Summer isn’t officially over until the 22nd, but for me personally today is it. Adios. Off with ya.

There will be plenty of warm days ahead but with a different feel, a certain gravitational pull if you will to those crisp mornings and chilly evenings. Firepit weather.

I don’t really have a dog in the favorite season fight anymore, I like them all.

When I was taking weekly motorcycle excursions of course I preferred the warm months. Now I equally appreciate the cold ones, especially when even opening the front door is 100% optional.

I like snow for the first time in 20 years. I can put on a pot of coffee and stare at it. There were no “snow days” in my former life, in fact it was the exact opposite, it was go time. Get ready for extra hours and a bigger headache.

They can have it. Is my coffee ready yet?

Let’s recap and think about what lies ahead, these next few months are going to be interesting to say the least.

I will fully admit the way this market has bought into the soft landing scenario caught me a little on my back foot. Now I got to get it back on the good foot. Hey!

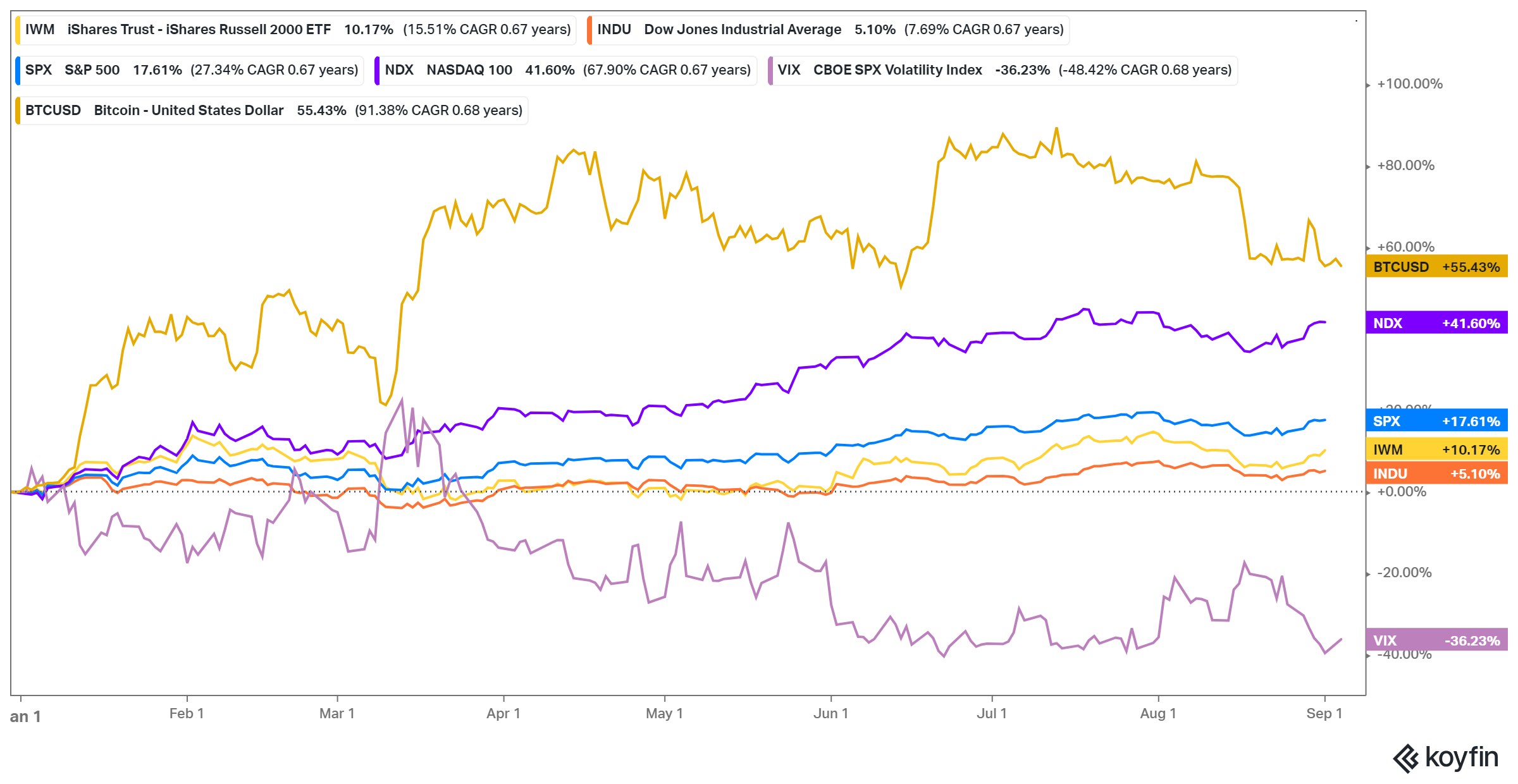

There’s your YTD, including BTC and the VIX for good measure. Speaks for itself. We have navigated the debt ceiling fiasco, survived the SVB and SBF (Sam Bankman-Fraud) collapse and emerged unscathed.

