Old habits die hard.

I can’t help but smile and shake my head as the planner in me – always present – notices the halfway mark for the year is quickly approaching. Stop everything!

Have you accomplished what you wanted to? No? Why not?

Have you at least made progress? Not as much as you would like? Why not?

The year is almost half over, what have you got to show for it?

I am not as hard on myself as I used to be. The older version of myself traded in lofty goals and resolutions years ago and settled into a much more effective approach: Lean toward the best version of me in everything I do. Forget about the past and the pursuit of perfection. Just lean towards best.

I do still enjoy some good honest reflection, prolonged uninterrupted thought. I never really know when the moment will strike or how long it will last, I just know when to recognize it and roll with it. Some of my best ideas emerge during those periods.

Sometimes at night when I sit on the deck I can hear the long slow moan of tires on pavement in the distance. Someone on their way to work perhaps, a third-shifter (been there done that) or just someone headed home, albeit in a big damn hurry. The hurry…is something I don’t miss.

I just finished up reading The Psychology of Money by Morgan Housel, you can find a link to the kindle version in my Off Duty section. It’s a good summer “mid-year” read and forces you take inventory on several items. I like books that inspire thought and reflection, this was definitely one.

For example, from Chapter 13 on Room for Error:

…I think of my own money as barbelled. I take risks with one portion and am terrified with the other. This is not inconsistent, but the psychology of money would lead you to believe that it is. I just want to ensure I can remain standing long enough for my risks to pay off. You have to survive to succeed. To repeat a point we’ve made a few times in this book: The ability to do what you want, when you want, for as long as you want, has an infinite ROI.

So many good nuggets in that one paragraph…

All investing involves risk. You decide how much. I have long been a proponent of the mentioned barbell theory, which simply means equally offset the risk with something safe. The size of each end of the barbell itself may adjust over time, depending on the level of risk or instrument being used. If you invest in a vanilla 60/40 stock/bond portfolio you are doing this by default and may not even realize it.

Survival is most important. As a trader, I know how it feels to get way too far over my skis. I also know how it feels to faceplant the landing and try to figure out what happened after the fact. Proper risk management prevents that. Proper position sizing. Honoring stop loss orders. I plan to add a post later this summer on 9 rules for traders that will summarize what I personally practice in order to stay in the game.

Lastly, true financial independence is defined. Financial independence is not a multi-million dollar retirement portfolio. It is not a number. The independence and the freedom is an ongoing evolving process that you define based on your level of Solvency. It is truly that simple.

I could have remained gainfully employed much longer than I did and amassed a much larger “nest egg” to draw upon in future years but I realized I didn’t care about the amount. The amount was irrelevant.

What I cared about was time.

I cared about being able to pull some of that time and those funds forward to use now. What I have also discovered is the extra time available now allows me to better plan for that possible future.

Food for thought.

My second summer reading recommendation is The Comfort Crisis by Michael Easter. You will also find that kindle link in Off Duty. This will register even more if you find yourself trying to unplug and hit reset this summer.

Back to revisiting the first half which is a few short days away from being in the books.

I will start with a reminder and refresher for myself that the market is always forward looking. The market is pricing in expectations for 6 months out. Sometimes I forget that and my focus narrows.

The blip due to the bank failures earlier this year was quickly erased and SPY soon re-entered a bull market having re-traced 20% from the October lows.

Inflation has come down and the Fed has paused (for now):

The market has kept escalating Geopolitical tensions at bay and the US consumer is resiliently spending. Ask anyone who has traveled abroad recently what the airports and flights look like. People are more willing than ever to pay to play, evidently still reeling from pandemic lockdown syndrome.

