accounts like 401(k)’s or Traditional IRA’s.

How is the offer calculated?

This is where market dynamics, primarily interest rates, come into play.

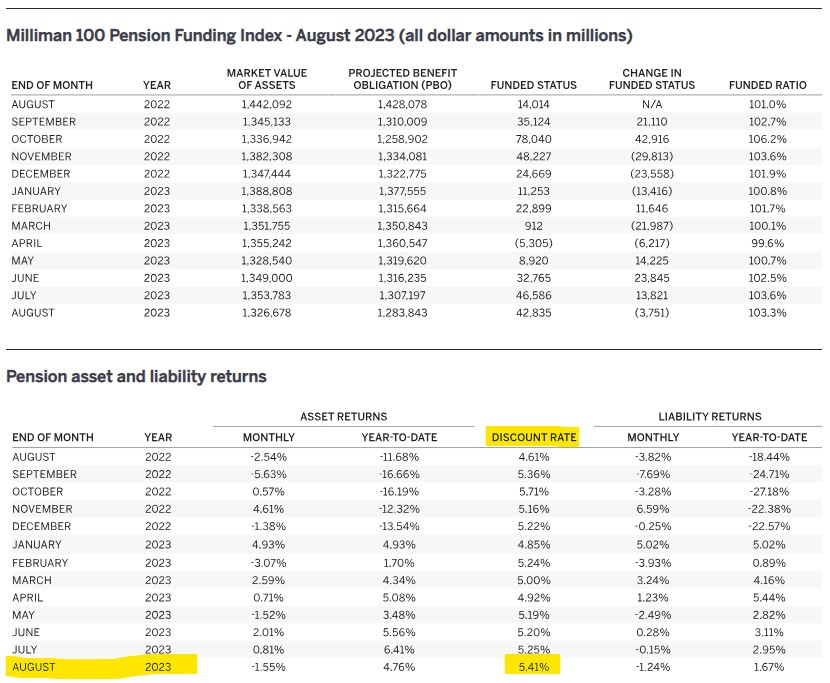

Pensions are valued using a discount rate, which is basically the yield on a basket of high rated corporate bonds. There is no base or standard rate, they will vary by company based on their chosen method. A quick search will lead to some good resources for a current estimate:

So we are about 5.41% currently on an example discount rate. Just think of this rate as your expected annual rate of return on your pension. It has a major impact on lump sum offers.

By taking a lump sum now, you are ultimately being expected to duplicate the same monthly payment the pension would have provided. So the rate of return plays a large role.

Higher rates equate to lower lump sums because you are expected to earn a higher return over time. In other words, in theory you should need less upfront if it compounds at a high rate of return.

Lower rates equate to higher lump sums because you are expected to earn a lower return over time. In other words, in theory you should need more upfront if it compounds at a low rate of return.

The company making the lump sum offer is obligated to value it properly using a current rate, as you can see in the above table it will fluctuate monthly as overall interest rates fluctuate. You can also search the term “discount rate” in your company’s annual proxy statement to see what they have used recently.

There are calculators on the web that can back into an estimate of what your lump sum will need to earn based on your age, expected payment at age 65, the discount rate and life expectancy.

So this is why I was crossing my fingers for a buyout offer two years ago when rates were much lower. I knew it would max out my lump sum. The company knows that too. Oh well.

Tables have turned in their favor now with rates at historically high levels. There is no better time to offload those obligations and you can count on more offers being made. Unfortunately the lump sums will be lower.

Things To Consider

The pension is guaranteed mailbox money every month. For many that will be reason enough alone to just let it ride and keep that payment intact.

If you feel like you can earn more than the discount rate and prefer to control your own destiny and investment choices, the lump sum may be appealing. Just keep in mind with rates at these levels, your offer will be at multi-year lows.

How do you feel about health and longevity? A longer life expectancy tilts the favor toward keeping the pension intact simply because the longer you live, the more your lump sum will need to earn and grow in order to keep doling out that monthly payment.

How do you feel about inflation or future expenses? The pension payment is fixed and will not adjust for inflation or cost of living like social security. If you have other income sources lined up, you may lean toward a lump sum and be more aggressive to potentially generate a higher payment later.

How do you feel about your employer? Are they financially secure? Private pensions are guaranteed up to a maximum monthly payment of $6,750 per person at age 65, but you may prefer to take the lump sum if you want to cut the cord now and take the reins.

Lastly, I think it’s worth considering the offer may only come once. Turning it down now could mean turning it down forever, you will need to be OK with that.

This is a very tough and a very personal decision. In the end though I think it comes down to how comfortable you are managing your own money.

I would recommend anyone facing this decision to get some second opinions and have a pro run some different scenarios. They will likely take several other factors into consideration and may uncover something that helps clarify your situation.

For me personally, I think if the offer is made I will likely take it, simply because I was planning to start my payments early at 55 (thus lowering the payment) while any lump sum offer will be calculated using the payment due at 65.

I am comfortable managing it and feel like I would have a good shot making it grow and earn more over time.

Make no mistake though, if the offer does come I will be mulling it over and crunching the numbers right up to the decision deadline. I definitely won’t be taking it lightly.

Here is a good AARP Article that also mulls this decision over.