The market looks ahead, typically up to six months out, so when I look at the chart above I see no recession and perhaps some rate cuts early 2024. At least that is what is being priced in.

Your guess is as good as mine what really happens, but make no mistake, inflation data, all recent data has been promising.

I see two major risks: re-inflation or harder landing.

If we cruise into fall and the consumer keeps spending, economy keeps growing, the inflation fight could be renewed or re-intensified if you will. On the flip side of the coin, we keep deflating and the economy starts to head south and we realize the grass may not be as green in 2024 as we had hoped. Goldilocks lingers right in the middle.

We get our next CPI read on Wednesday the 13th, followed by the Fed meeting on the 19th-20th. Everyone sees no change, as do I. They have succeeded thus far, time to chill.

As for the broader market, The Trend is The Trend my friend until it ain’t. There was a very clear buy signal for SPY on August 29th, which reversed the short lived sell signal from August 9th. I personally thought it might be a head fake, it was not:

Nothing bearish in that chart at all.

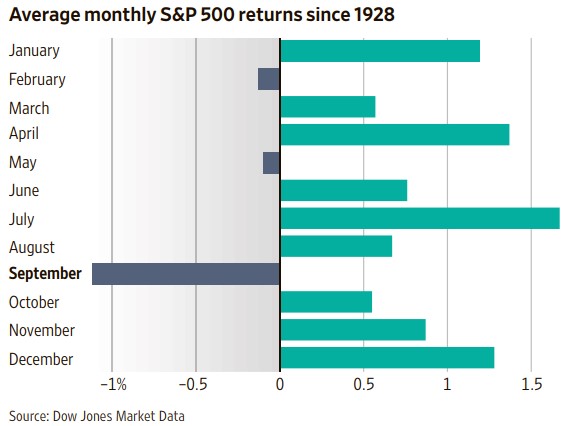

Now before we get all excited and circle up for Kumbaya, remember the VIX is bottom feeding, hovering below 14 ahead of what is typically a dicey month for risk assets. Exhibits A and B:

I have always viewed a sub 20 VIX as “complacent”. OK, well then 13.82 is “we don’t care“.

Not saying this will be a September to remember but odds say it might. Washington might have a say as well, unfortunately.

I would lean toward a calmer September if we were a little closer to the 20/50 day moving averages in SPY and the VIX wasn’t flatlined. I digress.

A few final charts before I stage left, the first is my markup on SPY and the trading range I will be watching for. Bottom is the unfilled gap from early June, top is 460:

I will update this one as we go along, it will be very interesting to see how it plays out. Like I said above, nothing bearish on this chart and we are more than a week away from any real data, and the Fed. Could be churn, key could be how much! We have not seen many 1%+ intraday moves in 2023, either direction for that matter.

