I was surprised the debt ceiling resolution got bid up as much as it did given where we have been trading, but the FOMO movement continues. Don’t fight the tape, right?

The VIX traded at a 14 handle today. 14. Fourteen.

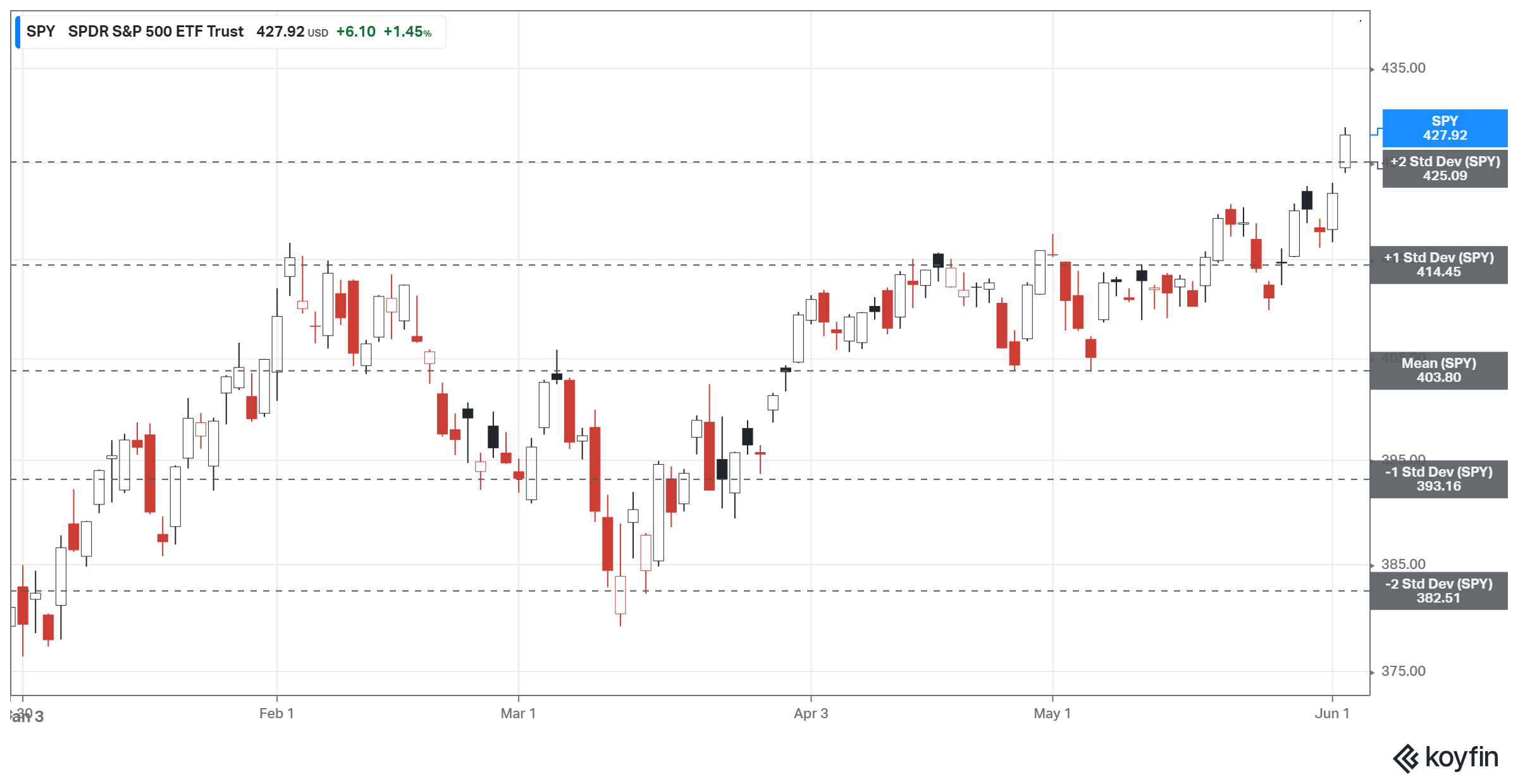

Not to imply 20 was panic level by any means, but we had inched toward it twice only to crater below 15, no worries, nothing to see here, moving along. The chart above is a view of -2 and +2 standard deviations from mean. You can view the same for just about anything on Koyfin.

