As we stroll leisurely into the second half of the year, anyone wondering if the most predicted recession in history is upon us, allow me to retort.

Exhibit A

Stop and let that sink in for a moment. The busiest day in…history? Does that sound like “consumer retrenchment” to you?

As inflation continues to cool there has been a lot of reference to the job market which has remained pretty strong against this backdrop. For inflation to get back to the Fed’s 2% long term target, the job market needs to cool a bit.

Strong jobs market = Strong economy = Strong demand = Sticky inflation?

Exhibit B

Today’s employment number from ADP came in at more than 2x consensus! If there was anything hiding behind the curtain that would signal a recession is off the table, said curtain just swung open.

This will trigger talks of further rate hikes ahead and forget about cuts in 2023.

I noticed yesterday that rates further out on the curve had started ticking higher (meaning future growth is being priced in). That continued in earnest this morning after the jobs data release:

Today’s move put the 10year firmly back above 4%, but what got my attention was the 30year moving right in lockstep now above 4% also. A common play on rising long term rates is the leveraged ETF TBT which essentially 2x shorts long-term bonds, you can see below it has broken out of its (8 month) down channel:

The overwhelming chatter I hear this am is about Fed moving to 6%. Two weeks ago those same voices were asking “are we done at 5%”? Take your pick but the higher for longer camp just got a little more of both, higher and longer.

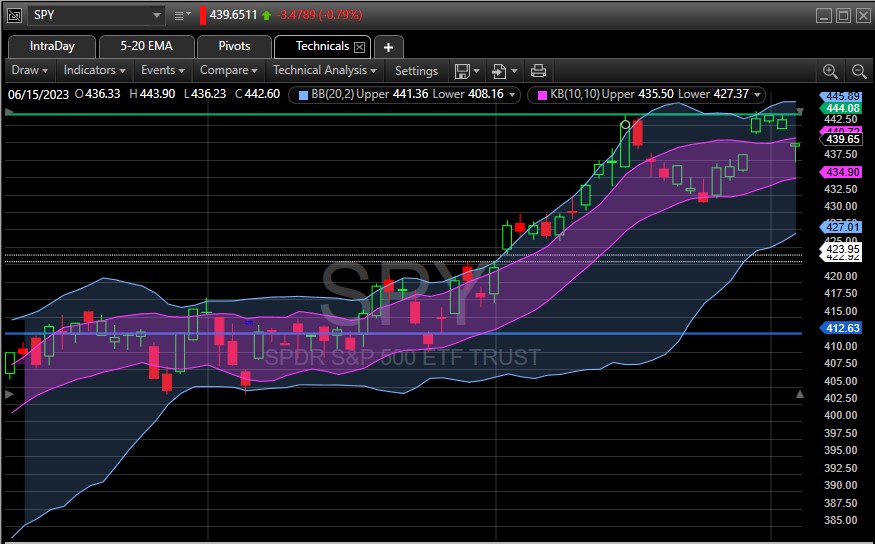

So all of the above has spooked the market a bit and rightfully so. We are off the lows as I write this but there is more downside ahead in my opinion. The chart below is a long-term view I use on my trading platform that plots 3 month support and resistance against two price channels (Keltner and Bollinger Bands):

We gapped up to resistance last Friday at the end of the month and after today we are back in consolidation. I added the unfilled gap to the chart in white (422.92 – 423.95). Do all gaps get filled? We shall see!

All for now.

As I mentioned in my last post, these lazy summer days are best spent away from the desk. Low volumes can lead to some wonkiness and exaggerated moves in both directions. We get more jobs data tomorrow, but I think today officially lit the fire.

On a personal note, I just wrapped up the process of rolling over my old 401(k) to my existing brokerage platform. I now have four accounts under one roof: Taxable Account, Rollover IRA, Roth IRA and Health Savings Account (HSA).

I wish I had made that move long ago and I may do a post later on that process. I highly recommend it. Next item for me to consider is a Roth Conversion on that Rollover IRA. Need to mull that one over.

My goal this summer is to get smaller, close accounts, delete apps and simplify some things. As of today I have moved 17 logins to my “closed” folder. I feel better already.

Now I just need to translate “get smaller” to my waistline this summer also.

Plenty of time…right?

Right.

Have a good weekend.