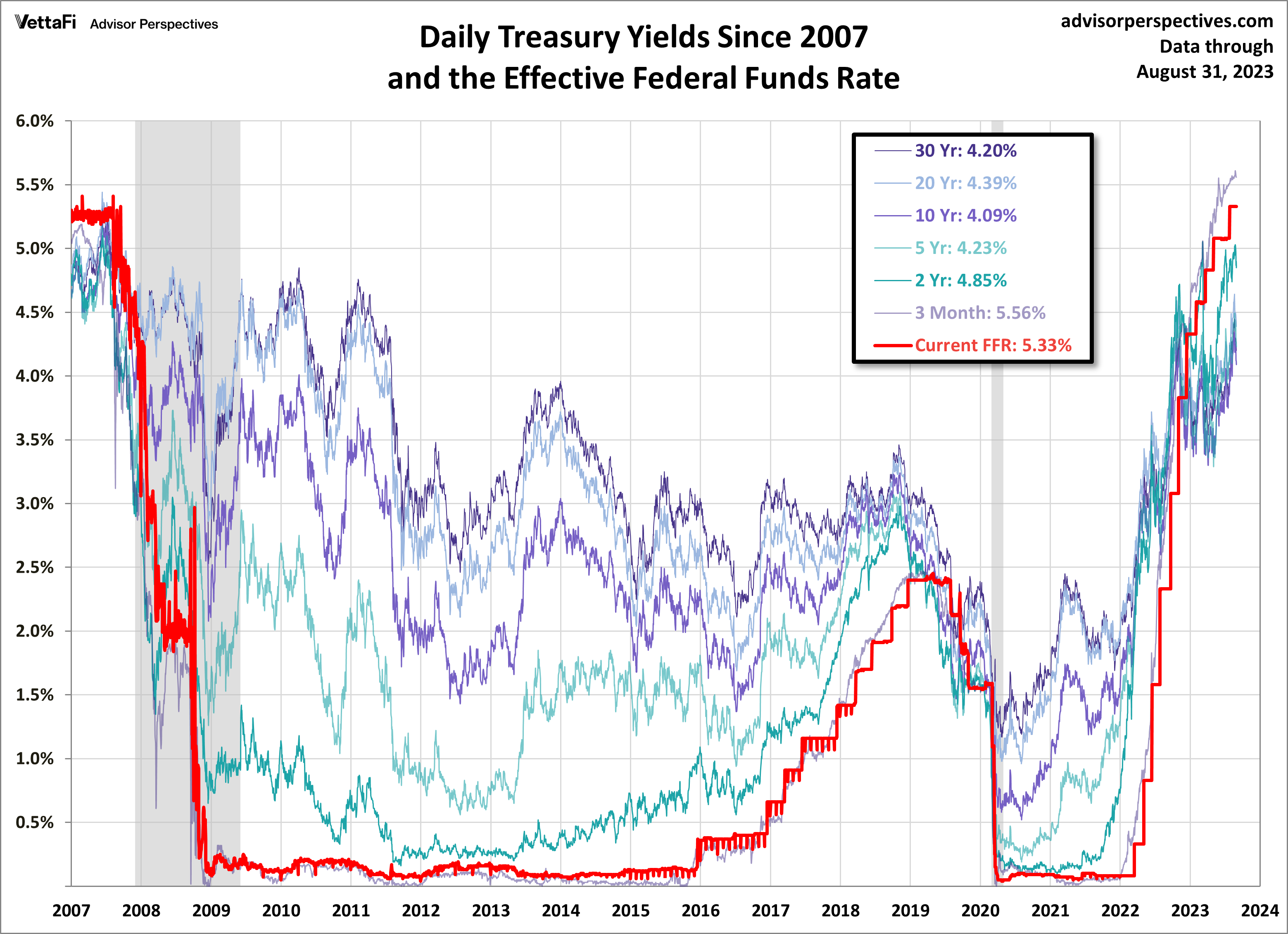

Lest we forget about yields.

They have been whipsawing as of late, especially the 10yr around the 4% level:

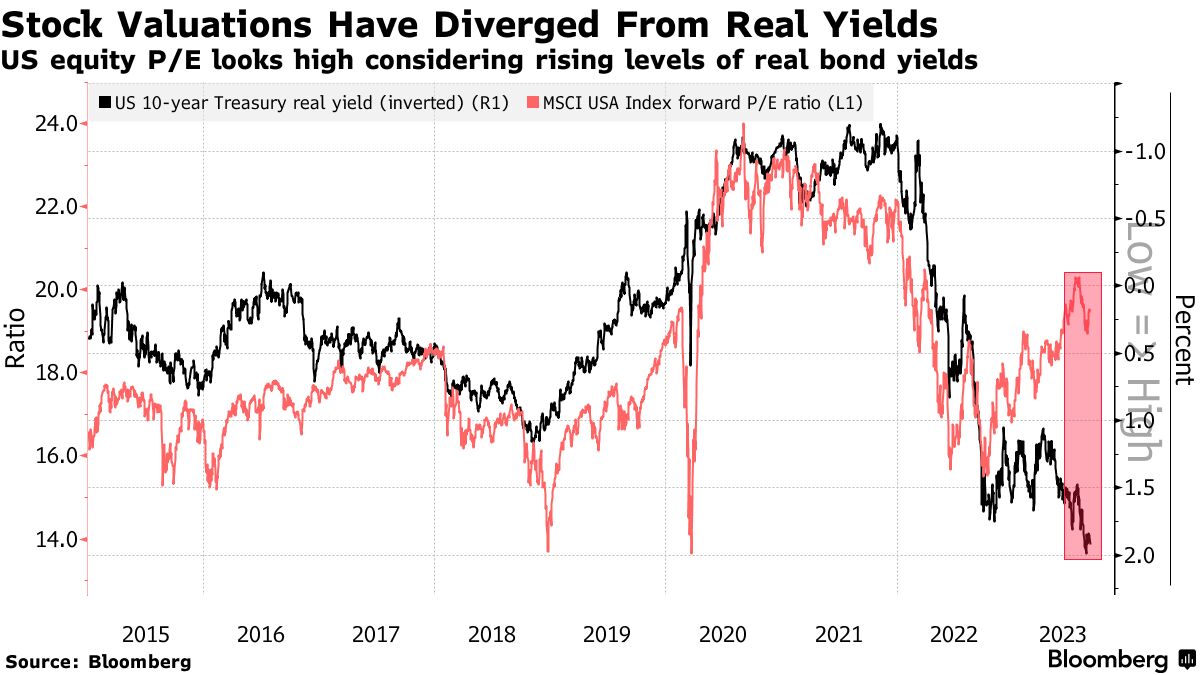

Something will have to give, either bonds catch a serious bid and ratchet yields down or the broader market pulls back and settles a bit lower, even if only temporary:

