More Q2 earnings on tap this week but look for the Fed meeting Tues-Wed and the “speak” following what is expected to be the last 25bps increase to dominate the headlines.

If you are looking for an app and website to track corporate earnings, look no further than Quartr. I use the app and recently added the website to my favorites. It is truly a one-stop-shop for earnings data, slide decks, live calls and transcripts.

Next CPI read is not until August 10th followed by September 13th, both arriving before the next Fed gathering on Sept 19-20. So the Fed will have two data points to ponder ahead of what is likely to be another pause.

There will no doubt be some select hand wringing after this week’s increase, but it is fully priced in. Not much that isn’t priced in now with the Dow up 10 trading sessions in a row. That has put sir Dow in some rare air perched atop +2 standard deviations on the YTD:

Checking in on SPY, we blew past 450 in short order and my “summer trading range” has been left behind:

Note above (yellow line) how the RSI (Relative Strength Index) has steadily climbed and managed to stay above 50. Seems vulnerable here but I can point to about 10 other times since the March low it seemed vulnerable also. This is the classic summer melt-up, low volume buying against a vacuum of practically zero selling pressure.

Will this be the week where supply takes over and the sellers step in? I don’t think anything the Fed can say or do will lead to that, but some lackluster forward guidance from the tech giants could. Just one man’s opinion. I am hedging with some at the money puts and it appears items on my watchlist will remain being watched only for a little longer.

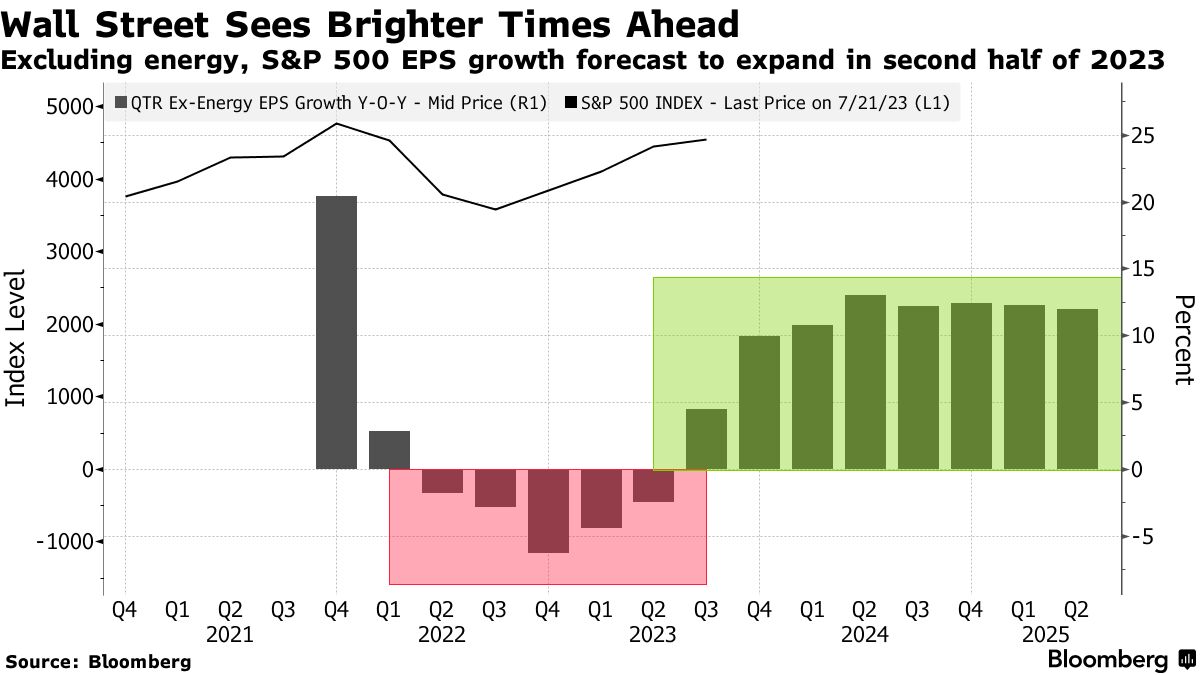

The latter half of the year is shaping up to be quite interesting. This current earnings trough is expected to resolve itself rather quickly and if the consumer stays strong this summer, spending continues, one must wonder if we could see inflation stall or dare I say turn back higher?

