Reader Note: This post will be updated occasionally as we navigate the debt ceiling drama...

To be honest I had put debt ceiling talks on the back burner. Been there done that, several times and this particular market has a very good way of shrugging off “concerns”.

Inflation has been front and center. The Fed. Rate hikes.

I do recall a brief mention from Janet Yellen back in late January, putting the first few warnings out there. I pulled the article:

“We feel strongly it will be a calamity not to raise the debt ceiling”

Yellen – January 2023

The problem is we have all seen this before. Not our first rodeo, right? We know it gets resolved and we know markets will not pay much attention. Right?

Fast forward to mid February, more mentions by Biden and Yellen:

“Let’s not wait until the last minute,” Yellen said. ”I believe it is a basic responsibility of our nation’s leaders to get this done.”

Yellen – February 2023

Fast forward to mid March, post the SVB debacle. More warnings:

Yellen said Biden was prepared to discuss and negotiate his plan with Republicans, but she reiterated the administration’s stance for a “clean” debt limit increase.

“It can’t be a condition for raising the debt ceiling,” she said. “The debt ceiling simply must be raised.”

Yellen – March 2023

Fast forward to mid April! Forget about no strings attached.

McCarthy seems to be wanting to send the first shot across the bow, let’s not forget this is the same Republican house speaker that took 15 sessions to elect?

My mind circles back to coverage of him falling asleep behind Biden at the state of the union. If it weren’t for the clapping and standing ovations from Biden’s inept and oblivious VP we may have a still shot of McCarthy actually falling asleep.

No wait, maybe I found one!

So what’s in the 320 page proposal?

- 1.5T debt limit increase (ok)

- kicks the can down the road to March 31, 2024 (almost a full year, oh my)

- ends billions of dollars of clean energy tax breaks and EV purchases (that will go over well)

- no more student debt relief (I’m sure Joe will like that)

- get rid of an 80B funding boost to the IRS (I’ve had more trouble actually PAYING the IRS recently than I ever did getting a refund, it’s a dumpster fire additional funds or not)

I don’t have the stomach to go any further. It’s a shit show. One that I have largely forgotten about until recently, but days like today I am reminded this is in fact a REAL RISK looming and there is ZERO CHANCE it gets resolved prior to having the potential of sending markets deep into the red.

Sorry that is just reality. A stalemate cometh. Get ready.

My challenge to the puppets in DC is quite simple: Prove me wrong!

I won’t hold my breath and will be pre-positioned accordingly.

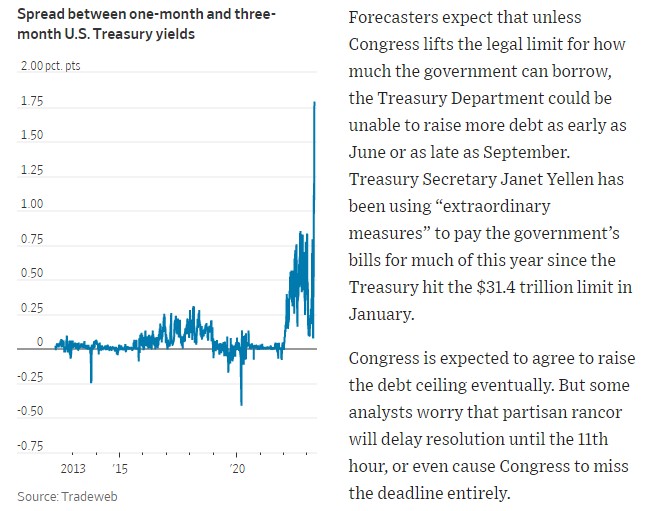

Analysts at Goldman Sachs Group Inc. on Tuesday warned that, due to declining tax receipts, the date for a US default could be closer to June — rather than August, as some economists have predicted.

Bloomberg

updates, shall we?

4/21

4/22

4/26

“I’m happy to meet with McCarthy, but not on whether or not the debt limit gets extended,” Biden said. “That’s not negotiable.”

“The president can no longer ignore by not negotiating,” McCarthy said. “We have done our job.”

4/27

4/28

WSJ Opinion: The House GOP’s Debt Ceiling Win

Which assumes negotiations and eventual compromise, see 4/27 image above

5/3

5/7

5/7 – Janet yellen on ABC’s “this week”

All I want to say is that it’s Congress’s job to do this. If they fail to do it, we will have an economic and financial catastrophe that will be of our own making, and there is no action that President Biden and US Treasury can take to prevent that catastrophe.

It simply is unacceptable for Congress to threaten economic calamity for American households and the global financial system as the cost of raising the debt ceiling and getting agreement on budget priorities.

5/9

5/16

Is that Kamala sitting in? Oh I feel better already.

5/19

5/24

5/26

5/27

5/28 – Drumroll…

Now it just needs to get through Congress.