There were faint hints of the Fed doing nothing today. Hopes per se. That was not going to happen given the numbers out Friday reaffirming sir inflation’s steadfastness.

The Fed made its final rate hike of 2023 (just one man’s opinion) and will enter watch and wait mode. Perhaps we should do the same.

Best case? Inflation continues to cool, wage growth levels off, businesses and consumers continue to spend, invest and we roll into the second half of the year having either soft landed or “no” landed.

Worst case? Inflation stalls north of 4% over summer, wage growth increases to keep pace, businesses and consumers retrench to hunker down mode and we slip, trip, flip into a 2H recession.

Before we get to any of that, there is a debt ceiling that needs resolution in Washington.

We aren’t done with earnings season yet (as an earnings call in my left ear competes with the Braves and Marlins in my right). Braves have put 13 runs up through 5 so I think it should work out OK...

Headlines earlier mentioned that “D-day” for the debt ceiling resolution has moved forward to early June. A stark contrast to some July/August estimates not long ago. Biden has signaled he wants to meet with “leaders” as soon as next week. I can’t wait.

The Fed speak has spoken. They are done for the year. Time to let it play out.

Finviz has updated the sideways range of SPY to 380-415, my range originally outlined in January (in blue) is 360-410. Take your pick. Fill in the blanks.

The question I would ask myself looking at either range as we dance on the ceiling is what catalyst would drive a breakout to the upside?

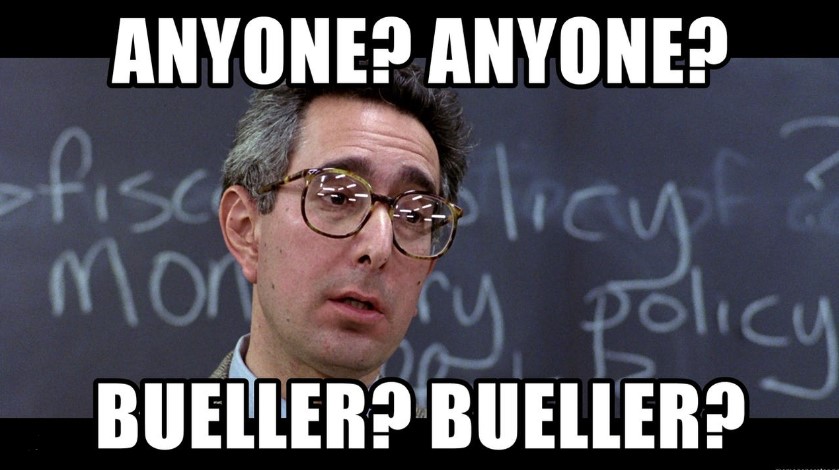

<< Crickets >>

What catalyst in the immediate future would lead to a breakout?

<< Crickets >>

OK, what catalysts do you see leading to upside?

<< Crickets >>

Time to grab a seat, ease into casual headline monitor mode. I have a feeling it’s going to be a long month.

Meanwhile, it’s Derby week in the River City, a welcome diversion and I have a 42 page Brisnet Quick Play PP for a full race card calling my name for Saturday May 6th.

I may be back before then.

Then again? Maybe not…