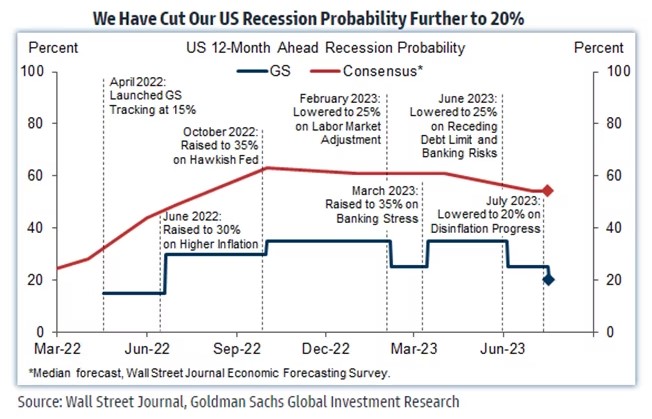

Goldman meanwhile has lowered the recession forecast to just 20% in the next 12 months:

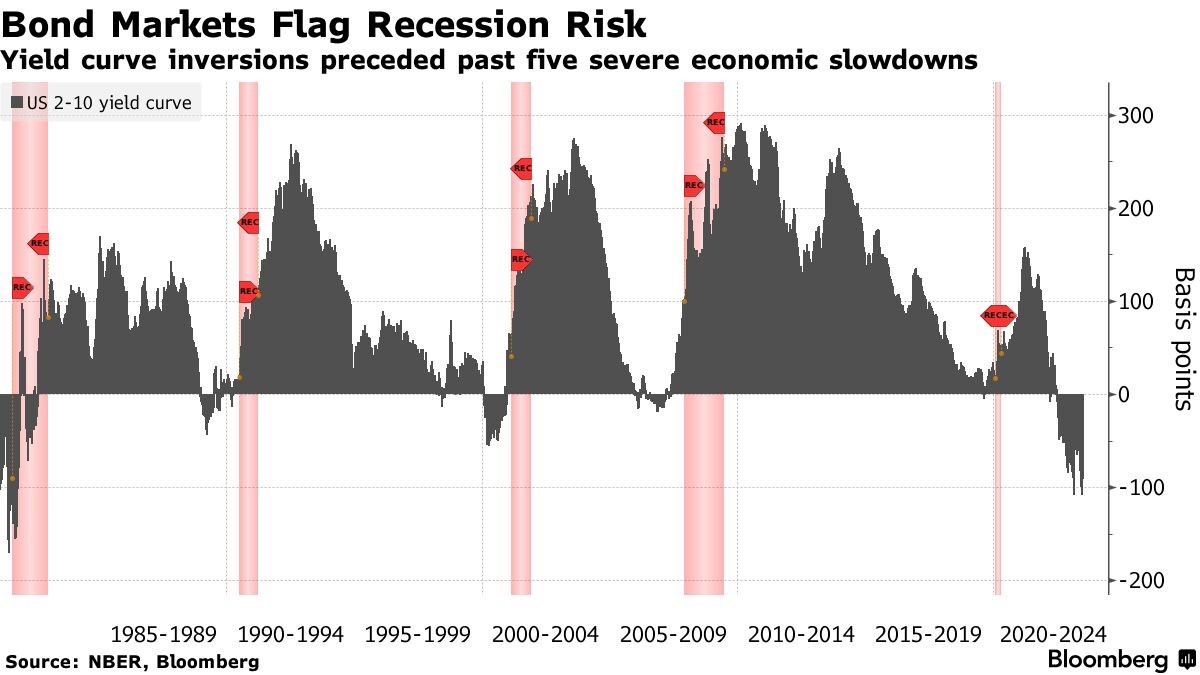

The bond market continues to disagree. We did see rates drop earlier this past week alongside another everything rally only to whipsaw higher later. Bottom line we remain highly inverted and if “this time is different” then the bond market has yet to get that memo.

That Bloomberg graphic is a little dated but the picture being painted remains the same. As I write this the “2s10s” is still sitting at a full -1%. That is definitely a level to watch.

on balance

I’ve seen this movie before. The market continues to melt up and shrugs off any bad news, volatility drifts lower, FOMO gains momentum, it all seems too good to be true.

It usually is. I have been sitting on a much larger cash % than I normally do, guessing by the amounts quoted sitting in money market accounts right now I am not alone.

Even if equities continue to march higher, they are extended and one must judge the risk premium being asked in contrast with cash earning close to 5%.

The question to ask is what are markets looking past? No 2H23 recession? No 2H23 reinflation risk? Does the FOMO crowd also include smart money which got caught offsides for too long?

All food for thought.

Let’s also not forget about those less fortunate overseas fighting to simply stay alive. The geopolitical headlines are getting worse, not better. China’s economy is on life support.

Now, to level-set, I am not Mr. Doom and Gloom, I just call it like I see it, stay close to it and as someone active in markets on a daily basis that is a pre-requisite. It’s not an option. The easy returns for 2023 are already in the rear view mirror.

There is also a peace of mind premium. With markets extended and fundamentally unhinged from reality, sitting in a higher % cash allows me to walk away and occupy my time and mind with reality.

These warm summer days aren’t going to be around forever ya know. In fact, these keys I am tapping away on are heating up and I need to find some shade.

Have a good week. Let’s see what The Honorable JP has to say Wednesday!