So this move not only touched -2 standard deviations, it punched through it. Debt ceiling drama was just that. Drama.

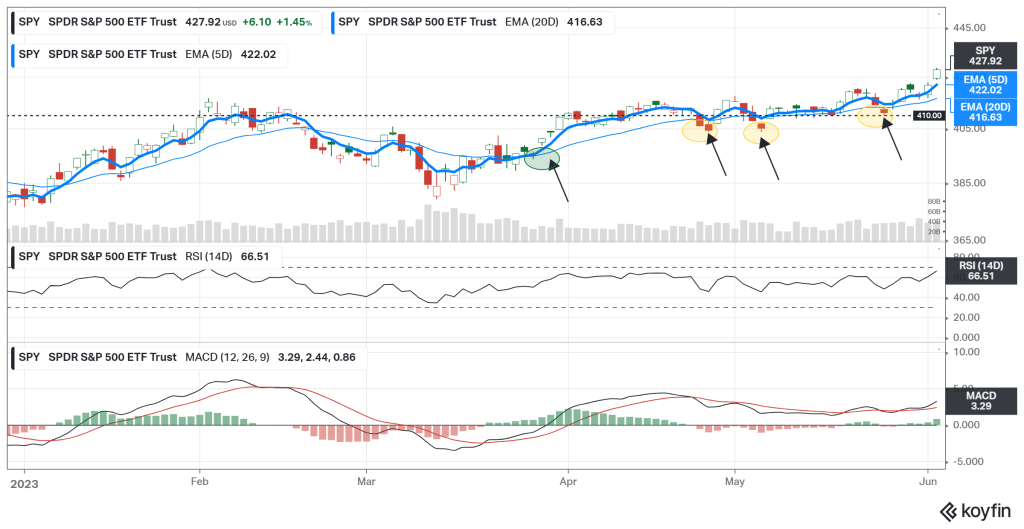

Let’s take a look at the broader market via SPY. Same QTD timeframe:

OK. Busting through the +2 on the upside, impressive, but this is just QTD what about YTD?

OK. That too.

Don’t fight the tape. Don’t fight it, ride it (as EY from SoFi said on a recent podcast).

Listen up. FOMO is a powerful force. There is no worse feeling than FOMO. I have lost large sums of money over a weekend because I had a position on and OPEC decided to toss a hand grenade. It sucks. But it still does not sting half as bad as knowing you have missed out on a recent-right-in-front-of-you movement.

For months now I have been saying 410 was the top. We would bounce off it for months if not years. That still may come true for the years part but for now? I was dead wrong. 410 is a memory. It is a lonely level of (possible) support at this point.

The buy signal generated in late March has held. There were 3 false sell signals (yellow circles above) that you didn’t really know were false until they were. The signal above is buying when the 5 day EMA crosses the 20 day EMA to upside, selling when the 5 day EMA cross the 20 day EMA to the downside. Look closely. Did the 5 ever cross below the 20? More than a day? Was there even ever a sell signal?

Kudos to you if you had the knack, the nads or the luck to hold through it.

When I need perspective, I zoom out.

So all clear, right? Inflation on the way down, debt ceiling BS behind us, we good?

I don’t know, let’s zoom out. Switch back to finviz and look at the weekly view of SPY:

The August 12, 2022 close on SPY was 427.10. Today we closed at 427.92. A tick higher on the week, and an impressive retracement when viewed in this timeframe. Will it hold? Tune in Monday.

Bottom line, when you zoom out, even impressive short term moves can be put into perspective. As the Fed would say? There is work to do.

I will be the first to admit I thought the debt ceiling would implode. Somehow they got it done. Good on them.

The aftermath and the market moves tell me everyone wants to get on with the Soft Landing, rally to new highs and be done with it. Doesn’t sound bad either to be honest.

All in due time perhaps, the June “Fed Pause” is still hanging around 75/25 leaning 100/0. I certainly hope sanity prevails and they take a breather. Let it play out.

As for markets? With the VIX under 15? They are just tired and glad to avoid default.

The sleepy trading days of summer await. Don’t get blinded by the present, zoom out when you want or need to get perspective.

As for the present, hopefully no hammock flips while I am trying to nap…