I guess it’s normal as we age to reflect more. I know I certainly do. The upcoming Memorial Day holiday is a time to remember those who served and died doing so, also a time to remember those close to us who have passed.

Hard to believe Dad has been gone 2 years, I still walk by the phone and expect it to ring with him on the other side. I miss him greatly and not one single day goes by that I don’t think about him.

I shipped a few family heirlooms to my aunt earlier in the week, she is the only surviving sibling out of five. A family bible that sat on my grandparent’s coffee table, some old photographs of her grandparents circa 1910ish and finally dad’s crisp white hat he donned with his USMC dress blues.

She needed those items and I am glad she now has them. They each represent their own different and unique moment in time.

Moving along…

I haven’t written much lately because there is nothing to say! My trading desk blinks alone most days as I am working outside in the sun with listener supported 91.9 WFPK in my ear. No better place to be.

It has been and will continue to be all about Washington until we get this debt ceiling drama behind us.

Markets have been doing their best to look past it, but this week has proved to be a bit shaky, the upcoming holiday weekend not helping things as it pertains to time to get the deal done.

SPY has managed to stay above the 410 level and red candles below were quickly bought. Let’s call it blind optimism for now. 😎

Not entirely blind I should point out, Q1 earnings are for the most part behind us and it was not as bad as many thought it would ultimately be. The buzzword now is “greedflation“, a term used to describe the company’s ability to pass on inflation to the consumer in the form of higher prices to protect margins.

No doubt a lot is in fact being passed along. Some data out from FactSet today show the earnings decline for S&P 500 companies came in at -2.2%, with 78% of said companies beating estimates. Glass half full.

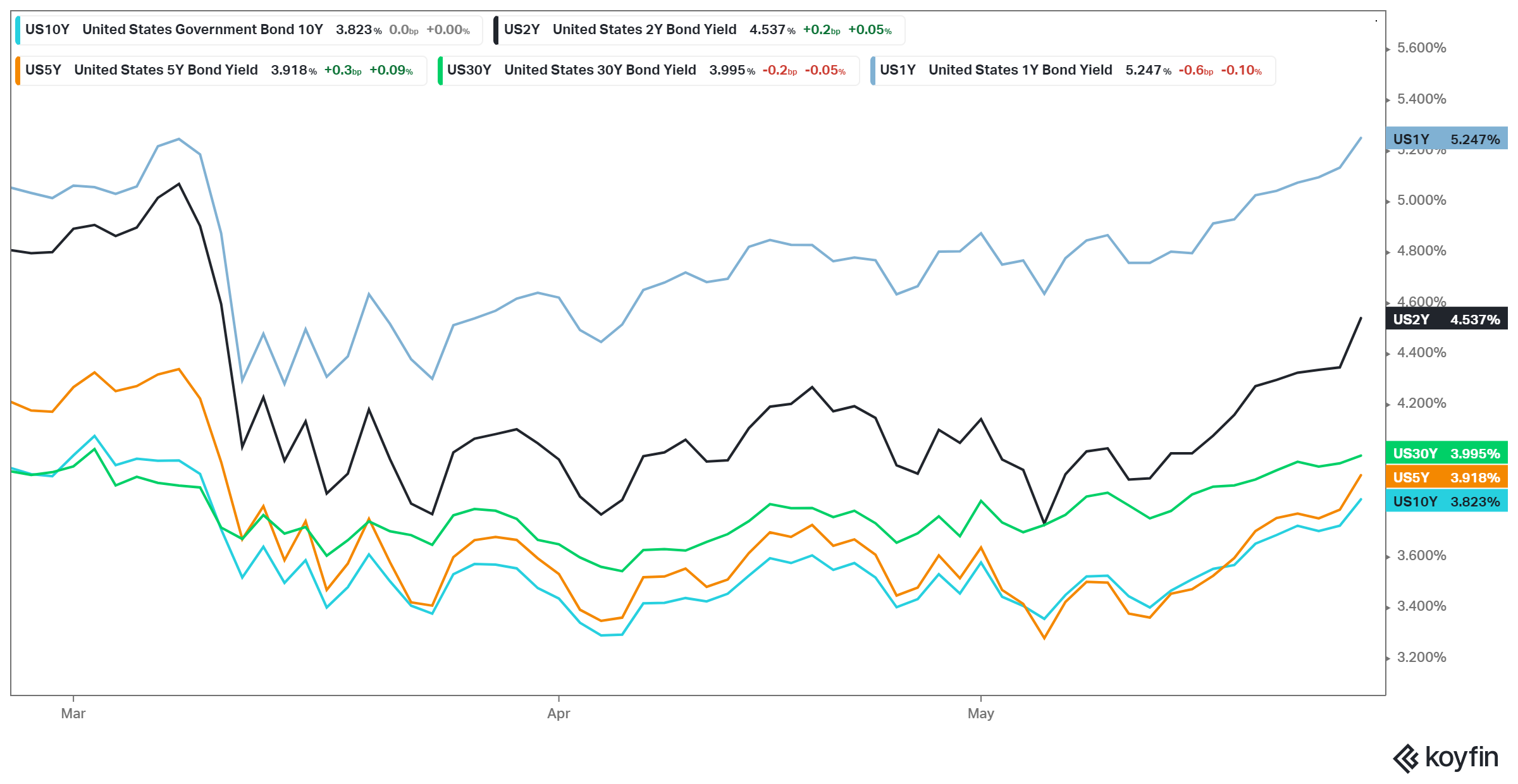

Rates are ticking up across the curve, no doubt prodded along by the increasing debt ceiling angst, to be honest I’m surprised this hasn’t spooked the overall market more. Housing market pain is back with the WSJ pegging the recent 30yr mortgage at 7.20%. Yikes.

I honestly think the soft landing / end of rate hike possibilities combined are still providing a tail wind across the current landscape.

So how will the market ultimately react to a debt ceiling deal or default?

I have no clue. No one does. We could get a deal announcement and trigger a sell on the news event just as easily as any selloff on a failure to ink a deal.

What I try to do around these media events and let’s face it, this is largely a media driven PANIC of possibilities, is to keep some dry powder handy for wishlist deployment if things get all squirrelly.

Stock prices are a record of investor psychology at this exact moment in time. Nothing more, nothing less. Chip maker Nvidia has predicted an iPhone-esque generational event due to the rapidly expanding global adoption of AI and they were up over 24% today. Not bad for one day.

It works the other way too. Let’s say the debt drama drags on and drags stocks down with it. I will be ready with wishlist in hand, ready to take advantage of mispricing of assets.

For example, I have already been adding to shares of a company that went public around this time two years ago. They actually pay a dividend, have continually raised it since their IPO and have publicly committed to more (substantial) increases ahead. The bank failures, recession talk and now debt drama have pushed it below its original IPO price.

It just can’t catch a bid, even though buying it here will likely result in a 10% yield on the cost basis by 2025, not to mention a potential to 2x on the investment capital? Where do I sign?

Whether you are a trader or investor or both, the message is simply this: Headline risks and temporary crises create opportunity. They always do.

Mr. Market is more than likely mispricing some assets because of hazy and cloudy skies.

The thing about cloudy skies?

They pass.

They are only here for this moment in time.

Enjoy your holiday weekend.

UPDATED 5/26: New PCE Inflation data

Rather than dedicate a new post to the inflation data out today, I will just tack it on here. It came in hot, probably not what the “June Pause” camp wanted to see, but… it is what it is. Queue the “still work to do” chatter: