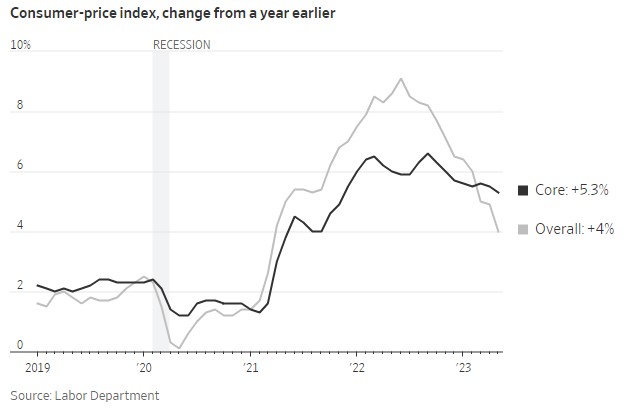

No drama from the CPI and PPI prints this week, if anything they painted the best possible scenario leading into the Fed meeting today. Rates were held steady as expected.

The overall market has been in front of this for a while and barring any unexpected “event” we are now primed to trade sideways or melt up as we let things simmer for a while.

We get our next CPI read on Wed July 12th, about the same time that Q2 earnings start to roll in. The Fed will meet a few weeks later on the 25th and 26th.

I hear some chatter about “don’t rule out another hike in July” which I think is the message they want everyone to heed, but I think corporate earnings may now take the lead alongside readings of consumer travel behavior.

I did a stock screen recently for “overbought” names and travel stocks were all over the top 10, which tells me the market expects the summer’s spend to continue in earnest. I am a little puzzled why Visa is rolling over, I would expect it to be making new highs if all systems were go? Worth watching.

From a technical perspective? If there are any “all gaps get filled” believers out there, we have one looming very large around the 423 level on SPY:

Granted it’s small, and you have to squint to see it, but we (techincally) gapped up on Friday June 2nd and it never filled. The range to fill is 423.95 down to 422.92. So a full point on SPY is hanging out there, just keep that in mind and we closed today at 437.18.

The 20day EMA sits around 425, which means to fill that gap described above we would need to break below not only the 5day, but also the 20day to get it done. I like this test personally because if this is truly a new bull market then a quick retrace and gap fill followed by higher highs shows health. Just one man’s opinion.

I maintain a large position in cash, mainly because it is summer and I am more interested in lawn work and trips to Lowe’s than I am staring at a trading screen, but alerts are set for any surprises.

So if we do get any sell offs this summer, watch those moving averages and see if we bounce. They seem to be a long way down right up to the point where they aren’t. Also, more importantly how strongly we bounce. Next up will be Q2 earnings after the July 4th holiday.

I cannot believe I am already talking about July 4th…

Get outside already!