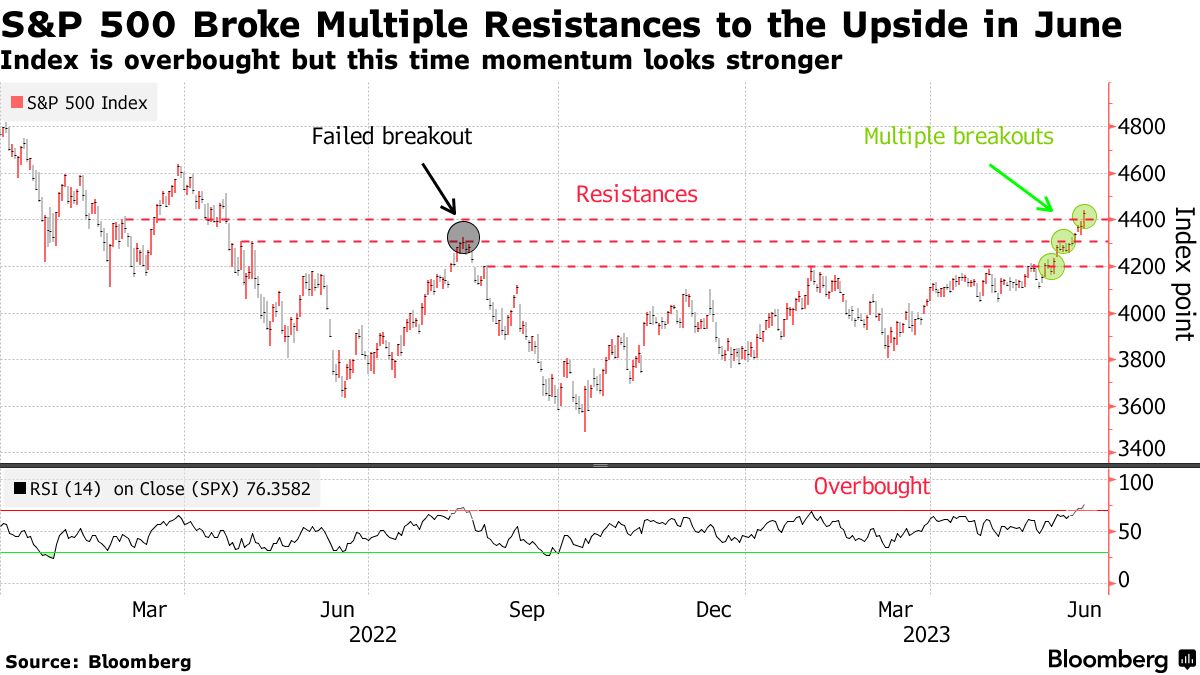

SPY flashed a buy signal back in late March and has not looked back. In fact the RSI (Relative Strength Index) has for the most part remained above 50 in the bull zone since then. Also, note the new uptrend channels created this month:

So…if the market is pricing in expectations 6 months from now, you could argue they have been saying “What Recession?” for several months now. At these price levels, inflation is expected to continue to cool, earnings are expected to stabilize and return to growth in the second half? We shall see.

At some point we revert to mean and the S&P will take a breather. Just a matter of when. I will also note for the technical crowd we have a gap to fill below 424. If that breaks, 420 is in play followed by 410 which will provide some pretty solid support given how long it acted as prior resistance.

Volatility has been non existent. The range slowly continues to grind downwards and at this rate will test 10 if we continue sideways or melting up through summer.

