In Lost Signal, I highlighted that most major averages had started to roll over. The charts looked very weak and the charts don’t lie.

That post didn’t age very well as markets ripped Thursday and Friday and the “lost signal” was quickly rediscovered. It was a classic stick save as the market shrugged off a lower AWS growth scare and marched higher. The imminent 5/20 EMA downside crossover was stopped dead in its tracks and reversed retaking 410 and then some.

Don’t fight the tape, they say…

That’s how fast a bearish read can turn (quasi) bullish. I will note however that overall market breadth remains weak, the majority of these moves higher are being driven by less than 9, 10 names? Do keep that in mind.

Volatility has left the building. Not sure what else to say at this point, things are eerily calm. I track VIX @ levels of 20, 28, 36 as you can see on the chart below. 20 being the bottom or “calm seas”, 28 being the mid-point or 1 standard deviation of “things are getting interesting” and 36 being the the top or 2 standard deviation of “Houston we have a problem”. We are off the charts, literally:

This “calm” does not translate to my nerves. Not at all. This reeks complacency. Now that I have said that, I am sure it will retreat below 15 despite the current economic and geopolitical backdrop. The backend of the VIX curve is steepening, sensing some turbulence ahead, but I won’t get into that here.

Nevertheless, entering (final hike?) Fed week, markets are saying they want to go higher. Perhaps making us “think” they want to go higher…

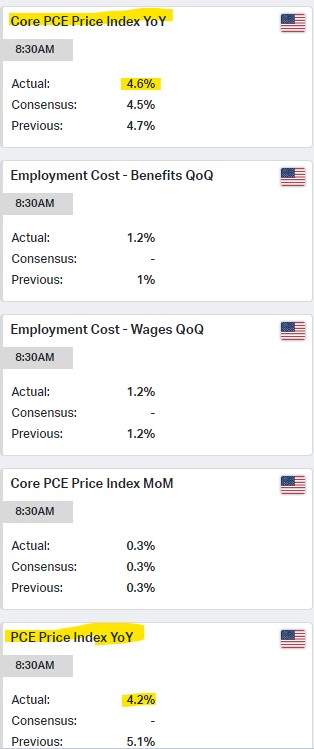

I expect another 25bps hike from the Fed this week. We could be waking up to headlines of a First Republic Bank takeover, which will raise eyebrows and increase “pause” talk, but inflation is still a problem. I didn’t write about the data out Friday, but here is a sample:

The biggest takeaway there is core PCE stubbornly ticking higher to 4.6% and still tracking above the headline number of 4.2%. That core read locked in another 25bps hike in my humble opinion.

Jobs numbers will be out Friday, well after the Fed has decided, but if we continue to see the inflation data level off, or refuse to recede, any ticks higher there will be met with resistance.

I think we stop for a while after this next hike. I really do. Let things simmer over summer and see if the data pulls back. Allow the tightening to work its way through the many layers it needs to. Grab a chair, some popcorn and turn to Capitol Hill.

Look for the debt ceiling talks (or lack thereof) to continually creep further up in the headlines. I anchored my post on it so I could update as it unfolds, stomach allowing. Consider this a preview of the 2024 election circus that awaits us.

All for now. More smaller cap tech earnings this week, we get a Fed decision and markets could be setting the mother of all bull traps as we enter the Merry Merry month of May. Then again?…

Time will tell.