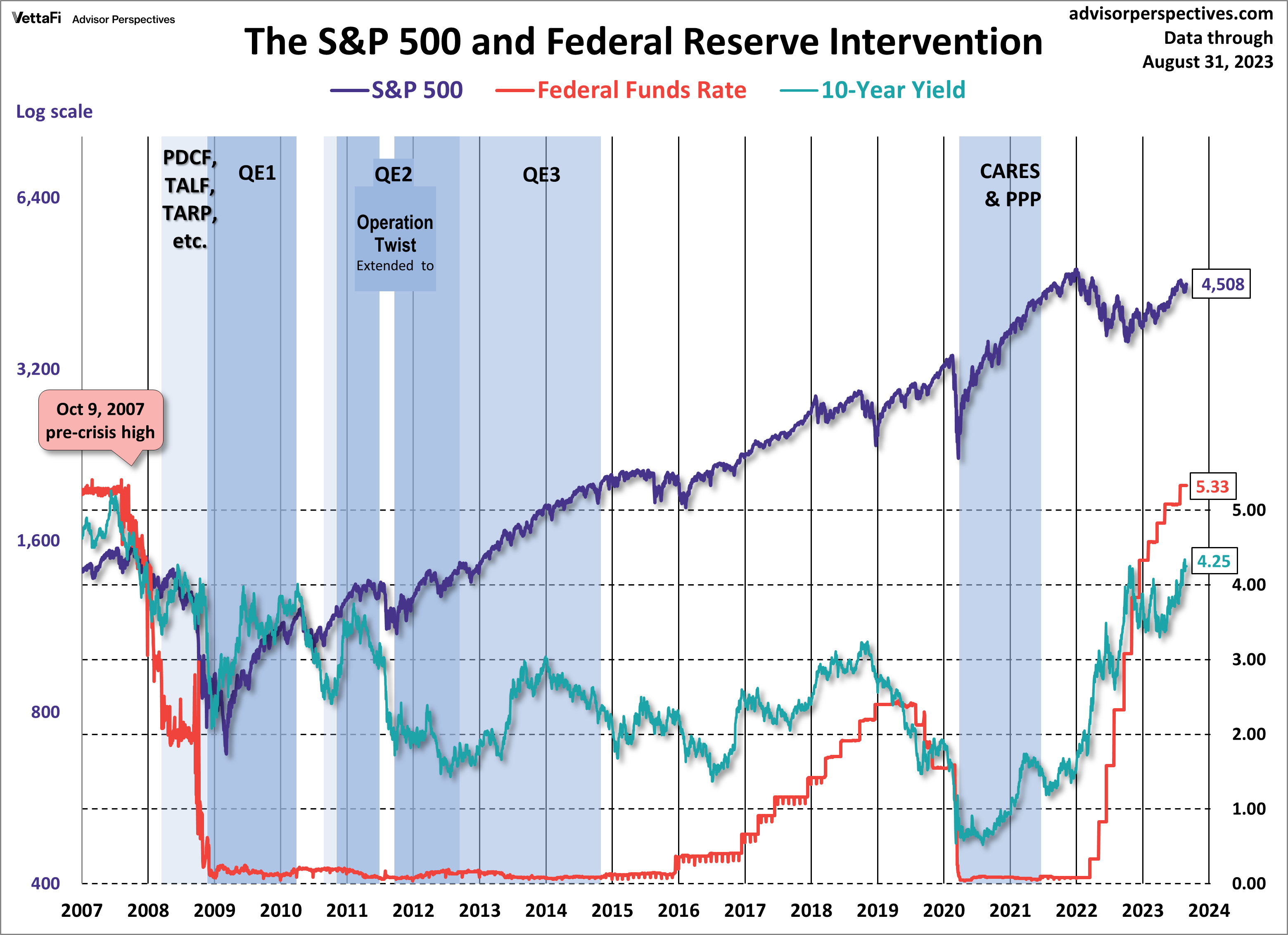

Viewed in a historical context, just how high all yields have now camped:

Last chart and it too is a repeat from my previous post, but I think it speaks volumes to 1) how far we have come, 2) how fast it has happened and 3) how the market (as of now) has barely flinched:

All for now! Have a great week.

Take us out of here Jimmy…….

It’s a jungle out there kiddies, have a very fruitful day!