I gave up alarms several years ago, traded them in for sunlight or my bladder, whichever comes calling first.

This particular day it was both as I peeled back the blinds in the bathroom to a little orange dot visible in a hazy sky.

Could be worse, I could have been on the Upper East Side of NY trying to navigate a Mars like atmosphere earlier this week I suppose. People handing out free masks, just what we want to see, masks again!

I definitely don’t miss the the city, or the commute I thought to myself as I measured out 54 grams of Arabica beans soon to be grinded for my daily pre-noon six-cup pick me up.

Sell in May and Go Away has taken on a whole new meaning this year, markets always tend to feel a bit sleepy in early Summer but this one feels more like a coma. I recall tracking the VIX at 20/28/36, 20 being the floor of complacency with the others being one and two standard deviations away.

If this keeps up I will need to update all of those levels, 10 is slowly becoming the new 20 (again, been a while but we’ve been there before) and if you look at the YTD with +/- two standard deviations the mean is now below 20:

That could all change in a few days.

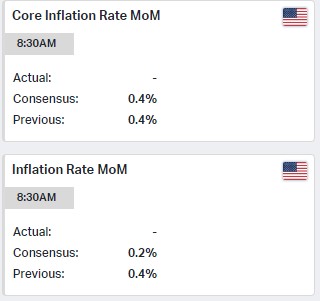

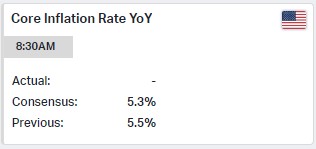

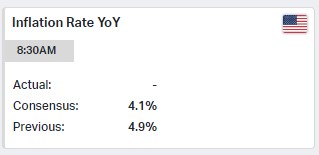

We have our next CPI read due Tuesday, coinciding with the Fed meeting start, decision and presser soon to follow on Wednesday afternoon. It’s about time we had some action.

Quick refresher on where we stand is in order. I love this 3Y view of CPI vs. Fed Funds from koyfin:

I still shake my head in awe at the rate of those hikes, 500bps in total. It also shows shows how slow they were to react to a rising CPI. CPI has fallen, not as fast as JP would like perhaps and one could argue it has stalled out here. Either way this week is where it gets interesting…

Worth noting that consensus expects a drop in Core and a 4.1% headline print vs. 4.9% previous. Seems like a high bar!

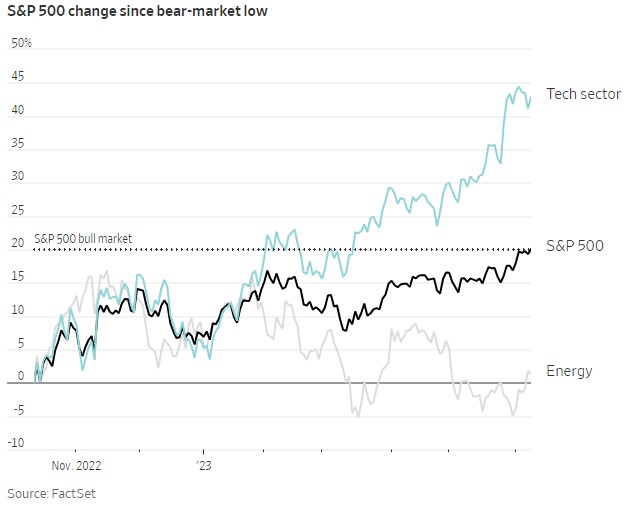

Market is priced for a Fed pause. Plain and simple. The S&P officially re-entering a bull market as of Thursday’s close, 20% off the October lows:

Never mind large cap tech, the RSI on SPY is sitting at 4 month highs with the buy signal generated back in late March still very much intact. My 410 level is long gone!

If CPI comes in hot, the pause thesis will be debated, for 24 hours at least. If it comes in better than expected the pause will be locked in and markets could rally even more. May the melt up continue…

The conundrum lies with the Fed presser afterward, most will expect some timeframe to be associated with the pause, length per se, but if they feel compelled to hike again due to a hot CPI read, look out. We are not priced for that in the least.

Oh well, at least there will be something to look at other than Don’s classified documents in his Mar-a-Lago bathroom.

Gold fixtures and marble floors? Really? Wait, is that a chandelier?

Who puts a chandelier in their shi**er? Nevermind…

Toilet probably plays Vivaldi’s Four Seasons when it flushes.. 🎵🎹

Have a great weekend!