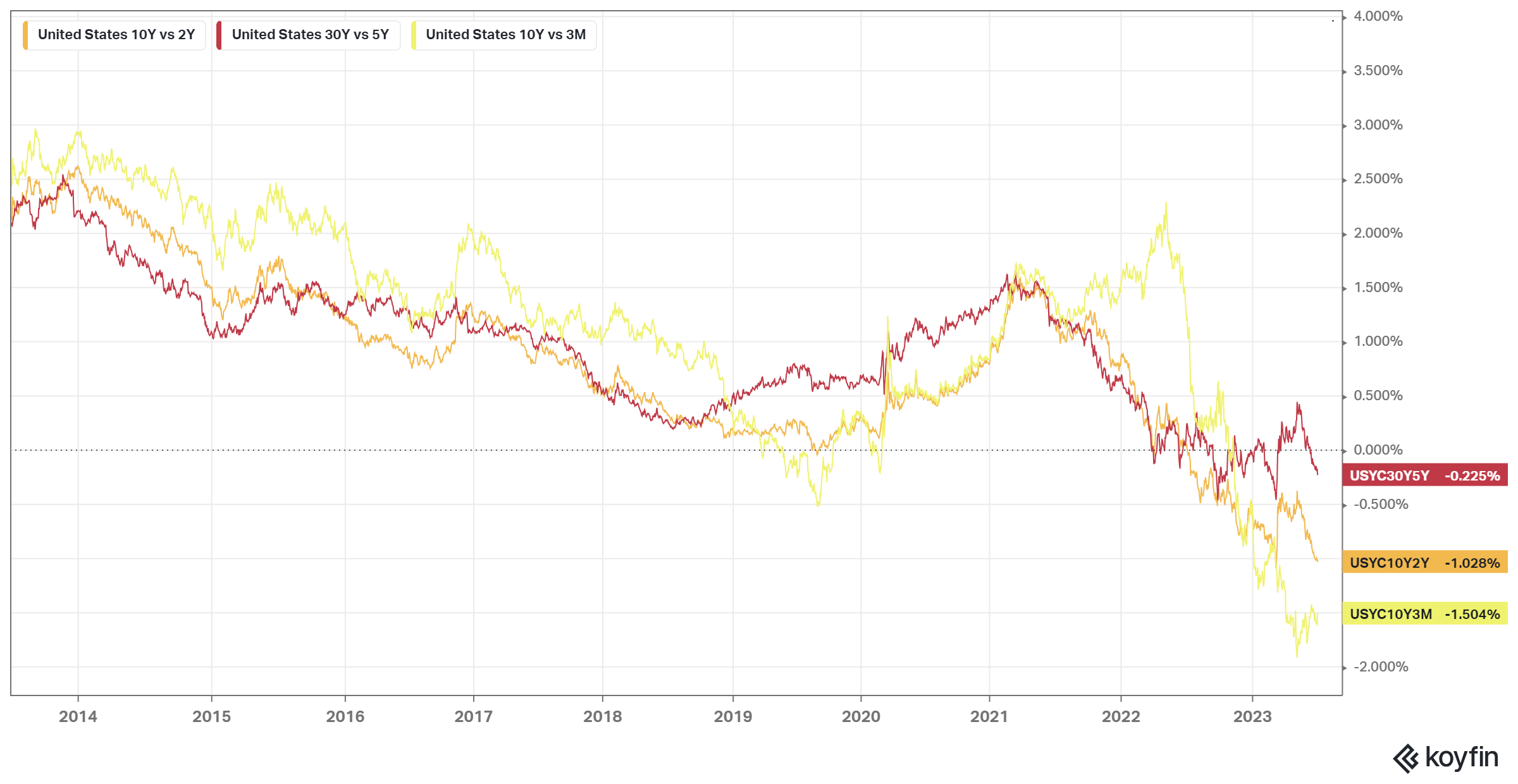

The bond market continues to sell what the equity market refuses to buy. We remain as inverted as inverted gets, all up and down the yield curve, so if we are to avoid a recession this will be the last indicator to finally break.

On balance

After a surprisingly positive first half given the headwinds of inflation, rate hikes, bank failures and geopolitical tensions, it is definitely worth a mid-year level-set. Time to take inventory and take some risk off the table perhaps.

The longer we go without some type of correction or mean reversion, the likelihood of a larger and/or longer downturn increases. As for now Mr. Market is and remains Teflon Don.

This is also a good time to unplug, grab a book or two or three, preferably titles that inspire reflection. Slow things down a bit, make some extra time for those around you.

Keep your eye on the ultimate prize.

The ability to do what you want, when you want, for as long as you want, has an infinite ROI.

Morgan Housel, The Psychology of Money