I certainly do appreciate the bloggers that keep hammering away during the dog days of August when most traders are more worried about dinner reservations in The Hampton’s than they are markets.

I am neither, I don’t tap the keys unless I have something to say or just need to level set and the closest I get to a shoreline is the jar of miniature shells that sits on my bathroom sink. I have no idea where they came from, probably a yard sale, I know I didn’t pick them up.

August is off to a typical August start, very low volume and you have to take every day with a grain of salt. Interns and Algos are behind the wheel and asleep at it at that.

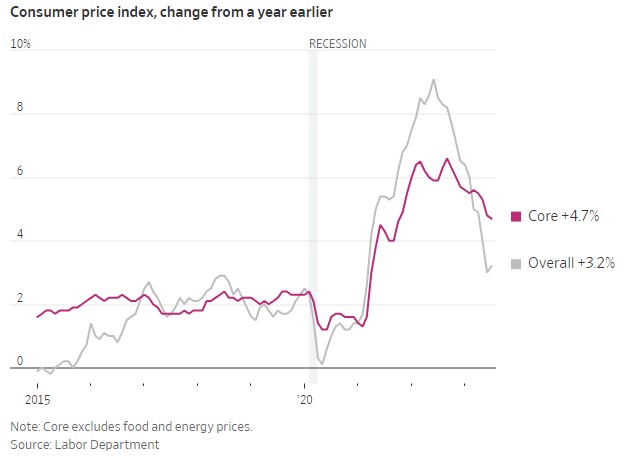

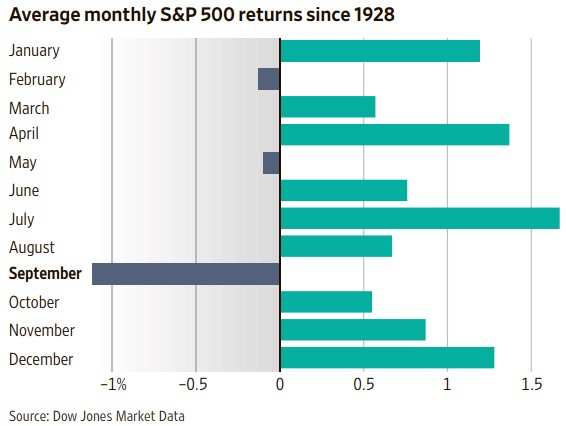

Nevertheless it was a busy week with a new CPI print, PPI, consumer sentiment data and the market itself seems to be rolling over or at least seriously considering it. I will present the readings in case you missed it:

CPI and PPI was really a non issue, which speaks to a broader theme of Macro to Micro taking shape. Everything has already been priced in. Everything. No more hikes in 2023.

Four years of engineering school and the only two notebooks I still have are Macro and Micro. Economics that is. I should have known then, right?

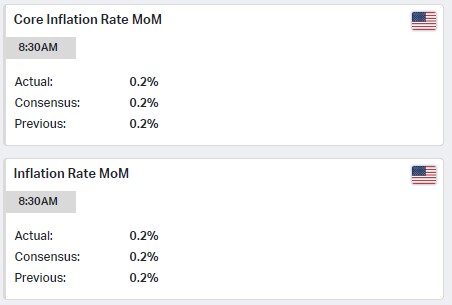

Speaking of Micro and zooming in per se, I am trying to wrap my arms around this whole AI thing. I don’t chase trends but when you see something so front and center, you have to pay attention. I enjoy the research more than I do the investing, sorry I am an ex-engineer, remember?

Interesting piece from Goldman in my inbox this weekend about the overall expected trajectory of AI:

Fascinating read and then of course I see this image on the front of my WSJ which freaks me out a little bit:

I just try to remind myself that robots have been around since Lost in Space, The Jetsons and Rocky IV and I have yet to see much less interact with any of the damn things in person 40 some odd years later.

That certainly helps temper my expectations and fears.

Moving along…

What the market is trying to figure out now is what happens in 2024, the election year (God help us). You will hear chatter about possible rate cuts and how many, I am not going to even speculate or entertain that here.

My take is inflation levels out at 3%, rates stay right where they are well into ’24 and the chatter zeroes in on whether the Fed is willing to accept the 3% vs. 2% target? Just one man’s opinion.

If you frequent these pages, you know I have been calling for a second half trading range for SPY as shown below. We are starting to show signs of rolling over into said range:

Black lines and trading range drawn on the chart are mine, the lavender lines as interpreted by finviz. My bottom channel line intersects the bottom of my range at an unfilled gap, also drawn by me. Not saying we get there, but keep it in mind.

Even if the original “steeper” channel has failed, the overall uptrend is clearly still intact. The rising channel on the RSI has also failed, MACD has failed, it all simply looks textbook rollover.

If you are short-term oriented plan accordingly, but long-term focused folk should welcome this pullback with open arms. It’s healthy. Shake out some excess, level-set entering Q4 and let more inflation and earnings data roll in.

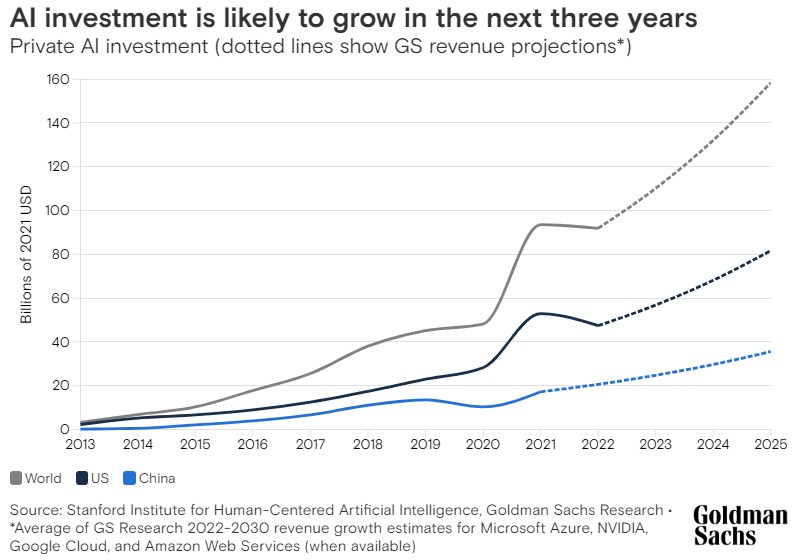

Everyone knows August is wonky just to due to the lack of liquidity, I would be remiss should I not point out September is the one to worry about, historically speaking that is:

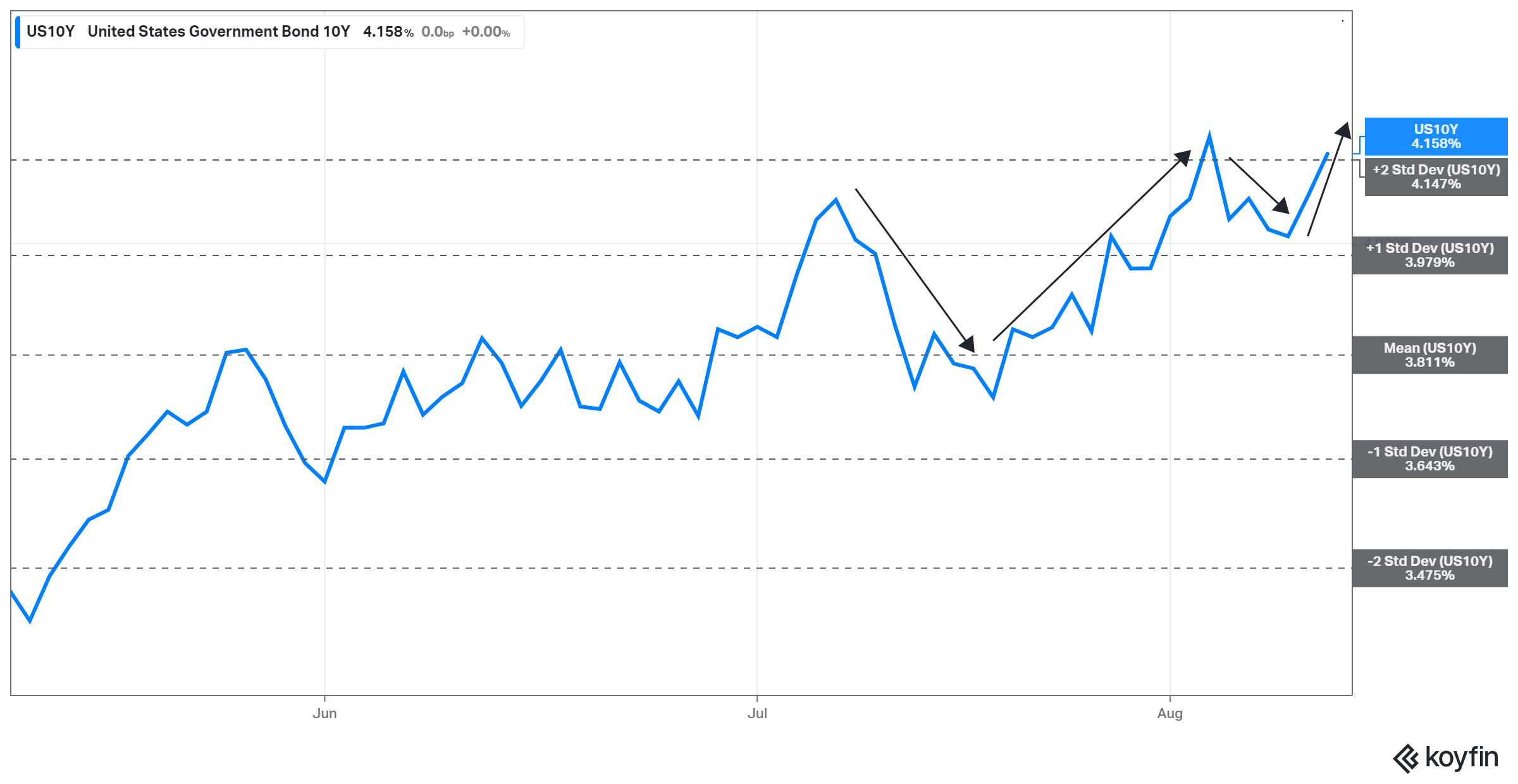

The only other thing I want to briefly touch on is yields. The stock market volatility that has gone AWOL is fully accounted for in the bond market. I can’t even keep up with it. One day the 10yr is under 4%, the next day over. The appetite for bonds is also meeting some serious selling pressure leading to everything down days:

These types of moves are let’s just say, not the norm, and if the 10yr continues to peg north of 4% you are you going to see that translate into 30yr mortgages creeping higher well above 7%.

Some well known hedge funds are betting on the long end rising, once again I don’t have any skin in this game other than I am glad to be earning 5% in idle cash for the first time since Moby was a Minnow.

I do expect “higher for longer”, everyone does at this point, but I will be watching for bonds to catch a bid as stocks start their late summer drift. If that bid doesn’t come and rates tick even higher in this late summer vacuum, well, that could lead to even more fireworks come September.

When everyone is back doing what they do.

In the meantime, enjoy your calm sleepy August Dog Days.

For these too shall pass…